|

市场调查报告书

商品编码

1444672

零售分析 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Retail Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

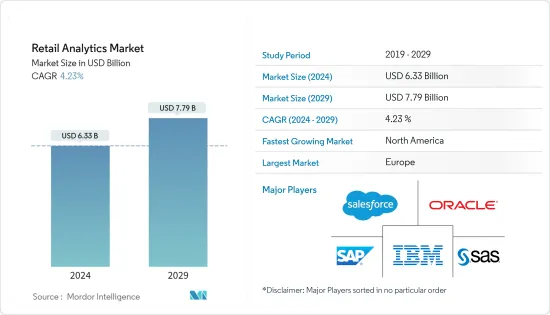

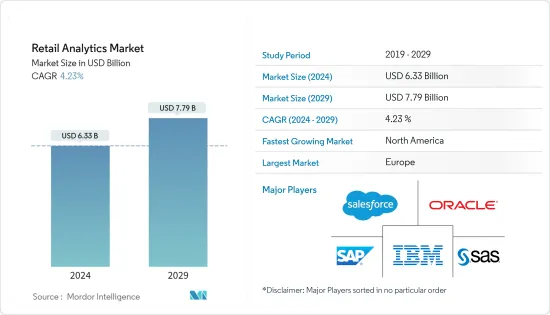

零售分析市场规模预计到 2024 年为 63.3 亿美元,预计到 2029 年将达到 77.9 亿美元,在预测期内(2024-2029 年)CAGR为 4.23%。

零售资料分析透过分析历史资料来实现更明智的决策、改善营运并增加销售。最终用户资料和后端流程(例如供应链和库存管理)一直是资料分析的主要来源。

主要亮点

- 商业智慧和分析系统已与后端应用程式集成,以更好地了解购物者的行为,从而促进一致的客户对话。所采用的全通路策略透过整合不同的资料来源并在客户的首选管道上与客户进行沟通,引导分析来满足多种管道的需求。向强烈个人化迈出的进一步一步加强了典型的客户终身价值和接触点。因此,目前的零售商更倾向于收集和分析位置、社交情绪、点击流等资料。

- 透过获取消费者行为资料来改善消费者体验和零售营运的数位化正在推动零售分析行业向前发展。采用零售分析的主要优点是它提供了有关客户行为的特定且有意义的资料。当业务经理了解如何估计财务回报时,管理公司的任何领域都会变得更加容易,而零售分析可以提供企业用来做出选择的资讯。零售分析为商家提供了清晰的业务概况,从分析社群媒体评论到了解活动对商店转换率的影响。

- 根据 IBM 的一项调查,高层估计,COVID-19 使他们的数位化进程加快了 67%;此外,疫情促使92%的他们将「提高营运效率」视为首要任务。

- 电子商务的出现使得实体店扩张的传统成长途径已经过时。线上平台、本地化分类和国际市场扩张已经改变了商品分析的方式。来自线上平台的激烈竞争促使零售商进入该领域,并提供了更清晰的分类、定价、促销、采购、补货以及店内规划和执行的情况。

- COVID-19的疫情引发了全球零售企业的数位化。这场大流行迫使传统零售业发生根本性转变,转向以人工智慧和分析等强大数位工具为中心的现代电子商务策略。线上消费习惯的日益普及,加剧了对数位创新和颠覆的需求。增加使用人工智慧来客製化购物体验、提高客户保留率并提高销售效率将有利于企业发展。

零售分析市场趋势

店内营运占主要份额

- 基于店内营运的分析已成为实体零售商营运策略中不可或缺的一部分。透过向合适的客户提供合适的产品等好处,对忠诚客户的进一步了解有助于制定提高客户黏性的策略。

- 当零售商使用多种技术(例如评估客户偏好、识别客户在店内的位置、有针对性的促销和购买习惯)向消费者提供客製化体验时,他们就实现了商店的数位转型。商店监控技术分析这些趋势,提供有价值的见解,帮助商家增加收入、销售额和客流量。

- 例如,2022 年 6 月,亚马逊推出了新的商店分析服务。这家电子商务巨头现在正试图透过向行销人员提供客户购买商品的资料来从其实体店面中获利。

- 据NewGenApps称,选择充分利用巨量资料分析潜力的商家可能会将其营业利润提高60%。此外,全通路零售商可以监控店内买家行为并及时向客户提供优惠,以激励店内购买或随后的线上销售,从而将交易保持在零售商的范围内。

- 资料分析和咨询公司 Quantzig 透过微观定位提高了店内销售额,并将德国时装零售商的利润提高了 12%。该零售商面临的挑战主要集中在如何在正确的时间向正确的资源提供洞察、缺乏明确阐述的分析策略以及资料品质差。

欧洲将占据重要份额

- 由于IBM公司和SAP SE等大型企业的存在,欧洲市场表现强劲,它们是预测分析和高级零售分析软体的领先供应商。此外,超过 600 万家公司活跃在该地区,员工超过 3,300 万人。欧洲是世界上许多大型零售商的所在地,例如特易购(Tesco)、家乐福(Carrefour)、利德尔(Lidl)、麦德龙(Metro AG)和阿尔迪(Aldi)。

- 最受欢迎的线上爱好之一是网上购物。它为客户提供了大量的商品,也为电子商务公司带来了许多销售困难。此外,零售业务中越来越多地使用云端服务将为欧洲零售分析市场在不久的将来提供可能性。

- 例如,2022 年 10 月,艾利丹尼森宣布与 SAP 合作,透过连接各自的分析产品云来解决零售业的浪费问题,使超市能够监控和优化其商品的有效期。两家公司已同意透过OEM安排将 SAP Analytics Cloud 整合到艾利丹尼森的 atma.io 连接产品云中。据报道,这些资料透过 atma.io 提供给 SAP Analytics 工具,并使用艾利丹尼森的数位辨识技术(例如无线射频辨识 (RFID))标记物品。

- 使用复杂的分析使互联网购物变得更加智能,并将实体数据和线上资料相结合,可以帮助商家定制目标,从而逐步改善电子商务销售,并有助于欧洲市场的扩张。

零售分析产业概述

零售分析市场竞争中等。该市场的一些主要参与者包括 IBM 公司、Oracle 公司、SAP SE、SAS Institute Inc. 和 Salesforce.com Inc. (Tableau Software Inc.) 等。市场参与者正在创新提供策略解决方案,以扩大其市场影响力和客户群。这使他们能够获得新合约并开拓新市场。市场的一些主要发展是:

- 2023 年 9 月,Oracle 与 Uber 合作推出了 Collect and Receive,这是 Oracle Retail 平台上的新产品,连接零售商和消费者,以增强和丰富最后一英里的交付。在 Oracle Retail Data Store 和云端平台技术的支援下,零售商可以透过预先整合的 API 连结到该公司的配送解决方案 Uber Direct。这个联合解决方案使零售商能够重新平衡库存,同时为客户提供更多选择,包括当日和预定送货选项、订单取货以及返回最近的零售或邮政地点。

- 2023 年 6 月,Salesforce 与 Google 合作扩大了策略合作伙伴关係,帮助企业利用资料和人工智慧提供更个人化的客户体验,更了解客户行为,并以更低的成本在行销、销售、服务和商务领域进行更有效的活动。两项新的资料和人工智慧创新将带来即时资料共享以及增强的预测和生成人工智慧功能。企业可以使用其资料和自订人工智慧模型来更好地预测客户需求,并降低跨平台同步资料的成本、风险和复杂性。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代产品的威胁

- 产业价值链分析

- COVID-19 对产业的影响

第 5 章:市场动态

- 市场驱动因素

- AI 和 AR/VR 的数据量不断增加以及技术进步

- 增加电子零售额

- 市场挑战

- 严重依赖传统流程且缺乏意识和专业知识

第 6 章:市场细分

- 按解决方案

- 软体

- 服务

- 按部署

- 云

- 本地部署

- 按功能分类

- 使用者管理

- 店内营运(库存管理和绩效管理)

- 供应链管理

- 行销和商品化(定价和收益管理)

- 其他功能(运输管理、订单管理)

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 亚太其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- SAP SE

- IBM Corporation

- Alteryx Inc.

- Salesforce.com Inc. (Tableau Software Inc.)

- Oracle Corporation

- Retail Next Inc.

- SAS Institute Inc.

- QlikTech International AB (Qlik)

- Altair Engineering Inc.

- Hitachi Vantara LLC

第 8 章:投资分析

第 9 章:市场的未来

The Retail Analytics Market size is estimated at USD 6.33 billion in 2024, and is expected to reach USD 7.79 billion by 2029, growing at a CAGR of 4.23% during the forecast period (2024-2029).

Retail data analytics follows analyzing historical data to enable smarter decisions, improve operations, and increase sales. Both end-user data and back-end processes, such as supply chain and inventory management, have been primary sources for data analytics.

Key Highlights

- Business Intelligence and Analytics systems have been integrated with back-end applications to understand better shoppers' behavior to facilitate consistent customer conversation. The omnichannel strategies being adopted led analytics to cater to multiple channels by consolidating disparate data sources and communicating with customers on their preferred channel. A further step towards intense personalization has strengthened the typical customer Lifetime Value and touchpoints. Therefore, current retailers have been more inclined to collect and analyze data like Location, Social sentiment, Clickstream, etc.

- Digitalization to improve consumer experience and retail operations by obtaining consumer behavior data is propelling the retail analytics industry forward. The major advantage of employing retail analytics is that it provides particular and meaningful data on customer behavior. When business managers understand how to estimate financial returns, it makes managing any area of a firm much easier, and retail analytics gives information that businesses use to make choices. Retail analytics give merchants with a clear picture of the business, from analyzing social media comments to understanding a campaign's effects on store conversion rates.

- According to an IBM survey, executives estimated that COVID-19 had expedited their digitalization by 67%; moreover, the outbreak drove them to prioritize 'Improve operational efficiency' as its top priority by 92%.

- The advent of e-commerce has rendered traditional growth avenues across brick-and-mortar store expansions as outdated. Online platforms, localized assortments, and international market expansions have transformed the way merchandising analytics is approached. Significant competition from the online platforms led retailers to enter that space and offered a clearer picture of assortment, pricing, promotions, sourcing, replenishment, and in-store planning and execution.

- The COVID-19 outbreak has triggered the global digitalization of retail enterprises. The pandemic forced a radical shift away from conventional retail and toward modern e-commerce strategies centered on powerful digital tools like Al and analytics. The growing popularity of online consumption habits has intensified the demand for digital innovation and disruption. Growing the use of Al to customize shopping experiences, increase customer retention, and improve sales efficiency would benefit corporate growth.

Retail Analytics Market Trends

In-store Operation Hold Major Share

- In-store-operation-based analytics has become an indispensable part of a brick-and-mortar retailer's operating strategy. With benefits ranging from offering the right product to the right customer, further insight on loyal customers leads to the development of strategies to increase customer stickiness.

- When retailers deliver customized experiences to their consumers using several technology such as evaluating customer preferences, recognizing customer location in-store, targeted promotions, and purchase habits, they accomplish digital transformation in shops. The shop monitoring technology analyzes these trends to offer valuable insights that assist merchants in increasing revenue, sales, and footfalls.

- For instance, in June 2022, Amazon launched its new Store Analytics service. The e-commerce behemoth is now attempting to profit on its physical storefronts by providing marketers with data on what customers buy.

- According to NewGenApps, merchants who choose to fully utilize the potential of big data analytics may improve their operating profits by 60%. Furthermore, the omnichannel retailer may monitor in-store buyer behaviour and deliver timely deals to customers to incentivize in-store purchases or later online sales, therefore keeping the transaction within the retailer's fold.

- Quantzig, a data analytics and advisory firm, increased its in-store sales through micro-targeting and the profits by 12% for a fashion retailer based out of Germany. The retailer faced challenges focused on delivering insights to the right resource at the right time, lack of clearly articulated analytics strategy, and poor data quality.

Europe to Hold Significant Share

- The European segment is strong, owing to the presence of large players like IBM Corporation and SAP SE, which are the leading providers of predictive analytics and advanced retail analytics software. Moreover, more than six million companies are active in this region and employ more than 33 million people. Europe is home to many of the large-scale retailers in the world, such as Tesco, Carrefour, Lidl, Metro AG, and Aldi.

- One of the most popular online hobbies is internet shopping. It offers a large range of items to customers and a plethora of sales difficulties to e-commerce firms. Furthermore, the growing use of cloud services in the retail business will provide possibilities in the European retail analytics market in the near future.

- For example, in October 2022, Avery Dennison announced a collaboration with SAP to address waste concerns in the retail industry by connecting their individual analytic product cloud, enabling supermarkets to monitor and optimize the expiry dates of their items. The firms have agreed to incorporate SAP Analytics Cloud into Avery Dennison's atma.io connected product cloud through an OEM arrangement. According to reports, the data is provided to the SAP Analytics tool via atma.io, as well as items labeled using Avery Dennison's digital identifying technology, such as radio frequency identification (RFID).

- The use of sophisticated analytics to make internet shopping smarter and the combining of physical and online data can assist merchants in customizing their targeting, leading to incremental improvements in e-commerce sales and contributing to the expansion of the market's European sector.

Retail Analytics Industry Overview

The Retail Analytics Market is moderately competitive. Some of the major players operating in the market include IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., and Salesforce.com Inc. (Tableau Software Inc.), among others. The players in the market are innovating in providing strategic solutions to increase their market presence and customer base. This enables them to secure new contracts and tap new markets. Some of the key developments in the market are:

- In September 2023, Oracle, in partnership with Uber, announced Collect and Receive, a new offering on the Oracle Retail platform connecting retailers and consumers to enhance and enrich last-mile delivery. Supported by the Oracle Retail Data Store and cloud platform technologies, retailers can link to Uber Direct, the company's delivery solution, through pre-integrated APIs. This joint solution allows retailers to rebalance inventory while giving customers more choices, including same-day and scheduled delivery options, order pickup, and returns to the closest retail or postal location.

- In June 2023, in partnership with Google, Salesforce expanded strategic partnerships to help businesses utilize data and AI to deliver more personalized customer experiences, better understand customer behavior, and run more effective campaigns at a lower cost across marketing, sales, service, and commerce. Two new data and AI innovations will bring real-time data sharing with enhanced predictive and generative AI capabilities. Businesses can use their data and custom AI models to better predict customer needs and reduce the cost, risk, and complexity of synchronizing data across platforms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact Of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Data and Technological Advancements in AI and AR/VR

- 5.1.2 Increasing E-retail Sales

- 5.2 Market Challenges

- 5.2.1 Significant Reliance on Traditional Processes and Lack of Awareness and Expertise

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Function

- 6.3.1 Customer Management

- 6.3.2 In-store Operation (Inventory Management and Performance Management)

- 6.3.3 Supply Chain Management

- 6.3.4 Marketing and Merchandizing (Pricing and Yield Management)

- 6.3.5 Other Functions (Transportation Management, Order Management)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Russia

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 IBM Corporation

- 7.1.3 Alteryx Inc.

- 7.1.4 Salesforce.com Inc. (Tableau Software Inc.)

- 7.1.5 Oracle Corporation

- 7.1.6 Retail Next Inc.

- 7.1.7 SAS Institute Inc.

- 7.1.8 QlikTech International AB (Qlik)

- 7.1.9 Altair Engineering Inc.

- 7.1.10 Hitachi Vantara LLC