|

市场调查报告书

商品编码

1522844

汽车车道警告系统:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Lane Warning Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

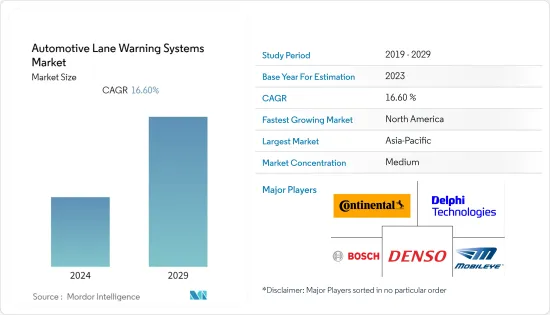

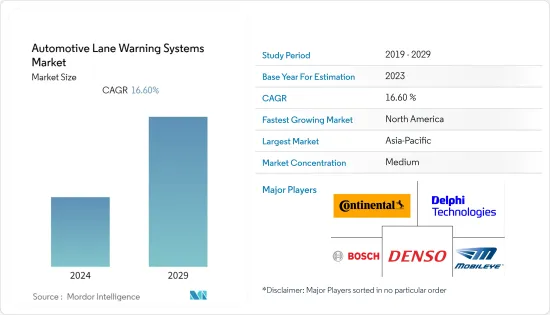

汽车车道警告系统市场规模预计到 2024 年为 59.4 亿美元,预计到 2029 年将达到 147.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 16.60%。

由于道路安全意识的提高以及世界各国政府对车辆先进安全功能的指令不断增加,汽车车道警告系统市场正经历显着成长。该市场是 ADAS(高级驾驶辅助系统)市场的一部分,反映了汽车行业向智慧、自动驾驶汽车的转变。

随着乘用车产量的增加以及汽车製造商将先进的安全功能作为标准配备,对车道警报系统的需求不断增加。消费者的偏好越来越倾向于配备先进安全技术的汽车,部分原因是人们对交通安全问题的认识不断增强,以及配备此类技术的汽车的高价值。

技术进步在这个市场中发挥了重要作用。摄影机、感测器和人工智慧技术的创新使车道警报系统更加准确和可靠。将这些系统与主动式车距维持定速系统和盲点检测等其他安全功能集成,可创建更全面的安全解决方案,进一步推动市场成长。

从地区来看,欧洲和北美市场的采用率领先,这主要是由于严格的政府法规要求在车辆上安装先进的安全系统。然而,随着中国和日本等国家大力投资汽车技术和基础设施开拓,亚太地区正成为成长最快的市场。

车道警报系统市场的未来充满希望,这些系统与自动驾驶和半自动车辆的扩展相结合将带来潜在的成长机会。

汽车车道预警系统市场趋势

乘用车领域推动市场成长

乘用车领域正在推动汽车车道预警系统市场的发展,其中全球乘用车产量和销售量的成长发挥了重要作用。随着乘用车变得更便宜和可用,特别是在新兴国家,对车道警报系统等先进安全功能的需求也增加。这些系统最初被认为是豪华或高端选择,但在消费者对更安全汽车的需求和监管压力的推动下,它们逐渐成为主流。

监管的影响确实是巨大的。包括欧洲和北美在内的许多地区都实施了严格的安全法规,要求或大力鼓励新车配备先进的安全系统。此监管力道有效扩大了乘用车领域车道警报系统的市场。

先进感测器、摄影机和软体的整合不仅提高了车道警报系统的有效性,而且随着时间的推移也使其更具成本效益。随着技术变得更加可用和生产成本下降,汽车製造商正在各种车型上安装此类系统,包括中檔汽车。

消费者对道路安全问题和 ADAS(高阶驾驶辅助系统)优势的认识不断提高,正在影响购买决策。消费者越来越多地选择具有车道偏离警告等安全功能的汽车,这些功能被认为对于安全驾驶至关重要。

此外,联网汽车和自动驾驶汽车的兴起为乘用车领域的车道警报系统市场创造了进一步的成长机会。随着汽车製造商投资半自动和自动驾驶汽车的开发,先进车道警报系统和其他 ADAS 技术的整合变得至关重要。

随着 ADAS 创新使乘用车变得更加安全和更具吸引力,这一趋势预计将持续下去。

北美是汽车车道预警系统的主要市场

北美已成为汽车车道警告系统的主要市场,这一趋势是由多种因素推动的。该地区,特别是美国和加拿大,是世界上人均汽车持有率最高的地区之一,为包括车道警报系统在内的先进车辆技术创造了广阔的市场。

这些国家的监管工作至关重要,采取积极措施鼓励甚至要求在车辆中采用安全技术。这项监管推动与该地区强大的技术创新相辅相成,该地区许多领先的汽车和技术公司不断开发尖端的驾驶员辅助系统。

此外,北美消费者对车辆安全的意识和重视程度很高。这种意识,加上对安全技术的投资意愿,正在进一步推动车道警报系统市场的发展。此外,政府和组织的各种道路安全措施强调了汽车先进安全功能的重要性。

经济因素也在发挥作用,北美强劲的经济使得个人消费者和车队营运商能够投资于配备这些先进技术的更新、更安全的车辆。所有这些方面协同作用,使北美成为汽车车道警告系统的重要市场。

加拿大政府宣布对所有车辆进行安全测试,并部署自动驾驶和联网汽车,同时提高人们对驾驶员辅助技术的认识。

- 2022 年 5 月,通用汽车宣布与 INRIX Inc. 建立建设性合作伙伴关係,根据通用汽车未来道路和 Inrix倡议的安全视图,透过分析支援的云端基础的应用程式直接向美国运输部提供安全解决方案资料。

- 2022 年 5 月,丰田宣布将在其北美组装厂使用来自德克萨斯州奥斯汀新兴企业Invisible AI 的电脑为基础的视觉技术。该技术可以处理身体运动资料,以提高品质、安全性和效率。

由于上述因素,对车辆安全解决方案的需求预计将会增加。预计这将推动所研究市场从 2024 年到 2029 年的成长。

汽车车道预警系统产业概况

汽车车道警告系统市场由以下参与者主导: Continental AG、Delphi Technologies、Mobileye、Robert Bosch GmbH、Hitachi Ltd、ZF Friedrichshafen AG、DENSO Corporation 和 Magna International Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 安全意识的提高推动市场成长

- 市场限制因素

- 网路安全担忧预计将抑制市场成长

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 功能类型

- 车道偏离警示系统

- 车道维持系统

- 感测器类型

- 视讯感应器

- 雷射感测器

- 红外线感测器

- 销售通路

- OEM

- 售后市场

- 汽车模型

- 客车

- 轻型商用车

- 大型商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Continental AG

- Delphi Technologies

- Mobileye

- DENSO Corporation

- Robert Bosch GmbH

- The Bendix Corporation

- Hitachi Ltd

- Iteris Inc.

- Nissan Motor Co. Ltd

- Volkswagen AG

- ZF TRW

第七章 市场机会及未来趋势

The Automotive Lane Warning Systems Market size is estimated at USD 5.94 billion in 2024, and is expected to reach USD 14.79 billion by 2029, growing at a CAGR of 16.60% during the forecast period (2024-2029).

The market for automotive lane warning systems was experiencing significant growth driven by heightened awareness of road safety and increasing mandates from governments worldwide for advanced safety features in vehicles. This market is a segment of the broader advanced driver assistance systems (ADAS) market, reflecting the automotive industry's shift toward more intelligent and autonomous vehicles.

The demand for lane warning systems was being bolstered by the rising production of passenger vehicles and the integration of advanced safety features as standard offerings by automobile manufacturers. Consumer preferences were increasingly leaning toward vehicles equipped with advanced safety technologies, partly due to a growing awareness of road safety issues and partly due to the higher perceived value of these technologically-equipped vehicles.

Technological advancements played a crucial role in this market. Innovations in camera, sensor, and artificial intelligence technologies were making lane warning systems more accurate and reliable. The integration of these systems with other safety features, like adaptive cruise control and blind spot detection, creates more comprehensive safety solutions, further driving the market growth.

Regionally, markets in Europe and North America were leading in terms of adoption largely due to stringent government regulations requiring the incorporation of advanced safety systems in vehicles. However, Asia-Pacific was emerging as a rapidly growing market, with countries like China and Japan investing heavily in automotive technology and infrastructure development.

The future of the lane warning systems market appeared promising, with potential growth opportunities in the integration of these systems into the expansion of autonomous and semi-autonomous vehicles.

Automotive Lane Warning Systems Market Trends

The Passenger Cars Segment is Driving the Market Growth

The passenger car segment is leading the automotive lane warning system market, with the global rise in passenger car production and sales playing a significant role. With the increasing affordability and availability of passenger cars, particularly in emerging economies, the demand for advanced safety features like lane warning systems has also escalated. These systems, initially seen as luxury or high-end options, were becoming more mainstream, driven both by consumer demand for safer vehicles and by regulatory pressures.

Regulatory influences were indeed significant. Many regions, including Europe and North America, have been implementing stringent safety regulations mandating or strongly encouraging the inclusion of advanced safety systems in new vehicles. This regulatory push effectively broadened the market for lane warning systems in the passenger car segment.

The integration of sophisticated sensors, cameras, and software not only improved the effectiveness of lane warning systems but also made them more cost-effective over time. As technology became more accessible and less expensive to produce, automakers started incorporating these systems across a wider range of models, including mid-range vehicles.

Growing public awareness about road safety issues and the benefits of advanced driver assistance systems (ADAS) is influencing buying decisions. Consumers were increasingly opting for vehicles equipped with safety features like lane departure warnings, which they viewed as essential for driving safety.

Moreover, the rise of connected and autonomous vehicles presented additional growth opportunities for the lane warning system market within the passenger car segment. As automakers invested in developing semi-autonomous and autonomous vehicles, the integration of sophisticated lane warning systems and other ADAS technologies became crucial.

This trend is expected to continue with innovations in ADAS that further enhance the safety and appeal of passenger vehicles.

North America is the Leading Market for Automotive Lane Warning Systems

North America has emerged as a leading market for automotive lane warning systems, a trend driven by a confluence of factors. The region, particularly the United States and Canada, boasts one of the highest rates of vehicle ownership per capita globally, creating a vast market for advanced automotive technologies, including lane warning systems.

Regulatory initiatives in these countries have been pivotal, with proactive measures encouraging or even mandating the adoption of safety technologies in vehicles. This regulatory push is complemented by the region's strong technological innovation, with many leading automotive and technology companies based here continually developing cutting-edge driver assistance systems.

Moreover, there is a significant consumer awareness and prioritization of vehicle safety in North America. This awareness, coupled with the willingness to invest in safety technologies, has further propelled the market for lane warning systems. Additionally, various road safety initiatives by governments and organizations have emphasized the importance of advanced safety features in vehicles.

Economic factors also play a role as the robust economies of North American countries enable both individual consumers and fleet operators to invest in newer, safer vehicles equipped with these advanced technologies. All these aspects synergistically contribute to North America's position as a key market in the realm of automotive lane warning systems.

The Canadian government announced the safe testing of every vehicle and deployment of automated and connected vehicles while spreading awareness regarding driver assistance technologies.

- In May 2022, GM announced its constructive partnership with INRIX Inc. to provide safety solutions data directly to the US Department of Transportation through its analytics-assisted cloud-based application under its Safety View by GM Future Roads & Inrix initiative.

- In May 2022, Toyota Motors announced that it would use computer-based vision technology sourced from Austin, Texas-based start-up company Invisible AI in its North American assembly plants. This technology shall be able to process body motion data to enhance quality, safety, and efficiency.

Due to the factors above, the demand for vehicle safety solutions is likely to increase. This is expected to propel the growth of the studied market between 2024 and 2029.

Automotive Lane Warning Systems Industry Overview

The automotive lane warning system market is dominated by players such as Continental AG, Delphi Technologies, Mobileye, Robert Bosch GmbH, Hitachi Ltd, ZF Friedrichshafen AG, DENSO Corporation, and Magna International Inc.

Companies are engaging in partnerships and acquisitions to develop new products and expand within the market. For instance,

- In November 2023, Honda Motor Co. Ltd unveiled its latest innovation, the Honda SENSING 360, an all-encompassing safety and driver-assistance system. This advanced technology is designed to eliminate blind spots surrounding the vehicle, aiding in preventing collisions and lessening the driver's workload during operation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Safety Awareness is Driving the Market Growth

- 4.2 Market Restraints

- 4.2.1 Cybersecurity Concerns is Anticipated to Restrain the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Function Type

- 5.1.1 Lane Departure Warning System

- 5.1.2 Lane Keeping System

- 5.2 Sensor Type

- 5.2.1 Video Sensors

- 5.2.2 Laser Sensors

- 5.2.3 Infrared Sensors

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies

- 6.2.3 Mobileye

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 The Bendix Corporation

- 6.2.7 Hitachi Ltd

- 6.2.8 Iteris Inc.

- 6.2.9 Nissan Motor Co. Ltd

- 6.2.10 Volkswagen AG

- 6.2.11 ZF TRW