|

市场调查报告书

商品编码

1687252

可再生能源-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

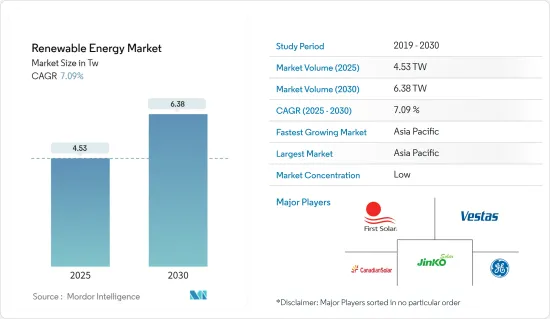

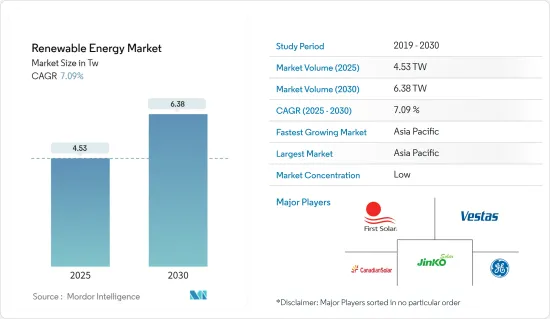

2025年可再生能源市场规模预估为453亿日元,预计2030年将达63.8亿日元,预测期间(2025-2030年)复合年增长率为7.09%。

关键亮点

- 从长远来看,政府对可再生能源的优惠政策以及太阳能板和风力发电机安装价格的下降预计将成为市场的主要驱动力。

- 然而,天然气发电使用的增加预计将阻碍可再生能源发电市场的成长。

- 预计全球雄心勃勃的可再生能源目标将为所研究的市场提供重大机会。

- 预计亚太地区将成为预测期内成长最快的市场,主要受中国和印度需求的推动。

可再生能源市场趋势

预计水电领域将在预测期内占据市场主导地位

- 水力发电是一种可再生能源,利用水从高处流向低处的能量来发电。发电工程为农业、家庭和企业提供清洁水,并减轻洪水和干旱等极端天气事件的影响。

- 水力发电是世界上最大的可再生电力来源。 2022年,水力可再生能源发电将占可再生能源总量的近41%,使水力发电成为全球可再生能源发电的最大贡献者。

- 根据国际可再生能源机构的预测,2022年全球水力发电装置容量将达到1,393吉瓦(GW),较2021年成长2.19%。由于即将上马的发电工程和技术进步,预计水力发电装置容量将会增加。

- Natel Energy 由两位麻省理工学院 (MIT) 校友兄弟于 2022 年 8 月创立,开发了一种模拟自然河流条件的水力发电系统,包括对鱼类安全的涡轮机。由于这种环保发展,预计预测期内对水力发电领域的需求将会增加。

- 2022年8月,印度政府宣布在尼泊尔开发两个水力发电发电工程,分别是西塞提水力发电发电工程和塞提河发电工程。这些计划的总营运成本预计约为24亿美元。

- 因此,预计水电领域将在预测期内占据市场主导地位。

预计亚太地区将在预测期内占据市场主导地位

- 近年来,亚太地区在可再生能源市场占据主导地位,预计在预测期内将继续保持主导地位。

- 2022年,中国成为全球可再生能源部署的领导者。 2022年全国可再生能源发电总容量将达1160.8吉瓦,较2021年成长约13.4%。水力发电、太阳能和风能是该国主要的再生能源来源。

- 由于经济和人口成长,印度对电力的需求大幅增加。 2022年水力发电量将达162.96吉瓦,高于2021年的147.12吉瓦。

- 此外,印度已成为继中国和美国之后的世界第三大电力消耗。过去十年来,印度的净发电能力大幅成长,这主要归功于包括大型水力发电在内的可再生能源。

- 印度政府设定目标,到2022财年引入1.75亿千瓦的可再生能源装置容量,其中包括1亿千瓦的太阳能、6000万千瓦的风能、1000万千瓦的生物能源和500万千瓦的小型水力。印度新和可再生能源部预计将在 2022 年向可再生能源、电动车、太阳能製造和绿色氢能领域投资 150 亿美元。

- 2022年1月,SJVN(Satluj Jal Vidyut Nigam Ltd)在北方邦新可再生能源发展局(UPNEDA)竞标中赢得了北方邦125兆瓦的太阳能发电工程。这些计划包括位于贾劳恩的 75 兆瓦併网太阳能计划和位于坎普尔德哈特区的 50 兆瓦太阳能计划。

- 日本政府也计划在2030年将二氧化碳排放减少50%,到2050年实现碳中和。 2022年9月,绿色电力投资公司(GPI)选定GE再生能源公司为青森县西津轻郡深浦町深浦风力发电厂的营运商。此计划涉及 19 台 GE 4.2-117 陆上风力发电机,是 GE 在日本的第三个专案。

- 2022 年 12 月,亚马逊宣布与麦格理绿色投资集团 (GIG) 印度投资组合公司的子公司 Vibrant Energy 合作开展印度首批风能和太阳能混合计划之一。这两个计划的可再生能源容量为 300 兆瓦,分别位于中央邦和卡纳塔克邦。

- 因此,预计此类发展将在预测期内推动亚太可再生能源市场的发展。

可再生能源产业概况

可再生能源市场分散。市场的主要企业(不分先后顺序)包括 First Solar Inc.、Vestas Wind Systems AS、Canadian Solar Inc.、Jinko Solar Holding 和 General Electric Company。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 调查前提条件

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 可再生能源结构(2023年)

- 可再生能源装置容量及2029年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府对可再生能源的支持

- 太阳能板和风力发电机价格下跌

- 加大水电、抽水发电工程投资

- 人们对地热能的兴趣日益浓厚

- 限制因素

- 扩大天然气发电利用

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 市场类型

- 太阳能电池

- 风

- 水力发电

- 生质能源

- 其他类型(地热、潮汐等)

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 奈及利亚

- 南非

- 卡达

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- EPC开发人员/营运商/业主

- Orsted AS

- EDF SA

- NextEra Energy Inc.

- Duke Energy Corporation

- Berkshire Hathway Energy

- Acciona Energia SA

- 设备供应商

- First Solar Inc.

- Vestas Wind Systems AS

- Canadian Solar Inc.

- Jinko Solar Holding Co. Ltd

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- EPC开发人员/营运商/业主

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 全球雄心勃勃的可再生能源目标

简介目录

Product Code: 57156

The Renewable Energy Market size is estimated at 4.53 tw in 2025, and is expected to reach 6.38 tw by 2030, at a CAGR of 7.09% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the major driving factors of the market are likely to be favorable government policies for renewable energy and declining prices of solar panels and wind turbine installations.

- However, the increasing penetration of natural gas for power generation is expected to hinder the renewable energy market's growth.

- The ambitious renewable energy targets worldwide are anticipated to provide huge opportunities for the market studied.

- Asia-Pacific is expected to be the fastest-growing market during the forecast period, with major demand from China and India.

Renewable Energy Market Trends

Hydropower Segment is Expected to Dominate the Market during the Forecast Period

- Hydroelectric power (hydropower) is a renewable energy source where electrical power is derived from the energy of water moving from higher to lower elevations. Hydropower projects supply clean water for agriculture, homes, and businesses and mitigate the impacts of extreme weather events such as floods and drought.

- Hydropower is the single largest source of renewable electricity globally. In 2022, renewable electricity generation from hydropower accounted for nearly 41% of total renewable energy, the largest contribution from hydropower in global renewable-based electricity generation.

- According to the International Renewable Energy Agency, in 2022, the global hydropower installed capacity reached 1,393 gigawatts (GW), representing a rise of 2.19% compared to 2021. The hydropower installed capacity is expected to grow with the upcoming hydro projects and technological advancements.

- In August 2022, Natel Energy, created by MIT alumni siblings, developed hydropower systems that included fish-safe turbines and other features that imitate natural river conditions. Thus, with such eco-friendly developments, the hydropower segment's demand is expected to increase during the forecast period.

- In August 2022, the Government of India announced the development of two hydropower projects in Nepal, namely the West Seti Hydropower Project and the Seti River Hydropower Project. The total cost of these projects is expected to be around USD 2.4 billion.

- Thus, the hydropower segment is expected to dominate the market during the forecast period.

Asia-Pacific is Anticipated to Dominate the Market during the Forecast Period

- Asia-Pacific has dominated the renewable energy market over recent years, and it is likely to maintain its dominance during the forecast period.

- In 2022, China was the global leader in renewable energy deployment. The country's total renewable energy capacity reached 1,160.8 GW in 2022, representing an increase of approximately 13.4% compared to 2021. Hydropower, solar, and wind are the major renewable energy sources in the country.

- India's power demand increased significantly in line with its expanding economy and growing population. In 2022, the country generated 162.96 GW of hydropower, up from 147.12 GW in 2021.

- India has also become the world's third-largest power consumer after China and the United States. India's net power generation capacity increased significantly in the last decade, majorly from renewable energy sources, including large hydro sources.

- The Government of India had set a target of installing 175 GW of renewable energy capacity by FY 2022, including 100 GW from solar, 60 GW from wind, 10 GW from biopower, and 5 GW from small hydropower. The Indian Ministry for New and Renewable Energy expected an investment of USD 15 billion in renewable energy, electric vehicles, manufacturing of solar equipment, and green hydrogen in 2022.

- In January 2022, SJVN (Satluj Jal Vidyut Nigam Ltd) bagged a solar project of 125 MW in Uttar Pradesh through a bidding process held by the Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA). The project includes a 75 MW grid-connected solar project in Jalaun and a 50 MW solar project in Kanpur Dehat districts.

- The Japanese government has also targeted reducing carbon emissions to 50% by 2030 and achieving carbon neutrality by 2050. In September 2022, Green Power Investment (GPI) chose GE Renewable Energy as the provider for the Fukaura Wind Farm in Fukaura Town, Nishi Tsugaru District, Aomori Prefecture, Japan. The project, which will include 19 units of GE's 4.2-117 onshore wind turbines, is GE's third in Japan.

- In December 2022, Amazon announced one of its first wind-solar hybrid projects in India with Vibrant Energy, a subsidiary of a portfolio company of Macquarie's Green Investment Group (GIG), India. The two projects represent 300 megawatts (MW) of renewable energy capacity, and the projects are located in Madhya Pradesh and Karnataka.

- Hence, such developments are expected to boost the Asia-Pacific renewable energy market during the forecast period.

Renewable Energy Industry Overview

The renewable energy market is fragmented. Some of the major players in the market (in no particular order) are First Solar Inc., Vestas Wind Systems AS, Canadian Solar Inc., Jinko Solar Holding Co. Ltd, and General Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2023

- 4.3 Renewable Energy Installed Capacity and Forecast till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies for Renewable Energy

- 4.6.1.2 The Declining Price of Solar Panels and Wind Turbine Installations

- 4.6.1.3 Increasing Investments in Hydropower and Pumped Storage Hydropower Projects

- 4.6.1.4 Growing Emphasis on Geothermal Energy

- 4.6.2 Restraints

- 4.6.2.1 Increasing Penetration of Natural Gas for Power Generation

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Types (Geothermal, Tidal, etc.)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 NORDIC

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Malaysia

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.3.7 Vietnam

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 Egypt

- 5.2.4.4 Nigeria

- 5.2.4.5 South Africa

- 5.2.4.6 Qatar

- 5.2.4.7 Rest of the Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of the South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 EPC Developers/Operators/Owners

- 6.3.1.1 Orsted AS

- 6.3.1.2 EDF SA

- 6.3.1.3 NextEra Energy Inc.

- 6.3.1.4 Duke Energy Corporation

- 6.3.1.5 Berkshire Hathway Energy

- 6.3.1.6 Acciona Energia SA

- 6.3.2 Equipment Suppliers

- 6.3.2.1 First Solar Inc.

- 6.3.2.2 Vestas Wind Systems AS

- 6.3.2.3 Canadian Solar Inc.

- 6.3.2.4 Jinko Solar Holding Co. Ltd

- 6.3.2.5 General Electric Company

- 6.3.2.6 Siemens Gamesa Renewable Energy SA

- 6.3.1 EPC Developers/Operators/Owners

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Renewable Energy Targets across the World

02-2729-4219

+886-2-2729-4219