|

市场调查报告书

商品编码

1522857

光电:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Optoelectronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

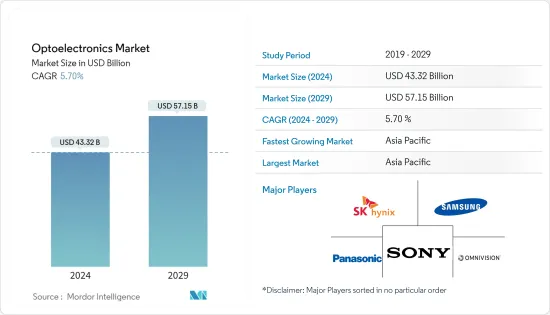

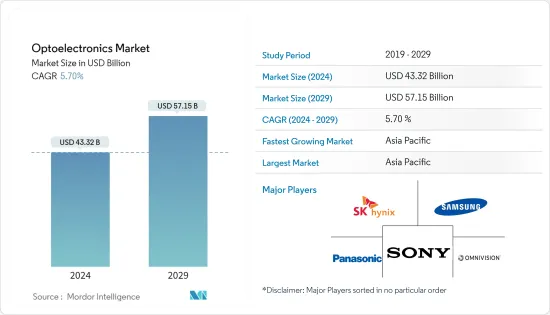

预计2024年光电市场规模为433.2亿美元,预计2029年将达571.5亿美元,在预测期内(2024-2029年)复合年增长率为5.70%。

主要亮点

- 一些市场推动因素正在增加对研究市场的需求。目前光电子学的市场趋势集中在各种装置的小型化、系统的最高整合度,例如发光二极体阵列、雷射阵列以及在同一晶片上与其他电子元件的整合系统。

- 光纤通讯、光储存、光学成像领域的整合也正在推动光电子市场的发展。此外,对智慧消费电子产品和下一代技术不断增长的需求预计将推动光电子产品的采用。

- 由于消费者对更好性能和更高解析度的需求不断增长,对 LED 的高需求使其成为电子设备显示技术的行业标准。 LED 用于手錶、电脑零件、医疗设备、光纤通讯、开关、消费性电子产品和 7 段显示器等领域。

- 此外,光电器件也用于各种消费性电子产品,从音讯技术到生物医学设备。该技术的工业应用的增加和 Li-Fi 市场的扩大也促进了市场的成长。 Li-Fi 是一种利用红外线和可见频谱进行高速资料通讯的无线通讯技术。 Li-Fi技术传输资料的速度非常快,每秒钟可以传输224GB的资料。

光电市场趋势

消费性电子产品大幅成长

- 光电子产品用于消费性电子市场的各种应用。 LED 彻底改变了照明系统,并用于电脑组件、手錶、开关、消费性电子产品等。智慧型手錶使用光电二极体等光电感测器来监测使用者的心率。 CMOS 影像感测器通常用于智慧型手机、平板电脑和数位单眼反光 (DSLR) 相机。 5G 网路的扩展以及具有先进技术和功能的新产品的推出正在推动智慧型手机、平板电脑和数位单眼相机的采用。混合实境耳机市场的扩张也在推动市场研究。

- 随着5G智慧型手机的普及,许多公司都推出了针对5G智慧型手机的影像感测器,这对市场做出了积极的贡献。例如,2022年,Google在印度推出了支援5G网路的Pixel 6a、Pixel 7和Pixel 7 Pro。 GooglePixel 6a支援19个5G频段,而Pixel 7和7 Pro则支援22个5G频段。

- 据GSMA称,拉丁美洲已进入5G时代,预计到2022年将有1500万个连接。到 2025 年,5G 预计将占该地区总连接数的 12%,其中一些国家,特别是巴西,这一比例将达到 20%,高于地区平均水平。

- 此外,根据爱立信的数据,到2028年,西欧的智慧型手机用户数将达到4.59亿。截至 2022 年,西欧智慧型手机用户数约为 4.4 亿。

- 混合实境耳机市场的扩张也在推动市场研究。例如,2023 年 6 月,苹果发布了 Vision Pro,这是一款配备 3D 相机的混合实境耳机,可协助用户拍摄 3D 太空照片和影片。

- 目前,大多数 AR 耳机都依赖一个或多个专用影像感测器,例如将调变红外线光源与电荷耦合元件 (CCD) 影像感测器结合的飞行时间 (ToF) 相机。因此,对这些耳机的需求不断增长正在显着推动研究市场的需求。

亚太地区占主要份额

- 由于其经济成长和在全球电子市场的巨大份额,预计中国将出现强劲的成长率。该国的製造业正在快速成长,各种技术正在被引入製造和通讯领域。

- 日本政府采取了强硬措施来振兴消费性电子和汽车等产业。政府也希望减少生产设施的集中度,以减少因地域限製而对生产的依赖。世界不同地区对半导体和电子供应链的日益关注预计将为所研究市场的成长提供有利的机会。

- 印度的购买力不断增强,社群媒体影响力的不断增强预计将推动电子产品市场的发展。在印度,网路使用者数量近年来大幅增加。网路需求的成长增加了对更快、更有效率的资料传输的需求,从而增加了对光电子产品的需求。

- 韩国汽车工业是世界乘用车销售和生产的主要市场之一。目前,它占韩国製造业总产值的10%以上,并且由于大量投资而不断成长。该产业由现代汽车集团等主要汽车製造商主导,该集团旗下拥有现代、起亚和捷恩斯。因此,韩国在推动汽车产业自动化技术方面具有很大的影响力。

- 据KAMA称,2022年,韩国出口乘用车和商用车约230万辆,比上年的204万辆增加15%。此外,2022年,韩国生产了约376万辆汽车。起亚汽车生产的汽车最多,占韩国汽车销售的39.4%。亚太地区汽车需求和产量的不断增长将提供重大的市场开拓机会。

光电产业概况

光电市场处于半固体状态,预计将继续以创新主导,策略联盟和频繁收购将成为参与者建立自己地位的关键策略。同时,SK 海力士公司、松下公司、三星电子、豪威科技公司和索尼公司专注于进一步付加价值和优化产品组合,以实现利润最大化。

- 2024 年 1 月 - Osram Licht AG 推出 ALIYOS 技术,该技术突破了多段区域照明的界限,并实现了发光模式的个人化。透明度、薄度和高设计自由度等特点使客户的照明解决方案与众不同。基于 ALYYOS 的照明装置由分段式迷你 LED 组成,可显示符号、字母、图像和抽象图案,用于装饰、资讯、警告和其他目的。透明的特殊功能允许将多个 LED 箔片放置在彼此后面。三维排列和每段的完全亮度控制,加上模组的透明度,可实现全新的照明和动画效果。

- 2023 年 12 月 - 三星电子和 SK 海力士同意将影像感测器的「感测器上 AI」技术商业化。两家公司的目标是改进以AI为中心的影像感测器技术,挑战日本市场领导SONY,并征服下一代市场。该公司目前正在进行一项概念验证研究,重点关注使用 CIM(记忆体计算)加速器的脸部辨识和物体辨识功能,这是一种下一代技术,可以执行计算 AI 模型所需的乘法和加法运算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 对智慧消费性电子产品和下一代技术的需求不断增长

- 增加技术的工业应用

- Li-Fi市场的扩大

- 市场限制因素

- 製造加工成本高

- 光电装置中的能量损失和加热挑战

第六章 市场细分

- 依设备类型

- LED

- 雷射二极体

- 影像感测器

- 光耦合器

- 光伏电池

- 其他的

- 按最终用户产业

- 车

- 航太/国防

- 消费性电子产品

- IT

- 卫生保健

- 住宅/商业

- 产业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 北美洲

第七章 竞争格局

- 供应商市场占有率分析

- 公司简介

- SK Hynix Inc.

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc.

- Sony Corporation

- Ams Osram AG

- Signify Holding

- Vishay Intertechnology Inc.

- Texas Instruments Inc.

- LITE-ON Technology Corporation

- Rohm Company Limited

- Mitsubishi Electric Corporation

- Broadcom Inc.

- Sharp Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Optoelectronics Market size is estimated at USD 43.32 billion in 2024, and is expected to reach USD 57.15 billion by 2029, growing at a CAGR of 5.70% during the forecast period (2024-2029).

Key Highlights

- Several market drivers augment the demand for the studied market. The current market trends in optoelectronics are focused on scaling down the sizes of different devices and achieve top levels of integration in systems, such as arrays of light-emitting diodes, laser arrays, and integrated systems with other electronic elements on the same chip.

- The convergence of optical communication, optical storage, and optical imaging sectors is also driving the advancements in the optoelectronics market. Moreover, the growing demand for smart consumer electronics and next-generation technologies is anticipated to boost the adoption of optoelectronics.

- High demands for LEDs have become an industry standard for display technology in electronic devices due to an increase in demand demand for better performance and higher resolution among consumers. LEDs are used in areas like watches, computer components, medical devices, fiber optic communication, switches, household appliances, and 7-segment displays.

- Further, optoelectronic devices are used in various consumer electronic products, ranging from audiovisual technology to biomedical equipment. The increasing industrial applications of the technology and the expansion of the Li-Fi market are also contributing to the market growth. Li-Fi is a wireless communication technology that makes use of infrared and visible light spectrum for high-speed data communication. Li-Fi technology transmits data very quickly and can deliver 224 GB of data per second.

Optoelectronics Market Trends

Consumer Electronics to Witness Significant Growth

- Optoelectronics has various applications in the consumer electronics market. LEDs have revolutionized lighting systems and are used in computer components, watches, switches, household appliances, etc. Smartwatches use optoelectronic sensors, such as photodiodes, to monitor the user's heart rate. CMOS image sensors are often used in smartphones, tablets, and digital single-lens reflex (DSLR) cameras. The growing 5G network and introduction of new products with advanced technologies and features fuels the adoption of smartphones, tablets, and DSLR cameras. Also, the expanding market for mixed reality headsets is aiding the market studied.

- With the rising proliferation of 5G smartphones, many players are introducing image sensors targeted for 5G smartphones, which is contributing positively to the market. For instance, in 2022, Google launched the Pixel 6a, Pixel 7, and Pixel 7 Pro to support the 5G network in India. The Google Pixel 6a supports 19 5G bands, whereas Pixel 7 and 7 Pro support 22 5G bands.

- According to GSMA, Latin America enters the 5G era with 15 million connections expected by 2022. By 2025, 5G is predicted to account for 12% of the region's total connections, with some countries, most notably Brazil, at 20%, exceeding the regional average.

- Furthermore, according to Ericsson, the number of smartphone subscriptions in Western Europe will reach 459 million by 2028. There were approximately 440 million smartphone subscriptions in Western Europe as of 2022.

- Also, the expanding market for mixed reality headsets is aiding the market studied. For instance, in June 2023, Apple introduced Vision Pro, a mixed-reality headset with a 3D camera to help users capture spatial photos and videos in 3D.

- Currently, most AR headsets depend on one or more special imaging sensors, including time of flight (ToF) cameras, which combine a modulated IR light source with a charged coupled device (CCD) image sensor. Thus, the growing demand for these headsets significantly fuels the demand of the studied market.

Asia-Pacific to Hold Major Share

- China is expected to experience a significant growth rate owing to its growing economy and significant share in the global electronics market. The manufacturing industry is rapidly growing in the country and is witnessing the deployment of various technologies in the manufacturing and telecommunications sectors, which is expected to aid the market's growth.

- The Japanese government is taking stringent measures to revive its industries, such as consumer electronics and automotive. Also, the government wishes to reduce the clustering of production facilities in one place to reduce production dependency on geographical constraints. The enhanced focus on the semiconductor and electronics supply chain by various global regions is expected to provide profitable opportunities for the growth of the studied market.

- India has a growing purchasing power, and the growing influence of social media is expected to drive the market for electronic goods. The increase in the number of internet users in India has witnessed a significant increase in recent years. This growth in the internet demand increased demand for faster and more efficient data transmission, driving the need for optoelectronics.

- The South Korean automotive industry is one of the major global markets for vehicle sales and production of passenger cars. It currently contributes more than 10% of all manufacturing output in the country and is experiencing growth owing to significant investments. The industry is dominated by major automakers such as the Hyundai Motor Group, which owns Hyundai, Kia, and Genesis. As a result, South Korea wields significant influence in driving automation technologies in its Automotive industry.

- According to KAMA, in 2022, South Korea exported approximately 2.3 million vehicles, comprising passenger cars and commercial vehicles, representing a 15% increase from the previous year's 2.04 million units. In addition, in 2022, around 3.76 million vehicles were manufactured in South Korea. Kia Motors produced the highest number of vehicles, accounting for 39.4% of automobile sales in South Korea. The increasing automotive demand and production in the Asia Pacific region would offer significant opportunities for developing the market studied.

Optoelectronics Industry Overview

The optoelectronics market is semi-consolidated and is expected to remain innovation-led, with strategic alliances and frequent acquisitions adopted as the key strategies by the players to establish their presence. Meanwhile, companies SK Hynix Inc., Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc., and Sony Corporation are focusing on further developing value-added capabilities and optimizing product mix to maximize margins.

- January 2024 - Osram Licht AG introduced the ALIYOS technology, which pushes the boundaries of multi-segmented area lighting and allows individualization of light emission patterns. Characteristics like transparency, thinness, and a high freedom of design differentiate customer's lighting solutions. An ALIYOS-based lighting unit can configure the segmented mini-LEDs to display symbols, words, images, or abstract patterns for the purposes of decoration, information, or warning. Due to the special feature of transparency, several LED foils can be placed behind each other. A three-dimensional arrangement and the full brightness control of each segment, in combination with the transparency of the modules, enable completely new lighting and animation effects.

- December 2023 - Samsung Electronics and SK Hynix joined to commercialize "On-sensor AI" technology for image sensors. They aim to elevate their image sensor technologies centered around AI and challenge the market leader, Japan's Sony, to dominate the next-generation market. The company is currently conducting proof-of-concept research focused on facial and object recognition features, using a Computing In Memory (CIM) accelerator, a next-generation technology capable of performing multiplication and addition operations required for AI model computations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for Smart Consumer Electronics and Next Generation Technologies

- 5.1.2 Increasing Industrial Applications of the Technology

- 5.1.3 Expansion of the Li-Fi Market

- 5.2 Market Restraints

- 5.2.1 High Manufacturing and Fabricating Costs

- 5.2.2 Challenges With Energy Loss and Heating of Optoelectronic Devices

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 LED

- 6.1.2 Laser Diode

- 6.1.3 Image Sensors

- 6.1.4 Optocouplers

- 6.1.5 Photovoltaic cells

- 6.1.6 Others

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Consumer Electronics

- 6.2.4 Information Technology

- 6.2.5 Healthcare

- 6.2.6 Residential and Commercial

- 6.2.7 Industrial

- 6.2.8 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.2.4 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis

- 7.2 Company Profiles*

- 7.2.1 SK Hynix Inc.

- 7.2.2 Panasonic Corporation

- 7.2.3 Samsung Electronics

- 7.2.4 Omnivision Technologies Inc.

- 7.2.5 Sony Corporation

- 7.2.6 Ams Osram AG

- 7.2.7 Signify Holding

- 7.2.8 Vishay Intertechnology Inc.

- 7.2.9 Texas Instruments Inc.

- 7.2.10 LITE-ON Technology Corporation

- 7.2.11 Rohm Company Limited

- 7.2.12 Mitsubishi Electric Corporation

- 7.2.13 Broadcom Inc.

- 7.2.14 Sharp Corporation