|

市场调查报告书

商品编码

1519842

汽车机器人市场占有率分析、产业趋势与统计、成长预测(2024-2029)Automotive Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

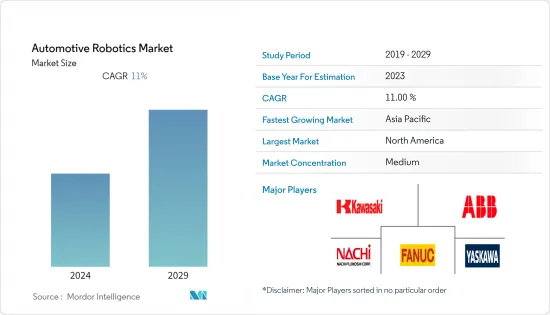

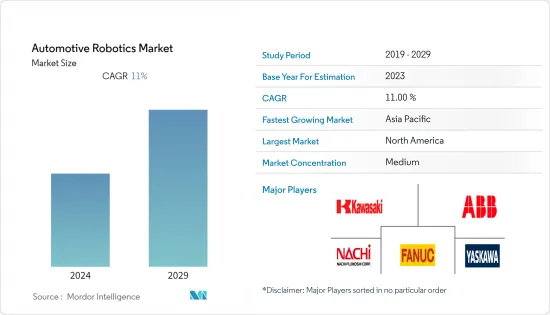

2024年汽车机器人市场规模为108亿美元,预计2029年将达到184亿美元,在预测期间(2024-2029年)复合年增长率为11%。

汽车机器人旨在支持汽车行业的车辆生产。电动车的惊人成长正在积极引导机器人的使用,以满足市场不断增长的消费者需求。汽车产业多年来一直在生产中使用工业机器人。

铰接式机器人构成了汽车机器人的大部分,其中焊接是汽车行业最常用的功能。汽车产业的机器人系统具有成本效益、高效且安全。

自动化产业的发展重点是降低成本、节省时间、生产高品质的产品以及以最小的错误率提高生产力。在生产工厂中,汽车机器人被部署来实现内部流程自动化并与工人建立合作,从而减少他们的工作量并提高效率。福特汽车和宝马等公司正在努力将该技术引入其生产工厂。

例如,2023 年 11 月,Realtime Robotics 宣布推出新的最佳化即服务解决方案。该解决方案将专有的最佳化软体与经验丰富的机器人技术相结合,并应用工程见解来提高製造商的生产力。它最近被德国汉诺威的大众商用车公司用于电动车製造的概念验证计划。

随着汽车技术的进步和电动车需求的增加,汽车机器人预计将在汽车行业中强劲增长,汽车生产过程中涉及各种机器人任务。考虑到市场潜力,机器人製造商正在努力推出各种新型号,以满足汽车产业对机器人的高需求。

例如,2023年6月,ABB宣布推出四款全新大型机器人型号和22个变体,以IRB 6710、IRB 6720、IRB 6730和IRB 6740等下一代型号为汽车行业客户提供支援。

预计北美在预测期内成长最快,其次是欧洲和亚太地区。主要企业之间的策略联盟、新兴国家可支配收入增加导致的汽车产量增加以及引入节能汽车机器人的研发活动投资增加等因素为市场带来了积极的前景。

汽车机器人市场趋势

焊接机器人占有率第一

汽车产业已广泛采用汽车机器人,其中焊接是最突出的应用之一。製造环境中常用的焊接机器人有两种。它们是半自动焊接机器人系统和自动焊接机器人系统,用于汽车製造中的大多数焊接任务,提供精度、效率和速度。

这些机器人有可能透过提高工厂安全性和降低人事费用将生产时间延长一倍甚至三倍,从而帮助节省数百万美元。

考虑到产业的减重需求,机器人焊接机在先进一流车辆的生产中发挥重要作用。由于严格的行业标准,机器人不断证明其能力。

随着技术的进步,越来越多的公司依赖机器人焊接系统来实现需要更精确组装的高科技应用,例如电动车和自动驾驶汽车。

例如,2023年7月,Ficep UK宣布推出新的自动化和机器人加工解决方案,以回应市场对高品质焊接系统的需求,以解决技术纯熟劳工短缺问题并提高生产力。在与 AGT Robotics 的新合作中,Ficep 开发了 Sabre 焊接机器人,以无缝解决当今钢结构製造市场中製造商面临的最困难和集中工艺。

机器人技术在许多行业的製造中发挥着重要作用,其中汽车占据了压倒性的市场份额。许多公司希望科技能够根据他们的需求而发展。

例如,2023年1月,自动化生产解决方案软体供应商Oqton与弹性电弧焊接机器人製造商Valk Welding宣布建立新的合作关係。两家公司共同开发的新技术和工艺旨在加强自动化机器人焊接在专业或小批量生产中的使用。

汽车产业正在将重点转向新技术趋势,例如更小的机器人和控制器、更快的通讯速度、更低的飞溅和更快的焊接。因此,焊接领域预计占有率最高。

亚太地区可望引领汽车机器人市场

由于对流程自动化、效率和生产力提高以及人为错误减少的需求不断增长,亚太地区越来越多地采用机器人技术。机器人技术正在应用于汽车、医疗保健、国防和航太等多个领域,以实现流程自动化和高效管理资源。工业机器人主要应用在亚太地区,因为它们在汽车产业中占据主导地位,且製造设备成本较低。由于亚太地区中小型工业的快速扩张,汽车机器人市场预计在预测期内将显着成长。

亚太地区是全球成长最快的地区,印度、中国、台湾和韩国等国家正成为该地区的领导者。 ABB 和 KUKA 等主要供应商在该地区设有业务。政府法规和资金正在授权计划改善基础设施。这些方面有利于该地区成为汽车製造中心,并正在推动汽车机器人市场的发展。

中国和印度是亚太地区的主要发展中国家,汽车、电子、航空等众多产业都在这些国家开设工厂,增加了汽车机器人的需求,使亚太地区成为新兴地区已经成为一个地区了。

该地区的主要企业正在大力投资即将推出的车辆,同时采用机器人技术和其他先进製造技术。例如,2023年11月,RSP将进入印度价值130亿美元的机器人自动化市场,并于2024年推出製造部门。斯堪的纳维亚机器人系统印度私人有限公司已在清奈註册。我们为印度客户提供汽车、电子等各领域的工业机器人配件。

2023年8月,中国汽车製造商吉利控股集团推出高端智慧科技品牌“吉悦”,并推出首款高科技车型。极悦01是与百度公司在「汽车机器人」领域合作的成果,将由吉利汽车生产。

因此,由于亚太地区的这一发展,亚太地区所占的份额是最高的。

汽车机器人产业概况

汽车机器人市场由全球和地区的老牌企业进行整合和主导。公司采用新产品发布、联盟和合併等策略来维持其市场地位。

- 2023年8月,消费汽车ADAS(高阶驾驶辅助系统)节能运算解决方案领先供应商地平线机器人公司与Aptiv PLC及其中国子公司Wind River建立了策略合作伙伴关係。此次合作标誌着安波福与中国国内汽车级运算解决方案供应商在 ADAS 和自动驾驶领域的首次合作。

该市场的主要企业包括Nachi-Fujikoshi Corp、ABB Ltd、FANUC Corporation、Kawasaki Robotics和Yaskawa Electric Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车工业快速成长

- 市场限制因素

- 引进工业机器人成本高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔:市场规模(单位:十亿美元)

- 按最终用户类型

- 汽车製造商

- 汽车零件製造商

- 依零件类型

- 控制器

- 机械臂

- 末端执行器

- 驱动器与感测器

- 依产品类型

- 笛卡儿机器人

- SCARA机器人

- 关节式机器人

- 其他产品类型

- 依功能类型

- 焊接机器人

- 喷漆机器人

- 组装机器人

- 切割/切割机器人

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- ABB Ltd

- Omron Adept Robotics

- FANUC Corp.

- Honda Motor Co. Ltd

- Kawasaki Robotics

- KUKA Robotics

- Yaskawa Electric Corporation

- Harmonic Drive System

- RobCo SWAT Ltd

- Nachi-Fujikoshi Corp.

第七章 市场机会及未来趋势

The Automotive Robotics Market size is estimated at USD 10.80 billion in 2024, and is expected to reach USD 18.40 billion by 2029, growing at a CAGR of 11% during the forecast period (2024-2029).

Automotive robots are designed to support the production of automobiles in the automotive industry. This extraordinary growth of electric vehicles is positively inducing the use of robots to meet the market's growing consumer requirements. The automotive industry has been using industrial robotics in production for many years.

Articulated robots hold a large part of automotive robots; by function, welding makes the largest use of robots in the automotive industry. Robotic systems in the automotive industry are cost-effective, efficient, and safe, as they can do their job quicker than their human counterparts.

Several companies majorly focus on reducing costs, saving time, producing high-quality products, and increasing productivity with a minimum error rate in the automation industry, thus driving the market. In the production plant, automotive robots are deployed to automate internal processes to reduce the workload of employees by creating a work collaboration with the workers to improve efficiency. Companies such as Ford Motors Co. and BMW are working on introducing technology in their production plants.

For instance, in November 2023, Realtime Robotics announced the launch of its new Optimization-as-a-Service solution. The solution uses a combination of proprietary optimization software and experienced robotics and applies engineering insights to improve a manufacturer's overall productivity. It has recently been used by Volkswagen Commercial Vehicles in Hanover, Germany, in a proof-of-concept project for EV manufacturing.

With the rising advancements in vehicle technologies and growing demand for electric vehicles, automotive robotics is expected to witness strong growth in the automotive industry for various robotic operations involved in the automobile production process. Considering the market potential, robotic manufacturers are working on launching various new models to cater to the high demand for robotics in the automotive industry.

For example, in June 2023, ABB announced the launch of four new large robot models and 22 variants to support automotive customers with next-generation models, including the IRB 6710, IRB 6720, IRB 6730, and IRB 6740.

North America is expected to grow significantly during the forecast period, followed by Europe and Asia-Pacific. Factors such as strategic collaborations among key players, growing vehicle production due to inflating disposable incomes in emerging economies, and rising investments in R&D activities for introducing energy-efficient automotive robots are creating a positive outlook for the market.

Automotive Robotics Market Trends

Welding Robots Hold the Highest Share

The automotive industry has adopted automotive robotics widely, with welding being one of the most prominent applications. Within the manufacturing environment, two types of welding robots are generally used, i.e., semiautomatic and automatic welding robot systems, for most welding operations in automotive manufacturing, which offer precision, efficiency, and speed.

These robots have increased factory safety and have helped save millions of dollars as they have the potential to double, or even triple, production time by cutting labor costs.

Considering the industry demands for lighter vehicles, robotic welders play an important role in producing advanced, top-tier vehicles. With strict industry standards, robots consistently prove their ability.

More companies are relying on robotic welding systems with technological advances for high-tech applications such as EV vehicles and self-driving cars, which require even more precise assembly.

For instance, in July 2023, Ficep UK launched a new automatic and robotic processing solution in response to market demand for a quality welding system to help address skilled labor shortages and increase productivity. In a new partnership with AGT Robotics, Ficep developed the Sabre welding robot to seamlessly tackle the most challenging and labor-intensive processes fabricators face in today's structural steel fabrication market.

Robotics play an important part in manufacturing in many industries, with automotive being the dominating segment. Many companies expect technology to evolve with their needs.

For example, in January 2023, Oqton, a software provider of automation production solutions, and Valk Welding, a manufacturer of flexible arc welding robots, announced a new partnership. The new techniques and processes jointly developed by the companies are intended to enhance the utilization of automated robotic welding for unique or small-batch production.

The automotive industry is shifting its focus toward new technology trends, like compact robots and controllers, higher communication speed, low spatter, and high-speed welding. Thus, the welding segment is expected to hold the highest share.

Asia-Pacific is Expected to Lead the Automotive Robotics Market

Robotics technology is increasingly being adopted in Asia-Pacific due to rising demand for the automation of processes, improved efficiency and productivity, and reduced human errors. Various sectors, including automotive, healthcare, defense, and aerospace, have adopted robotics technology for process automation and efficient resource management. Industrial robots are used mainly in Asia-Pacific due to their dominance in the automotive industry and low cost of manufacturing units. The automotive robotics market is expected to witness major growth during the forecast period due to the rapid expansion of small and medium-scale industries across Asia-Pacific.

Asia-Pacific is the fastest developing region globally, with countries like India, China, Taiwan, and South Korea evolving as the leaders in this region. Leading vendors, such as ABB and KUKA, are instituting the region as their operational bases. Government regulations and funds have empowered projects to improve the infrastructure. These aspects have made the region the favored automotive manufacturing hub, thus driving the automotive robotics market.

China and India are the principal countries in Asia-Pacific in terms of development, and many industries, such as automotive, electronics, and aviation, are opening their factories in these countries, thus generating the demand for automotive robotics and making Asia-Pacific an emerging region.

Major players in the region are adopting robotics and other advanced manufacturing technologies while also making huge investments in their upcoming vehicles. For instance, in November 2023, RSP tapped into India's USD 13 billion robotics and automation market to start a manufacturing unit in 2024. The Indian entity Scandinavian Robot Systems India Private Limited has been registered in Chennai. It will supply a range of industrial robot accessories to Indian customers of various sectors, such as automotive and electronics.

In August 2023, Chinese automaker Geely Holding Group launched a premium intelligent technology brand, JI YUE, and unveiled its first high-tech model. The JI YUE 01, the results of a tie-up with Baidu Inc. on "automotive robotics," will be produced by Geely.

Thus, owing to such developments in the region, Asia-Pacific holds the highest share.

Automotive Robotics Industry Overview

The automotive robotics market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- In August 2023, Horizon Robotics, a leading provider of energy-efficient computing solutions for advanced driver assistance systems (ADAS) in consumer vehicles, formed a strategic partnership with Aptiv PLC and its subsidiary Wind River in China. The collaboration marks Aptiv's first partnership with a Chinese domestic auto-grade computing solutions supplier for ADAS and automated driving.

Some of the major players in the market include Nachi-Fujikoshi Corp., ABB Ltd, FANUC Corporation, Kawasaki Robotics, and Yaskawa Electric Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Exponential Increase in Automotive Sector

- 4.2 Market Restraints

- 4.2.1 High Cost of Installation Related to Industrial Robots

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD billion)

- 5.1 By End-user Type

- 5.1.1 Vehicle Manufacturers

- 5.1.2 Automotive Component Manufacturers

- 5.2 By Component Type

- 5.2.1 Controllers

- 5.2.2 Robotic Arms

- 5.2.3 End Effectors

- 5.2.4 Drive and Sensors

- 5.3 By Product Type

- 5.3.1 Cartesian Robots

- 5.3.2 SCARA Robots

- 5.3.3 Articulated Robots

- 5.3.4 Other Product Types

- 5.4 By Function Type

- 5.4.1 Welding Robots

- 5.4.2 Painting Robots

- 5.4.3 Assembling and Disassembling Robots

- 5.4.4 Cutting and Milling Robots

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ABB Ltd

- 6.2.2 Omron Adept Robotics

- 6.2.3 FANUC Corp.

- 6.2.4 Honda Motor Co. Ltd

- 6.2.5 Kawasaki Robotics

- 6.2.6 KUKA Robotics

- 6.2.7 Yaskawa Electric Corporation

- 6.2.8 Harmonic Drive System

- 6.2.9 RobCo S.W.A.T Ltd

- 6.2.10 Nachi-Fujikoshi Corp.