|

市场调查报告书

商品编码

1690767

资料收益:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Data Monetization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

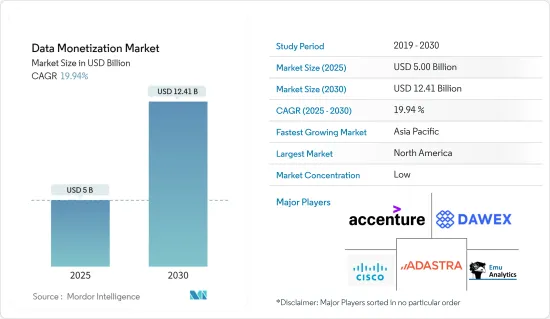

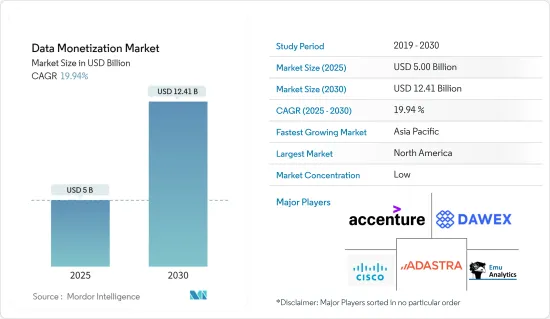

资料收益市场规模预估预估2025年为50亿美元,预估至2030年将达124.1亿美元,预测期间(2025-2030年)复合年增长率为19.94%。

B2B环境中资料在商业决策和策略发展中的重要性日益增加,正在推动市场需求。这也是由商业环境中数位设备和系统的整合而产生的资料、互联网使用量增长而导致的消费者资料量的增加以及市场中资料分析工具的出现所推动的,为市场增长和全球生成的资料的收益创造了机会。

主要亮点

- 资料商业化战略依赖更传统的分析技术,并且难以有效地处理非结构化资料。然而,透过云端平台更容易存取大规模运算资源,以及一些由人工智慧/机器学习驱动的分析引擎的商品化,正在创造以更实惠的价格获得价值和投资收益的机会,这将推动未来市场的成长。随着技术的进步,独立软体供应商正在转向自助式商业智慧,以增加应用程式收益并使其产品与众不同。

- 同样,对于开发应用程式的公司来说,自助式 BI 可以透过提高采用率和改善业务效率来提高这些应用程式的投资报酬率。这表明资料收益解决方案市场具有成长潜力。

- 资料商业化战略的广泛而新颖的应用可以使企业创造新的收益来源。这可以透过将资料直接出售给第三方、开发资料主导的产品和服务或使用资料增强现有服务来实现。预计这将加速未来几年所有终端用户群体采用资料收益解决方案。

- 随着越来越多的线上业务(例如网路银行和电子商务公司)的扩张,他们可能会采用资料收益解决方案来分析客户的购买模式和偏好并个人化产品推荐。预计这将提高销售额和客户满意度,从而推动预测期内的市场成长。

- 全球网路用户数量的不断增加以及企业中连网型设备和基于软体的解决方案的增长有助于跨各个终端用户群体生成客户资料,为市场增长创造机会。例如,2023年11月,通讯报告称,全球网路用户数已达54亿。这种增长可能会支持线上资料生成并在预测期内推动市场成长。

- 资料收益计划的担忧包括向外部方洩露资料的隐私和法律影响。因此,使用者应该仔细考虑从客户处获得的资料的权利和所有权。根据您所在的地区、行业以及在获取资料时签署的具体客户协议,这些监管政策可能需要大量资源和专业知识。这对寻求将资料收益的组织来说是一个挑战。

资料收益市场的趋势

大公司占大部分市场占有率

- 数位转型趋势正在塑造商业格局。大型企业正在加紧推进其云端迁移计划,并面临新的挑战,包括客户期望的提高、业务量的增加以及服务交付模式的改变。

- 这就是为什么许多大型企业都向高速云端服务供应商寻求资料即服务 (DaaS) 解决方案的原因。大多数都在致力于透过 DaaS产生收入。资料驱动的收益业务将实现自动化,从而提高生产力。

- 在美国,亚马逊、Facebook 和Google等公司正在利用资料收益来帮助其业务成长。因此,各行各业的组织都在利用资料寻找为业务成长创造价值的机会。

- 根据美国银行公司预测,到2024年,数位广告在美国广告支出中的占比预计将达到74%,高于2023年的69%。谷歌、Meta和亚马逊等科技巨头可能会继续主导美国线上广告产业。近年来,Expedia、Booking、eBay、Airbnb等美国公司一直投入巨额收益用于销售和行销。预计这一趋势将在预测期内持续下去。

- 大型企业可望设计可重构架构,广泛支援资料重用,以增加其资料收益解决方案的嵌入价值。这使我们能够满足严格的技术需求,例如高效能处理、进阶资料整合和可扩展性。

北美占据主要市场占有率

- 随着企业和消费者产生的资料量不断增加,北美资料收益市场正经历强劲成长。公司正在寻找新方法从这些资料中提取价值,从而推动创新资料商业化战略和技术的发展。采用先进的分析和人工智慧使企业能够从资料中获得可操作的见解,从而进一步推动市场成长。

- 此外,该地区率先采用和实施了高级分析解决方案和实践的创新方法,包括巨量资料、机器学习、资讯科学和高效能运算。该地区有实力雄厚的供应商,为市场的成长做出了贡献。其中包括 Google Inc.、思科系统公司、Adastra Corporation(加拿大)、Domo 和 Sisense Inc.

- 2023 年 6 月,思科宣布推出思科可观察性平台。它是一个开放、可扩展、API 驱动的全端可观察性 (FSO) 平台,建立在 OpenTelemetry 之上,并基于指标、事件、日誌和追踪 (MELT)。他将推动思科的全端可观察性策略,提供 AI/ML主导的分析和新的可观察性生态系统,以提供相关且有影响力的业务洞察。透过集中资料、分析、操作和实践,可观察性可以成为减少团队摩擦的关键方法。

- 数位设备和技术的普及极大地增加了企业和消费者产生的资料量,创造了更多的收益机会。根据Cisco预测,到 2023 年,北美地区人均设备和连线数量将达到 13.4 个,明显高于其他任何地区。

- 此外,企业越来越认识到资料作为策略资产的价值。我们正在探索透过各种方式将资料收益,包括出售资料、提供资料主导的服务以及将其用于定向广告。此外,随着企业寻求合规的方式将其资料资产收益,欧洲的 GDPR 和加州的 CCPA 等法律规范正在提高人们对资料隐私和安全的认识。

资料收益行业概览

由于中小企业和全球性公司的存在,资料收益市场竞争激烈。各个行业都在应用资料收益来为供应商提供成长机会、吸引新参与者进入市场并增强供应商之间的竞争。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。主要市场参与者包括埃森哲公司 (Accenture PLC)、Adastra 公司、思科系统公司 (Cisco Inc.)、Dawex Systems SAS 和 Emu Analytics 公司。

- 2024年5月,Accenture与Oracle将合作投资尖端生成式人工智慧解决方案、工具和培训资源。这些策略投资旨在使组织能够充分发挥资料的潜力,推动前所未有的成长,并培养持续创新的文化。Accenture和Oracle将结合各自的专业知识,帮助各行各业的客户透过大规模采用生成式人工智慧重塑业务。

- 2024 年 2 月,Dawex、施耐德电机、法雷奥、CEA 和 Prosyst 共同创立了 Data4Industry-X,这是一种面向工业领域的可靠资料交换解决方案。 Data4Industry-X主要关注汽车和发电行业,致力于提高在不同国家运营的知名跨国工业公司的竞争力并最大限度地减少对环境的影响。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对资料收益市场的影响评估

第五章 市场动态

- 市场驱动因素

- 高级分析和可视化的快速采用

- 业务资料的数量和种类不断增加

- 市场限制

- 与现有系统的互通性

- 监管政策结构多样

- 市场挑战

- 资料结构的复杂性和一致性资料的可用性不断增加

第六章 市场细分

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户产业

- BFSI

- 通讯和 IT

- 製造业

- 卫生保健

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Accenture PLC

- Adastra Corporation

- Cisco Systems Inc.

- Dawex Systems SAS

- Emu Analytics Ltd

- Thales Group

- Google LLC(Alphabet Inc.)

- IBM Corporation

- Infosys Limited

- Ness Technologies Inc.

- NetScout Systems Inc.

- Openwave Mobility Inc.(ENEA)

- SAP SE

- SAS Institute Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Data Monetization Market size is estimated at USD 5.00 billion in 2025, and is expected to reach USD 12.41 billion by 2030, at a CAGR of 19.94% during the forecast period (2025-2030).

The increasing importance of data in business decisions and strategy development in the B2B environment is driving the demand for the market. This is also supported by the integration of digital devices and systems in the business environment to generate data, the growth of internet usage to increase consumer data volume, and the emergence of data analytics tools in the market, creating an opportunity for the market's growth and to monetize the generated data worldwide.

Key Highlights

- Data monetization strategies relied on more traditional analytical techniques and struggled to deal effectively with unstructured data. However, easier access to significant computing resources via cloud platforms and the commoditization of some AI/machine learning-powered analysis engines are creating more affordable opportunities to extract both values and return on investment, which would drive the market's future growth. Independent software vendors have turned to self-service business intelligence to increase application revenue and differentiate their offerings in line with technological advancement.

- Similarly, self-service BI can contribute to application ROI for enterprises developing applications by increasing adoption and improving operational efficiencies. This shows the potential of the market's growth in data monetization solutions.

- The broad and emerging applications of data monetization strategies enable businesses to generate new revenue streams. This can be achieved through selling data directly to third parties, creating data-driven products or services, or using data to enhance existing offerings. This is expected to fuel the adoption of data monetization solutions across all end-user segments in the future.

- As online businesses expand, including expanding online banking and e-commerce companies, they may implement data monetization solutions to analyze customer purchasing patterns and preferences and personalize product recommendations. This is expected to increase sales and customer satisfaction, driving the market's growth during the forecast period.

- The increasing number of internet users worldwide, in line with the growth of connected devices and software-based solutions in businesses, is supporting the generation of customer data in various end-user segments, creating an opportunity for the market's growth. For instance, in November 2023, the International Telecommunication Union reported that internet users reached 5,400 million worldwide. This growth may support online data generation and fuel the market's growth during the forecast period.

- The privacy and legal implications of releasing data to outside entities are the primary concerns with data monetization projects. Therefore, users must carefully review their rights and ownership of the data they may have acquired from their customers. Depending on the geography, the industry, and the specific customer contracts signed at the moment of data acquisition, these regulatory policies may require considerable resources and expertise. This presents challenges for organizations seeking to monetize their datasets.

Data Monetization Market Trends

Large Enterprises to Hold Major Market Share

- The growing trends of digital transformation are shaping the business landscape. Large enterprises are ramping up their plans for cloud migration and confronting new challenges, including higher customer expectations, business volume growth, and service delivery model changes.

- Thus, many large enterprises are adopting Data as a Service (DaaS) solutions from high-speed cloud service providers. Most are engaged in revenue generation from DaaS. Data-based monetization tasks are set to become automated and offer higher productivity.

- In the United States, companies like Amazon, Facebook, and Google have monetized and used their data to fuel the growth of their business. As a result, organizations across all industries increasingly look at their data to uncover opportunities to create value for their business growth.

- According to the Bank of America Corporation, digital advertising is expected to reach 74% of US ad spending in 2024, up from 69% in 2023. Tech giants like Google, Meta, and Amazon will continue to have a significant share of the US online advertising industry. In recent years, companies in the United States, such as Expedia, Booking, eBay, and Airbnb, have allocated significant revenues to their sales and marketing. They are anticipated to continue doing so during the forecast period.

- Large enterprises are expected to design reconfigurable architectures that support extensive data reuse to enhance the embedded value of data monetization solutions. This helps them meet aggressive technical demands such as high-performance processing, advanced data integration, and scalability.

North America Holds Significant Market Share

- The North American data monetization market has been experiencing significant growth, driven by increasing volumes of data generated by businesses and consumers. Companies are finding new ways to extract value from this data, leading to the development of innovative data monetization strategies and technologies. Adopting advanced analytics and artificial intelligence has enabled organizations to derive actionable insights from their data, further fueling the market's growth.

- Furthermore, the region is an early adopter and host to innovative initiatives for advanced analytics solutions and practices, such as big data, machine learning, information science, and high-performance computing. It has a strong foothold of vendors, contributing to the market's growth. Some include Google Inc., Cisco Systems Inc., Adastra Corporation (Canada), Domo, and Sisense Inc.

- In June 2023, Cisco announced the Cisco Observability Platform, an open and extensible, API-driven Full-Stack Observability (FSO) platform built on OpenTelemetry and anchored on metrics, events, logs, and traces (MELT). Advancing Cisco's Full-Stack Observability strategy, it provides AI/ML-driven analytics and a new observability ecosystem, delivering relevant and impactful business insights. Observability can become the primary way to reduce team friction by unifying data, analysis, actions, and practices.

- The proliferation of digital devices and technologies has led to a massive increase in the volume of data generated by businesses and consumers, creating more monetization opportunities. According to Cisco Systems, the average number of devices and connections per person in North America was 13.4 in FY 2023, significantly higher than in other regions.

- Furthermore, businesses increasingly recognize the value of their data as a strategic asset. They are exploring ways to monetize it through various means, such as selling data, offering data-driven services, or leveraging it for targeted advertising. Regulatory frameworks such as the GDPR in Europe and the CCPA in California also have heightened awareness around data privacy and security, prompting companies to find compliant ways to monetize their data assets.

Data Monetization Industry Overview

The data monetization market is competitive due to the presence of small and medium-sized enterprises and global players. Data monetization is used in various industries to provide vendors with growth opportunities, attracting new players into the market and driving competition among vendors. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage. Some key market players include Accenture PLC, Adastra Corporation, Cisco Systems Inc., Dawex Systems SAS, and Emu Analytics Ltd., among others.

- In May 2024, Accenture and Oracle joined forces to invest in state-of-the-art generative AI solutions, tools, and training resources. These strategic investments aim to enable organizations to unlock the full potential of their data, propelling them toward unprecedented growth and fostering a culture of continuous innovation. By combining their expertise, Accenture and Oracle are dedicated to helping clients across diverse industries reinvent their businesses through the adoption of generative AI at scale.

- In February 2024, Dawex, Schneider Electric, Valeo, CEA, and Prosyst collaborated to establish Data4Industry-X, the Reliable Data Exchange Solution for the Industrial Sector. Primarily focusing on the automotive and power generation industries, Data4Industry-X strives to enhance competitiveness and minimize the environmental impact of prominent multinational industrial corporations operating in various countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Data Monetization Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Advanced Analytics and Visualization

- 5.1.2 Increasing Volume and Variety of Business Data

- 5.2 Market Restraints

- 5.2.1 Interoperability With Existing Systems

- 5.2.2 Varying Structure of Regulatory Policies

- 5.3 Market Challenge

- 5.3.1 Increasing Complexities in Data Structures and Availability of Consistent Data

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium-sized Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 Telecom and IT

- 6.2.3 Manufacturing

- 6.2.4 Healthcare

- 6.2.5 Retail

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Adastra Corporation

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Dawex Systems SAS

- 7.1.5 Emu Analytics Ltd

- 7.1.6 Thales Group

- 7.1.7 Google LLC (Alphabet Inc.)

- 7.1.8 IBM Corporation

- 7.1.9 Infosys Limited

- 7.1.10 Ness Technologies Inc.

- 7.1.11 NetScout Systems Inc.

- 7.1.12 Openwave Mobility Inc. (ENEA)

- 7.1.13 SAP SE

- 7.1.14 SAS Institute Inc.