|

市场调查报告书

商品编码

1639515

润滑油 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

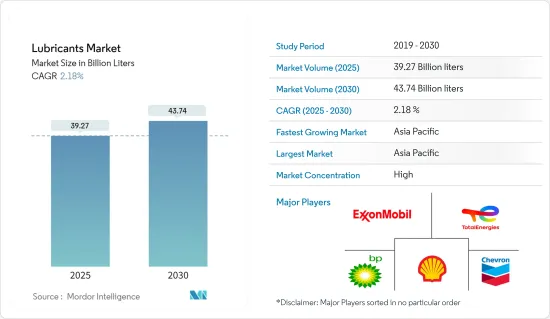

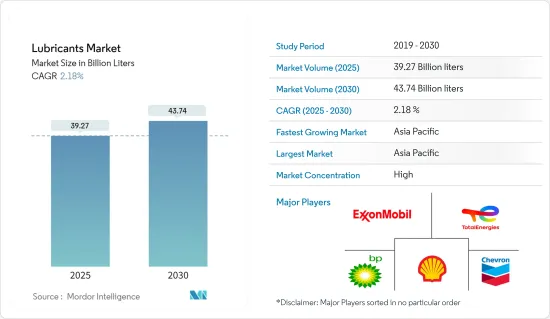

2025年润滑油市场规模预估为392.7亿公升,预估至2030年将达437.4亿公升,预测期间(2025-2030年)复合年增长率为2.18%。

2020 年,由于 COVID-19 造成的全球供应链中断,润滑油市场面临挫折。疫情导致许多为润滑油产业提供基础油和添加剂等重要原料的工厂关闭。在汽车行业积极前景以及石油和天然气行业持续进步的推动下,润滑油市场预计在未来几年将出现温和但积极的增长。

主要亮点

- 短期来看,汽车保有量的快速成长和发电产业投资的强劲成长是推动该市场需求的关键因素。

- 然而,由于环境问题日益严重,严格的法规预计将阻碍市场的成长。

- 生物润滑剂的日益普及预计将在该市场创造新的商机。

- 预计亚太地区将主导全球市场,其中大部分需求来自中国和印度。

润滑油市场趋势

汽车和其他运输领域主导市场

- 润滑油市场主要由汽车业和其他运输业(包括飞机和船舶)主导。

- 汽车产业是润滑油的主要消费者之一,润滑油对于确保车辆的平稳运作至关重要。润滑剂还有助于清洗和冷却引擎部件,防止生锈和腐蚀积聚。

- 在汽车领域,商用车和两轮车使用机油、变速箱油、液压油、润滑脂等各种润滑油,带动了润滑油产业的发展。

- 机油、齿轮油、变速箱油、润滑脂和压缩机油主要用于小型车辆,包括摩托车和乘用车。OEM和售后市场都非常喜欢这些润滑剂。

- 新兴市场对轻型高性能汽车的需求不断增加、汽车轮毂数量不断增加以及可支配收入不断增加是润滑油需求旺盛的关键原因。

- 国际汽车製造商组织(OICA)报告称,2023年全球新车销量稳定成长,达到9,270万辆以上,较2022年成长11.9%。其中,乘用车新车销量与前一年同期比较增11.3%至6,530万辆,高于2022年的5,860万辆。同时,2023年全球商用车新註册量将达到2,750万辆,比2022年的2,420万辆成长13.3%。

- 2023年北美汽车销量为1,919万辆,比2022年的1,693万辆成长13.4%。 1919万辆汽车总销量中,乘用车398万辆,商用车1521万辆,其余为重卡、客车、客车的组合。

- 此外,根据欧洲汽车工业协会的资料,2023年欧洲新车註册数量与前一年同期比较增加18.7%。 2023年,乘用车销量将达到1500万辆,商用车销量将达到290万辆,而2022年将分别达到1264万辆和244万辆。

- 鑑于这些动态,预计市场在预测期内将显着成长。

亚太地区主导市场

- 亚太地区领先全球市场占有率。随着中国、印度和日本等国家加大力度发展风力发电并提高汽车产量,该地区对润滑油的需求正在上升。

- 中国在润滑油消费和生产方面均位居世界强国。塑造中国润滑油格局的主要企业包括壳牌公司、中石化、埃克森美孚公司和英国石油公司。该行业的成长是由整个预测期内投资活性化和扩张所推动的。

- 2024 年 6 月,壳牌完成了曼谷油脂製造工厂的重大扩建,产能增加两倍。此次扩建将使该工厂能够满足泰国一半的润滑脂需求,将年产量从 5,000 吨增加到 15,000 吨。

- 2023 年 9 月,麦克唐奇石化有限公司宣布计划在中国天津建造一座新的复合工厂。

- 在汽车数量迅速增加和技术进步的推动下,中国汽车产业已成为润滑油的最大消费国。中国工业协会(CAAM)宣布,2023年,中国汽车产销双双创历史新高,达3,000万辆,与前一年同期比较增长两位数。

- 受可支配收入增加、新型运动型多用途车的繁荣和有吸引力的贷款利率的推动,到 2023 年,印度的乘用车销量将首次突破 400 万辆大关。印度汽车工业协会 (SIAM) 的数据显示,印度国内市场轿车、轿车和多功能车销量超过 410 万辆,比一年前的 379 万辆增长 8.2%。其中,多用途车占总量的57.4%。

- 此外,随着经济体越来越倾向于风能等可再生能源,亚太地区的离岸风力发电装置容量预计将大幅增加。世界风力发电理事会(GWEC)预测,到2029年,亚太地区离岸风力发电装置量将比2022年成长225.4%。这种激增将在预测期内扩大风电产业的润滑油需求。

- 考虑到这些动态,亚太地区的润滑油消费量将增加,确保该地区的持续市场主导地位。

润滑油产业概况

全球润滑油市场本质上是一体化的。主要参与企业(排名不分先后)包括壳牌公司、埃克森美孚、BP公司(嘉实多)、TotalEnergies和雪佛龙公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车保有量快速成长带动润滑油需求

- 发电业投资强劲成长

- 其他司机

- 抑制因素

- 由于环境问题日益严重,监管更加严格

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 团体

- 第一组

- 第二组

- 第三组

- 第四组

- 第五组

- 基料

- 矿物油润滑剂

- 合成润滑油

- 半合成润滑油

- 生物性润滑剂

- 产品类型

- 机油

- 变速箱/液压油

- 金属加工油

- 一般工业油

- 齿轮油

- 润滑脂

- 加工油

- 其他的

- 最终用户产业

- 发电

- 机动车辆及其他运输

- 重型设备

- 饮食

- 冶金/金属加工

- 化学製造

- 其他最终用户产业(包装、石油和天然气)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation(Sinopec)

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd

- LUKOIL

- MOTUL

- Petromin

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- TotalEnergies

- Valvoline(Saudi Aramco)

第七章 市场机会及未来趋势

- 扩大生物润滑剂的采用

- 其他机会

The Lubricants Market size is estimated at 39.27 billion liters in 2025, and is expected to reach 43.74 billion liters by 2030, at a CAGR of 2.18% during the forecast period (2025-2030).

In 2020, the lubricants market faced setbacks due to global supply chain disruptions caused by COVID-19. The pandemic led to shutdowns of numerous factories supplying essential raw materials, such as base oil and additives, to the lubricants industry. Nevertheless, buoyed by a positive automotive industry outlook and consistent advancements in the oil and gas sector, the lubricants market is expected to experience modest yet positive growth in the coming years.

Key Highlights

- Over the short term, the surging vehicle population and robust growth of investments in the power generation sector are the major factors driving the demand for the market studied.

- However, stringent regulations amidst growing environmental concerns are expected to hinder the market's growth.

- Nevertheless, the growing adoption of bio-lubricants is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Lubricants Market Trends

Automotive and Other Transportation Segment to Dominate the Market

- Automotive and other transportation sectors, including aircraft and marine, dominate the lubricant market.

- The automotive sector stands out as one of the primary consumers of lubricants, which are crucial for ensuring smooth vehicle operation. The lubricants also help clean and cool down the engine parts and prevent them from buildup of rust and corrosion.

- In the automotive sector, various lubricants such as engine oil, transmission oil, hydraulic oil, greases, and other lubricants are used in commercial vehicles and motorcycles, which will drive the lubricants industry.

- Light-duty vehicles, encompassing two-wheelers and passenger cars, predominantly use engine oils, gear oils, transmission oils, greases, and compressor oils. Both OEMs and the aftermarket show a strong preference for these lubricants.

- Growing demand for lightweight, high-performance cars in emerging markets, increasing automotive hubs, and rising disposable income are the major reasons for the high demand for lubricants.

- In 2023, global new vehicle sales saw a robust growth of 11.9% over 2022, totaling over 92.7 million units, as reported by the Organisation Internationale des Constructeurs d'Automobiles (OICA). Specifically, new passenger vehicle sales climbed by 11.3% year-over-year, hitting 65.3 million units, up from 58.6 million in 2022. Concurrently, new commercial vehicle registrations worldwide rose to 27.5 million units in 2023, marking a notable 13.3% increase from the 24.2 million units recorded in 2022.

- In North America, motor vehicle sales in 2023 accounted for 19.19 million units, an increase of 13.4% compared to 2022's sales, which was reported to be 16.93 million units, according to the OICA. Out of the total 19.19 million units, passenger cars accounted for 3.98 million units, commercial vehicles made up 15.21 million units, and the remaining units were a combination of heavy trucks, buses, and coaches.

- Furthermore, as per the data from the European Automobile Manufacturers Association, in Europe, the overall registration of new motor vehicles increased by 18.7% in 2023 compared to the previous year. In 2023, passenger car and commercial vehicle sales reached 15 million units and 2.90 million units, respectively, compared to 12.64 million units and 2.44 million units in 2022.

- Given these dynamics, the market is poised for significant growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region led the global market share. As countries like China, India, and Japan ramp up their wind power initiatives and bolster automotive production, the demand for lubricants in the region is on the rise.

- China stands out as a global powerhouse, both in lubricant consumption and production. Major players shaping China's lubricant landscape include Shell Plc, Sinopec, ExxonMobil Corporation, and BP Plc. The sector's growth was bolstered by heightened investments and expansions throughout the forecast period.

- In June 2024, Shell completed a significant expansion at its grease manufacturing plant in Bangkok, tripling its production capacity. This enhancement positions the plant to meet half of Thailand's grease demand, boosting its annual output from 5,000 to 15,000 metric tons.

- In September 2023, McDonch Petrochemical Co. unveiled plans for a new blending plant in Tianjin, China, targeting an annual production of 50,000 finished lubricant products.

- China's automotive sector, driven by a burgeoning vehicle fleet and tech advancements, emerges as the top lubricant consumer. 2023 saw both sales and production of automobiles in China hit a record 30 million units, marking a notable double-digit growth from the prior year, as highlighted by the China Association of Automobile Manufacturers (CAAM).

- In 2023, India's passenger vehicle sales surpassed the 4 million milestone for the first time, fueled by increasing disposable incomes, a boom in new sport-utility vehicles, and attractive loan rates. The domestic market recorded sales of over 4.1 million cars, sedans, and utility vehicles, marking an 8.2% rise from the previous year's 3.79 million, according to the Society of Indian Automobile Manufacturers (SIAM). Significantly, utility vehicles made up 57.4% of the overall sales.

- Moreover, with economies increasingly leaning towards renewable energies like wind, the Asia-Pacific's offshore wind installations are set for a significant uptick. The Global Wind Energy Council (GWEC) projects a 225.4% growth in the region's offshore wind installation volume by 2029, compared to 2022. This surge is poised to amplify the wind power industry's lubricant demand during the forecast period.

- Given these dynamics, lubricant consumption in the Asia-Pacific is set to rise, ensuring the region's continued market dominance.

Lubricants Industry Overview

The Global lubricants market is consolidated in nature. The major players (not in any particular order) include Shell PLC, Exxon Mobil Corporation, BP PLC (Castrol), TotalEnergies, and Chevron Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Vehicle Population to Drive the Demand for Lubricants

- 4.1.2 Robust Growth of Investments in the Power Generation Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Amidst Growing Environmental Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Group

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Group V

- 5.2 Base Stock

- 5.2.1 Mineral Oil Lubricant

- 5.2.2 Synthetic Lubricant

- 5.2.3 Semi-synthetic Lubricant

- 5.2.4 Bio-based Lubricant

- 5.3 Product Type

- 5.3.1 Engine Oil

- 5.3.2 Transmission and Hydraulic Fluid

- 5.3.3 Metalworking Fluid

- 5.3.4 General Industrial Oil

- 5.3.5 Gear Oil

- 5.3.6 Grease

- 5.3.7 Process Oil

- 5.3.8 Other Product Types

- 5.4 End-user Industry

- 5.4.1 Power Generation

- 5.4.2 Automotive and Other Transportation

- 5.4.3 Heavy Equipment

- 5.4.4 Food and Beverage

- 5.4.5 Metallurgy and Metalworking

- 5.4.6 Chemical Manufacturing

- 5.4.7 Other End-user Industries (Packaging, Oil and Gas)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 NORDIC countries

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 South Africa

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BP PLC

- 6.4.2 Chevron Corporation

- 6.4.3 China National Petroleum Corporation (CNPC)

- 6.4.4 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.5 ENEOS Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Hindustan Petroleum Corporation Limited

- 6.4.9 Idemitsu Kosan Co. Ltd

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 LUKOIL

- 6.4.12 MOTUL

- 6.4.13 Petromin

- 6.4.14 PETRONAS Lubricants International

- 6.4.15 Phillips 66 Company

- 6.4.16 PT Pertamina Lubricants

- 6.4.17 Repsol

- 6.4.18 Shell PLC

- 6.4.19 TotalEnergies

- 6.4.20 Valvoline (Saudi Aramco)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Bio-lubricants

- 7.2 Other Opportunities