|

市场调查报告书

商品编码

1445949

金融科技中的人工智慧 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)AI in Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

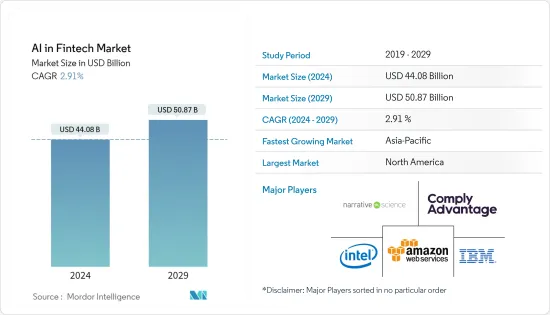

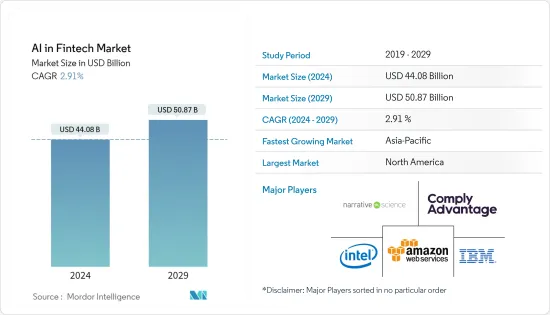

人工智慧金融科技市场规模预计到 2024 年为 440.8 亿美元,预计到 2029 年将达到 508.7 亿美元,预测期内(2024-2029 年)CAGR为 2.91%。

COVID-19 大流行的爆发加速了人们与金融服务互动方式的改变。以支付和财富为重点的金融科技公司一直致力于透过投资新资源或扩大能力来加强现有基础设施,以承受更高交易量对其係统造成的压力。儘管这对金融科技公司来说似乎具有挑战性,但此类行动对人工智慧解决方案提出了巨大的需求,因为这些公司的收入依赖交易量。这些因素预计将带动金融科技市场对人工智慧解决方案的需求。

主要亮点

- 金融公司是大型电脑和关联式资料库的早期采用者。他们热切地等待着更高水准的运算能力。人工智慧 (AI) 透过在更广泛的范围内应用源自人类智慧方面的方法来改善结果。过去几年的计算军备竞赛彻底改变了金融科技公司。机器学习、人工智慧、神经网路、大数据分析、演化演算法等技术使电脑能够处理比以往任何时候都庞大、多样、多样且深入的资料集。

- 此外,人工智慧和机器学习使银行和金融科技受益,因为它们可以处理大量有关客户的资讯。然后对这些资料和资讯进行比较,以获得有关客户想要的及时服务/产品的结果,这从本质上有助于发展客户关係。

- 此外,机器学习正在以前所未有的速度被采用,特别是用于创建倾向模型。银行和保险公司正在为网路和行动应用程式引入基于机器学习的解决方案。透过根据即时行为资料预测客户的产品倾向,进一步增强了即时目标行销。

- 一些市场现有企业正在透过明确提供解决方案来建立利基市场,例如银行业的人工智慧聊天机器人。例如,2021 年 6 月,Talisma 和 Active.Ai 合作,使用支援对话 AI 的聊天机器人来改善 BFSI 的客户体验。

- 此外,一些信用卡公司在其现有的诈欺侦测工作流程中实施了预测分析,以减少误报。研究市场进一步吸引了一些为信用卡公司和其他金融机构提供基于人工智慧的反洗钱 (AML) 和诈欺检测解决方案的参与者。

- 例如,2022 年 6 月,人工智慧驱动的反洗钱 (AML) 软体开发商 Lucinity 与诈欺管理公司 SEON 合作,在 AML 合规软体中包含即时诈欺预防功能。 SEON的诈欺预防解决方案将透过Lucinity的平台提供,为客户提供从交易监控到即时诈欺侦测和预防的合规风险服务。

- 此外,人工智慧就绪的基础设施应该能够进行高效的资料管理,具有足够的处理能力,敏捷、灵活和可扩展,并且能够容纳不同数量的资料。因此,对于金融科技小型企业来说,组装必要的硬体和软体元素来支援人工智慧将更具挑战性。此外,随着人工智慧和深度学习应用程式民主化的扩大,不仅对科技巨头而言,而且对中小型企业来说也是可行的。对人工智慧专业人员完成这项工作的需求也在激增,而训练有素的资源的稀缺是人工智慧在金融科技领域面临的主要挑战。

人工智慧在金融科技市场趋势的应用

诈欺检测预计将显着增长

- 人工智慧可以帮助确定快速有效的方法来检测金融诈欺和不当行为。它们允许机器准确地处理庞大的资料集,而人们有时会遇到困难。使用人工智慧进行诈欺检测具有多种优势。快速运算能力是人工智慧和机器学习的众所周知的优势。它可以掌握用户的应用程式使用习惯,例如交易方式、付款方式等,从而能够即时发现异常情况。它减少了误报,并允许专家专注于更复杂的问题,因为它比手动技术更有效。

- 根据认证诈欺审查员 (ACFE) 和分析先驱 SAS 进行的一项新民意调查,去年国际上使用人工智慧 (AI) 和机器学习 (ML) 进行诈欺检测的情况有所增加。调查显示,13% 的组织采用人工智慧 (AI) 和机器学习来侦测和阻止欺诈,另有 25% 的组织计划在未来一两年内这样做,增幅约为 200%。根据这项民意调查,诈欺审查人员发现这项跨产业的反诈欺技术和其他反诈欺技术正在广泛传播。

- 此外,印度储备银行 (RBI) 报告称,2022 财年印度各地发生了约 9,103 起银行诈欺事件。这一数字比前一年有所增加,扭转了过去十年的趋势。银行诈骗总价值从 1.38 兆印度卢比下降至 6,040 亿印度卢比。银行诈欺案件的如此大量增加将使人工智慧市场参与者能够开发新的解决方案或工具来满足客户的广泛需求。

- 市场上的参与者正在合作,为客户提供更好的服务。例如,2023 年 2 月,万事达卡与中东和非洲首屈一指的数位商务供应商 Network International 合作,解决诈欺、拒绝付款和退款问题,以最大限度地降低收单机构的成本和风险。透过此次合作,Network 将在整个地区推出万事达卡的 Brighterion 人工智慧 (AI) 技术,为收单机构和企业提供交易诈欺筛选和商家监控。

- 此外,2022 年3 月,为全球保险业提供人工智慧驱动的决策自动化和优化解决方案的提供者Shift Technology 与为财产和意外伤害保险行业提供技术解决方案的全球提供商Duck Creek Technologies 宣布建立解决方案合作伙伴关係,以支援人工智慧的诈欺侦测功能将于 2022 年上市。完全整合后,Duck Creek Claims 用户将直接在其索赔管理软体系统中收到即时诈欺警报。

北美占据最大的市场份额

- 由于着名的人工智慧软体和系统供应商、金融机构对人工智慧专案的联合投资以及大多数人工智慧在金融科技解决方案中的采用,北美预计将主导金融科技市场的人工智慧。预计该地区在未来几年将在这一领域实现显着增长。此外,北美是许多人工智慧金融科技公司的业务中心,Sidetrade 等公司选择将其北美业务设在卡加利。

- 政府对人工智慧的措施和投资。例如,会推动市场。史丹佛大学最近的一项研究资料显示,2022 财年,美国政府在人工智慧 (AI) 合约上花费了 33 亿美元。联邦政府机构的技术支出从 2021 年的 27 亿美元每年增长超过 6 亿美元,其中决策科学、电脑视觉和自主领域获得了大部分投资。自 2017 年美国政府在人工智慧技术上花费 13 亿美元以来,人工智慧合约总支出已成长超过 2.5 倍。

- 市场参与者正在合作,为该地区的客户提供更好的服务。例如,2022 年 8 月,NACUSO CUSO 年度奖得主、透过更好的评分改善信贷准入的参与者 Zest AI 宣布与全球资料、分析和技术公司 Equifax, Inc. 建立合作伙伴关係。此次合作将使信用社能够使用 Zest AI 的核保技术来分析更多 Equifax 来源的资料,从而以更快的速度接受更多申请,特别是那些传统上银行服务不足的申请。这是 Zest AI 与国家消费者报告机构的第一个大型分销关係。

- 一些公司的解决方案可以帮助企业透过下一代最佳行动软体发展零售银行业务,检测和打击金融欺诈,并透过多通路客户体验解决方案改善客户关係。例如,2022 年 4 月,协作应收帐款领域的参与者 Versapay 今天表示,已完成对美国金融科技新创公司 DadeSystems 的收购。此次收购后,Versapay 的一系列应收帐款 (AR) 自动化解决方案及其人工智慧和机器学习功能得到了扩展。它还扩大了 Versapay 的企业和中端市场足迹,同时为其不断成长的员工增加了关键技能。

- 该地区的银行已开始使用区块链技术来记录资料并打击诈欺。区块链记录每笔交易的详细信息,从而更容易检测骇客企图。该技术允许在全球范围内进行支付,并允许以较低的佣金进行快速交易。区块链的分散式帐本技术(DLT)有助于跨不同商店和分散式网路记录和共享资料。此外,加密和演算法方法可以跨金融网路同步资料。这是重要的一步,因为交易资料可以储存在不同的位置。它为区块链互通性和跨行业资料交换铺平了道路。

人工智慧在金融科技产业概述

由于全球参与者众多,金融科技市场的人工智慧正走向分散化。大公司的各种收购和合作预计很快就会发生,重点是创新。市场上一些主要的参与者包括 IBM 公司、英特尔公司、Narrative Science 和微软公司。

2023 年 2 月,汶莱的 Baiuri 银行选择了新加坡软体即服务 (SaaS) 金融科技公司 Finbots.ai,透过人工智慧 (AI) 实现信用风险管理现代化。据Finbots.ai称,其人工智慧信用建模解决方案creditX将使Baiduri Bank能够以极少的时间和成本设计和部署高品质的信用记分卡。这将最大限度地降低信贷风险,提高零售和中小型组织(SME)的效率和敏捷性,并加快银行针对服务不足的信贷市场的普惠金融活动。

2023 年 2 月,丰业银行推出了新工具 Scotia Smart Investor,为客户提供更好的资产控制。这家加拿大银行透过 Assistance+ 推出了这款新设备,将人工智慧驱动的建议与即时个人化帮助相结合。 Scotia Smart Investor 由丰业银行关联的共同基金交易商丰业证券创建。该工具包括人工智慧驱动的建议引擎,将帮助用户设计、规划、监控和更新财务目标。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 人工智慧在金融科技的新兴应用

- 技术简介

- COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 金融组织对流程自动化的需求不断增加

- 提高资料来源的可用性

- 市场限制

- 需要熟练的劳动力

第 6 章:市场细分

- 按类型

- 解决方案

- 服务

- 按部署

- 云

- 本地部署

- 按应用

- 聊天机器人

- 信用评分

- 量化与资产管理

- 诈欺识别

- 其他应用

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第 7 章:竞争格局

- 公司简介

- IBM Corporation

- Intel Corporation

- ComplyAdvantage.com

- Narrative Science

- Amazon Web Services Inc.

- IPsoft Inc.

- Next IT Corporation

- Microsoft Corporation

- Onfido

- Ripple Labs Inc.

- Active.Ai

- TIBCO Software (Alpine Data Labs)

- Trifacta Software Inc.

- Data Minr Inc.

- Zeitgold

- Sift Science Inc.

- Pefin Holdings LLC

- Betterment Holdings

- WealthFront Inc.

第 8 章:投资分析

第 9 章:市场的未来

The AI in Fintech Market size is estimated at USD 44.08 billion in 2024, and is expected to reach USD 50.87 billion by 2029, growing at a CAGR of 2.91% during the forecast period (2024-2029).

The COVID-19 pandemic outbreak has been accelerating the change in the way how people interact with financial services. Payment- and wealth-focused fintech companies have focused on bolstering their existing infrastructure by investing in new resources or expanding capacity to withstand the stress to their systems from higher transaction volumes. Though it seemed challenging for fintech companies, such actions have provided a significant need for AI solutions as these companies depend on transaction volumes for revenue. Such factors are expected to spearhead the demand for AI solutions in the fintech market.

Key Highlights

- Financial firms have been the early adopters of the mainframe computer and relational database. They eagerly waited for the next level of computational power. Artificial Intelligence (AI) improves results by applying methods derived from the aspects of human intelligence at a broader scale. The computational arms race for past years has revolutionized fintech companies. Technologies, such as machine learning, AI, neural networks, Big Data Analytics, evolutionary algorithms, and much more, have allowed computers to crunch huge, varied, diverse, and deep datasets than ever before.

- Moreover, AI and machine learning have benefited banks and fintech as they can process vast amounts of information about customers. This data and information are then compared to obtain results about timely services/products that customers want, which has aided, essentially, in developing customer relations.

- Additionally, machine learning is being adopted at unprecedented rates, specifically to create propensity models. Banks and insurance companies are introducing machine learning-based solutions for web and mobile applications. This has further enhanced the real-time target marketing by predicting the product propensity of the customers based on behavioral data in real-time.

- Several market incumbents are establishing a niche by explicitly offering solutions, like AI Chatbots for banking. For instance, in June 2021, Talisma and Active.Ai has partnered to enable improved customer experience in BFSI using conversation AI enabled Chatbot.

- Moreover, several credit card companies implement predictive analytics into their existing fraud detection workflows to reduce false positives. The studied market further gains traction with several players offering AI-based Anti-money Laundering (AML) and Fraud detection solutions for credit card companies and other financial institutions.

- For instance, in June 2022, Lucinity, a developer of AI-driven anti-money laundering (AML) software has partnered with fraud management company SEON to include real time fraud prevention capabilities in AML compliance software. SEON's fraud prevention solution will be available through Lucinity's platform, providing customers with compliance risk services from transaction monitoring to real-time fraud detection and prevention.

- Further, AI-ready infrastructure should be capable of efficient data management, have enough processing power, be agile, flexible, and scalable, and have the capacity to accommodate different volumes of data. Therefore, it would be more challenging for fintech small businesses to assemble the necessary hardware and software elements to support AI. Moreover, as the democratization of AI and deep learning applications expands, not only for tech giants but is now viable for small and medium-sized businesses. The demand for AI professionals to do the work has ballooned as well, and the scarcity of trained resources is the major challenge for AI in fintech.

AI in Fintech Market Trends

Fraud Detection is Expected to Witness Significant Growth

- Artificial intelligence can assist in identifying rapid and effective ways to detect financial fraud and malpractice. They allow machines to process enormous datasets accurately, which people sometimes struggle with. Using artificial intelligence for fraud detection has various advantages. The ability to compute quickly is a well-known benefit of AI and machine learning. It creates a grasp of a user's app usage habits, such as transaction methods, payments, and so on, allowing it to spot anomalies in real-time. It reduces false positives and allows specialists to focus on more complex issues because it is more efficient than manual techniques.

- According to a new poll conducted by Certified Fraud Examiners (ACFE) and analytics pioneer SAS, the use of Artificial Intelligence (AI) and Machine Learning (ML) for fraud detection increased internationally last year. According to the poll, 13% of organizations employ artificial intelligence (AI) and machine learning to detect and deter fraud, with another 25% planning to do so in the next year or two, representing roughly 200% growth. According to the poll, fraud examiners identified this and other anti-fraud tech developments in a cross-industry that are extensively spreading.

- Further, the Reserve Bank of India (RBI) reported around 9,103 bank fraud incidents across India in fiscal year 2022. This increased over the previous year, reversing the last decade's trend. The total value of bank scams fell from INR 1.38 trillion to INR 604 billion. Such high rise in the bank fraud cases would allow the AI market players to develop new solutions or tools to cater wide range of needs of the customer.

- The players in the market are collobarting to provide better service to its customer. For instance, in february 2023, Mastercard partnered with Network International, the Middle East and Africa's premier provider of digital commerce, to address fraud, declines, and chargebacks to minimise costs and risk for acquirers. Through the collaboration, Network will roll out Mastercard's Brighterion Artificial Intelligence (AI) technology across the region, providing acquirers and businesses with transaction fraud screening and merchant monitoring.

- Further, in March 2022, Shift Technology, a provider of AI-driven decision automation and optimisation solutions for the global insurance industry, and Duck Creek Technologies, a global provider of technology solutions to the P&C insurance industry, have announced a solution partnership to bring AI-enabled fraud detection capabilities to market in 2022. Once fully integrated, Duck Creek Claims users will receive real-time fraud alerts directly into their claims management software system.

North America Accounts For the Largest Market Share

- North America is expected to dominate the AI in Fintech market due to prominent AI software and systems suppliers, combined investment by financial institutions into AI projects, and the adoption of most AI in Fintech solutions. The region is expected to experience significant growth in this area in the coming years. Additionally, North America serves as the business hub for many AI Fintech firms, with companies like Sidetrade choosing to locate their North American operations in Calgary.

- Government initiatives and investments towards AI. would drive the market for instance. In fiscal year 2022, the U.S. government spent USD 3.3 billion on artificial intelligence (A.I.) contracts, according to data from a recent Stanford University study. Spending by federal government agencies on technology climbed by over USD 600 million annually, from USD 2.7 billion in 2021, with the decision science, computer vision, and autonomous segments receiving the majority of investment. Since 2017, when the U.S. government spent USD 1.3 billion on artificial technology, total spending on A.I. contracts has climbed by over 2.5 times.

- The players in the market are collobarting to provide better service to the customer in the region. For instance, in august 2022, Zest AI, the recipient of NACUSO's CUSO of the Year Award and a player in improving credit access through better scoring announced a partnership with Equifax, Inc., a worldwide data, analytics, and technology firm. The collaboration will allow credit unions that use Zest AI's underwriting technology to analyze more of the data sourced by Equifax to accept more applications with better speed, particularly those who have traditionally been underbanked. This is Zest AI's first big distribution relationship with a National Consumer Reporting Agency.

- Some companies' solutions help businesses grow retail banking with next-best-action software, detect and combat financial fraud, and improve client relationships with multichannel customer experience solutions. For insatnce, in April 2022, Versapay, a player in Collaborative Accounts Receivable, said today that it has finalised its acquisition of DadeSystems, a fintech startup based in the United States. Versapay's array of accounts receivable (AR) automation solutions has been expanded, as have its AI and machine learning capabilities, as a result of the acquisition. It also broadens Versapay's enterprise and mid-market footprint while adding critical skills to its growing staff.

- Banks in the region have started using blockchain technology to record data and combat fraud. Blockchain records the details of each transaction, making it easier to detect hacker attempts This technology permits worldwide payments and allows for speedy transactions with low commissions. The Distributed Ledger Technology (DLT) of Blockchain assists in the recording and sharing data across different stores and a distributed network. Furthermore, cryptographic and algorithmic methods synchronize data across the financial network. This is a significant step since transaction data can be stored in different locations. It paves the way for blockchain interoperability and cross-industry data exchange.

AI in Fintech Industry Overview

AI in the Fintech market is moving towards fragmented due to many global players. Various acquisitions and collaborations of large companies are expected to occur shortly, focusing on innovation. Some major players in the market include IBM Corporation, Intel Corporation, Narrative Science, and Microsoft Corporation.

In February 2023, Baiduri Bank in Brunei chose Singapore-based Software-as-a-Service (SaaS) fintech Finbots.ai to modernize its credit risk management with artificial intelligence (AI). According to Finbots.ai, its AI credit modeling solution, creditX, will allow Baiduri Bank to design and deploy high-quality credit scorecards in a fraction of the time and cost. This will minimize credit risk, increase efficiency and agility for retail and small and medium-sized organizations (SMEs), as well as expedite the bank's financial inclusion campaign for the underserved credit market.

In February 2023, Scotiabank introduced a new tool, Scotia Smart Investor, to give customers greater asset control. The Canadian lender introduced the new device via assistance+, combining AI-powered recommendations with real-time personalized assistance. Scotia Smart Investor was created by Scotia Securities, Scotiabank's linked mutual fund dealer. The tool, which includes an AI-powered advice engine, will assist users in designing, planning, monitoring, and updating financial goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Emerging Uses of AI in Financial Technology

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Process Automation Among Financial Organizations

- 5.1.2 Increasing Availability of Data Sources

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Application

- 6.3.1 Chatbots

- 6.3.2 Credit Scoring

- 6.3.3 Quantitative & Asset Management

- 6.3.4 Fraud Detection

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 ComplyAdvantage.com

- 7.1.4 Narrative Science

- 7.1.5 Amazon Web Services Inc.

- 7.1.6 IPsoft Inc.

- 7.1.7 Next IT Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Onfido

- 7.1.10 Ripple Labs Inc.

- 7.1.11 Active.Ai

- 7.1.12 TIBCO Software (Alpine Data Labs)

- 7.1.13 Trifacta Software Inc.

- 7.1.14 Data Minr Inc.

- 7.1.15 Zeitgold

- 7.1.16 Sift Science Inc.

- 7.1.17 Pefin Holdings LLC

- 7.1.18 Betterment Holdings

- 7.1.19 WealthFront Inc.