|

市场调查报告书

商品编码

1445972

专业视听系统 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Professional Audio-Visual Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

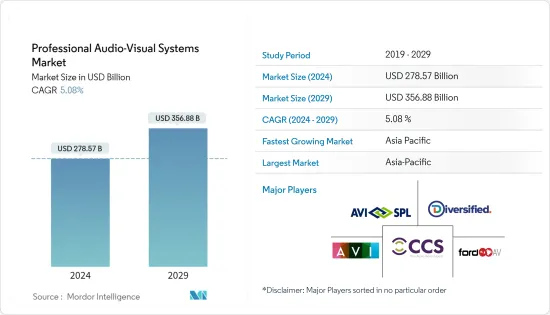

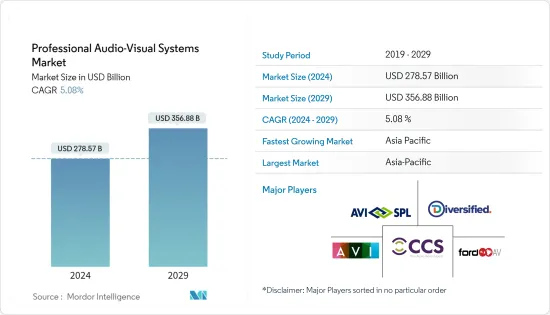

专业视听系统市场规模预计到2024年为2785.7亿美元,预计到2029年将达到3568.8亿美元,在预测期内(2024-2029年)CAGR为5.08%。

主要亮点

- 市场规模源自于各种产品类型的销售,例如采集和製作设备、视讯投影、串流媒体、储存以及分发和服务。市场规模还包括专业视听系统解决方案在各种最终用户垂直领域的销售,例如企业、场馆和活动、零售、媒体和娱乐以及其他最终用户垂直领域。

- 其他促进成长的因素包括众多技术发展,例如采用物联网(IoT)和云端运算平台的专业视听。这些技术非常适合现场活动、安全、协作、会议、学习和监控。预计其他因素,例如提供专业内容的 360 度摄影机、无人机和虚拟实境 (VR) 系统的创建以及电信基础设施的进步,可能会推动市场成长。

- 由于各个团队需要更好的视听解决方案来实现无缝连接,北美地区正在见证从以前的本地解决方案转向私有云、公有云和混合云端部署的转变。预计这将在预测期内推动市场。 Deltek 联邦市场分析团队编制的 2022 财年 (FY) 最新资料显示,联邦政府在云端商品和服务上的支出总计为 123 亿美元。美国最近在推动云端技术、加强网路安全以及提高国内和国际营运效率方面做出了重大努力。

- 在预测期内,对大型资本投资的需求不断增加,而中小企业的采用率较低,这可能会成为专业 AV(视听)成长的市场限制。缺乏熟练的专业人员、较短的更换週期和一对一的学习将是市场成长面临的最重大和最紧迫的挑战。

- COVID-19 严重影响了专业视听产业,给供应链带来了巨大压力,并导致众多企业倒闭。值得注意的是,疫情对娱乐、休閒和零售业产生了重大影响,导致视听技术的需求急剧下降。现场活动市场以及租赁市场受到的打击最为严重。许多知名的製作公司都在倒闭,小型租赁公司正在关闭,而製造商(尤其是音讯行业的製造商)正在提供这个空间。

专业视听系统市场趋势

企业部门视听系统的部署见证了显着的CAGR

- 从家庭办公室到会议室,人们的工作方式正在快速改变。越来越多的公司正在帮助员工远端兼职工作,以减少通勤时间并创造更多的工作与生活平衡。此外,他们还把客户放在第一位,注重关係并将合作伙伴聚集在一起提供全面的解决方案,因为大多数企业都受到技术过时和工作场所效率低下的困扰。

- 专业视听系统能够有效率地创造强烈的第一印象并鼓励团队和组织之间的协作。儘管面临着独特的挑战,专业的视音频解决方案可以帮助公司提供必要的工具来轻鬆协调,而正确的会议室技术可以实现所有这些各方之间的无缝连接。它不仅能够比单独的音讯建立更深层的关係,还可以透过减少差旅费用来充当节省成本的工具。

- 值得注意的是,视讯会议已成为会议室的中心舞台,因为 Zoom、Teams、Poly(以前称为 Polycom)、StarLeaf 和 LifeSize 都提供各种会议室解决方案。大多数平台都支援 Outlook 和 Google 集成,以便轻鬆安排会议。此外,推动加入也正成为更容易获得的选择。因此,随着视讯通话变得更加主流,组织正在与客户、合作伙伴和异地员工通话,而这些外部参与者可能会从不同的视讯会议平台通话。因此,扩展网路会议是一个大趋势,越来越多的公司正在标准化其会议室中的技术,音讯是会议室通讯的第二部分。

- 此外,由于经济成长的强劲商业信心和光明前景,商业房地产持续蓬勃发展。除此之外,自从疫情改变了许多公司的运作方式以来,共享办公空间的使用量大幅增加。例如,由内容贡献者 Alberto Di Risio 撰写的 Coworking Resources 发布的一篇文章标题为「2020 年全球共享办公室成长研究」。 Di Risio 的文章部分写道:“今年全球联合办公空间的数量预计将达到近 20,000 个,到 2024 年将超过 40,000 个。所有这些因素都预示着企业部门专业视听系统部署的增长前景。”

亚太地区预计将成为成长最快的市场

- 该地区媒体和娱乐产业不断增加的投资预计将推动所研究市场对专业视听系统的需求。据印度品牌资产基金会(IBEF) 称,2000 年4 月至2022 年9 月期间,资讯和广播产业的外国直接投资流入量为98.5 亿美元。该地区媒体和娱乐产业投资的增加预计将推动该地区媒体和娱乐产业的投资成长。该地区对专业视音频系统的需求成长。

- 亚太地区的公司一直致力于根据该地区的产品和服务研究市场开发各种产品和服务。

- 例如,2022 年 8 月,BenQ 发布了 EH620 商用智慧投影机,整合了完整的 Windows 作业系统,并嵌入了英特尔赛扬处理器 4000 系列,以简化混合工作场所的企业基于云端的会议。它是一款一体式智慧投影仪,内建 Windows 运算功能和作业系统,并具有随时融入基于 Windows 的工作场所的功能,可实现与企业笔记型电脑或 PC 相同的安全、控制和存取流程。无需连接外部 PC,EH620 可促进从 Office 365 到 Adobe Document Cloud、Microsoft Azure、Zoom 和其他会议应用程式的 Windows 业务应用程式的全面补充,从而实现高效的会议生产力和全面的安全性。

- 同样,三星印度公司于2022 年9 月推出了The Wall All-In-One(一种模组化MicroLED,彻底改变了显示器的未来)和Flip Pro(一种将教育体验提升到新水平的互动式显示器)。

专业视听系统产业概况

由于许多大大小小的厂商在国内和国际市场上提供解决方案,专业视听系统市场竞争非常激烈。与公司相关的品牌形象对市场有重大影响。由于强大的品牌是更好的解决方案的代名词,成熟的企业预计将占上风。市场上一些主要的参与者包括 AVI-SPL Inc.、AVI Systems Inc.、Ford Audio-Video LLC 和 Solotech Inc. 等。总体而言,预计供应商之间的竞争强度将在预测期内很高并加剧。

2023 年 3 月,Alphatec AV 宣布在印度推出两个领先的专业音响品牌。该公司将独家代理专门从事超薄扬声器设计的德国扬声器製造商BEC-AKUSTIK,以及一直设计和製造具有先进串流媒体技术和高音质扬声器的瑞典音频公司Audio Pro。

2022 年 8 月,AVI-SPL 宣布在班加罗尔开设了新办事处,这是其在印度的第三个办事处。凭藉着十多年为印度客户服务的经验,AVI-SPL 正式在印度开展业务,成立了 AVI-SPL India Private Limited。班加罗尔办事处将作为客户开发、视听 (AV) 和统一通讯 (UC) 工程、专案管理和託管服务的中心。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代产品的威胁

第 5 章:市场动态

- 市场驱动因素

- 云端平台的快速采用

- 市场限制

- 视听系统的高昂营运和法律成本

第 6 章:市场细分

- 按类型

- 捕获和生产设备

- 视讯投影

- 串流媒体、储存和分发

- 服务

- 其他类型

- 按最终用户垂直领域

- 公司的

- 场地和活动

- 零售

- 媒体和娱乐

- 其他最终用户垂直领域

- 按地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- AVI-SPL Inc.

- Diversified

- AVI Systems Inc.

- Ford Audio-Video LLC

- CCS Presentation Systems Inc.

- Solutionz Inc.

- Electrosonic Group

- Avidex (Telerent Leasing Corporation)

- Solotech Inc.

- Conference Technologies Inc.

- Vistacom Inc.

第 8 章:投资分析

第 9 章:市场机会与未来成长

The Professional Audio-Visual Systems Market size is estimated at USD 278.57 billion in 2024, and is expected to reach USD 356.88 billion by 2029, growing at a CAGR of 5.08% during the forecast period (2024-2029).

Key Highlights

- The market size has derived from the sales of various product types such as capture and production equipment, video projection, streaming media, storage, and distribution and services. The market size also includes the sales of pro AV system solutions in various end-user verticals such as corporate, venues and events, retail, media and entertainment, and other end-user verticals.

- Other growth-promoting factors include numerous technological developments, such as adopting professional audio-visual with the Internet of Things (IoT) and cloud computing platforms. These technologies work well for live events, security, collaboration, conferencing, learning, and monitoring. It is anticipated that additional factors, such as the creation of 360-degree cameras, drones, and virtual reality (VR) systems to provide specialized content and advancements in the telecommunications infrastructure, may fuel the market growth.

- As various teams require better audio-visual solutions for seamless connectivity, the North American region is witnessing a shift to private, public, and hybrid cloud deployments over the previous on-premises solutions. This is expected to drive the market during the forecast period. The latest data compiled by Deltek's Federal Market Analysis team for fiscal year (FY) 2022 showed that the federal government spent a total of USD 12.3 Billion on cloud goods and services. The United States recently made significant efforts to advance cloud technology, strengthen cybersecurity, and increase the effectiveness of operations both domestically and internationally.

- The increasing need for large capital investments and a lower adoption rate among small and medium-sized businesses will likely act as market restraints for pro AV (audio-visual) growth during the forecast period. The lack of skilled professionals, short replacement cycles, and one-on-one learning will be the most significant and pressing challenges to the market's growth.

- COVID-19 significantly impacted the professional audio-visual industry, putting enormous strain on the supply chain and causing numerous businesses to fail. Notably, the pandemic has significantly impacted entertainment, leisure, and retail, resulting in a sharp decline in demand for audio-visual technologies. The market for live events, and thus rentals, has been hit the hardest. Numerous high-profile production companies are failing, smaller rental houses are closing, and manufacturers, particularly in the audio sector, are supplying this space.

Professional Audio-Visual Systems Market Trends

Deployment of Audio-Visual Systems in the Corporate Sector in Witnessing a Significant CAGR

- From the home office to the conference room, the way people work is changing at a rapid pace. More and more companies are facilitating employees to work remotely part-time to cut down on commuting and create more work-life balance. Furthermore, they're also putting the customer first, focusing on relationships and bringing together partners to provide a comprehensive solution, as most businesses suffer from outdated technologies and inefficiency in the workplace.

- Professional audio-visual systems have the efficiency to create powerful first impressions and encourage collaborations between teams and organizations. Professional AV solutions facilitate companies with the necessary tools to coordinate easily despite their unique challenges, and the right meeting room technology enables a seamless connection between all these parties. Not only does it enable relationship building on a deeper level than audio alone, but it also acts as a cost-saving tool by reducing travel expenses.

- Notably, video conferencing has taken center stage in the meeting room as Zoom, Teams, Poly (previously Polycom), StarLeaf, and LifeSize all offer various conference room solutions. Most platforms facilitate Outlook and Google integrations for easy meeting scheduling. Furthermore, the push to join is also becoming a more readily available option. Thus, as video calls become more mainstream, organizations are on calls with clients, partners, and off-site employees, and these external participants may be calling in from a different video conferencing platform. Thus, scaling web conferencing is a big trend, and more and more companies are standardizing technologies in their conference rooms, with audio being the second piece of meeting room communication.

- Moreover, commercial properties continue to be buoyant owing to robust business confidence and bright prospect in the growing economies. In addition to this, the use of coworking space has surged substantially since the pandemic altered the way many companies function. For instance, one of the articles posted by Coworking Resources, authored by content contributor Alberto Di Risio, is entitled 'Global Coworking Growth Study 2020.' Di Risio's article reads in part, 'The number of coworking spaces worldwide is expected to reach almost 20,000 this year and cross over 40,000 by 2024. All these factors present growth prospects for professional audio-visual system deployment in the corporate sector.

Asia-Pacific is Expected to be the Fastest-growing Market

- The increasing investment in the media and entertainment industry in the region is expected to promote the demand for pro-AV systems in the market studied. According to the India Brand Equity Foundation (IBEF), FDI inflows in the information and broadcasting sector stood at USD 9.85 billion between April 2000 and September 2022. Such an increase in investments in the media and entertainment industry in the region is expected to fuel the demand growth for pro-AV systems in the region.

- The companies in the Asian-Pacific region have been focusing on developing various products and services in the market studied as per the products and services in the region.

- For instance, in August 2022, BenQ announced EH620 smart projector for business, integrating the full Windows operating system and embedded with Intel Celeron Processor 4000 Series onboard to streamline enterprise cloud-based meetings for the hybrid workplace. It is an all-in-one smart projector with built-in Windows computing capabilities and operating system, along with ready-to-assimilate capability into Windows-based workplaces, facilitating the same security, control, and access processes as enterprise laptops or PCs. Without the need for connecting an external PC, EH620 can facilitate the full complement of Windows business applications ranging from Office 365 to Adobe Document Cloud, Microsoft Azure, Zoom, and other conferencing apps for efficient meeting productivity with total security.

- Similarly, in September 2022, Samsung India launched its The Wall All-In-One - the modular MicroLED that is revolutionizing the future of display and the Flip Pro - an interactive display that takes the education experience to the next level.

Professional Audio-Visual Systems Industry Overview

The professional audio-visual systems market is highly competitive due to many small and large players providing their solutions in domestic and international markets. The brand identity associated with companies significantly influences the market. As strong brands are synonymous with better solutions, well-established players are expected to have the upper hand. Some of the major players in the market are AVI-SPL Inc., AVI Systems Inc., Ford Audio-Video LLC, and Solotech Inc., among others. Overall, the intensity of competitive rivalry among the vendors is expected to be high and increase during the forecast period.

In March 2023, Alphatec AV announced the launch of two leading professional audio brands in India. The company will exclusively distribute BEC-AKUSTIK, a German loudspeaker manufacturer that specializes in ultra-flat and slim speaker designs, and Audio Pro, a Swedish audio company that has been designing and manufacturing speakers with advanced streaming technology and high sound quality.

In August 2022, AVI-SPL announced it had opened a new office in Bangalore, its third location in India. With over a decade of experience serving clients in India, AVI-SPL formally established operations in the country with the incorporation of AVI-SPL India Private Limited. The Bangalore office would serve as a hub for customer development, audio-visual (AV) and unified communications (UC) engineering, project management, and managed services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Impact Of COVID-19 On The Market

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Cloud Platforms

- 5.2 Market Restraints

- 5.2.1 High Operating and Legal Costs of Audio-Visual Systems

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Capture and Production Equipment

- 6.1.2 Video Projection

- 6.1.3 Streaming Media, Storage, and Distribution

- 6.1.4 Services

- 6.1.5 Other Types

- 6.2 By End-user Vertical

- 6.2.1 Corporate

- 6.2.2 Venues and Events

- 6.2.3 Retail

- 6.2.4 Media and Entertainment

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AVI-SPL Inc.

- 7.1.2 Diversified

- 7.1.3 AVI Systems Inc.

- 7.1.4 Ford Audio-Video LLC

- 7.1.5 CCS Presentation Systems Inc.

- 7.1.6 Solutionz Inc.

- 7.1.7 Electrosonic Group

- 7.1.8 Avidex (Telerent Leasing Corporation)

- 7.1.9 Solotech Inc.

- 7.1.10 Conference Technologies Inc.

- 7.1.11 Vistacom Inc.