|

市场调查报告书

商品编码

1444753

户外 Wi-Fi:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Outdoor Wi-Fi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

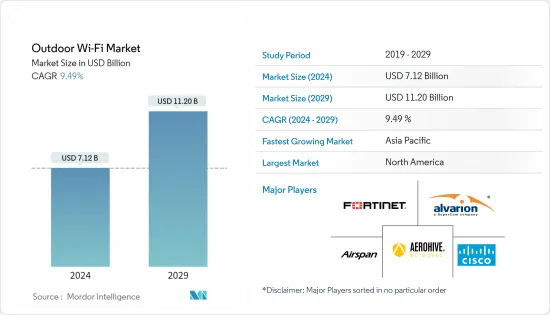

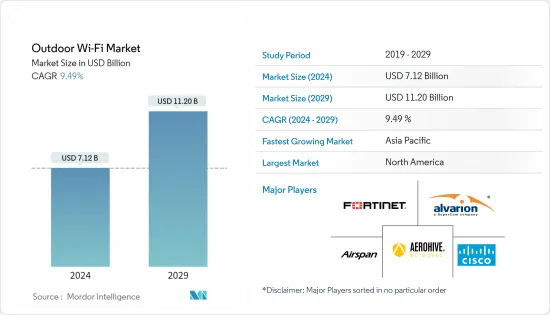

室外Wi-Fi市场规模预计2024年为71.2亿美元,预计2029年将达到112亿美元,在预测期内(2024-2029年)复合年增长率为9.49%增长。

现在许多地方都安装了户外Wi-Fi热点,包括地铁站、饭店、火车站、咖啡馆馆、市场、机场、公园、高等教育机构和其他公共场所。它促进了互联网令人难以置信的可访问性。市场扩张的理由包括社群媒体使用的增加、网路普及的提高以及一些国家对智慧型装置的需求不断增长。

主要亮点

- 各国政府正在优先考虑世界各地的户外 Wi-Fi普及,以加速宽频服务的普及。据爱立信称,到年终,全球固定宽频连线数量预计将达到15亿。它还预测到年终北美将有3.4亿5G用户。因此,这种扩张可能会影响未来户外Wi-Fi市场的成长。

- 此外,政府推出 Wi-Fi 热点的措施将显着推动所研究的市场。例如,去年5月,印度电讯部门的一位高级官员表示,国营的Bharat Sanchar Nigam将于去年6月将其3万个Wi-Fi热点迁移到PM-WANI框架。铁路部门制定了雄心勃勃的计划,将所有未来热点纳入这一框架之下。为了加速宽频网路在全国的普及,政府于 2020 年 12 月核准当地基拉纳斯和邻里商店建立户外 Wi-Fi 网路和网路基地台。 PM-WANI(室外 Wi-Fi接取网路介面)包含潜在的功能。在这个国家发起一场大规模的 Wi-Fi 革命。

- 此外,电讯(ITU) 估计去年有 53 亿人(即世界人口的 66%)使用网路。这比 2019 年成长了 24%,在此期间预计将有 11 亿人加入网路。网路普及的提高为国内外户外 Wi-Fi 供应商推出新产品、扩大频宽和占领重要市场占有率创造了机会。

- 疫情期间,在家工作已成为新常态。随着消费者要求在家工作的压力,各行业和住宅市场正在增加户外 Wi-Fi 的使用来满足这一需求。 Wi-Fi 服务显着增加,社群媒体使用量也增加。例如,《纽约时报》报道称,义大利的群组通话数量增加了十倍,Facebook 的 WhatsApp、Messenger 和 Instagram 平台上的语音通话分别增加了 100% 和 50%。同样,Google注意到其视讯会议产品的使用量增加以及 YouTube 的新使用趋势,但表示尖峰时段流量水平仍然在其范围内。包括 Netflix、Akamai 和 YouTube 在内的许多应用程式供应商已同意降低欧洲高峰时段影片串流的质量,理由是需求增加。有些人已将预设世界设定从高分辨率更改为标准分辨率。

- 相反,如果没有 VPN,您的室外 Wi-Fi 很容易受到中间人 (MITM) 攻击、邪恶双胞胎攻击、恶意软体注入以及 Wi-Fi 窥探和嗅探等攻击。热点降低了上述所有攻击风险。加密过程有效地保护您的所有资料免遭窥探。骇客可以看到您正在使用室外 Wi-Fi 连接到互联网,但他们无法读取正在发送的资料的详细资讯。

室外Wi-Fi市场趋势

全球智慧城市计划投资不断成长

- 智慧城市是使用人工智慧(AI)、物联网(IoT)、云端储存、巨量资料和资料分析等先进技术的城市区域。他们收集和分析使用资料,并利用从中获得的见解来有效管理资源、服务和资产。政府采取越来越多的措施来应对都市化和人口过剩,以及永续对资源管理的需求不断增长,正在推动智慧城市产业的成长。

- 美国是智慧城市开发平台的领先地区之一。物联网智慧社区技术使城市能够更有效地利用资源,并改善从空气和水质到交通、能源和通讯基础设施的一切。据 Smart America 称,未来 20 年,美国城市政府可能会花费高达 41 兆美元用于基础设施升级,以利用物联网。

- 去年11月,智慧城市组织Smart Cities Council开始在英国营运。智慧城市理事会及其相关的全球影响力计画将政府、企业、学术界、慈善界和慈善界聚集在一起,采取行动,以应对当今城市和社区面临的主要挑战和机会。英国的「智慧」从地方和基础设施的扩展包括人员、安全、美丽、永续性、弹性和公平。

- 此外,丰田正在日本富士山脚下建造一座占地 175 英亩的智慧城市,距离东京约 100 英里。 「未来之城」将成为机器人、智慧家庭和人工智慧等技术的试验场。该设施最初将容纳 2,000 名丰田员工及其家人、退休夫妇、零售商和科学家,以测试和开发这些技术。丰田编织城市的居民将居住在智慧家庭中,该智慧家庭配备了辅助日常生活的家庭机器人系统和用于监控健康和其他必需品的基于感测器的人工智慧。

- 根据国际管理髮展研究所的数据,新加坡是 2021 年智慧城市排名第一的城市。与榜单上的其他城市相比,它有很多优势,包括清洁、医疗服务和安全CCTV摄影机。预计此类发展将推动所研究的市场。

亚太地区将经历显着成长

- 由于中国和印度这两个全球最大经济体的存在,亚太地区户外Wi-Fi市场预计将成长更快。该地区强劲的经济成长及其带来的信息表明,互联网即将为亚太地区带来动态变化。因此,该地区的户外Wi-Fi市场蕴藏着巨大的机会。

- 各公司在该地区的 Wi-Fi 技术形势具有竞争力,导致推出了与最新技术相关的各种产品。例如,去年3月,中国科技公司中兴通讯展示了全球首款Wi-Fi 7消费性产品中兴MC888旗舰。中兴MC888旗舰是一款Wi-Fi 7 5G CPE(客户驻地设备),可从4G LTE和5G网路取得蜂巢式资料,并将其转换为Wi-Fi讯号供用户连线。当三个频宽都充分利用时,中兴MC888旗舰支援2.4G Hz/5G Hz/6 Hz频宽,速度高达19 Gbps。功能包括 320 MHz频宽、多链路操作 (MLO)、4K QAM 等。

- 去年10月,IIIT海得拉巴智慧城市生活实验室与Silicon Labs合作建立了覆盖校园的Wi-SUN网络,以促进物联网(IoT)和智慧城市研究和解决方案。 Wi-SUN 连接数百万个物联网节点,使公用事业、城市和企业能够创建远距、低功耗无线网膜网路。该计划包括将校园路灯改造为 Wi-SUN 智慧路灯,以便在整个校园内建立强大的网络,并使用这些灯作为路由器节点来传输感测器资料。

- 韩国将主导Wi-Fi 6E的商业化。 Wi-Fi 6E 是新一代 Wi-Fi,将连线扩展到 6 GHz频宽,可实现更快的速度、更多的频宽和更低的延迟。例如,去年1月,在科学技术资讯通讯部举办的活动中,Wi-Fi 6E在南部度假岛济州岛进行了各种测试。在演示中,8K VR即时串流服务在虚拟实境主题乐园进行了测试。此外,在高中体育馆,参与者使用即时摄影机和 Wi-Fi 6E 路由器透过大约 100 台装置同时观看比赛。此外,Wi-Fi 6E漫游服务也在国内机场进行了测试。

- 2022年8月,D-Link推出DSL X1852E Wi-Fi路由器。该路由器在 5 GHz频宽上提供高达 1200 Mbps 的速度,在 2.4 GHz频宽上提供高达 574 Mbps 的速度,并采用最新的 WPA3 128 位元加密。该路由器还融合了Wi-Fi 6最先进的正交频分多址(OFDMA)技术。它还提供双向 MU-MIMO 技术,有助于将资料流同时分配到多个装置。

室外Wi-Fi行业概况

室外Wi-Fi市场较为分散,现有竞争对手之间的竞争非常激烈。我们也期望看到大公司的收购以及与强调创新的Start-Ups的合作。该市场的主要企业包括思科系统公司和惠普企业公司。

- 2022 年 5 月:思科宣布发布首款支援 Wi-Fi 6E 的室外网路基地台,并对远端工业操作进行了改进。全新 Catalyst IW9167 系列为我们的工业无线产品组合增添了前所未有的多功能性。单一硬体解决方案和两种无线替代方案为企业提供了多种选择,为其应用部署最佳无线技术。当您的业务需求发生变化时,您还可以透过在两种技术之间快速切换来确保您的部署面向未来。

- 2022 年 5 月:Qualcomm Technologies, Inc. 宣布推出支援 Wi-Fi 7 的 Qualcomm Networking Pro Series Gen 3 平台系列。 Qualcomm Networking Pro 系列 Gen3 是高效能 Wi-Fi 7 网路基础设施平台产品组合,目前正在提供样品并可供全球开发合作伙伴使用。该产品将Wi-Fi 7功能与Qualcomm Technologies的智慧多通道管理技术结合,以提高Wi-Fi 6/6E设备的速度、降低延迟和网路利用率。为新一代 Wi-Fi 7 用户端设备提供突破性的吞吐量和极低的延迟。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间敌对的强度

- 替代品的威胁

- 技术简介

第五章市场动态

- 市场动态介绍

- 市场驱动因素

- 对物联网的需求不断增长以及连网设备的普及

- 全球智慧城市计划投资不断成长

- 市场限制因素

- 隐私和安全问题日益严重

第六章市场区隔

- 副产品

- 无线区域网路控制器

- 网路基地台

- 无线主机网关

- 按服务

- 网路规划设计

- 安装与支援

- 按实施模型

- 户外热点

- 专用网路

- 按最终用户产业

- 卫生保健

- 教育

- 物流运输

- 旅行和招待

- 公共工程

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 主要供应商简介

- Aerohive Networks

- Airspan Networks

- Alvarion Technologies(SuperCom)

- Cisco Systems Inc.

- Fortinet Inc.

- Hewlett-Packard Company

- Huawei Technologies Co. Ltd

- Juniper Networks

- Netgear Inc.

- Nokia Siemens Networks

- Ubiquiti Networks Inc.

- Zebra Technologies

第八章投资分析

第九章市场机会与未来趋势

The Outdoor Wi-Fi Market size is estimated at USD 7.12 billion in 2024, and is expected to reach USD 11.20 billion by 2029, growing at a CAGR of 9.49% during the forecast period (2024-2029).

Numerous venues, including metro stations, hotels, railroad stations, cafes, markets, airports, parks, institutions of higher learning, and other public spaces, now feature outdoor Wi-Fi hotspots. It encourages the internet's tremendous accessibility. The grounds for the market's expansion include rising social media usage, increasing internet penetration, and rising demand for smart devices in several nations.

Key Highlights

- Governments are prioritizing outdoor Wi-Fi penetration across the globe to speed the broadband services uptake. According to Ericsson, the global number of fixed broadband connections is estimated to reach 1.5 billion by the end of 2026. It also predicted that by the end of 2026, North America would have 340 million 5G subscriptions. As a result, such expansion will likely influence the future outdoor Wi-Fi market's growth.

- Moreover, the government initiatives towards deploying Wi-Fi hotspots will significantly drive the studied market. For instance, in May last year, a senior telecom department of India official stated that state-owned Bharat Sanchar Nigam would transition 30,000 of its Wi-Fi hotspots to the PM-WANI framework in June last year. Railways include an ambitious plan for all its future hotspots to be under the framework. To promote broadband internet proliferation throughout the nation, the government approved the establishment of outdoor Wi-Fi networks and access points by local Kirana and neighborhood shops in December 2020. The PM-WANI, or outdoor Wi-Fi Access Network Interface, includes the potential to start a vast Wi-Fi revolution in the nation.

- Further, last year, the International Telecommunication Union (ITU) estimated that 5.3 billion people, or 66% of the world's population, would use the internet. It marks a 24% growth from 2019, with an expected 1.1 billion people joining the internet throughout that time. Such a rise in internet penetration will create opportunities for local and international outdoor Wi-Fi vendors to introduce new products and increase the bandwidth to capture a significant market share.

- Throughout the pandemic, working from home became the new norm. Due to consumer pressure to work entirely from home, industries and the residential market have increased outdoor Wi-Fi use to meet this demand. Wi-Fi services rose to a greater extent, boosting social media use. For instance, The New York Times reports that group calls in Italy climbed tenfold while voice calls on Facebook's WhatsApp, Messenger, and Instagram platforms increased by 100% and 50%, respectively. Similarly, Google notes rising videoconferencing product usage and new YouTube usage trends but says peak traffic levels are still well within their capabilities. Many application providers, including Netflix, Akamai, and YouTube, have agreed to lower video streaming quality during peak hours in Europe due to increased demand. Some have also changed default global settings from high-definition to standard-definition.

- On the flip side, without VPNs, outdoor Wi-Fi is exposed to attacks like Man-in-the-Middle (MITM) attacks, evil Twin attacks, malware injection, Wi-Fi snooping and sniffing, etc. Using VPN on free public hotspots will reduce all of these mentioned attacks risks. The encryption process will effectively shield all the user's data from snooping. While the hacker can see that the user is connected to the internet with the help of outdoor Wi-Fi, they cannot read the transmitted data details.

Outdoor Wi-Fi Market Trends

Growing Investments in Smart City Projects Globally

- A smart city is an urban area using advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), cloud storage, big data, and data analytics. They gather and analyze utilization data and use the insights gained from them to manage resources, services, and assets effectively. Growing government measures to address urbanization and overpopulation and the growing need for resource management for sustainable development are driving growth in the smart cities industry.

- The United States is one of the top regions for developing platforms for smart cities. With IoT Smart Communities technology, cities can use resources more effectively and enhance everything from air and water quality to transportation, energy, and communication infrastructure. According to Smart America, during the next 20 years, American city governments may spend up to USD 41 trillion upgrading their infrastructure to take advantage of the Internet of Things.

- In November last year, the Smart Cities Council, a smart cities organization, began operations in the United Kingdom. The Smart Cities Council and its associated global impact program, "Everyone," bring together government, business, academia, philanthropy, and charity to take action and impact the key challenges and possibilities that cities and communities face today. People, safety, beauty, sustainability, resilience, and equity will be included in the expansion of "smart" from place and infrastructure in the United Kingdom.

- Further, Toyota is constructing a 175-acre smart city at the foot of Japan's Mount Fuji, approximately 62 miles from Tokyo. The "future city" will serve as a trial ground for technology such as robotics, smart homes, and artificial intelligence. It will initially house 2,000 Toyota employees and their families, retired couples, retailers, and scientists to test and develop these technologies. Toyota's "Woven City" residents would live in smart homes with in-home robotics systems to help with daily life and sensor-based artificial intelligence to monitor health and other necessities.

- According to International Institute for Management Development, Singapore was the top smart city in 2021. Compared to the other cities on the list, it has many benefits, such as good cleanliness, medical services, and security CCTV cameras. Such developments are expected to drive the studied market.

Asia-Pacific to Witness the Significant Growth

- The Asia-Pacific outdoor Wi-Fi market is expected to grow faster because of the presence of the two largest economies of the world, i.e., China and India. The strong economic growth in the region, coupled with the information that the internet brings, interprets that the internet is poised for dynamic change in the Asia-Pacific region. Due to this, the outdoor Wi-Fi market includes a massive opportunity in this region.

- Companies are competitive in the technological Wi-Fi landscape in the region, leading to various products launch related to the latest technology. For instance, in March last year, ZTE, a Chinese technology company, showcased the world's first Wi-Fi 7 consumer-ready product named the ZTE MC888 Flagship. The ZTE MC888 Flagship is a Wi-Fi 7 5G CPE (Customer Premises Equipment) that takes cellular data from 4G LTE and 5G networks and converts it to Wi-Fi signals so users can connect. If all three bands were fully utilized, the ZTE MC888 Flagship would support the 2.4G Hz/5G Hz/6 Hz frequency bands and up to 19 Gbps speeds. Features like 320 MHz bandwidth, multi-link operation (MLO), and 4K QAM are included.

- In October last year, a campus-wide Wi-SUN network was established by the IIIT Hyderabad Smart City Living Lab in collaboration with Silicon Labs to facilitate research and solutions for the Internet of Things (IoT) and smart cities. To connect millions of IoT nodes, Wi-SUN enables utilities, cities, and businesses to construct long-range, low-power wireless mesh networks. To create a robust network across the campus and use these lights as router nodes to transfer sensor data, this project involves converting campus streetlights to Wi-SUN smart streetlights.

- South Korea plans to lead Wi-Fi 6E commercialization, the following Wi-Fi generation that extends the connectivity to the 6 GHz band, thus enabling more bandwidth and faster speeds at lower latency. For instance, in January last year, Wi-Fi 6E was tested in various ways on the southern resort island of Jeju at an event conducted by the Ministry of Science and ICT. An 8K VR real-time streaming service was tested in a virtual reality theme park during the demonstration. Also, participants at a high school gymnasium watched a game simultaneously through about 100 terminals using a relay camera and a Wi-Fi 6E router. Moreover, the Wi-Fi 6E roaming service was tested at an airport in the country.

- In August 2022, D-Link launched DSL X1852E Wi-Fi Router. This router offers speeds up to 1200 Mbps on its 5 GHz band and 574 Mbps on its 2.4 GHz band with the latest WPA3 128-bit encryption. This router also incorporates Wi-Fi 6's cutting-edge Orthogonal Frequency Division Multiple Access (OFDMA) technologies. It also provides two-way MU-MIMO technology, which helps distribute data flow to multiple devices simultaneously.

Outdoor Wi-Fi Industry Overview

The outdoor Wi-Fi market is fragmented, and the competitive rivalry among existing competitors is high. Also, moving forward, acquisitions and collaboration of large companies with startups are expected, focusing on innovation. Some key players in the market are Cisco Systems Inc. and Hewlett-Packard Enterprise Company, among others.

- May 2022: Cisco announced the release of its first outdoor Wi-Fi 6E-ready access point and improvements for remote industrial operations. The new Catalyst IW9167 Series adds greater versatility to our industrial wireless portfolio than ever. With a single hardware solution and two wireless alternatives, we give businesses more excellent options for deploying the best wireless technologies for their applications - and for future-proofing deployments by quickly switching between the two technologies as business needs change.

- May 2022: Qualcomm Technologies, Inc. announced the availability of its Wi-Fi 7-enabled Qualcomm Networking Pro Series Gen 3 platform family. The Qualcomm Networking Pro Series, Gen3, is a high-performance Wi-Fi 7 network infrastructure platform portfolio that is now sampling and accessible to global development partners. The products combine Wi-Fi 7 features with Qualcomm Technologies' intelligent multi-channel management technologies to improve speeds, lower latency, and network utilization for Wi-Fi 6/6E devices. It offers game-changing throughput and incredibly low latency for the next generation of Wi-Fi 7 client devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Demand for Internet of Things and Penetration of Internet Enabled Gadgets

- 5.2.2 Growing Investments in Smart City Projects Globally

- 5.3 Market Restraints

- 5.3.1 Rising Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 WLAN Controllers

- 6.1.2 Access Points

- 6.1.3 Wireless Hospot Gateways

- 6.2 By Service

- 6.2.1 Network Planning and Design

- 6.2.2 Installation and Support

- 6.3 By Implementation Model

- 6.3.1 Outdoor Hotspots

- 6.3.2 Private Networks

- 6.4 By End-user Industry

- 6.4.1 Healthcare

- 6.4.2 Education

- 6.4.3 Logistics and Transportation

- 6.4.4 Travel and Hospitality

- 6.4.5 Public Utilities

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Key Vendor Profiles

- 7.1.1 Aerohive Networks

- 7.1.2 Airspan Networks

- 7.1.3 Alvarion Technologies (SuperCom)

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Fortinet Inc.

- 7.1.6 Hewlett-Packard Company

- 7.1.7 Huawei Technologies Co. Ltd

- 7.1.8 Juniper Networks

- 7.1.9 Netgear Inc.

- 7.1.10 Nokia Siemens Networks

- 7.1.11 Ubiquiti Networks Inc.

- 7.1.12 Zebra Technologies