|

市场调查报告书

商品编码

1519864

轻型车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Lightweight Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

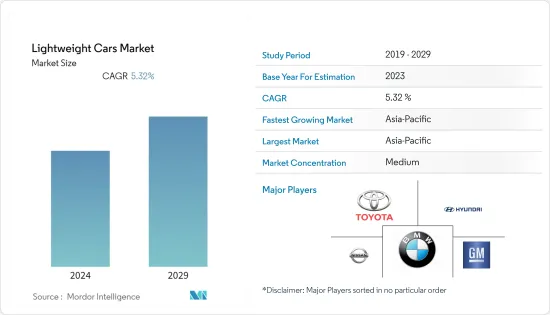

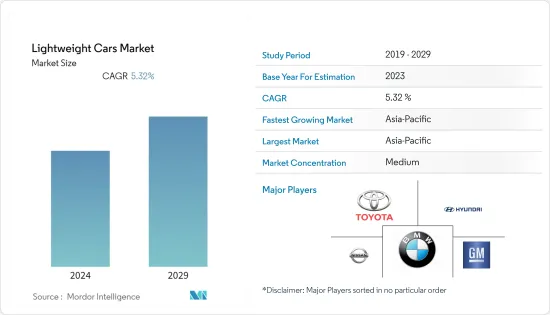

轻型车市场规模预计将从2024年的737.2亿美元成长到2029年的979.5亿美元,预测期间(2024-2029年)复合年增长率为5.32%。

轻型车市场是全球汽车产业重要且发展的部分。该市场重点关注采用可减轻总重量的材料和技术设计的车辆,从而提高燃油经济性、性能和环境影响。

燃油效率和排放法规的提高是轻型车市场的主要驱动力。世界各国政府正在实施更严格的排放标准以应对气候变化,鼓励製造商生产更轻、更省油的汽车。这种监管环境与消费者所寻求的绩效利益密切相关。

此外,更轻的车辆可提供改进的动态性能,例如更好的加速和操控性,从而吸引了重视高性能驾驶体验的细分市场。此外,技术进步也扮演重要角色。材料科学和工程的进步使製造商能够在不影响安全性或功能的情况下减轻车辆重量,从而满足监管和消费者的需求。

北美、欧洲和亚太地区等地区因其独特的监管、经济状况和消费趋势而处于轻型车市场的前沿。例如,欧洲有严格的排放气体法规,是轻型车技术的主要推动者。总的来说,这些区域市场正在为全球转向更轻、更有效率的车辆做出贡献。

轻型车市场趋势

对轻型车的需求增加

轻型车市场发展迅速,主要得益于轻型车的需求不断增加。该部门专注于透过先进材料和设计技术减轻车辆重量,以提高燃油效率、性能并减少对环境的影响。向轻量化汽车的转变是为了响应永续性、技术进步和不断变化的消费者偏好的全球趋势。

此外,更严格的全球排放法规和燃油效率日益重要是轻型车市场的主要驱动力。随着世界各国政府实施减少温室气体排放的政策,轻量化正成为关键策略。与重型车辆相比,轻型车辆消费量的燃料更少,排放的污染物也更少,这使得它们在环境法规严格的市场中更具吸引力。

新兴市场的开拓和高强度钢、铝、镁和碳纤维等材料的采用是轻型车市场的核心。此外,製造和设计方面的技术创新,例如电脑辅助工程和3D列印,使得轻质材料的使用更加精确和高效,进一步推动市场成长。

电动和混合动力汽车的兴起也是轻型车市场的主要动力。轻量化对于这些车辆最大限度地提高续航里程和效率至关重要,因此轻量化设计成为电动车 (EV) 和混合技术的基本要素。这一趋势正在推动对专为电动和混合动力汽车定制的轻量材料和设计的投资和创新的增加。

这一趋势导致了对专门针对电动和混合动力汽车的轻质材料和设计的投资和创新的增加。该市场预计将持续成长和创新,因为它在向更永续和更有效率的运输解决方案的更广泛转变中发挥关键作用。

亚太地区主导市场

亚太地区经济充满活力,汽车产业快速发展,在全球轻型车市场中发挥着举足轻重的作用。该地区的特点是在中国、日本、印度和韩国等国家的推动下,汽车产量和消费量较高。

轻型车领域专注于减轻品质以提高燃油效率和性能的车辆,受各种市场力量和技术创新的影响,该领域正在经历显着增长。

亚太地区经济格局的特点是强劲成长,尤其是中国和印度等新兴经济体。这种成长导致购买力增强和中阶不断壮大,从而推动了对汽车(包括轻型汽车)的需求。该地区的经济扩张不仅涉及汽车销量的增加,还包括增加对汽车研发的投资,重点是轻质材料和技术。

亚太地区的公司也正在投资研发,以创造不损害车辆安全或性能的创新减重解决方案。这包括製造流程的进步以及将轻质部件整合到车辆设计中。

丰田、本田、现代、塔塔汽车等亚太地区主要汽车製造商正在大力投资轻型车市场。除了开发新车型外,这些公司还与材料供应商和技术公司合作,推动轻型车技术。

这些合作对于推动创新和降低与轻质材料和技术相关的成本至关重要。

轻型车产业概况

轻型车市场已整合,轻型车市场的主要企业包括丰田汽车公司、日产汽车公司、起亚汽车公司、现代汽车公司和福特马达公司。

汽车製造商主要控制轻型车市场。我们也与主要复合材料製造公司建立了长期合作关係。由于需要永续性和低排放气体来保护环境,许多OEM正在引入电动车作为模型。该行业正在寻求投资和开发具有最佳性能和续航里程组合的电动车。例如

- 2023年12月,丰田欧洲宣布计画推出与比亚迪共同开发的新型电动运动跨界车。此次推出预计将在未来几年内推出,是丰田到 2026 年在欧洲扩大电动和低排放气体汽车产品组合的更广泛策略的一部分。

- 这项倡议符合丰田对永续交通的承诺,也是其向欧洲市场推出各种环保汽车的重要一步。与比亚迪的合作凸显了丰田利用合作伙伴关係来推进其轻型电动车技术和产品阵容的方法。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 技术创新和材料进步可能会推动需求

- 市场限制因素

- 轻量材料的高成本预计将限制市场成长潜力

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔:市场规模(单位:美元)

- 车型

- 客车

- 跑车

- 材料种类

- 玻璃纤维

- 碳纤维

- 高强度钢

- 其他材料

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Toyota Motor Corporation

- Volkswagen

- Ford Motor Company

- Hyundai Motor Co.

- Nissan Motor Co. Ltd

- General Motors Company

- Honda Motor Co. Ltd

- Kia Motors Corporation

- Ferrari SpA

- Lamborghini SpA

第七章 市场机会及未来趋势

The Lightweight Cars Market size in terms of Equal-5.32 is expected to grow from USD 73.72 billion in 2024 to USD 97.95 billion by 2029, at a CAGR of 5.32% during the forecast period (2024-2029).

The lightweight material market represents a significant and evolving segment of the global automotive industry. This market focuses on vehicles designed with materials and technologies that reduce overall weight, leading to improvements in fuel efficiency, performance and environmental impact.

The push for fuel efficiency and emission regulations is a primary driver of the lightweight car market. Governments worldwide are imposing stricter emission standards to combat climate change, incentivizing manufacturers to produce lighter, more fuel-efficient vehicles. This regulatory landscape is intricately connected to performance benefits sought by consumers.

Furthermore, lighter vehicles offer enhanced dynamics like better acceleration and handling, appealing to a segment of the market that values a high-performance driving experience. Additionally, Technological Advancements play a crucial role. Developments in material science and engineering have enabled manufacturers to reduce vehicle weight without compromising on safety or functionality, thus addressing both regulatory and consumer demands.

Regions like North America, Europe and Asia-Pacific are at the forefront of the lightweight car market each influenced by their specific regulatory, economic and consumer landscapes. Europe, for instance, with its stringent emission regulations has been a significant driver of lightweight vehicle technology. These regional markets collectively contribute to a global movement towards lighter more efficient vehicles.

Lightweight Cars Market Trends

Increasing Demand for Lightweight Passenger Cars

The lightweight vehicle market is rapidly evolving primarily driven by the increasing demand for lightweight passenger cars. This segment focuses on reducing vehicle weight through advanced materials and design techniques to enhance fuel efficiency, performance and reduce environmental impact.The shift towards lightweight vehicles is a response to global trends in sustainability, technological advancements and changing consumer preferences.

Furthremore, stricter global emission standards and the rising importance of fuel efficiency are significant drivers of the lightweight vehicle market. Governments worldwide are implementing policies to reduce greenhouse gas emissions leading to a focus on lightweighting as a key strategy.As lightweight vehicles consume less fuel and emit fewer pollutants compared to heavier counterparts making them increasingly attractive in markets with stringent environmental regulations.

The development and adoption of advanced materials such as high-strength steel, aluminum, magnesium and carbon fiber are central to the lightweight car market. These materials offer the necessary strength and durability while significantly reducing vehicle weight.Moreover, technological innovations in manufacturing and design, such as computer-aided engineering and 3D printing, have enabled more precise and efficient use of lightweight materials, further driving market growth.

Also, the rise of electric and hybrid vehicles has been a major catalyst for the lightweight vehicle market. In these vehicles, reducing weight is crucial for maximizing range and efficiency, making lightweight design an essential aspect of electric vehicle (EV) and hybrid technology.This trend has led to increased investment and innovation in lightweight materials and design specifically tailored for electric vehicle and hybrid vehicles.

The market is poised for continued growth and innovation playing a crucial role in the broader shift towards more sustainable and efficient transportation solutions.

Asia Pacific Region is Dominating the Market

The Asia-Pacific region with its dynamic economies and rapidly evolving automotive sector plays a pivotal role in the global lightweight car market. This region is characterized by its significant automotive production and consumption, driven by countries like China, Japan, India, and South Korea.

The lightweight car segment, focusing on vehicles designed with reduced mass for enhanced fuel efficiency and performance, is seeing substantial growth in this region, influenced by various market forces and technological innovations.

Asia-Pacific's economic landscape is marked by robust growth particularly in emerging economies such as China and India. This growth has led to increased purchasing power and a growing middle class which in turn fuels demand for automobiles, including lightweight vehicles.The region's economic expansion is not just limited to increased vehicle sales but also encompasses growing investments in automotive research and development, focusing on lightweight materials and technologies.

Moreover, the region is witnessing significant advancements in automotive technologies with a strong focus on developing lightweight materials such as high-strength steel, aluminum, magnesium and carbon fiber.Also, companies in Asia-Pacific are investing in research and development to create innovative lightweight solutions that do not compromise vehicle safety or performance. This includes advancements in manufacturing processes and the integration of lightweight components into vehicle design.

Major automotive players in the Asia-Pacific region such as Toyota, Honda, Hyundai, and Tata Motors are heavily invested in the lightweight car market. These companies are not only developing new models but also collaborating with material suppliers and technology firms to advance lightweight automotive technologies.

These collaborations are essential in driving innovation and reducing the costs associated with lightweight materials and technologies making them more accessible and viable for mass-market vehicles resulting in drive the growth of the market.

Lightweight Cars Industry Overview

Lightweight Cars Market is consolidated, some of the major players in the lightweight car market are Toyota Motor Corporation, Nissan Motor Co. Ltd, Kia Motors Corporation, Hyundai Motor Co., and Ford Motor Company.

Auto manufacturers majorly dominate the market for lightweight cars. They also have a long-standing partnership with major composite manufacturing companies. With the need for sustainability and lower emissions to protect the environment, many OEMs are releasing electric vehicles on their models. The industry is looking to invest in and develop electric vehicles with the best combination of performance and a long travel range. For instance,

- In December 2023, Toyota Europe has announced plans to roll out a new electric vehicle a Sport Crossover developed in collaboration with BYD. This launch, expected within the next few years is part of Toyota's broader strategy to expand its electric and low-emission vehicle portfolio in Europe by 2026.

- This initiative aligns with the company's commitment to sustainable transportation and marks a significant step in its efforts to introduce a diverse range of environmentally friendly vehicles to the European market. The collaboration with BYD underscores Toyota's approach to leveraging partnerships in advancing its light electric vehicle technology and offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Technological Innovations and Material Advancements is Likely to Fuel Demand

- 4.2 Market Restraints

- 4.2.1 High Cost of Lightweight Materials is Anticipated to Restrict the Market Growth Potential

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 Car Type

- 5.1.1 Passenger Cars

- 5.1.2 Sports Cars

- 5.2 Material Type

- 5.2.1 Glass Fiber

- 5.2.2 Carbon Fiber

- 5.2.3 High-strength Steel

- 5.2.4 Other Material Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Volkswagen

- 6.2.3 Ford Motor Company

- 6.2.4 Hyundai Motor Co.

- 6.2.5 Nissan Motor Co. Ltd

- 6.2.6 General Motors Company

- 6.2.7 Honda Motor Co. Ltd

- 6.2.8 Kia Motors Corporation

- 6.2.9 Ferrari SpA

- 6.2.10 Lamborghini SpA