|

市场调查报告书

商品编码

1536787

汽车致动器:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

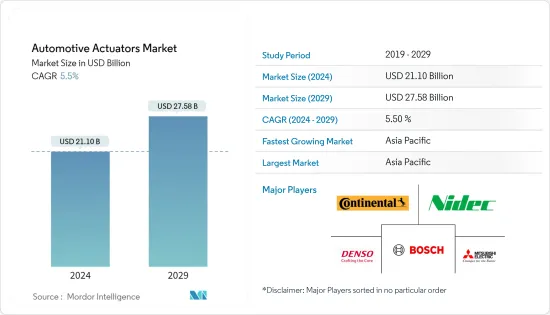

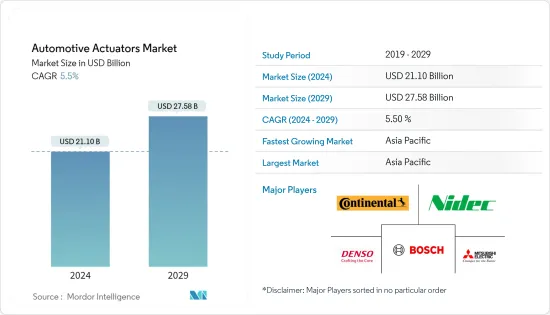

预计2024年汽车致动器市场规模为211亿美元,2029年将达275.8亿美元,在预测期间(2024-2029年)复合年增长率为5.5%。

从中期来看,电动车在该地区的广泛采用预计将推动汽车致动器的需求。这种增长是由对燃油效率和舒适性日益增长的需求推动的,尤其是乘用车。因此,汽车致动器市场预计在预测期内将出现显着成长。

自动驾驶汽车和 ADAS(高级驾驶辅助系统)等汽车行业的技术进步正在迅速增加致动器的使用。在各种 ADAS 功能中,主动式车距维持定速系统(ACC) 和自我调整头灯系统 (AFS) 在现代汽车中越来越受欢迎。这些系统包括自动煞车辅助、车道维持系统等,显着提高了驾驶安全性。

对节油车辆的需求不断增长以及对先进致动器产品的需求不断增长,正促使主要製造商投资于研发活动,这可能会导致未来几年市场的显着成长。

汽车致动器市场趋势

油门致动器和煞车致动器显着成长

随着减少车辆排放气体的需求不断增加,在预测期内,内燃机汽车和混合电动车对紧凑型、轻型 EGR致动器和节气门致动器的需求将会增加。

节气门致动器主要根据油门输入来调节进入引擎燃烧的空气量。随着汽车引擎管理系统需求的增加,预计未来几年对气动致动器的需求将会增加。

混合电动车因其比传统内燃机汽车更好的燃油效率而受到消费者的欢迎。由于监管机构要求减少排放气体的压力越来越大,汽车产业正在增加混合动力汽车的产量,预计在预测期内,混合动力汽车的市场将显着成长。

传统柴油引擎采用复杂的燃油管理系统,其中包括整合式节气门控制单元。这些引擎因其效率提高、功能增强、驾驶安全性提高以及碳排放减少而广受欢迎。先进的油门致动器可以与其他车辆功能集成,并监控引擎转速,以便在各种地形上平稳驾驶。

由于全国对电动车的需求不断增长,预计未来几年对电动致动器的需求将会增加。领先的汽车製造商正在该国推出新的电动车车型,预计将促进市场成长。

- 2023年2月,吉利汽车推出了L7,这是其全新Galaxy电动车系列中的首款车型。 L7 具有先进的安全性和舒适性。

对提供更好乘客舒适度的功能的需求不断增加,这是不断发展的致动器行业中领先製造商的关键差异化因素。

因此,OEM正在大力投资,透过向客户提供最好的致动器来改善驾驶和乘客体验,预计这将推动未来几年的市场成长。

亚太地区占主要市场占有率

预计亚太地区的汽车零件製造业将经历更快的成长。印度、日本和中国正成为美国和德国等国家的主要供应商。这一增长是由乘用车和商用车销量增加所推动的。

中国是亚太汽车製造市场的主要企业,顶级汽车製造商占有重要地位。预计这将在整个预测期内为市场创造有利的机会。

为了鼓励汽车产业的发展,中国政府实施了多项奖励计划来促进汽车销售并补贴电动车的购买。

根据中国工业协会(CAAM)的数据,2023年1月至5月,中国乘用车销量成长11.1%。在此期间,与去年同期相比,销量为1,061万台。纯电动车、插电式混合动力汽车、氢燃料电池车等新能源车销量也成长46.8%。

印度政府实施了严格的法规,以应对日益增加的车辆排放气体和对环保车辆日益增长的需求。预计这项倡议将在预测期内推动市场扩张。因此,许多汽车製造商正在根据各种计划在印度进行投资。

汽车电气化的不断成长趋势是推动汽车致动器市场的关键因素。主要汽车製造商和汽车零件製造商正在联合开发智慧驾驶系统,如智慧驾驶座、电子燃油喷射系统等,预计在预测期内市场将显着成长。

- 2023年2月,北汽集团与博世中国签署战略合作协议,在智慧驾驶座、智慧驾驶、智慧网联领域进行全面深入的策略合作,拓展所签署汽车的使用情境。

随着全部区域,预计未来几年对致动器的需求将会增加。

汽车致动器产业概况

汽车致动器市场由几家主要製造商主导,包括罗伯特博世有限公司、日本电产公司、电装公司、德昌电机和安波福PLC。几家主要製造商正在全部区域扩大其製造设施,以加强产品系列,这可能会推动预测期内的市场成长。例如

- 2023 年 9 月,马瑞利推出了一系列用于电动车的全新多功能智慧致动器,旨在简化复杂车辆功能的驱动。

- 2023年6月,科世达集团投资5,386万美元,为大众集团生产最新的SAC(智慧型致动器充电)技术和充电系统。

- 2022 年 9 月,克诺尔股份公司在 IAA 交通运输展览会上展示产品系列。克诺尔集团成立了一个名为 eCUBATOR 的电动车创新部门。关键技术包括能源管理系统、电子机械致动器、附加驱动和动力传动系统整合功能以及电子煞车系统。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 车辆安全功能的需求不断增长

- 市场限制因素

- 与致动器相关的高成本

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按应用程式类型

- 节气门致动器

- 座椅调整致动器

- 煞车致动器

- 关闭致动器

- 其他的

- 按车型

- 客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Continental AG

- BorgWarner Inc.

- Aptiv PLC

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Nidec Corporation

- Johnson Electric Holdings Limited

- Hitachi Ltd

- CTS Corporation

- Denso Corp.

- Hella KGaA Hueck & Co.

第七章 市场机会及未来趋势

第八章 主要供应商讯息

The Automotive Actuators Market size is estimated at USD 21.10 billion in 2024, and is expected to reach USD 27.58 billion by 2029, growing at a CAGR of 5.5% during the forecast period (2024-2029).

Over the medium term, the adoption of electric vehicles in the region is expected to drive up the demand for automotive actuators. This growth is attributed to the increasing need for fuel efficiency and comfort, particularly in passenger vehicles. Therefore, the automotive actuators market is anticipated to experience significant growth during the forecast period.

Due to technological advancements in the automotive industry, such as autonomous vehicles and advanced driver assistance systems (ADAS), the usage of actuators has increased rapidly. Among the various ADAS, the adaptive cruise control (ACC) and adaptive front-lighting system (AFS) features have become increasingly popular in modern vehicles. These systems include automated brake assist, lane keep assist, and others, which have greatly improved driving safety.

The growing demand for cars that save fuel and the increasing demand for advanced actuator products are pushing major manufacturers to invest in R&D activities, which is likely to witness major growth for the market in the coming years.

Automotive Actuators Market Trends

Throttle Actuator and Brake Actuator Witnessing Major Growth

With the increasing demand for reduced vehicle emissions, there is likely to be a higher need for compact and lightweight EGR actuators and throttle actuators from both ICE and hybrid electric vehicles during the forecast period.

The throttle valve actuator regulates the amount of air that enters the engine for combustion, primarily based on the accelerator's input. With the growing need for engine management systems in vehicles, the demand for pneumatic actuators is expected to increase in the coming years.

Hybrid electric vehicles have been well-received by consumers due to their ability to provide better fuel economy in comparison to conventional IC engine vehicles. As a result of mounting pressure from regulatory authorities to reduce emissions, the automotive industry has increased the production of hybrid vehicles, which is expected to lead to significant growth for the market during the forecast period.

Conventional diesel engines utilize advanced fuel management systems, including integrated throttle control units. These engines are popular due to their increased efficiency, enhanced functionality, improved operational safety, and reduced carbon emissions. Advanced throttle actuators allow for integration with other vehicle functions, enabling smooth driving over various terrains by monitoring engine speed.

The demand for electric actuators is expected to increase in the coming years due to the rising demand for electric vehicles nationwide. Major vehicle manufacturers are launching new EV models in the country, which is expected to enhance the market's growth. For example,

- In February 2023, Geely launched the L7, the first model in the new Galaxy electric vehicle lineup. The L7 is equipped with advanced safety and comfort features.

There is an increasing demand for features that provide better comfort to passengers, which has become a crucial factor for top manufacturers to distinguish themselves in the growing actuators industry.

Consequently, OEMs invest heavily to improve the driving and passenger experience by providing the best actuators to their customers, which is anticipated to boost the market's growth in the coming years.

Asia-Pacific Holds the Major Market Share

The automotive component manufacturing industry in Asia-Pacific is projected to experience faster growth. India, Japan, and China are emerging as major suppliers to countries like the United States and Germany. This growth is driven by increasing sales of passenger cars and commercial vehicles.

China is a major player in the Asia-Pacific vehicle manufacturing market, with a significant presence of top automotive manufacturers. This is expected to create lucrative opportunities in the market throughout the forecast period.

The Chinese government has implemented multiple incentive plans to boost automobile sales and provide subsidies for purchasing electric vehicles to encourage growth in the automotive industry.

China's passenger car sales increased by 11.1% from January to May 2023, according to the China Association of Automobile Manufacturers (CAAM). During this period, 10.61 million units were sold compared to the same period of the previous year. The sales of new energy vehicles, which include pure electric vehicles, plug-in hybrids, and hydrogen fuel-cell vehicles, also increased by 46.8%.

The Indian government has implemented strict regulations in response to rising vehicular emissions and increased demand for eco-friendly automobiles. This initiative is expected to drive market expansion over the forecast period. As a result, many car manufacturers are investing in India under various schemes.

The growing trend of vehicle electrification is a significant factor driving the automotive actuators market. Major vehicle and automotive component manufacturers are collaborating to develop intelligent driving systems, including intelligent cockpits, electronic fuel injection systems, and others, which are likely to witness major growth in the market during the forecast period. For instance,

- In February 2023, the BAIC Group and Bosch China signed a strategic cooperation agreement to conduct comprehensive and in-depth strategic cooperation in the fields of intelligent cockpits, intelligent driving, and intelligent connectivity to expand vehicle usage scenarios.

With such development across the region, the demand for actuators is likely to increase in the coming years.

Automotive Actuators Industry Overview

The automotive actuators market is dominated by several key players, such as Robert Bosch GmbH, Nidec Corporation, Denso Corporation, Johnson Electric, and Aptiv PLC, which have captured significant shares in the market. Several key manufacturers are expanding their manufacturing facilities across the region to enhance their product portfolio, which is likely to boost the market's growth during the forecast period. For instance,

- In September 2023, Marelli introduced a new range of multipurpose smart actuators for electric cars designed to simplify complex vehicle functions' actuation.

- In June 2023, KOSTAL Group invested USD 53.86 million to produce the latest SAC (Smart Actuator Charging) technologies and charging systems for the Volkswagen Group.

- In September 2022, Knorr-Bremse AG introduced a product portfolio for the e-mobility transformation at IAA Transportation. Knorr-Bremse set up an e-mobility innovation unit called eCUBATOR. Key technologies include energy management systems, electromechanical actuators, additional drive and powertrain integration functions, and electronic braking systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in demand for Safety Features in Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost Associated with Actuators

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Application Type

- 5.1.1 Throttle Actuator

- 5.1.2 Seat Adjustment Actuator

- 5.1.3 Brake Actuator

- 5.1.4 Closure Actuator

- 5.1.5 Other Application Types

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 BorgWarner Inc.

- 6.2.3 Aptiv PLC

- 6.2.4 Robert Bosch GmbH

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.6 Nidec Corporation

- 6.2.7 Johnson Electric Holdings Limited

- 6.2.8 Hitachi Ltd

- 6.2.9 CTS Corporation

- 6.2.10 Denso Corp.

- 6.2.11 Hella KGaA Hueck & Co.