|

市场调查报告书

商品编码

1445663

大数据工程服务 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Big Data Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

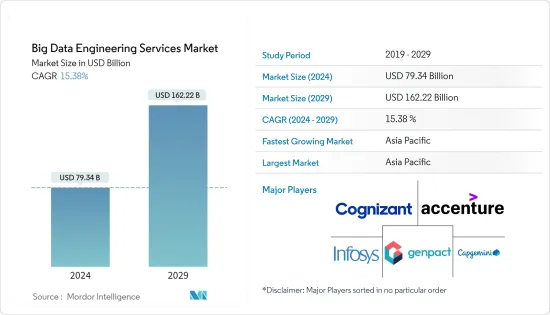

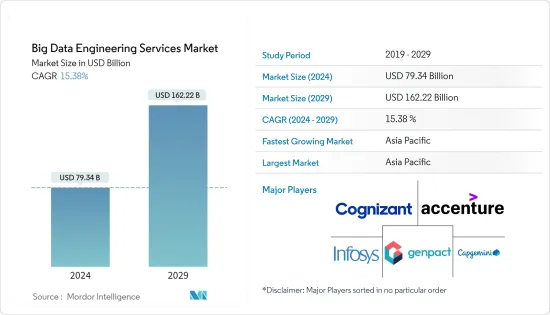

大数据工程服务市场规模预计到2024年为793.4亿美元,预计到2029年将达到1622.2亿美元,在预测期内(2024-2029年)CAGR为15.38%。

应用程式介面对于资料整合和工程是必需的。资料工程师使用专门的工具、程序和设备来准备和分析资料以供以后分析。让资料变得有价值从资料工程开始。

主要亮点

- COVID-19 大流行为资料分析师提供了研究全球大数据模式的绝佳机会。任何组织都可以从这种资料工程策略方法中受益,但这对于银行等旨在逐步发展同时快速创新的行业至关重要。

- 金融业正在迅速变化并提供新的消费产品和服务。银行业将大大影响数据工程市场。澳洲国民银行和 Amazon Web Services 的合作伙伴关係不断发展。据该银行称,其 70% 的程式现已迁移到云端,并且它刚刚成为第一家转换其线上商业银行平台的澳洲大型银行。

- 医疗保健中使用的资料量正在快速增长。电子健康记录是医疗保健产业最普遍的重要资料来源。与过去相比,当这些资讯储存在手写檔案中时,借助电子病历创建的大量资料和机器学习等强大的分析技术,医学研究人员现在可以创建预测模型。

- 对于资料工程专案来说,不理解特定使用者群组的需求是很困难的。不断涌入的资料和处理价值不一致的问题很快就会变得不堪重负。透过资料治理计划建立全面的资料管理策略是应对此资料工程挑战的潜在应对措施。

大数据工程服务市场趋势

银行业大数据分析预计将显着成长

- 随着科技的发展,消费者使用更多的设备来发起交易。金融部门正在迅速发展,并向消费者推出新的服务和商品。实际的困难在于如何保存新鲜资料、如何将其与所有旧资料连接起来以及如何在新产品和服务中使用。由于巧妙的资料设计可以带来更具适应性的业务模型,因此资料工程是一个至关重要的领域。

- 2022 年 7 月 - HDFC 银行与 NIIT 金融、银行和保险研究所 (NIIT IFBI) 签署协议,培训和僱用资料工程师。在此类计画的帮助下,BFSI 部门将提高其数位技能,学生将能够在资料工程领域发展扎实的职业生涯,并促进利用分析来获得业务洞察力。该银行预计每年透过该计划聘用近 100 名资料科学家。

- 2022 年 7 月 - 为了扩大数位经济的劳动力,联邦银行与莫纳什大学和皇家墨尔本理工大学合作建立一个中心,为 400 多名软体开发人员、云端工程师和网路专业人员提供服务。该计划的目标是促进银行业创新、技术和能力。

亚太地区将占据主要市场份额

- 由于网路、智慧型手机的普及和城市化的快速发展,亚太地区预计将拥有重要的市场。过去五年来,对数位能力的需求,特别是对人工智慧/机器学习、巨量资料分析和资料科学的人才的需求不断上升。

- NASSCOM 的一项调查显示,由于对数据科学和人工智慧专家的需求不断增长,到 2024 年,印度预计将拥有超过 100 万名专家。印度在人工智慧人才集中度和技能渗透率报告中排名第一,在人工智慧科学出版物方面排名第五。截至 2022 年 8 月,印度已安装的技能总数为 41.6 万,对 DS&AI 的总体需求为 62.9 万。现有人才总数的 46% 包括机器学习工程师和资料工程师。

- 2022年3月 - 为了为数据相关行业的高潜力员工创建全行资料分析计划,中国建设银行股份有限公司(CCB)与香港大学商学院合作。由于这种关係,银行可以更好地识别消费者对贷款、金融产品和付款的需求。

大数据工程服务业概况

凭藉差异化和加值服务的新机会,适度分散的大数据工程服务市场有可能改变竞争格局。由于众多产业都在人工智慧方面进行广泛投资,因此对巨量资料工程技术和能力的需求很高。为了在智慧领域获得市场份额并扩大其服务范围,埃森哲等知名厂商Plc 和Capgemini SE 正在对新公司和新技术进行收购和投资。

- 2022 年 11 月 - 埃森哲与日本人工智慧和巨量资料分析服务公司合作,增加了庞大的资料科学家团队。为了做出更好、更快的决策,企业现在需要对其营运进行 360 度视角。需要数据科学专业知识和人工智慧能力才能获得这种全面的观点并能够复製组织的每个领域。

- 2022 年 12 月 - Cognizant 宣布与企业资料管理领域的市场领导者 Syniti 建立策略合作伙伴关係。Syniti 知识平台 (SKP) 透过简化资料转换加快向SAP S/4HANA 的迁移。对于基于SAP 的转换,使用SAPAP高阶资料迁移的客户管理阶层发现资料迁移速度提高了 46%。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 由于互连设备和社群媒体的惊人成长,非结构化资料量不断增加

- 数据服务公司提供具有成本效益的服务和尖端专业知识

- 市场限制

- 服务提供者无法提供即时洞察

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场的影响评估

第 5 章:新兴科技趋势

第 6 章:市场细分

- 按类型

- 资料建模

- 数据整合

- 数据品质

- 分析

- 按业务职能

- 行销与销售

- 金融

- 营运

- 人力资源

- 按组织规模

- 中小企业

- 大型企业

- 依部署类型

- 云

- 本地部署

- 按最终用户产业

- BFSI

- 政府

- 媒体和电信

- 零售

- 製造业

- 卫生保健

- 其他最终用户垂直领域

- 地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Accenture PLC

- Genpact Inc.

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Capgemini SE

- NTT Data Inc.

- Mphasis Limited

- L&T Technology Services

- Hexaware Technologies Inc.

- KPMG LLP

- Ernst & Young LLP

- Latentview Analytics Corporation

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Big Data Engineering Services Market size is estimated at USD 79.34 billion in 2024, and is expected to reach USD 162.22 billion by 2029, growing at a CAGR of 15.38% during the forecast period (2024-2029).

Application programming interfaces are necessary for data integration and engineering. Data engineers use specialized tools, procedures, and equipment to prepare and analyze data for later analysis. Making data valuable begins with data engineering.

Key Highlights

- The COVID-19 pandemic has provided data analysts with fantastic opportunities to research global Big Data patterns. Any organization would benefit from this strategic approach to data engineering, but it is crucial for businesses in sectors like banking that aim to develop gradually while simultaneously innovating quickly.

- The financial industry is quickly changing and providing new consumer products and services. The Banking Industry would significantly impact Data Engineering Market. The National Australia Bank and Amazon Web Services partnership have grown. According to the bank, 70% of its programs have now been migrated to the cloud, and it just became the first significant Australian bank to convert its online business banking platform.

- The amount of data used in healthcare is growing quickly. Electronic health records are the most prevalent significant data source in the healthcare industry. In contrast to the past, when this information was stored in handwritten files, medical researchers can now create prediction models thanks to the enormous data created by EHRs and powerful analytics techniques like machine learning.

- Not comprehending the needs of a specific user group is difficult for a data engineering project. The endless influx of data and dealing with value inconsistencies can quickly become overwhelming. Establishing a thorough data management strategy with a data governance plan is one potential response to this data engineering challange.

Big Data Engineering Services Market Trends

Big Data Analytics in Banking is Expected to Grow Significantly

- As technology develops, there are more devices being used by consumers to initiate transactions. The financial sector is evolving rapidly and introducing new services and goods to consumers. The actual difficulty is how fresh data is kept, connected to all the old data, and used in new product and services. Because clever data design can lead to more adaptable business models, data engineering is a crucial field.

- July 2022 - HDFC bank signed a deal with NIIT Institute of Finance, Banking and Insurance (NIIT IFBI), to train and hire Data Engineers. With the help of such programs, the BFSI sector will improve its digital skills, and students will be able to develop a solid career in data engineering and foster the use of analytics to gain business insights. The bank anticipates hiring close to 100 data scientists through this initiative each year.

- July 2022 - In order to expand the workforce for the digital economy, Commonwealth Bank teams up with Monash University and RMIT University to build a centre that will serve more than 400 software developers, cloud engineers, and cyber professionals. The program's goal is to advance banking innovation, technology, and competency.

Asia Pacific to Hold Major Market Share

- The Asia Pacific region is expected to hold a significant market Due to the rapid growth of the internet, the smartphone generation, and urbanization. The demand for digital capabilities, particularly for talent in artificial intelligence/machine learning, big data analytics, and data science, has risen over the last five years.

- According to a NASSCOM survey, India is expected to have more than 1 million experts by 2024 due to the rising demand for Data Science & AI specialists. India ranked first in the report for AI talent concentration and skill penetration and fifth for AI scientific publications. India had a total installed skill base of 416K and a 629K overall demand for DS&AI as of August 2022. 46% of the total established talent comprises ML engineers and data engineers.

- March 2022 - To create a bank-wide data analytics program for high-potential employees working in data-related sectors, China Construction Bank Corporation (CCB) cooperated with HKU Business School. As a result of this relationship, the bank can better identify consumer needs for loans, financial products, and payments.

Big Data Engineering Services Industry Overview

With new opportunities for differentiation and value-added services, the moderately fragmented Big Data Engineering services market has the potential to change the competitive landscape. Because so many sectors are investing extensively in AI, there is a high demand for big data engineering technology and capabilities.In order to gain market share in the intelligence sector and expand the scope of their service offerings, well-known vendors, such as Accenture Plc and Capgemini SE, are making acquisitions and investments in new companies and technologies.

- November 2022 - Accenture tied up with Japanese AI and big data analytics services to add a large team of data scientists.To make better and quicker decisions, businesses now require a 360-degree view of their operations. Data science expertise and AI capabilities are needed to obtain this comprehensive viewpoint and be able to replicate every area of the organization.

- December 2022 - Cognizant announced a strategic partnership with Syniti the market leaders in enterprise data management.Syniti Knowledge Platform (SKP) speeds migration to SAP S/4HANA by streamlining data transformation.For their SAP-based transformations, customers who use SAP Advanced Data Migration and Management see a 46% faster data migration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Volume of Unstructured Data, Due to the Phenomenal Growth of Interconnected Devices and Social Media

- 4.2.2 Cost-Effective Services and Cutting-Edge Expertise Rendered By Data Servicing Companies

- 4.3 Market Restraints

- 4.3.1 Inability of Service Providers to Provide Real-Time Insights

- 4.4 Porters FIve Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment on the Impact of COVID-19 on the market

5 EMERGING TECHNOLOGY TRENDS

6 MARKET SEGMENTATION

- 6.1 By Type**

- 6.1.1 Data Modelling

- 6.1.2 Data Integration

- 6.1.3 Data Quality

- 6.1.4 Analytics

- 6.2 By Business Function

- 6.2.1 Marketing and Sales

- 6.2.2 Finance

- 6.2.3 Operations

- 6.2.4 Human Resource

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprizes

- 6.3.2 Large Enterprises

- 6.4 By Deployement Type

- 6.4.1 Cloud

- 6.4.2 On-Premise

- 6.5 By End-user Industry

- 6.5.1 BFSI

- 6.5.2 Government

- 6.5.3 Media and Telecommunication

- 6.5.4 Retail

- 6.5.5 Manufacturing

- 6.5.6 Healthcare

- 6.5.7 Other End-user Verticals

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Accenture PLC

- 7.1.2 Genpact Inc.

- 7.1.3 Cognizant Technology Solutions Corporation

- 7.1.4 Infosys Limited

- 7.1.5 Capgemini SE

- 7.1.6 NTT Data Inc.

- 7.1.7 Mphasis Limited

- 7.1.8 L&T Technology Services

- 7.1.9 Hexaware Technologies Inc.

- 7.1.10 KPMG LLP

- 7.1.11 Ernst & Young LLP

- 7.1.12 Latentview Analytics Corporation