|

市场调查报告书

商品编码

1521649

强力运动:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Powersports - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

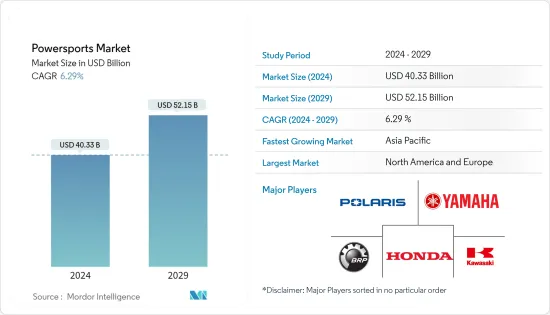

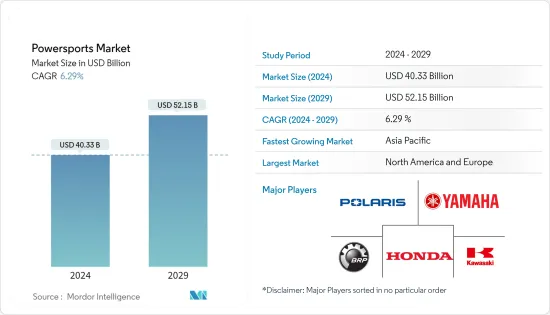

预计2024年强力运动市场规模将达到403.3亿美元,预计2029年将达到521.5亿美元,在预测期内(2024-2029年)复合年增长率为6.29%。

强力运动市场呈现出由北极星公司、雅马哈汽车公司、哈雷戴维森公司、BRP公司、本田汽车公司、川崎重工公司和铃木汽车公司等少数全球巨头主导的格局。这些公司透过广泛的产品系列、技术进步和策略联盟在这个市场上建立了自己的据点。

强力运动产业在全球经济中占有重要地位,为创造就业、旅游业以及休閒和运动整体做出了贡献。近年来,由于可支配收入增加、都市化以及对冒险运动和休閒的兴趣日益浓厚等因素,该市场稳步增长。 2023年全球可支配所得为69.64兆美元,较上年(2022年)成长0.89%。这些资料显示收入增加,这肯定会影响此类休閒和有趣游乐设施的支出。

有几个关键因素促进了强力运动市场近期的成长。关键因素之一是对冒险和旅行的需求不断增长。 2022年,旅行和旅游业对全球国内生产总值(GDP)的总贡献比2019年下降23%。 2022年,就旅行总量和旅游业对GDP的贡献而言,美国和中国是迄今为止领先的旅游市场。德国、英国和日本当年的排名紧随其后。此外,技术进步促进了更有效率、更环保、更先进的车辆的开发,使它们对消费者更具吸引力。此外,汽车行业日益增长的个人化和客製化趋势也延伸到了强力运动车辆,让客户可以客製化他们的机器以满足他们的特定需求和偏好。

儘管有这些成长趋势,强力运动市场仍面临一些挑战和障碍。主要挑战之一是对环境永续性的日益关注以及废气标准和监管要求的收紧。製造商必须投资研发,开发符合这些准则的环保车辆,同时保持性能和吸引力。另一个挑战是全球经济的波动,可能会影响消费者支出和对强力运动跑车的需求。

但这些挑战也带来了成长和创新的机会。例如,对永续性的推动导致了电动和混合强力运动跑车的出现,开拓了新的市场领域。此外,全球对探险旅游和户外休閒活动不断增长的需求为强力运动製造商提供了巨大的潜在基本客群。此外,人们对永续性的兴趣日益浓厚,将鼓励电动和混合动力汽车的开拓,扩大市场并回应消费者日益增长的环保意识。

强力运动市场趋势

技术进步带来的消费者偏好变化推动市场需求

近年来,消费者的偏好明显转向户外活动、探险运动和健身。这种变化是由于人们越来越渴望过着更健康、更积极的生活方式,并寻求令人兴奋和新颖的体验。因此,对满足这些爱好的运动用品和车辆的需求激增。

人们现在更倾向于冒险和户外活动。 2021年,美国有5,140万人参加公路自行车、山地自行车和小轮车赛事。这导致了对强力运动车辆的需求激增,这些车辆可以让您探索不同的地形并享受惊险的体验。对新奇和刺激的渴望刺激了对冒险运动和户外活动的需求。全地形车和越野自行车等强力运动车辆描述了令人兴奋的体验,让使用者能够探索新地形并挑战自我。

此外,个人化和客製化趋势的不断增长鼓励製造商提供各种型号和配件来满足个人偏好。高品质运动器材和车辆的可用性和可及性的增加使个人更容易参与这些活动。然而,社群媒体的兴起使人们更容易共用他们的经历并展示他们的成就。因此,其他活动也开始采取积极的生活方式,从事体育运动和户外活动。此外,体育产业影响者在推动这些活动并鼓励更多人参与方面发挥关键作用。

随着先进技术的采用,强力运动产业不断发展。製造商专注于提高其产品的性能、效率和安全性。例如,将电子燃油喷射(EFI)系统整合到马达和全地形车中可以提高燃油效率并减少排放气体。此外,电动强力运动的发展为製造商迎合有环保意识的消费者提供了新的机会。例如

*北极星于 2023 年 8 月推出全球首款全电动 Ranger XP Kinetic 和 Ranger XD 1500,进一步扩大了其产品阵容。它配备 110 马力和 140 磅英尺瞬时扭矩发动机,可提供最大的功率和能力,包括牵引高达 2,500 磅和行业领先的 1,250 磅的能力。

*2023年2月,VOLTERRA Motors宣布推出其电动强力运动系列DTFe-50和DTFe-110。配备蓝牙连接和可更换的锂离子电池。

随着这些发展,我们相信对创新车辆的需求将持续成长。此外,先进技术的持续发展和对永续性的日益重视将进一步推动该市场的未来扩张。

预计亚太地区在预测期内将实现最高成长

由于中国、印度和日本等国家的多种因素,亚太地区的强力运动市场正在不断成长。促成这一增长的因素包括可支配收入的增加、中阶的壮大以及休閒活动的增加。 2023年,亚太地区可支配所得将达20.77兆美元,较2019年成长7.62%。人们对休閒的需求也不断增加,尤其是年轻一代,马达、Scooter、全地形车和水上摩托车等强力运动车辆的受欢迎程度直线上升。这些国家的政府正在推动绿色和永续交通途径,导致人们对电动和混合强力运动车辆的兴趣增加。

儘管有这些正面因素,亚太强力运动市场仍面临来自公共运输和汽车共享服务等其他交通途径的竞争等挑战。经济波动也会影响消费者在强力运动车辆等非必需品上的支出。然而,市场也存在成长机会,包括冒险旅行需求的增加和极限运动的日益普及。此外,强力运动产业仍在发展的新兴经济体也存在市场拓展潜力。

政府政策和法规在塑造亚太强力运动市场方面发挥关键作用。该地区各国政府正在推出政策和法规,以推广更清洁、更环保的强力运动车辆。例如,中国实施了严格的排放法规,导致电动马达和Scooter的产量和销售增加。日本透过奖励和补贴鼓励电动车的采用。该地区的製造商透过推出新产品、建立合作伙伴关係以及投资于技术进步来应对这些发展。例如

*2024年1月,Altmin在印度获得了1亿美元的锂离子电池创新投资,彰显了该公司在市场上的战略地位,标誌着电动车价值链的重大进步。

*2023年9月,雅马哈与CFMOTO建立合作关係,在中国生产摩托车,包括强力运动跑车。

考虑到这些发展,由于休閒需求的增加、中阶的崛起以及对环保交通方式日益浓厚的兴趣,亚太地区强力运动市场的未来被认为是充满希望的。由于技术进步、产品创新和新经营模式的采用,预计未来几年该市场将显着成长。电动和混合动力汽车的日益普及预计也将有助于市场成长。

强力运动产业概况

强力运动市场呈现出一个统一的格局,由北极星公司、雅马哈汽车公司、哈雷戴维森公司、BRP公司、本田汽车公司、川崎重工公司和铃木汽车公司等几家大型全球参与企业主导。这些公司透过广泛的产品系列、技术进步和策略联盟在这个市场上站稳了脚跟。

*2023 年 11 月,领先的强力运动公司 Taiga 宣布推出一款创新的互联云端行动应用程序,以改变强力运动的拥有体验。这款尖端应用程式旨在透过提供即时车辆资料、个人化乘车建议和无缝连接来提高用户参与度和便利性。该应用程式的推出是强力运动产业的重要一步,为用户带来了更互联和互动的体验。

*2023 年 3 月,Polaris推出了Polaris Xchange,这是一个致力于买卖二手强力运动车辆的市场。这个创新平台旨在为买家和卖家提供无缝、安全的体验,并提供多种经过认证的二手北极星车辆选择。

*2023 年 2 月,Ski-Doo 和 Lynx 计划于 2024 年推出最新电动车型 Grand Touring Electric 和 Adventure Electric。

*2023 年 3 月,BRP 将与 Tread Lightly 和 RideSafe 合作,促进负责任的骑乘并提高强力运动的安全性。此次合作旨在教育骑士在享受强力运动车辆时环保和安全驾驶的重要性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行概述

第四章市场动态

- 市场概况

- 市场驱动因素

- 可支配收入的增加和消费者对冒险运动的偏好推动了市场的成长

- 市场限制因素

- 高昂的初始投资和维护成本阻碍了市场成长

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- PESTLE分析

第五章市场区隔

- 汽车模型

- 个人水上自行车

- 全地形车

- 大型摩托车

- 并排的车

- 雪上摩托车

- 推进力

- 柴油引擎

- 汽油

- 电

- 目的

- 在公路式

- 越野

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 併购

- 公司简介

- Polaris Inc.

- Yamaha Motor Co., Ltd.

- BRP Inc.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- KTM AG

- Arctic Cat Inc.

- Changjiang Motorcycle Co., Ltd.

- Harley-Davidson, Inc.

第七章 市场机会及未来趋势

The Powersports Market size is estimated at USD 40.33 billion in 2024, and is expected to reach USD 52.15 billion by 2029, growing at a CAGR of 6.29% during the forecast period (2024-2029).

The powersports market exhibits a consolidated landscape, dominated by a few major global players such as Polaris Inc., Yamaha Motor Co. Ltd, Harley-Davidson Inc., BRP Inc., Honda Motor Co. Ltd, Kawasaki Heavy Industries, Suzuki Motor Corporation, and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

The powersports industry holds significant importance in the global economy, contributing to job creation, tourism, and the overall leisure and sports sector. In recent years, the market has experienced steady growth, driven by factors such as increasing disposable incomes, urbanization, and a growing interest in adventure sports and recreational activities. In 2023, global disposable income was USD 69.64 trillion, which is 0.89 % greater than the previous year (2022). This data shows the incremental increase in income, which surely impacts spending on such recreational and interesting vehicles.

Several key factors have contributed to the growth of the Powersports market in recent times. One of the primary drivers is the rising demand for adventure and travel, as people seek to escape their daily routines and engage in thrilling experiences. In 2022, the total contribution of travel and tourism to the global gross domestic product (GDP) was 23 percent lower than in 2019. In 2022, the United States and China were by far the leading travel markets based on the total contribution of travel and tourism to GDP. That year, Germany, the United Kingdom, and Japan followed in the ranking. Additionally, advancements in technology have led to the development of more efficient, eco-friendly, and technologically advanced vehicles, making them more appealing to consumers. Furthermore, the growing trend of personalization and customization in the automotive industry has extended to Powersports vehicles, allowing customers to tailor their machines to their specific needs and preferences.

Despite the growth trends, the powersports market faces several challenges and obstacles. One of the significant challenges is the increasing focus on environmental sustainability, leading to stricter emissions standards and regulatory requirements. Manufacturers must invest in research and development to create eco-friendly vehicles that adhere to these guidelines while maintaining performance and appeal. Another challenge is the fluctuating global economy, which can impact consumer spending and demand for powersports vehicles.

However, these challenges also present opportunities for growth and innovation. For instance, the push for sustainability has led to the emergence of electric and hybrid powersports vehicles, opening new segments in the market. Additionally, the increasing global demand for adventure tourism and outdoor recreational activities provides a vast potential customer base for powersports manufacturers. Furthermore, the increasing focus on sustainability is likely to drive the development of electric and hybrid vehicles, expanding the market and catering to the growing environmental consciousness of consumers.

Powersports Market Trends

Changing Consumer Preferences due to technological Advancements Drives the Demand in the Market

In recent years, there has been a notable shift in consumer preferences toward outdoor activities, adventure sports, and fitness-related pursuits. This change is driven by an increasing desire among people to lead healthier, more active lifestyles and seek experiences that offer excitement and novelty. As a result, the demand for sports equipment and vehicles that cater to these interests has surged.

People are now more inclined toward adventure and outdoor activities. In 2021, 51.4 million people participated in Road biking, mountain biking, and BMX events in the United States. This has led to a surge in demand for Powersports vehicles that allow them to explore various terrains and enjoy thrilling experiences. The desire for novelty and thrill has fuelled the demand for adventure sports and outdoor activities. Powersport vehicles, such as ATVs and off-road motorcycles, provide exciting experiences that enable users to explore new terrains and challenge themselves.

Furthermore, the growing trend of personalization and customization has encouraged manufacturers to offer a wide range of models and accessories to cater to individual preferences. The increasing availability of high-quality sports equipment and vehicles, coupled with improved accessibility, has made it easier for individuals to participate in these activities. However, the rise of social media has made it easier for people to share their experiences and showcase their achievements. This has inspired others to adopt an active lifestyle and engage in sports and outdoor activities. Additionally, influencers in the sports industry have played a significant role in promoting these activities and encouraging more people to participate.

The Powersports industry is continuously evolving with the introduction of advanced technology. Manufacturers are focusing on improving the performance, efficiency, and safety of their products. For instance, the integration of electronic fuel injection (EFI) systems in motorcycles and ATVs has led to better fuel efficiency and reduced emissions. Additionally, the development of electric-powered powersports has opened new opportunities for manufacturers to cater to environmentally conscious consumers. For instance,

* In August 2023, Polaris unveiled its first-of-its-kind all-electric Ranger XP Kinetic and the Ranger XD 1500, further expanding its product lineup. It has an engine of 110 horsepower and 140 lb-ft of instant torque delivering maximum power and capability, including the ability to effortlessly tow up to 2,500lbs and haul an industry-best 1,250 lbs.

* In February 2023, VOLTERRA Motors announced the launch of an electric powersports line-up, the DTFe-50 and DTFe-110. This bike comes with Bluetooth connectivity and swappable lithium-ion batteries.

With such development, the demand for innovative vehicles will continue to grow. Additionally, the ongoing development of advanced technologies and a focus on sustainability will further fuel the future expansion of this market.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

The Asia-Pacific powersport market is experiencing growth due to several factors in countries such as China, India, Japan, and others. Factors contributing to this growth include rising disposable income, a growing middle class, and an increase in leisure activities. In 2023, the Asia-Pacific disposable income reached USD 20.77 trillion, a 7.62% increase from 2019. There has also been a rise in demand for recreational activities, particularly among the younger generation, leading to a surge in popularity for Powersport vehicles like motorcycles, scooters, ATVs, and personal watercraft. Governments in these countries are promoting eco-friendly and sustainable transportation, resulting in increased interest in electric and hybrid powersport vehicles.

Despite these positive factors, the Asia-Pacific powersport market faces challenges such as competition from other modes of transportation like public transit and car-sharing services. Economic fluctuations can also impact consumer spending on discretionary items like powersport vehicles. However, the market presents opportunities for growth, including the increasing demand for adventure tourism and the growing popularity of extreme sports. Additionally, the market has potential for expansion in emerging economies where the Powersport industry is still developing.

Government policies and rules play a vital role in shaping the Asia-Pacific Powersport market. Governments in the region have introduced policies and rules to promote cleaner and greener Powersport vehicles. For instance, China has implemented strict emission norms, leading to an increase in electric motorcycle and scooter production and sales. Japan has encouraged electric vehicle adoption through incentives and subsidies. Manufacturers in the region respond to these developments by launching new products, forming partnerships, and investing in technological advancements. For example -

* In January 2024, Altmin secured a USD100 million investment for lithium-ion battery innovation in India, demonstrating the company's strategic position in the market and representing a significant advancement in the electric vehicle value chain.

* In September 2023, Yamaha entered a partnership with CFMOTO for Chinese motorcycle manufacturing, including Powersport vehicles.

Considering these developments, the future of the Asia-Pacific Powersport market looks promising due to the increasing demand for recreational activities, the rise of the middle class, and the growing interest in eco-friendly transportation. The market is expected to witness significant growth in the coming years, driven by technological advancements, product innovations, and the introduction of new business models. The increasing adoption of electric and hybrid Powersport vehicles is also expected to contribute to the market's growth.

Powersports Industry Overview

The Powersports market exhibits a consolidated landscape, dominated by a few major global players such as Polaris Inc., Yamaha Motor Co. Ltd, Harley-Davidson Inc., BRP Inc., Honda Motor Co. Ltd, Kawasaki Heavy Industries, Suzuki Motor Corporation, and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

* In November 2023, Taiga, a leading Powersports company, unveiled its innovative connected cloud mobile app, transforming the Powersports ownership experience. This cutting-edge app aims to enhance user engagement and convenience by providing real-time vehicle data, personalized ride recommendations, and seamless connectivity. The app's launch marks a significant step forward in the Powersports industry, offering users a more connected and interactive experience.

* In March 2023, Polaris launched Polaris Xchange, a dedicated marketplace for buying and selling pre-owned Powersports vehicles. This innovative platform aims to provide buyers and sellers with a seamless and secure experience, offering a wide range of certified pre-owned Polaris vehicles.

* In February 2023, Ski-Doo and Lynx are planning to unveil their latest electric in 2024, the Grand Touring Electric and Adventure Electric models.

* In March 2023, BRP formed partnerships with Tread Lightly and RideSafe to promote responsible riding and enhance Powersports safety. This collaboration aims to educate riders on the importance of environmental stewardship and safe practices while enjoying their Powersports vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing disposable income and consumer preferences for adventure sports propel the market growth

- 4.3 Market Restraints

- 4.3.1 High initial investment and maintenance costs obstruct the market growth

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle type

- 5.1.1 Personal watercrafts

- 5.1.2 All-terrain vehicles

- 5.1.3 Heavy weight motorcycles

- 5.1.4 Side by side vehicles

- 5.1.5 Snow mobiles

- 5.2 Propulsion

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Electric

- 5.3 Application

- 5.3.1 On-Road

- 5.3.2 Off-Road

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.5 Middle East

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Polaris Inc.

- 6.3.2 Yamaha Motor Co., Ltd.

- 6.3.3 BRP Inc.

- 6.3.4 Honda Motor Co., Ltd.

- 6.3.5 Kawasaki Heavy Industries

- 6.3.6 Suzuki Motor Corporation

- 6.3.7 KTM AG

- 6.3.8 Arctic Cat Inc.

- 6.3.9 Changjiang Motorcycle Co., Ltd.

- 6.3.10 Harley-Davidson, Inc.