|

市场调查报告书

商品编码

1521530

冷冻和冷藏货柜运输:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Refrigerated Container Shipping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

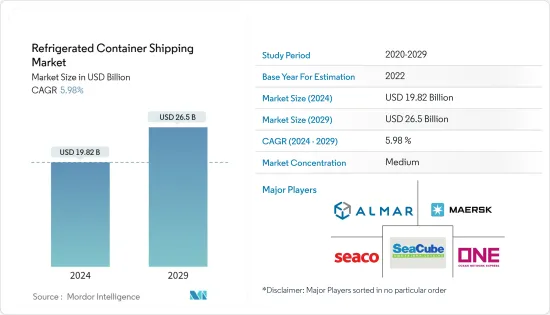

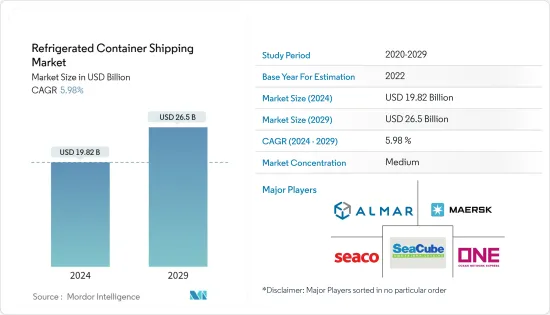

冷冻和冷藏货柜运输的市场规模预计到 2024 年为 198.2 亿美元,预计到 2029 年将达到 265 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.98%。

主要亮点

- 冷冻和冷藏货柜运输市场对生鲜产品的需求正在增加,这也受到电子商务兴起和追踪技术进步的影响。由于缺乏航空运输,需求也在增加,但冷藏货物运输可以透过改进技术来满足。

- 冷藏运输并未像干运那样受到新冠肺炎 (COVID-19) 的影响。全球停电意味着消费者有更多的时间、对住宅维修更感兴趣,并且迫切需要美化他们的家庭办公室。这对干运物流产生了巨大的影响。由于肉类、柑橘和异国风水果的需求增加,生鲜食品的需求保持相对稳定,2023年上半年年增4.8%。例如,德尔蒙生鲜食品毛利润成长40%,利润率成长33.3%。

- 冷藏运输受益于优先配载,使得运输冷藏货物时不太可能出现瓶颈。 2023 年,儘管克服劳动力和空间限制的挑战仍然存在,但冷藏公司仍出现积极迹象。

冷冻冷藏集装箱运输市场趋势

医药市场需求增加

- 製药工业是最重要的工业之一。它满足全球约62%的疫苗接种需求,是全球最大的学名药供应商,占全球总供应量的20%。这个行业已经建立了数千年,但近年来显着扩张。

- 科技发展是推动医药物流产业发展的一大趋势。为了维持市场地位,领先的医药物流公司正在开发新技术,例如云端基础的供应链营运、物联网技术等。

- 康德乐 (Cardinal Health) 于 2022 年 4 月获得了一份价值 5780 万美元的合同,负责存放和交付 80,000 个托盘的个人防护设备(PPE)。它是为了支持美国卫生与公众服务部 (HHS) 的一个部门—国家战略储备 (SNS)。

- 最近的一项研究基于对15条冷藏航线的分析,显示2021年第三季成长了50%,其中干货货柜运价增加了四倍多。此外,根据该公司的 Dalreftrans 子公司扩大策略,FESCO Transport Group 计划于 2022 年 7 月将其冷藏货柜船队在 2022 年夏末之前扩大到 4,000 个单位。这样,药品运输和物流需求的不断增长正在推动冷藏货柜的使用。

贸易路线增加

- 贸易路线是用于商业货物通行的道路和停靠站的物流网络。这使得产品能够在遥远的市场上蓬勃发展。贸易路线包括可能连接到较小的经济和非商业性运输路线网络的远距。随着海运量和贸易航线数量的不断增加,预计冷藏货柜的需求将会很高。

- 海运类别是首选的运输方式,在冷冻货柜市场中占据最大份额,预计在未来几年也将保持其主导地位。至2024年,海上冷藏贸易量将总合1.24亿吨,年增率为3.7%。同时,由于食品供应链的“更广泛的弹性”,干货每年可能仅增长 2.2%。

- 由于全球经济受到各种衝击,预计全球贸易将在2022年下半年失去动力,并在2023年持续低迷。世贸组织专家预测2022年全球商品贸易量将成长3.5%,高于2022年4月的3.0%成长率。不过,其预测2023年成长率为1.0%,显着低于先前预测的3.4%。

- 冷藏物流的日益普及不仅归因于所谓新兴国家的经济进步,也归因于现有市场行为的变化。例如,随着植物性饮食变得越来越流行,酪梨等产品从拉丁美洲出口到欧洲、中国和北美。这种转变产生了对客製化物流解决方案的需求。冷藏集装箱就是解决方案。

冷冻冷藏货柜运输业概况

冷冻冷藏货柜运输市场是一个高度分散、竞争激烈的市场,各国和地区都有国内外参与者。主要参与者包括 AP Moller-Maersk、Seaco Srl 和 SeaCube Container Leasing Ltd。推动市场成长的主要原因是贸易路线的增加、对处方笺产品的需求、电子商务行业的扩张以及即时追踪技术的引入。

此外,驳船经常用于在河流和运河上运输散装货物。业内人士表示,在预测期内,製药业将成长最快。这是由于对生技药品、细胞疗法、疫苗和血液製品的需求增加,所有这些都需要温控储存和运输。近年来,对海上冷藏生鲜产品的支持预计将增加全球贸易。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 扩大贸易关係

- 生鲜产品的需求增加

- 市场限制因素

- 货物盗窃

- 维护成本上升

- 市场机会

- 技术进步

- 节能冷冻

- 价值链/供应链分析

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场区隔

- 按运输方式

- 海运

- 路

- 铁路

- 按用途

- 水果和蔬菜

- 肉品

- 乳製品

- 疫苗及生物製药

- 药品

- 化学品

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 世界其他地区

第六章 竞争状况

- 市场集中度概况

- 公司简介

- AP Moller-Maersk A/S

- Singamas Container Holdings Ltd.

- China International Marine Containers(Group)Co. Ltd.

- Seaco Srl

- Triton International Ltd.

- MSC Mediterranean Shipping Company SA

- Hapag-Lloyd AG

- Ocean Network Express Pte. Ltd.

- ZIM Integrated Shipping Services Ltd.

- SeaCube Container Leasing Ltd.

- BSL Containers Ltd.

- Almar Container Group*

- 其他公司

第七章 市场的未来

第8章附录

The Refrigerated Container Shipping Market size is estimated at USD 19.82 billion in 2024, and is expected to reach USD 26.5 billion by 2029, growing at a CAGR of 5.98% during the forecast period (2024-2029).

Key Highlights

- The refrigerated container shipping market is observing a rise in demand for perishable goods, though the rise in e-commerce and advances in tracking technology are also creating an impact. There is also increased demand resulting from a lack of air transportation, which refrigerated cargo shipping can accommodate due to improvements in technology.

- Reefer shipping had not suffered nearly as much from the impact of COVID-19 as dry shipping. Global lockdowns meant consumers had more time, more interest in home improvements, and a pressing need to kit out home offices. It hit dry shipping logistics hard. The demand for fresh foods remained relatively steady, with an increase of 4.8% year over year in the first half of 2023 as a result of increased appetite for meat, citrus, and exotic fruits. Fresh Del Monte Produce, for example, enjoyed a gross profit increase of 40% and a profit margin increase of 33.3%.

- Reefer shipping benefits from prioritized stowing, making it less likely to experience bottlenecks when shipping refrigerated items. It bodes well for reefer shipping companies in 2023, though there are still challenges with labor and space constraints to overcome.

Refrigerated Container Shipping Market Trends

Rising demand for pharmaceutical market

- The pharmaceutical industry is one of the most important. It satisfies about 62% of worldwide vaccination demand and is the largest global provider of generic pharmaceuticals, accounting for 20% of total global supply by volume. Although this industry was established for millennia, it saw a substantial expansion in recent years.

- Technological developments are a major trend that is gaining traction in the pharmaceutical logistics industry. To maintain their market position, major pharmaceutical logistics businesses are developing new technologies such as cloud-based supply chain operations, IoT technology, and others.

- Cardinal Health was awarded a contract worth USD 57.8 million in April 2022 for the storage and distribution of 80,000 pallets of personal protective equipment (PPE). It was to support the Strategic National Stockpile (SNS), a division of the US Department of Health and Human Services (HHS).

- According to recent research, there was a 50% increase in the third quarter of 2021 based on an analysis of 15 reefer trade routes, while dry container freight charges more than quadrupled in 2021. In addition, under the company's Dalreftrans subsidiary expansion strategy, FESCO Transportation Group intended to extend its fleet of reefer containers to 4,000 units by the end of summer 2022 in July 2022. Thus, an increase in the need for pharmaceutical product transportation and logistics is driving the use of reefer containers.

Increase in number of trade routes

- A trade route is a logistical network of roads and stoppages used for commercial goods transit. It enables commodities to prosper in distant marketplaces. One trade route includes long-distance arteries that may be linked to smaller networks of economic and non-commercial transportation routes. As the amount of marine traffic and the number of trade routes continue to grow, reefer containers are projected to be in high demand.

- Supported transportation method, the seaways category, holds the largest share of the reefer container market and is projected to maintain its dominance in the next years. By 2024, seaborne refrigerated trade will total 124 million tonnes, reflecting a 3.7% annual growth rate. Dry cargo, on the other hand, will only rise at a 2.2% yearly rate, owing to the "broader resilience" of the food supply chain.

- As various shocks weigh on the global economy, global commerce lost impetus in the second half of 2022 and will remain weak in 2023. WTO experts expected a 3.5% growth in global goods trade volumes in 2022, up from 3.0% in April 2022. However, they predicted a 1.0% growth in 2023, a significant decrease from the earlier prediction of 3.4%.

- The growing popularity of reefer logistics is due not just to economic advances in so-called developing nations but also to changes in the behavior of established markets. Plant-based diets, for example, grew in popularity, and goods such as avocados are exported from Latin America to Europe, China, and North America. This shift generates a need for customized logistical solutions. Reefer containers are the solution.

Refrigerated Container Shipping Industry Overview

The refrigerated container shipping market is highly fragmented and competitive, with a mix of domestic and international players existing in all countries and regions. Some of the major players are A.P. Moller-Maersk, Seaco Srl, SeaCube Container Leasing Ltd., etc. The primary reasons driving the market growth include an increase in the number of trade routes, demand for prescription products, the expansion of the e-commerce industry, and the introduction of real-time tracking technologies.

Furthermore, barges are frequently utilized to move bulk commodities on rivers and canals. According to the industry, the pharmaceutical sector will expand the quickest throughout the predicted period. It is due to an increase in demand for biologics, cell treatments, vaccines, and blood products, all of which require temperature-controlled storage and shipping. It is predicted to increase global trade by supporting refrigerated perishables at sea in recent years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing trade relations

- 4.2.2 Increased demand for perishable goods

- 4.3 Market Restraints

- 4.3.1 Cargo theft

- 4.3.2 High cost of maintainig

- 4.4 Market opportunities

- 4.4.1 Advancements in technology

- 4.4.2 energy-efficient refrigeration

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Covid-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Transportation Mode

- 5.1.1 Seaways

- 5.1.2 Roadways

- 5.1.3 Railways

- 5.2 By Application

- 5.2.1 Fruits and Vegetables

- 5.2.2 Meat Products

- 5.2.3 Dairy Products

- 5.2.4 Vaccines and Biologicals

- 5.2.5 Pharmaceuticals

- 5.2.6 Chemicals

- 5.2.7 Other Applications

- 5.3 By Region

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Middle East, and Africa

- 5.3.5 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 A.P. Moller - Maersk A/S

- 6.2.2 Singamas Container Holdings Ltd.

- 6.2.3 China International Marine Containers (Group) Co. Ltd.

- 6.2.4 Seaco Srl

- 6.2.5 Triton International Ltd.

- 6.2.6 MSC Mediterranean Shipping Company S.A.

- 6.2.7 Hapag-Lloyd AG

- 6.2.8 Ocean Network Express Pte. Ltd.

- 6.2.9 ZIM Integrated Shipping Services Ltd.

- 6.2.10 SeaCube Container Leasing Ltd.

- 6.2.11 BSL Containers Ltd.

- 6.2.12 Almar Container Group*

- 6.3 Other Companies