|

市场调查报告书

商品编码

1536796

汽车导航系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

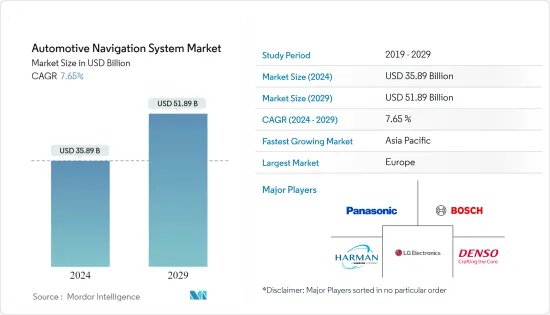

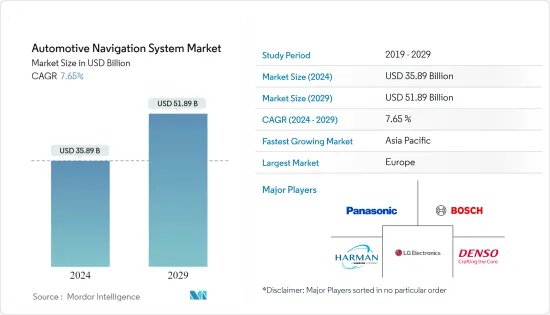

预计2024年全球汽车导航系统市场规模将达358.9亿美元,2024-2029年预测期间复合年增长率为7.65%,预计2029年将达到518.9亿美元。

未来几年,汽车导航系统中即时交通资料、地图更新和智慧型手机使用的整合将成为吸引大量客户需求的关键因素。此外,自动驾驶汽车和连网汽车技术的快速增强预计将推动对先进汽车导航系统的需求,因为它们严重依赖道路上其他车辆的即时资讯。然而,日益严重的网路安全问题和导航系统的高成本是预测期内阻碍市场成长的因素。

此外,消费者对使用私人交通途径的偏好的变化以及全球物流业的扩张促进了乘用车和商用车领域的成长,这反过来又推动了汽车导航系统的采用,产生了积极的影响。商用车辆必须长途运输货物和乘客,因此这些车辆的驾驶人需要快速了解高速路线,以减少行驶停机时间。这些因素预计将影响汽车导航系统市场的成长。

*根据国际汽车工业协会(OICA)的数据,全球新乘用车销量从2021年的5640万辆增至2022年的5740万辆,与前一年同期比较增长1.9%。

*同样,轻型商用车新车销量从2021年的1,860万辆增至2022年的1,980万辆,与前一年同期比较成长7%。

预计亚太地区将成为汽车导航系统的主要区域市场,日本、印度和中国在预测期内将发展成为汽车製造的主要中心。由于汽车电子机械系统(MEMS)感测器的普及,预计北美和欧洲国家的需求将会增加。这些感测器是最突出的新兴应用之一,越来越多地用于汽车导航系统市场的电控系统和轮胎压力监测系统。

汽车导航系统市场趋势

售后市场领域将成为预测期内的驱动力

除了原始製造商在工厂安装导航系统外,售后频道的安装率在预测期内也可能显着成长。

全球电子商务产业的成长增加了电子商务公司按时向客户交货产品的压力。由于这项要求,许多电子商务公司与现有物流提供者合作进行企业对客户 (B2C) 运输。为了满足这项需求,物流公司正在部署更多车辆并扩大服务范围。这些车辆大多配备卫星导航系统,以确保按时到达客户手中。此外,电子商务公司还推出「随地送达」、「当日送达」甚至「当日送达」等优惠来吸引更多消费者。

*2022年美国电商用户数达2.4072亿,而2021年为2.2376亿,年与前一年同期比较7.5%。

*根据印度品牌资产基金会 (IBEF) 的数据,印度预计在 2019 年至 2022 年间将吸引 1.25 亿消费者,到年终预计将增加 8,000 万名购物者。

近年来发布的大多数汽车都配备了导航系统,可以帮助乘客到达目的地,同时让他们保持娱乐。出厂时未配备导航系统的旧车仍可在仪表板中安装售后导航系统,或者服务人员也可以使用可携式导航系统。此外,希望采用OEM提供的车型中不具备的先进导航系统的客户越来越倾向于透过售后市场销售管道购买这些产品。因此,在政府大力推动减少碳排放的推动下,消费者对电动车的偏好正在导致售后市场销售管道的扩张。

*根据国际能源总署(IEA)的数据,2022年全球电池式电动车销量将达到730万辆,而2021年为460万辆,与前一年同期比较同期成长58.6%。

随着各种导航系统供应商在电子商务平台上列出其产品,预计该市场的售后市场将在预测期内快速成长。

欧洲引领汽车导航系统市场

近年来,欧洲汽车工业已成为全球主要的汽车出口国,欧洲车主也将导航视为汽车的重要安全措施。各个地区的政府当局都要求在未来几年内所有汽车都必须连接到 GPS 系统。欧洲标准化委员会 (CEN) 和欧洲通讯标准协会 (ETSI) 最近发布了一套协作智慧交通系统的初步标准。

该地区的销售额正在迅速成长。雷诺、三菱电机、电装、博世、日产、Garmin、现代和丰田等汽车OEM的存在也引人注目。安全和保全服务对整个欧洲市场的汽车产业贡献最大,而导航被认为是汽车的重要安全措施。

*根据德国联邦汽车管理局(KBA)数据,2023年10月德国新乘用车註册量为218,959辆,较去年同月增长4.9%。 2023年1月至10月新车註册量为2,257,025辆(较去年同期成长13.5%)。

*根据英国汽车工业协会(SMMT)的数据,2023年11月英国乘用车销量为156,525辆,较10月增长9.5%。此外,2023年1月至11月,全国乘用车销量达170万辆,较去年同期成长18.6%。

欧洲各地的汽车製造商和层级供应商一直在透过资料驱动的解决方案测试导航平台提供者的实力,以开发行动管理和导航技术等领域的数位服务。各欧洲汽车製造商正积极致力于提供先进的导航解决方案,以改善客户的驾驶体验并在生态系统中获得竞争优势。

*2023 年 5 月,中国汽车製造商领克宣布其创新的三词地址导航系统将应用于欧洲车辆。三字地址的新颖系统将世界划分为 57 兆个 300 万个正方形,为每个正方形提供三个单字的独特组合,以形成三字地址地址。

对电动车的需求不断增长、无线通讯技术的高普及率以及先进通讯基础设施的可用性不断提高是推动欧洲国家自动驾驶汽车和独立导航系统市场的关键因素。

汽车导航系统产业概况

汽车导航系统市场高度分散,并且与在生态系统中运作的各种国际和地区参与者竞争激烈。主要参与者包括松下控股公司、罗伯特博世有限公司、哈曼国际工业公司、LG电子公司、电装公司、爱信公司、三菱电机公司、Garmin有限公司。透过整合AI(人工智慧)和AR(扩增实境)等新技术,这些公司将改善导航系统的功能,并满足全球对先进汽车导航系统不断增长的需求。

*2023年12月,Genesys International在ADAS Show 2023上公布了ADAS地图的最新进展。 Genesys 展示的一大亮点是印度高保真 2D 标准清晰度 (SD) 地图,覆盖 830 万公里的道路,并包含超过 4000 万个兴趣点 (POI)。

*2022年4月,Mapbox宣布将推出由北美丰田汽车公司为部分丰田和Lexus车辆开发的下一代多媒体系统,提供超越顾客期望的驾驶体验。 Mapbox 地图软体开发套件采用的地图设计补充了丰田的下一代多媒体系统,为驾驶员提供直觉的逐嚮导航。

由于自动驾驶汽车融入生态系统,市场预计汽车导航系统技术将迅速增强。预计主要企业将积极制定策略,与汽车製造商建立长期合作伙伴关係,以获得产业竞争优势。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 改变消费者对私人交通途径的偏好

- 市场限制因素

- 购买和安装成本高

- 工业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模:以金额为准- 美元)

- 按车型

- 客车

- 商用车

- 按销售管道

- 目标商标产品(OEM)

- 售后市场

- 按萤幕大小

- 小于 6 英寸

- 6-10英寸

- 10吋或以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他领域

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Harman International Industries

- LG Electronics Inc.

- Denso Corporation

- Aisin Corporation

- Mitsubishi Electric Corporation

- Garmin Ltd

- Visteon Corporation

- TomTom International BV

- Faurecia Clarion Electronics Co. Ltd

- JVC Kenwood Corporation

第七章 市场机会及未来趋势

- 将人工智慧(AI)和物联网(IoT)等先进技术融入导航系统将推动市场需求

第八章 供应商资讯

The Automotive Navigation System Market size is estimated at USD 35.89 billion in 2024, and is expected to reach USD 51.89 billion by 2029, growing at a CAGR of 7.65% during the forecast period (2024-2029).

Over the coming years, the integration of real-time traffic data, map updates, and smartphone usage in automotive navigation systems will serve as major factors for attracting significant customer demand. Further, rapid enhancement in autonomous vehicles and connected vehicle technology is expected to fuel the demand for advanced automotive navigation systems as they heavily rely on real-time information concerning other vehicles on the road. However, increasing cybersecurity issues and the high cost of navigation systems are a few factors that are likely to hinder the market's growth during the forecast period.

Moreover, consumers' shifting preference toward availing private transportation mediums and the expanding logistics industry worldwide are contributing to the growth of the passenger and commercial vehicle segments, which, in turn, positively impacts the penetration of automotive navigation systems. Commercial vehicles are required to travel for a longer duration for cargo and passenger transportation purposes, and therefore, the drivers of these vehicles require swift knowledge of the faster routes to reduce travel downtime. Such factors are expected to impact the growth of the automotive navigation system market.

* According to the International Organization of Motor Vehicle Manufacturers (OICA), new passenger vehicle sales worldwide touched 57.4 million units in 2022 compared to 56.4 million units in 2021, representing a Y-o-Y growth of 1.9%.

* Similarly, new light commercial vehicle sales touched 19.8 million units in 2022 compared to 18.6 million units in 2021 worldwide, recording a substantial Y-o-Y growth of 7%.

Asia-Pacific is projected to emerge as the key regional market for automotive navigation systems, with Japan, India, and China developing as major automotive manufacturing hubs during the forecast period. The demand across North American and European countries is likely to increase due to the penetration of automobile micro-electro-mechanical systems (MEMS) sensors. These sensors are among the most prominent emerging applications and are increasingly being used in electronic control units and tire pressure monitoring systems in the automotive navigation systems market.

Automotive Navigation System Market Trends

Aftermarket Segment to Gain Traction during the Forecast Period

Apart from the factory fitment of the navigation system from the original equipment manufacturer's end, the fitment rate from the aftermarket channels is also likely to witness considerable growth during the forecast period.

Growth in the e-commerce industry worldwide has resulted in increased pressure on e-commerce companies to deliver products to customers on time. Due to this requirement, many e-commerce companies are forming alliances with existing logistic providers for business-to-customer (B2C) deliveries. To cater to the demand, logistics companies have been expanding their services by entering more vehicles into service. These vehicles are primarily equipped with satellite navigation systems to reach customers as per schedule. Furthermore, e-commerce companies have introduced offers like 'anywhere delivery,' 'same day delivery,' and even 'same hour delivery' to attract a larger number of consumers.

* The number of e-commerce users in the United States reached 240.72 million units in 2022 compared to 223.76 million units in 2021, showcasing a Y-o-Y growth of 7.5%.

* According to the India Brand Equity Foundation (IBEF), India gained 125 million shoppers between 2019 and 2022, with another 80 million expected by the end of 2025.

Most vehicles rolled out in recent years have been equipped with navigation systems that assist drivers in reaching their destinations while also entertaining their occupants. Older cars that were not originally manufactured with a factory-fitted navigation system can have aftermarket navigation systems fitted to their dashboards, or drivers can even use portable navigation systems. Moreover, customers looking to integrate advanced navigation systems that are not equipped in vehicle models offered by OEMs are also increasingly preferring to avail themselves of aftermarket sales channels for purchasing these products. Therefore, consumers' preference toward availing electric vehicles owing to an aggressive government push toward reducing carbon emissions is leading to the expansion of the aftermarket sales channel.

* According to the International Energy Agency (IEA), battery electric vehicle sales worldwide touched 7.3 million units in 2022 compared to 4.6 million units in 2021, representing a Y-o-Y growth of 58.6%.

With various navigation system suppliers listing their products on e-commerce platforms, the aftermarket segment of the market is expected to register surging growth during the forecast period.

Europe Leading the Automotive Navigation System Market

In recent years, the European automotive industry has emerged as a major exporter of automobiles worldwide, and European vehicle owners consider navigation a key safety measure in vehicles. Government authorities across regional countries are aiming to ensure that all cars must be connected with GPS systems over the coming years. The European Committee for Standardization (CEN) and the European Telecommunications Standards Institute (ETSI) recently issued an initial set of standards prescribed for cooperative intelligent transport systems.

The region is actively witnessing a surge in sales. It also has a notable presence of automotive OEMs like Renault, Mitsubishi Electric Corporation, Denso, Bosch, Nissan, Garmin, Hyundai, and Toyota. Safety and security service is the largest contributor to the automotive industry across the European market, with navigation considered a crucial safety measure for vehicles.

* According to the Germany Federal Motor Vehicle Office (KBA), in October 2023, new passenger car registrations in the country increased by 4.9% Y-o-Y to 218,959 units. During the first ten months of 2023, 2,257,025 new cars were registered (up 13.5% Y-o-Y).

* According to the Society of Motor Manufacturers and Traders (SMMT), in November 2023, passenger vehicle sales in the United Kingdom increased by 9.5% to 156,525 units compared to October 2023. Furthermore, passenger car sales in the country touched 1.7 million units in the first 11 months of 2023, showcasing a Y-o-Y growth of 18.6% compared to the same period in 2022.

Automakers and tier-1 suppliers across European countries are also consistently testing the strength of navigation platform providers in data-based solutions to develop digital services in fields such as mobility management and navigation technology. Various automakers in Europe are actively engaged in offering advanced navigation solutions to customers to enhance their driving experience and gain a competitive edge in the ecosystem. For instance,

* In May 2023, Lynk & Co., a China-based car manufacturer, announced the adoption of an innovative what3words navigation system for its European fleet, providing customers with an alternative to traditional systems such as Google Maps. The what3words' novel system has divided the world into 57 trillion 3 m squares, and each square has been given a unique combination of three words, forming its what3words address.

Growing demand for electric vehicles, high penetration of wireless communication technology, and increasing availability of advanced telecom infrastructure are among the major factors driving the market for autonomous cars and dependent navigation systems across European countries.

Automotive Navigation System Industry Overview

The automotive navigation system market is fragmented and highly competitive due to various international and regional players operating in the ecosystem. Some of the major players include Panasonic Holdings Corporation, Robert Bosch GmbH, Harman International Industries, LG Electronics Inc., Denso Corporation, Aisin Corporation, Mitsubishi Electric Corporation, and Garmin Ltd. These companies are increasingly focusing on improving their navigation system functionalities through the integration of emerging technologies, such as AI (artificial intelligence) and AR (augmented reality), to cater to the growing demand for advanced navigation systems in vehicles worldwide.

* In December 2023, Genesys International announced its latest development in ADAS Maps at the ADAS Show 2023, which comprises solutions that enhance the safety and support for autonomous vehicles with highly detailed road information. The highlight of Genesys' showcase was their high fidelity 2D Standard Definition (SD) map for India, which covers 8.3 million km of roads and features over 40 million Points of Interest.

* In April 2022, Mapbox announced the launch of the next-generation multimedia system developed by Toyota Motor North America for select Toyota and Lexus vehicles to offer a driving experience exceeding customer expectations. The Mapbox Maps software development kit incorporates a map design that complements Toyota's next-generation multimedia system, making turn-by-turn navigation intuitive for drivers.

The market is anticipated to witness rapid enhancements in automotive navigation system technology owing to the integration of autonomous vehicles into the ecosystem. Major players are expected to actively strategize and form long-term partnerships with automakers to gain a competitive edge in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Shifting Preference of Consumers to Avail Private Medium of Transportation

- 4.2 Market Restraints

- 4.2.1 High Purchase and Installation Costs

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Sales Channel

- 5.2.1 Original Equipment Manufacturers (OEMs)

- 5.2.2 Aftermarket

- 5.3 By Screen Size

- 5.3.1 Less than 6 Inches

- 5.3.2 6-10 Inches

- 5.3.3 More than 10 Inches

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Panasonic Holdings Corporation

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Harman International Industries

- 6.2.4 LG Electronics Inc.

- 6.2.5 Denso Corporation

- 6.2.6 Aisin Corporation

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.8 Garmin Ltd

- 6.2.9 Visteon Corporation

- 6.2.10 TomTom International BV

- 6.2.11 Faurecia Clarion Electronics Co. Ltd

- 6.2.12 JVC Kenwood Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Advanced Technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) into Navigation Systems Propelling Market Demand