|

市场调查报告书

商品编码

1519912

共享单车:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Bike Sharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

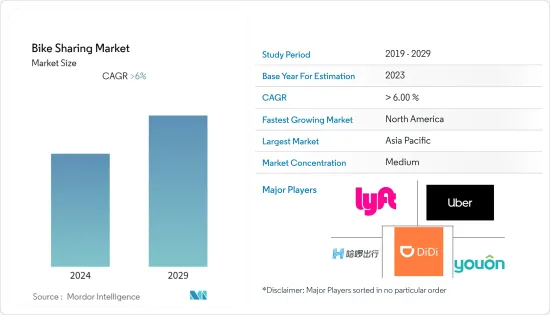

预计2024年共享单车市场规模为78.5亿美元,预计2029年将达到124.4亿美元,预测期(2024-2029年)复合年增长率为9.65%。

不断增加的车辆排放和噪音正在导致世界各地主要城市的严重污染。对清洁能源和高功率车辆的需求也在健康成长,预计将推动全球共享单车市场的发展。

此外,城市交通需求的不断增长导致道路上的车辆数量不断增加,导致严重的交通拥堵和严重的环境污染。自行车共享计画已在亚太、北美和欧洲等地区广泛采用,以缓解上述问题。许多自行车共享业者已开始专注于扩大电动自行车服务车队,以便在自行车共享市场日益激烈的竞争中生存。

GPS 技术的广泛使用、消费者支援的行动付款和物联网 (IoT) 等技术进步的不断进步,以及自行车锁定和追踪系统投资成本的降低,正在推动无桩自行车共享系统的市场发展。

无桩自行车共享系统为增加城市通勤带来了更好的自行车共享服务。该系统让使用者可以灵活地在任何合法的公共车辆停车场而不是营运商的自行车站取放自行车,从而方便了转换。

共享单车市场趋势

电动自行车细分市场预计在预测期内成长最快

对环保交通途径和休閒活动的日益关注以及交通拥堵的减少是推动自行车共享市场扩张的主要因素。移动性在当今世界发挥着重要作用。然而,随着环境和健康问题的不断加剧以及排放量的不断上升,地方政府和国际组织正在製定严格的排放法规以降低碳排放水平。

随着石化燃料迅速枯竭,永续性成为世界各国政府和社会关注的问题和重大挑战。这使得电动自行车成为应对这项挑战的理想解决方案。电动自行车,尤其是电动自行车,正逐渐成为理想的交通工具。智慧电动自行车等电动自行车既环保又可靠。例如

- 2022 年 11 月,波多黎各和加勒比地区微型交通行业的领先公司之一 Skootel 将在岛上推出第一个共用电动自行车系统,提供除熟悉的电动Scooter之外的另一种交通途径。

世界各国政府都在推广电动自行车并采取各种措施。电动自行车需求主要由中国、巴西、美国、德国、义大利和印度等国家推动。

- 2023 年 12 月,美国国际开发金融公司 (DFC) 和 IDB Invest 宣布总合微型旅游平台 Tembici 联合投资 2,300 万美元,以支持自行车共享服务在拉丁美洲的扩张。

- 2022 年 3 月,Blue Like an Orange Capital 向在巴西和智利开展业务的电动车公司 Tembici 投资 1,000 万美元。

预计上述因素将在预测期内推动自行车共享市场的发展。

预计亚太地区将在预测期内主导市场

亚太地区是该地区的市场领导,预计在未来几年将保持其主导地位。由于自行车销量庞大,预计中国的成长率将高于其他亚太国家。过去两年,中国占据了亚太地区自行车市场50%以上的份额,这是由于该国为了应对交通拥堵和汽车污染加剧而对电动自行车的高消费。例如,亚洲在全球自行车销量中所占份额最高,其中中国在 2022 年以约 4,300 万辆的销量领先。 2022年自行车销量第二大的地区将是欧洲,售出约2,400万辆自行车。

在印度,日益严重的污染和健康问题导致更多人使用自行车共享交通工具,而不是汽车或摩托车。此外,自行车运动在印度各代人中越来越受欢迎。政府和印度自行车联合会正在寻求在未来几年推出新的自行车比赛和锦标赛,以促进自行车运动。例如,2023 年 4 月,自行车共享服务 MYBYK 在印度孟买南部的 10 个地点推出了 100 辆自行车,以促进最后一英里的连接。这项租赁服务是与 Buryanmumbai 市政公司合作,面向居民、办公室用户和游览 Marine Drive 和 Gateway of India 等地区的游客。该服务可透过 MYBYK 应用程式获得,费用从每天 59 印度卢比(0.86 美元)到每月 749 印度卢比(9.07 美元)不等。 MYBYK也计划推出电动自行车。

鑑于上述共享单车市场的开拓,预计该地区的市场在未来几年将大幅成长。

共享单车产业概况

共享单车市场主要由以下几家企业占据: Lyft、Uber、Neutron Holdings Inc.、美团评论、dba Lime(原 LimeBike)、Youon Bike 和 Bird Rides 过去几年,共享单车市场经历了起起落落。各种新公司进入市场,而另一些公司则在服务几年后退出。

- 2023 年 2 月,TIER Mobility 透过收购自行车共享供应商 nextbike 扩大了在西班牙的业务。该服务于新年前在马略卡岛帕尔马推出,并计划于 2023 年初在巴塞隆纳大都会区、格乔和米斯拉塔推出。 AMBici 是巴塞隆纳及其周边地区的服务名称。

- 2022年10月,巴塞隆纳大都会区自行车共享计画公布,计画于2023年启动。 AMBici 将在 236 个车站安装 2,600 辆电动自行车,其中包括七个带有该市 Bicing 系统的转换点。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 共享车队中电动自行车的采用率增加

- 市场限制因素

- 有限的基础设施可能会阻碍市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 自行车

- 常规/普通自行车

- E-bike

- 共享系统

- 带底座

- 无坞站

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Uber Technologies Inc.

- Didi Chuxing Technology Co.

- Neutron Holdings Inc.

- Lyft Inc.

- Bluegogo

- JCDecaux Group

- Youon Bike

- Bird Rides Inc.

- Hellobike

- Meituan Bike

第七章 市场机会及未来趋势

The Bike Sharing Market size is estimated at USD 7.85 billion in 2024, and is expected to reach USD 12.44 billion by 2029, growing at a CAGR of 9.65% during the forecast period (2024-2029).

The rise in vehicular gas emissions and noise is leading to high levels of pollution in major cities worldwide. The demand for clean energy and high-powered vehicles is simultaneously witnessing a healthy growth rate, and this is anticipated to drive the global market for bike-sharing.

Moreover, the growing need for urban transportation periodically increases the number of vehicles on roads, which leads to heavy traffic congestion and high environmental pollution. Bike-sharing programs have been widely adopted by regions like Asia-Pacific, North America, and Europe to alleviate the abovementioned issues. Many bike-sharing operators have started focusing on expanding their fleet of e-bike services to sustain themselves in the growing competition in the bike-sharing market.

The growing number of technological advancements, such as the proliferation of GPS technology, consumer-ready mobile payments, and the Internet of Things (IoT), and the reduction in investment costs of locking and tracking systems for bikes have led to the introduction of dockless bike-sharing systems in the market.

The dockless bike-sharing system has resulted in better bike-sharing services for the growing urban commutes. The system allows the ease of transit access by offering users the sheer flexibility of picking up and dropping off bikes freely at any legal public vehicle parking lot instead of the operator's bike stations.

Bike Sharing Market Trends

E-bike Segment Expected to be the Fastest-growing Segment Over the Forecast Period

An increasing focus on greener transportation and leisure activities and decreasing traffic congestion are some of the primary reasons driving the expansion of the bike-sharing market. Mobility plays a significant role in the current world. However, due to continually growing environmental and health concerns and increasing emission levels, regional governments and international organizations are enacting stringent emission norms to reduce carbon emission levels.

The depletion of fossil fuel levels at an alarming rate is creating sustainability concerns for future generations, posing a huge challenge for governments and societies worldwide. Thus, e-bikes are proving to be an ideal solution for the challenge. E-bikes, especially pedelecs, are gradually becoming the ideal mode of transportation. E-bikes, such as pedelecs, are eco-friendly and reliable. For instance,

- In November 2022, Skootel, one of the leading companies in the micro-mobility industry in Puerto Rico and the Caribbean, launched the first shared electric bike systems on the island, expanding its alternative transportation offerings beyond its familiar electric scooters.

Governments across the world are promoting e-bikes and also taking various initiatives. E-bike demand is primarily driven by countries such as China, Brazil, the United States, Germany, Italy, and India.

- In December 2023, the US International Development Finance Corporation (DFC) and IDB Invest announced that they were co-investing a combined USD 23 million in equity in the micro-mobility platform Tembici to support the expansion of bicycle-sharing services in Latin America.

- In March 2022, Blue Like an Orange Capital invested USD 10 million in Tembici, an electro-mobility company operating in Brazil and Chile.

The aforementioned factors are anticipated to boost the bike-sharing market over the forecast period.

Asia-Pacific Expected to Dominate the Market During the Forecast Period

Asia-Pacific is expected to be the regional market leader, and it is anticipated to remain dominant over the coming years. China is expected to experience a higher growth rate than other Asia-Pacific countries due to the huge sales of bicycles. China has contributed more than 50% of the Asia-Pacific bicycle market over the past two years due to its high consumption of electric bikes to tackle heavy traffic conditions, as well as growing vehicle pollution in the country. For instance, the largest share of bicycle sales worldwide was in Asia, with China leading with around 43 million units sold in 2022. The region with the second highest bicycle sales in 2022 was Europe, with around 24 million bicycles.

In India, due to an increase in pollution and health concerns, people are opting to use bike-sharing transportation instead of cars and bikes. Additionally, cycling sports are gaining popularity among all generations in India. The government and the Cycling Federation of India are launching new cycle races and championships to promote the use of bicycles over the coming years. For instance, in April 2023, MYBYK, a bicycle-sharing service, launched 100 bicycles at 10 locations across South Mumbai, India, to promote last-mile connectivity. The rental service, in partnership with the Brihanmumbai Municipal Corporation, is aimed at residents, officegoers, and tourists visiting areas including Marine Drive and the Gateway of India. The service is being run through MYBYK's app, and tariffs range from INR 59 (USD 0.86) per day to INR 749 (USD 9.07) per month. MYBYK also plans to introduce electric bicycles in the area.

Based on the abovementioned developments in the bike-sharing market, the market is anticipated to grow at a substantial rate over the coming years in the region.

Bike Sharing Industry Overview

The bike-sharing market is majorly dominated by players such as Lyft, Uber, Neutron Holdings Inc., Meituan, dba Lime (formerly LimeBike), Youon Bike, and Bird Rides. The bike-sharing market witnessed its ups and downs during the last few years. Various new companies entered the market, while some exited after a few years of service.

- In February 2023, TIER Mobility acquired bike-sharing provider nextbike, which then expanded its presence in Spain. The service was launched in Palma de Mallorca just before the New Year and was to be followed by launches in the Barcelona Metropolitan Region, Getxo, and Mislata in early 2023. AMBici is the service's name in and around Barcelona.

- In October 2022, the Barcelona Metropolitan Area bike-sharing scheme was announced, with plans to be launched in 2023. AMBici will have 2,600 electric bicycles at 236 stations, including seven transfer points with the city's Bicing system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Inclusion of E-bikes in the Sharing Fleet

- 4.2 Market Restraints

- 4.2.1 Limited Infrastructure May Hinder Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Bike

- 5.1.1 Traditional/Regular Bike

- 5.1.2 E-bike

- 5.2 Sharing System

- 5.2.1 Docked

- 5.2.2 Dockless

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Uber Technologies Inc.

- 6.2.2 Didi Chuxing Technology Co.

- 6.2.3 Neutron Holdings Inc.

- 6.2.4 Lyft Inc.

- 6.2.5 Bluegogo

- 6.2.6 JCDecaux Group

- 6.2.7 Youon Bike

- 6.2.8 Bird Rides Inc.

- 6.2.9 Hellobike

- 6.2.10 Meituan Bike