|

市场调查报告书

商品编码

1519892

第三方付款:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Third Party Payment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

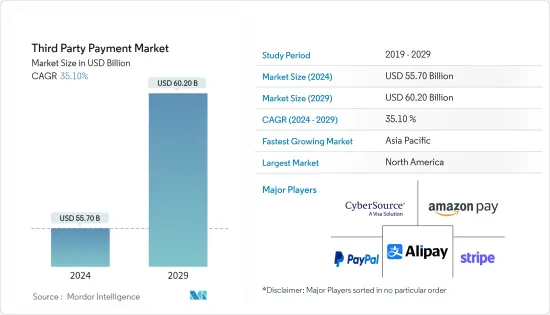

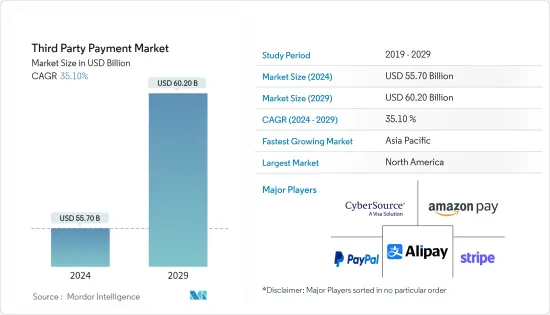

第三方付款市场规模预计到2024年为557亿美元,预计到2029年将达到602亿美元,在预测期内(2024-2029年)复合年增长率预计将增长35.10%。

预计 2024 年至 2029 年第三方支付市场将大幅成长。科技的进步改变了数位时代用户互动和交易的方式,导致更多的人和企业透过线上付款管道参与第三方交易。例如,在零售交易中,PayPal 是一个充当第三方的线上付款门户,卖家和买家在此进行交易,并使用 PayPal 网关进行付款。

主要亮点

- 各行业的企业越来越多地采用数位付款,尤其是小型企业对企业交易。第三方参与交易因其便利性和相对简单性而成为必不可少的要素。

- 随着越来越多的公司将付款整合到其产品中,付款格局正在改变。企业代表客户转移资金的第三方支付比传统的应付帐款帐款、应收帐款和第一方付款更为普遍。

- 此外,与传统商家帐户相比,第三方支付处理商通常会对每笔交易申请更高的费用,而且客户身分也被混淆。安全威胁和技术整合因素也可能阻碍市场成长。

- 儘管第三方支付市场竞争激烈,但由于竞争后的全球復苏趋势明显,市场成长前景乐观,投资者对此持乐观态度。因此,我们预计未来几年该领域的投资将会增加。

第三方支付市场趋势

POS(销售点)领域预计将推动市场发展

- 现金交易仍然在付款处理系统领域占据主导地位,对无现金未来的预测不太可能很快实现。然而,该细分市场仍在急剧转向电子钱包,并大幅远离现金。

- 此外,世界各地的商店和服务机构正在迅速采用和整合 PayPal、Samsung Pay、支付宝、Apple Pay 和微信支付等行动付款应用程式来接受付款。由于生活方式和消费者习惯的变化以及PayPal第三方支付的快速增长,这一趋势很可能从2024年持续到2029年。

- 亚太地区和欧洲、中东和非洲等高成长地区将推动第三方支付市场的成长,预计未来 POS 的现金使用量也将出现两位数下降。

- 行动 POS(销售点)设备的日益普及也是该细分市场成长的一个促成因素。据 Mobile Payments Today 最近发布的部落格称,行业专家预测,到 2023 年,行动 POS 交易数量将增加两倍。

- 此外,Google等公司正在为智慧型手机用户提供便利的非接触式付款。这些技术在相容的智慧型手机和智慧型手錶中利用近场通讯(NFC) 技术。用户必须将信用卡或签帐金融卡资讯保存在 Android Pay 帐户中,并在支付商品和服务费用时将智慧型手机或手錶放在零售销售点终端附近。

亚太地区市场可望实现显着成长

- 就行动付款而言,付款领域的创新主要由亚洲推动。亚洲市场的消费者在网路生活的各个方面都要求同等或更高的舒适度和安全性,特别是在付款和购物方面。

- 随着数位交易变得越来越普遍,该地区的企业迅速采用电子付款系统来促进安全、便利的交易。同时,政府和知名组织正在积极倡导无现金交易,作为更广泛的数位化倡议的一部分,进一步推动 POS(销售点)系统在市场上的采用。因此,监管机构正在带头推动数位化工作,以促进无现金付款并加速 POS 市场的成长。

- 政府支持数位付款的努力也是推动亚太地区已开发市场的因素。因此,影响亚太第三方付款市场的三个主要因素是:电子商务、POS渗透率和政府措施。

- 在全部区域,消费者将受益于更有效率、更便利的付款流程,以及更短的排队时间、无现金问题和更快的排队速度等便利性。

- 随着中国和印度等国家透过行动电子钱包采用数位付款,亚太市场预计将大幅成长。无处不在的行动装置、先进的数位基础设施以及不断增长的应用程式使用量正在推动亚太地区数位和行动钱包的快速成长。

第三方支付产业概况

第三方支付市场竞争激烈。市场上的一些参与者已经运营了相当长一段时间。从那时起,许多新兴企业纷纷涌现,抓住了这个市场提供的巨大机会。有些玩家只在某些地区活跃。主要参与者包括 PayPal Holdings Inc.、Stripe Inc.、Alipay.com 和 Amazon Payments Inc.。近期市场趋势如下:

- 2023 年 6 月,Stripe Inc. 宣布与 Google Workspace 合作,支援使用 Google 日历进行付费预约。这项新功能可让企业连接他们的 Stripe 帐户、设定价格,然后让客户能够在 Google 日历中预订和支付服务。

- 2023 年 4 月 - PayPal Holdings Inc. 宣布为其小型企业付款解决方案推出新功能。这些解决方案允许小型企业接受各种付款方式,包括 PayPal Venmo 和 PayPal Pay Later 产品,透过为客户提供更多付款方式选择来加快结帐速度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 网路的普及导致数位付款的普及

- 由于基于云端基础的系统,B2B 销售成长,POS 领域销售增加

- 世界高成长地区电子商务的成长

- 市场限制因素

- 安全和隐私问题抑制市场

第六章 市场细分

- 按类型

- 在线的

- 移动的

- 销售点管理

- 按最终用户

- BFSI

- 零售

- 电子商务

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- PayPal Holdings Inc.

- Stripe Inc.

- Alipay.com Co. Ltd

- Amazon Payments Inc.

- Authorize.Net(CyberSource Corporation)

- WePay Inc.(JPMorgan Chase & Co.)

- 2checkout.Com Inc.(Avangate BV)

- Adyen NV

- First Data Corporation(Fiserv Inc.)

- One 97 Communications Limited

第八章投资分析

第九章 市场机会及未来趋势

The Third Party Payment Market size is estimated at USD 55.70 billion in 2024, and is expected to reach USD 60.20 billion by 2029, growing at a CAGR of 35.10% during the forecast period (2024-2029).

The third party payment market is expected to rise at a considerable rate between 2024 and 2029. More people and businesses are taking part in third-party transactions via online payment platforms due to the development of technology that has changed how users interact and conduct transactions in the digital age. For example, in a retail transaction, PayPal is an online payment portal that acts as a third party, where the seller and the buyer can perform the transaction, and the payment is made using the PayPal gateway.

Key Highlights

- Enterprises across sectors have made a major effort to accept digital payments, particularly in small business-to-business transactions. Third-party involvement in transactions has been an essential factor owing to its convenience and relatively simple nature.

- The flow of payments has changed as more companies incorporate payments into their products. Third-party payments, where businesses move money for their customers, have become more prevalent than traditional accounts payable and receivable or first-party payments.

- Moreover, third-party payment processors often charge higher per-transaction fees compared to traditional merchant accounts, and customer identity is obfuscated. Security threats and technical integration factors might hamper the market's growth.

- Although the third party payment market is highly competitive, the market is expected to grow as the global recovery trend post-COVID is clear, and investors are optimistic as the market growth looks promising. Therefore, it is expected that there will be more investment in this field in the coming years.

Third Party Payment Market Trends

The Point of Sale Segment is Expected to Drive the Market

- Cash transactions continue to dominate the payment processing system segment, and it is unlikely that future predictions of a cashless state will be realized anytime soon. However, this segment is still witnessing a radical shift toward eWallets because of the dramatic change from cash.

- Moreover, stores and services across the world have been rapidly adopting and integrating mobile payment applications, such as PayPal, Samsung Pay, AliPay, Apple Pay, and WeChat Pay, to accept payments. This trend will be maintained between 2024 and 2029 due to changes in lifestyles and consumer habits, as well as the rapid growth of PayPal third-party payments.

- High-growth regions, like APAC and EMEA, are expected to drive the growth of the third party payment market and are also projected to witness a double-digit reduction in the use of cash at point of sale in the future.

- The growing adoption of mobile point of sale (POS) devices is also a factor contributing to this segment's growth. Industry experts predicted the number of mobile point-of-sale transactions to triple by 2023, according to a recent blog from Mobile Payments Today.

- Moreover, companies such as Google have made it convenient for smartphone users to make contactless payments. These technologies make use of near-field communication (NFC) technology on supported smartphones and smartwatches. A user stores his/her credit or debit card information on the Android Pay account, and when the user wants to pay for an item or service, the phone or watch should be placed near the retailer's point-of-sale terminal.

Asia-Pacific is Expected to Register a Major Growth in the Market

- Innovation in the field of payments is being driven mainly by Asia with regard to Mobile Payments. Consumers in Asian markets, especially with regard to payments and shopping, are more than willing to take equal measures of comfort and security for all aspects of their online lives.

- The increasing prevalence of digital transactions has spurred businesses in the region to swiftly embrace electronic payment systems, facilitating secure and convenient transactions. Concurrently, governments and prominent organizations are actively advocating for cashless transactions as part of broader digitalization initiatives, further propelling the adoption of point-of-sale (PoS) systems in the market. Consequently, regulatory bodies are promoting cashless payments and spearheading digitization endeavors to foster the growth of the point-of-sale market.

- Government initiatives to support digital payments are another factor driving an advanced market in Asia-Pacific. Thus, the three main factors impacting the third-party payment market in Asia-Pacific are e-commerce, PoS proliferation, and government initiatives.

- In addition to the convenience of shorter lines, elimination of cash-on-hand issues, and fast-moving queues throughout the region, consumers are able to benefit from a more efficient and convenient payment process.

- As countries such as China and India are adopting a digital payment option through mobile wallets, the Asia-Pacific market has been expected to grow significantly. The ubiquitous mobile devices, advanced digital infrastructure, and the growing usage of apps drive digital/mobile wallets, which are growing rapidly in Asia-Pacific.

Third Party Payment Industry Overview

The third party payment market is highly competitive. It has some players who have been in the business for quite some time. Subsequently, many startups are coming up to seize the huge opportunity this market offers. Some players have a presence only in a particular geography. The major players include PayPal Holdings Inc., Stripe Inc., Alipay.com Co. Ltd, and Amazon Payments Inc. The recent developments in the market are as follows:

- June 2023: Stripe Inc. announced a partnership with Google Workspace to power paid appointment bookings with Google Calendar. With this new feature, businesses can connect their Stripe account, set a price, and then offer their clients the ability to book and pay for services in Google Calendar.

- April 2023 - PayPal Holdings Inc. announced the addition of new features to complete its payment small business solutions. These solutions allow small businesses to accept a range of payments, including PayPal Venmo and PayPal Pay Later Products, giving customers more choices as to how they can pay can help drive checkout.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Penetration of Internet Leading to Proliferation of Digital Payments

- 5.1.2 Cloud Based Systems Leading to Growth of B2B Sales and also Higher Sales in the POS Segment

- 5.1.3 Growth of E-Commerce Across the High Growth Regions of the World

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Concerns to Restrain the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Online

- 6.1.2 Mobile

- 6.1.3 Point of Sale

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 E-Commerce

- 6.2.4 Other End User

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 PayPal Holdings Inc.

- 7.1.2 Stripe Inc.

- 7.1.3 Alipay.com Co. Ltd

- 7.1.4 Amazon Payments Inc.

- 7.1.5 Authorize.Net (CyberSource Corporation)

- 7.1.6 WePay Inc. (JPMorgan Chase & Co.)

- 7.1.7 2checkout.Com Inc. (Avangate BV)

- 7.1.8 Adyen NV

- 7.1.9 First Data Corporation (Fiserv Inc.)

- 7.1.10 One 97 Communications Limited