|

市场调查报告书

商品编码

1444427

电子商务包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)E-Commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

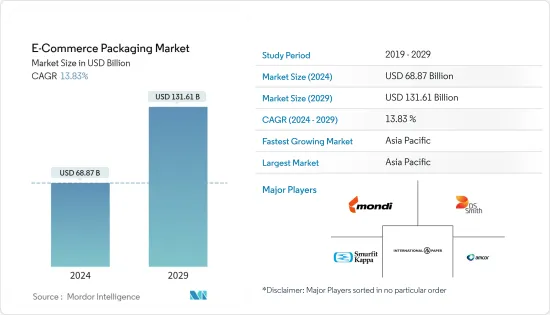

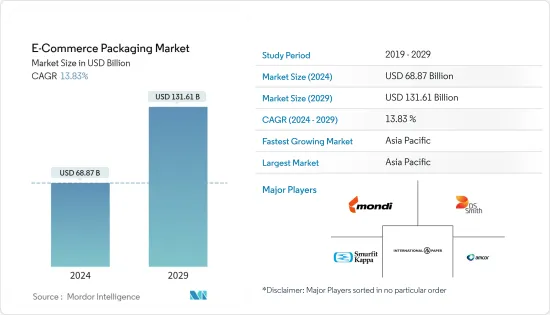

预计2024年电商包装市场规模为688.7亿美元,预计到2029年将达到1,316.1亿美元,在预测期(2024-2029年)成长13.83%,以复合年增长率成长。

随着线上支出的增加以及网路和智慧型手机的广泛使用,经济正在迅速扩张。然而,购买前缺乏第一手产品体验以及互联网公司在全球农村地区的普及有限预计将成为该行业成长的主要限制因素。此外,俄罗斯和乌克兰之间的战争影响了整个包装生态系统。

主要亮点

- 电子商务网站已成为消费者购买产品的热门选择,原因有很多,包括送货上门、方便且易于搜寻产品。电子商务业务领域的快速扩张极大地增加了对固体包装解决方案的需求。

- 全球新兴经济体的网路普及不断提高,大多数人都可以上网,这使得电子商务和包装供应商能够进入开拓的市场,并在此过程中产生可观的收入。这创造了巨大的潜在市场机会获得市场占有率。

- 人们对塑胶废弃物的认识不断增强,公司正致力于最大限度地减少塑胶废弃物并提供 100% 可回收和生物分解性的产品。

- 在 COVID-19感染疾病期间,市场有所成长。大多数国家,特别是中国、美国和德国,都对人员和货物的流动实施了限制。然而,消费者对食品、药品和蔬菜等必需品的需求使电子商务产业免受这些法律的约束。电子商务平台透过限制人员流动和提供送货上门服务来防止病毒传播至关重要。

- 农村人口对电商平台缺乏了解可能会阻碍市场拓展。消费者对电子商务产业越来越感兴趣,政府也积极支持创新方法的开发,以增加企业的选择。然而,开发中国家的成长乏力和需求低迷限制了这些地区的市场开拓。

电商包装市场趋势

消费性电器产品产业实现显着成长

- 消费性电器产品塑造了消费者的安全、通讯和娱乐生活方式。预计 2021 年将有超过 21.4 亿人进行网路购物。家电是开关週期短的细分市场。此外,电器产品的采用率创出月度新高,出货较去年同期成长。

- 电子商务赢得了消费者对优质交付和售后支援的信任,鼓励他们在线下多个订单。包装解决方案提供强大的包装解决方案,可承受搬运和物流过程中的损坏。

- 行动市场是普及的消费性电器产品新类别,科技驱动的持续发展正在使行动市场倍增。此外,为了应对这种成长,电子商务公司正在合作进行产品发布和销售,从而导致电子商务包装市场的需求增加。

- 产品开发数量的增加开启了新的市场机会并提高了该行业的成长率。阐明设计和製造过程的各种产品创新也有助于市场成长。开发有效且环保的电子商务包装材料的技术进步预计将为电子商务包装市场的製造商提供盈利的机会。

- 许多电子商务公司都专注于永续包装解决方案,以减少塑胶废弃物并过渡到纸质包装。这一趋势预计也将影响对外部影响敏感的消费电子产业,透过更好的设计使包装更加坚固。例如,电子商务巨头亚马逊推出了无忧包装解决方案,以消除额外的运输箱。

亚太地区预计将占据最大份额

- 亚太地区是全球成长最快的电子商务市场之一。由于印度和中国等主要国家的客户群不断扩大,电子商务出货正在增加。因此,该地区对包装解决方案的需求将会增加。

- 政府推动数位化的努力不断让个人接触线上商务模式,增加了该地区对电子商务包装解决方案的需求。印度拥有 100% 折扣的 FDI 政策,鼓励亚马逊等公司在印度建立更大的业务。

- IBEF表示,由于网路普及不断提高以及相对强劲的经济表现,印度电子商务收益将从2020年的462亿美元增至2025年的1880亿美元,成为全球成长最快的国家。

- 亚太地区在 2021 年占据最大的市场占有率,预计在整个预测期内将保持这一地位。不断增长的网路普及、智慧型手机用户的增加以及日益年轻的消费者群体都有助于该公司的优势。此外,阿里巴巴、亚马逊和 Flipkart 等该地区的主要电子商务公司可能会增加其线上包装服务在该地区的使用。

电商包装产业概况

提供电子商务包装解决方案的多家参与者加剧了市场竞争。因此,市场适度分散,许多公司正在製定扩大策略。市场上营运的一些主要企业包括 Amcor PLC、Mondi PLC、International Paper Company、Smurfit Kappa Group PLC 等。

2022年5月,纸包装产品综合製造商Smurfit Kappa UK Limited宣布收购Atlas Packaging。 Atlas Packaging 总部位于德文郡北巴恩斯特珀尔,是一家独立瓦楞包装供应商。该公司对其在英国强大的市场影响进行了大量投资,这使其能够满足需求并为其广大客户群创造价值。我们在商店包装、礼盒和电子商务领域拥有强大的影响力,提供一系列令人兴奋的创新产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 价值链分析

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对的强度

第五章市场动态

- 促进因素

- 抑制因素

第六章市场区隔

- 依材料类型

- 塑胶

- 纸板

- 纸

- 其他材料

- 最终用户

- 时尚服饰

- 家用电器

- 食品与饮品

- 个人保健产品

- 其他最终用户

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他的

- 亚太地区

- 印度

- 中国

- 日本

- 其他的

- 拉丁美洲

- 巴西

- 阿根廷

- 其他的

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他的

- 北美洲

第七章 竞争形势

- 公司简介

- Amcor PLC

- Mondi PLC

- International Paper Company

- Smurfit Kappa Group PLC

- DS Smith PLC

- Klabin SA

- Georgia-Pacific LLC

- Nippon Paper Industries Co. Ltd

- Pacman LLC

- Sealed Air Corporation

- Rengo Co. Ltd

- Shorr Packaging Corporation

第八章投资分析

第九章市场机会与未来趋势

The E-Commerce Packaging Market size is estimated at USD 68.87 billion in 2024, and is expected to reach USD 131.61 billion by 2029, growing at a CAGR of 13.83% during the forecast period (2024-2029).

Online spending is rising, the internet and smartphones are becoming more widely used, and the economy is expanding quickly. However, the lack of first-hand product experience prior to purchase and the limited penetration of internet enterprises in rural areas of the world are anticipated to be significant growth inhibitors for the sector. Further, the Russia-Ukraine war had an impact on the overall packaging ecosystem.

Key Highlights

- E-commerce websites have become a popular choice among consumers for purchasing goods for various reasons, including at-home delivery, convenience, and easy product searching. The fast global expansion of the e-commerce business has dramatically increased the demand for solid packaging solutions.

- Rising internet penetration and growing access to the internet for most of the population in developing economies across the globe have created tremendous potential market opportunities for e-commerce and packaging providers to venture into untapped markets and gain substantial market share during the process.

- The awareness about plastic waste is growing, and companies focus on minimizing it and offering 100% recyclable and biodegradable products.

- The market increased during the COVID-19 pandemic. Most countries, notably China, the United States, and Germany, established restrictions on the movement of people and goods. However, due to customer demand for necessary commodities such as food, pharmaceuticals, veggies, and other things, the e-commerce industry was exempted from these laws. E-commerce platforms are vital in preventing virus spread by limiting people's movement and providing door-to-door delivery services.

- The lack of understanding of e-commerce platforms among the rural population would hamper the market's expansion. Consumers are becoming increasingly interested in the e-commerce industry, and governments are actively supporting the deployment of innovative approaches to broaden company options. However, the lack of growth in underdeveloped countries restricts the market from tapping into these regions due to fewer demands.

Ecommerce Packaging Market Trends

Consumer Electronics Segment to Witness Significant Growth

- Consumer electronics are shaping consumers' security, communications, and entertainment lifestyles. Over 2.14 billion people were estimated to shop online in the year 2021. Consumer electronics is the segment that has a shorter changeover period. Also, the adoption of consumer electronics is reaching a new high every month, increasing shipments yearly.

- E-Commerce has gained consumers' trust in quality deliverables and aftersales support, encouraging them for multiple orders online. Packaging solutions offer robust packaging solutions to sustain damages during handling and logistics.

- The mobile market is the refreshed category of consumer electronics with the highest penetration, and with continuous development by the technologies, the mobile market growth is multiplying. Also, in response to this growth, e-commerce companies are partnering for their launches and distribution, resulting in the growing demand for the e-commerce packaging market.

- The increasing number of product developments will increase the industry's growth rate by opening up new market opportunities. Various product innovations illuminating design and manufacturing processes also assist market growth. Technological improvements in developing effective and environmentally friendly e-commerce packaging are projected to generate profitable opportunities for manufacturers in the e-commerce packaging market.

- Many e-commerce companies focus on sustainable packaging solutions to reduce plastic waste and move towards paper-based packaging. The trend is also expected to hit the consumer electronics segment, which is sensitive to external impacts with better design to make packaging more robust. For instance, e-commerce giant Amazon introduced a Frustration-Free Packaging solution to eliminate additional shipping boxes.

Asia Pacific is Expected to Hold the largest Share

- Asia-Pacific is one of the world's fastest-growing e-commerce markets. Growing client bases in key countries such as India and China drive increased e-commerce shipments. As a result, there will be greater demand for packaging solutions in the area.

- Government attempts to promote digitalization constantly introduce individuals to online modes of commerce, fueling demand for e-commerce packaging solutions in the region. India has a favorable FDI policy of 100 percent, which encourages corporations like Amazon to establish a greater presence in the country.

- IBEF has said that increasing internet penetration and relatively stronger economic performance will lead India's E-commerce revenue to climb from USD 46.2 billion in 2020 to USD 188 billion in 2025, the fastest growing in the world.

- The Asia-Pacific region held the largest market share in 2021 and is expected to hold that position throughout the forecast period. The expanding internet penetration, the growing number of smartphone users, and the rising youthful demographic consumer base all contribute to the company's dominance. Furthermore, large e-commerce companies in the region, such as Alibaba, Amazon, and Flipkart, will increase the region's usage of online packaging services.

Ecommerce Packaging Industry Overview

The availability of several players providing e-commerce packaging solutions has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies. Key players operating in the market include Amcor PLC, Mondi PLC, International Paper Company, and Smurfit Kappa Group PLC, among others.

In May 2022, Smurfit Kappa UK Limited, an integrated manufacturer of paper-based packaging products, announced the acquisition of Atlas Packaging. Based in Barnstaple, North Devon, Atlas Packaging is an independent corrugated packaging provider. The company is well invested with a strong market presence in the UK, allowing it to meet the needs of and deliver value to its broad customer base. With a powerful presence in shelf-ready packaging, gift boxing, and the e-commerce sector, they offer an exciting and wide range of innovative products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Value Chain Analysis

- 4.2 Market Overview

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Corrugated

- 6.1.3 Paper

- 6.1.4 Other Materials

- 6.2 End User

- 6.2.1 Fashion & Apparel

- 6.2.2 Consumer Electronics

- 6.2.3 Food & Beverages

- 6.2.4 Personal Care Products

- 6.2.5 Other End-Users

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 US

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Amcor PLC

- 7.1.2 Mondi PLC

- 7.1.3 International Paper Company

- 7.1.4 Smurfit Kappa Group PLC

- 7.1.5 DS Smith PLC

- 7.1.6 Klabin SA

- 7.1.7 Georgia-Pacific LLC

- 7.1.8 Nippon Paper Industries Co. Ltd

- 7.1.9 Pacman LLC

- 7.1.10 Sealed Air Corporation

- 7.1.11 Rengo Co. Ltd

- 7.1.12 Shorr Packaging Corporation