|

市场调查报告书

商品编码

1444940

电动山地自行车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)E-Mountain Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

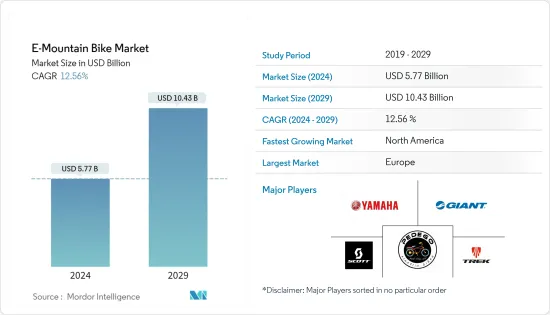

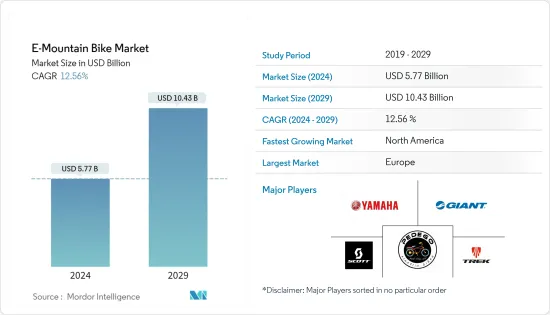

电动山地自行车市场规模预计到 2024 年为 57.7 亿美元,预计到 2029 年将达到 104.3 亿美元,在预测期内(2024-2029 年)增长 12.56%,预计复合年增长率为

主要亮点

- 从更广泛的范围来看,与其他市场的重大负面影响相比,COVID-19 对电动山地自行车市场的影响不大。由于人们对个人出行的兴趣增加以及克服交通拥堵的需要,预计对个人车辆的需求将会增加。随着环境影响的增加以及对废气温度升高的担忧,电动自行车成为传统自行车和摩托车的绝佳替代品。

- 然而,COVID-19 将人员流动减少到零,使该行业倒退,并停止了新型电动自行车的生产。 COVID-19 之后,由于消费者休閒和健康意识的增加,预计市场将出现显着的经济成长。

- 从长远来看,随着年轻一代对健行和休閒活动的浓厚兴趣,e-Mountain正在快速增长。然而,有关这些自行车的速度和安全问题的政府法规等因素可能会阻碍市场成长。例如,国际自行车联盟(UCI)对电动山地自行车马达采用了严格的规定,功率不得超过250瓦。踏板辅助的最高速度不得超过 25 公里/小时。

- 预计欧洲将创下电动山地自行车普及最高的纪录,并引领全球。

电动山地自行车(EMTB)市场趋势

对永续交通的需求不断增长

- 移动性在我们当今生活的社会中发挥着重要作用。环境保护已成为世界各地社会和政府面临的一项严峻挑战,主要由于自然资源稀缺和日益严重的环境问题,人们对保护和维持后代流动性的兴趣日益浓厚。Masu。

- 因此,对电动山地自行车不断增长的需求使其成为应对这项挑战的理想解决方案。由于排放量不断上升,环境和健康问题不断加剧,世界各国政府和国际组织正在製定严格的排放标准,以降低碳排放水准。

- 为此,世界各地的一些国际组织对车辆制定了严格的标准。例如,欧盟于2020年1月实施了法规(EU) 2019/631,制定了新的小客车和货车二氧化碳排放性能标准。欧洲登记的新小客车平均二氧化碳排放与前一年同期比较下降了12%,而电动车的份额增加了两倍。

- 此外,石化燃料水平正在以惊人的速度下降,引发人们对其对子孙后代的永续性的担忧。这项因素对政府和社会提出了重大挑战。

- 近年来,由于燃料成本上涨,电动自行车销量快速成长,电动自行车越来越多地被采用交通途径。瑞士被认为是最好的徒步地点之一。市场参与者正在推出轻巧且坚固的电动登山车,这些登山车具有大电池容量、卓越的舒适性、更大的续航里程和卓越的功能,以扩大其客户群。

- 例如,2022年10月,Ibis Oso推出了新款E-山地自行车。这款自行车采用全碳纤维车架以减轻重量。重量为 53 磅(24 公斤)。奥索表示,这是第一款采用该公司上连桿悬吊脱链技术的自行车。 Bosch Performance Line CX马达为 eMTB 提供动力,包括电池和显示器。

- 考虑到这些因素和发展,电动山地自行车的需求预计在预测期内将出现更高的成长率。

欧洲引领电动山地自行车市场

- 欧洲电动山地自行车/E-MTB预计将做出最大的贡献,对电动自行车的需求再次成为行业趋势,对更轻、更小、性能更好的自行车的需求。销售数据显示,电动自行车在休閒自行车爱好者中越来越受欢迎,他们希望在健行后享受远距骑行而不感到疲劳。

- 此外,政府的立场支持电动山地自行车在欧洲的长期成长。例如,英国政府已开始采取措施增加该国电动自行车和摩托车的使用。该国已开始提供国家激励措施,并计划增加对电动电动的补贴以鼓励其使用。政府宣布决定设定目标,到 2035 年逐步淘汰所有配备内燃机 (ICE) 的新型两轮车。

- 2021年4月,法国议会通过了一项支持电动自行车的法律。在法国,污染环境的旧车车主如果选择报废,将获得奖励。法国议会最近通过了一项法案,允许旧车以 2,500 欧元(2,660 美元)的价格进行交易,作为购买电动自行车的奖励。该法案的主要目的是在污染环境的旧车报废时为购买电动式自行车提供财政援助。

- 法国电动山地自行车市场也在成长。推动市场的关键因素包括电动货运和电动山地自行车类别的成长、交通量的增加以及对减少排放的日益关注。玩家们正在欧洲推出电动山地自行车,以扩大他们的消费群和成长潜力。

电动山地自行车(EMTB)产业概述

电动山地自行车市场正在成长,市场主要企业包括雅马哈汽车、Pedego 电动自行车、BH Bikes 和 CUBE。两家公司都透过推出配备最新技术的新产品来扩大在全球的业务。随着市场的发展,其他行业的各种龙头企业纷纷进入市场。

玩家专注于打造适合各种地形的舒适、可靠且高效的山地自行车。这有助于该公司在长期预测期内获得消费者地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔(市场规模:按金额)

- 依推进类型

- 踏板辅助

- 油门辅助

- 按用途

- 休閒

- 通勤

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 瑞士

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Giant Manufacturing Co. Ltd

- Pivot Cycles

- Scott Sports SA

- Trek Bicycle Corporation

- Trinx Bikes

- CUBE GmbH &Co. KG

- Yamaha Motor Co. Ltd

- Pedego Electric Bikes

- BH Bikes

第七章市场机会与未来趋势

The E-Mountain Bike Market size is estimated at USD 5.77 billion in 2024, and is expected to reach USD 10.43 billion by 2029, growing at a CAGR of 12.56% during the forecast period (2024-2029).

Key Highlights

- On a broader scale, COVID-19 had a marginal impact on the e-mountain bike market compared to the adverse effects it vastly had on different markets. With the preference for personal mobility that is to rise and the need to overcome traffic congestion, the demand for personal vehicles will increase. Also, with the growing environmental impact and concerns over rising temperatures due to emissions, e-bikes are a great alternative to conventional bicycles and motorcycles.

- However, COVID-19 set back the industry with zero mobility of people and halted the manufacturing of new e-bikes. Post COVID-19, with the recreational activities and health awareness among consumers, the market is set to a good rise in terms of economy.

- Over the longer term, the e-mountain is growing rapidly as the younger generation shows excellent interest in trekking and recreational activities. However, factors like government regulations regarding speed and safety issues associated with these bikes are likely to hinder the market's growth. For instance, The Union Cycliste Internationale (UCI) adopted strict regulations regarding the electric motors on e-mountain bikes, which must not exceed 250 watts. Pedaling assistance is only permitted to a maximum speed of 25 kph.

- Europe is anticipated to register the highest adoption rate for E-mountain bikes which is leading the global stance from the front.

E-Mountain Bike (EMTB) Market Trends

Growing Demand for Sustainable Transportation

- Mobility plays a vital role in the current society that we live in. With the growing concern for preserving and sustaining it for future generations, mainly because of the increasing scarcity of natural resources and environmental concerns, protecting the environment poses a significant challenge to society and governments worldwide.

- As a result, the rising demand for e-mountain bikes is an ideal solution to the challenge. With the continually growing environmental and health concerns due to the increasing emission levels, governments and international organizations worldwide are enacting stringent emission norms to reduce carbon emission levels.

- Owing to this, some international organizations worldwide are implanting strict criteria for vehicles. For instance, In January 2020, European Union implemented Regulation (EU) 2019/631, setting CO2 emission performance standards for new passenger cars and vans. The average CO2 emissions from new passenger cars registered in Europe have decreased by 12% compared to the previous year, and the share of electric vehicles tripled.

- Additionally, the depletion of fossil fuel levels at an alarming rate has been creating concerns for sustainability for future generations. This factor is posing a huge challenge for governments and society.

- Over the years, the sales of e-bikes have increased rapidly due to the rise in fuel costs, which has led to the growth of the implementation of electric bicycles as a daily means of transport. Switzerland is considered one of the best trekking places. Players in the market are launching lighter and rugged e-MTBs with massive batteries, better comfort, improved range, and better features to widen their customer base.

- For instance, in October 2022, the Ibis Oso launched a new e-mountain bike. The bicycle has a full-carbon-fiber frame to reduce its weight; it weighs 53 pounds (24 kg). Oso says this is the first bike to use its upper-link suspension de-link technology. The Bosch Performance Line CX motor powers the eMTB, including a battery and display.

- Considering these factors and development, demand for e-mountain bikes is anticipated to register a higher growth rate during the forecast period.

Europe is Leading the E-mountain Bike Market

- The e-mountain bikes/E-MTB in Europe are expected to contribute most to the development of the overall market as demand from e-bikes is again setting trends in the industry, as there is a great demand for lighter and smaller bikes with more performance. The sales figures show that e-bikes are becoming popular among recreational cyclists who prefer to enjoy longer rides without getting exhausted after trekking.

- In addition, the government stance has favored the growth of e-mountain bikes over the longer term across Europe. For instance, the United Kingdom government has started taking steps to enhance the adoption of e-Bikes and motorcycles in the country. The country started providing national incentives and is also planning to increase the financial subsidies on e-bikes to promote their usage. The government announced the decision to set a 2035 target for phasing out all new motorcycles equipped with an internal combustion engine (ICE).

- In April 2021, the French assembly passed a bill favoring e-bikes. Owners of outdated, polluting vehicles in France would be offered incentives if they chose to discard them. The French National Assembly recently adopted draft legislation permitting clunkers to be traded for a EUR 2,500 (USD 2,660) incentive to purchase an electric bicycle. The draft bill's principal goal is to provide financial help to buy electrically assisted bicycles if a polluting old vehicle is scrapped.

- The market for e-mountain bikes in France is also equally growing. Some of the major factors driving the market are the rise in the e-cargo and e-mountain bikes category, increasing traffic, and increasing focus on reducing exhaust emissions. Players are introducing e-mountain bikes in Europe to expand their consumer base and growth potential.

E-Mountain Bike (EMTB) Industry Overview

The e-mountain bike market is growing, and some of the major players in the market are Yamaha Motor, Pedego Electric Bikes, BH Bikes, and CUBE. The companies are expanding their presence worldwide by launching new products with the latest technology. As the market is growing, various major players from other sectors of industries are entering the market.

Players are focusing on building reliable and efficient mountain bikes comfortable with different terrains. This has helped the companies to gain consumer stances over the longer-term forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Propulsion Type

- 5.1.1 Pedal -assisted

- 5.1.2 Throttle-Assisted

- 5.2 By Application

- 5.2.1 Leisure

- 5.2.2 Commuting

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 Switzerland

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Giant Manufacturing Co. Ltd

- 6.2.2 Pivot Cycles

- 6.2.3 Scott Sports SA

- 6.2.4 Trek Bicycle Corporation

- 6.2.5 Trinx Bikes

- 6.2.6 CUBE GmbH & Co. KG

- 6.2.7 Yamaha Motor Co. Ltd

- 6.2.8 Pedego Electric Bikes

- 6.2.9 BH Bikes