|

市场调查报告书

商品编码

1536854

热交换器:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Heat Exchanger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

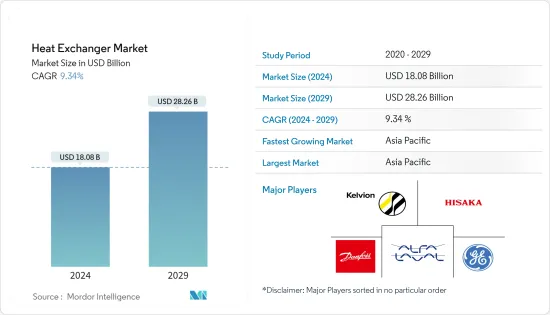

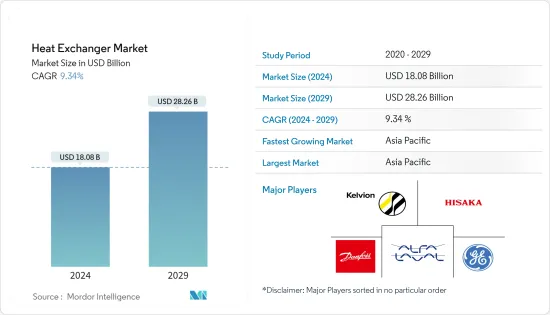

预计2024年全球热交换器市场规模将达到180.8亿美元,2024-2029年预测期间复合年增长率为9.34%,到2029年将达到282.6亿美元。

主要亮点

- 从中期来看,工业应用的增加、新发电厂的扩建和市场开拓预计将在预测期内推动市场发展。

- 另一方面,需要很少热交换器的可再生能源的增加预计将对市场产生负面影响。

- 然而,中国和印度等新兴国家日益工业化和都市化需要更多的发电量,这预计将是热交换器市场的机会。

- 由于中国、日本、韩国和印度的工业开拓不断增加,预计亚太地区将主导热交换器市场。

热交换器市场趋势

发电预计将主导市场

- 由于家庭和工业对电力的需求不断增加,发电行业预计将主导市场。在预测期内,该细分市场也可能主导热交换器市场。

- 热交换器广泛应用于化石能源和热能发电。发电厂使用热交换器从热废气中收集热量来发电。在预测期内,能源领域需求的成长可能会推动热交换器市场的发展。

- 根据美国能源情报署的数据,2023 年美国总发电量为 4,178兆瓦瓦时 (TWh)。与前一年相比,发电量减少了50太瓦时,但随着都市化的推进,未来电力需求预计将进一步增加。

- 在核能发电厂中,热交换器将热量从一次侧(核子反应炉)传递到二次侧的蒸汽产生器。 2024年4月,阿拉伯联合大公国宣布将竞标建造一座新核能发电厂,使这个海湾小国的核子反应炉增加一倍。此类计划可能会增加电力产业对热交换器的需求。

- 因此,预计此类计划将在预测期内对热交换器市场产生积极影响。

亚太地区预计将主导市场

- 亚太地区过去在热交换器市场上占据主导地位。在预测期内,多个在建电力计划也可能主导市场。

- 截至2023年7月,中国有1,142座运作的燃煤发电厂,政府计画兴建更大的燃煤发电厂。预计这一因素将推动该国热交换器的需求。

- 多家热交换器製造商正在投资扩大其区域业务,预计将推动市场发展。 2023年6月,全球最大的空气热交换器领域营运商LU-VE集团与中国湖北省天门县签署协议,扩大LU-VE天门生产工厂。

- NTPC也计划今年开始兴建更多燃煤电厂。该国继续依赖燃料来满足其不断增长的能源需求。总部位于新德里的NTPC计划签署一份建造燃煤发电厂的合约。

- 此外,随着印度和中国等国家集中精力建设新核能发电厂,预计未来热交换器市场的需求将会增加。例如,2023 年 5 月,印度核电公司同意在印度的两个地点开发六座 700 兆瓦加压重水反应器(PHWR)。

- 因此,此类计划预计将在预测期内推动亚太热交换器市场的发展。

热交换器产业概况

热交换器市场适度分散。该市场的主要企业包括(排名不分先后)Alfa Laval AB、Danfoss AS、General Electric Company、Hisaka Works Ltd 和 Kelvion Holding GmbH。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 市场规模与需求预测,~2029 年(十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 全球工业化进展

- 新发电厂的扩建与开发

- 抑制因素

- 增加可再生能源的部署

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 建筑类型

- 壳管

- 板框

- 其他建筑类型

- 最终用户

- 石油和天然气工业

- 发电

- 化学

- 食品/饮料

- 其他最终用户

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 北欧的

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 泰国

- 印尼

- 马来西亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 奈及利亚

- 南非

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟和协议

- 主要企业策略

- 公司简介

- Alfa Laval AB

- Barriquand Technologies Thermiques SAS

- Danfoss AS

- General Electric Company

- Hisaka Works Ltd

- Mersen SA

- Thermax Limited

- SPX Flow Inc.

- Kelvion Holding GmbH

- 市场排名份额(%)分析

第七章 市场机会及未来趋势

- 热交换器开发的技术进步

简介目录

Product Code: 52593

The Heat Exchanger Market size is estimated at USD 18.08 billion in 2024, and is expected to reach USD 28.26 billion by 2029, growing at a CAGR of 9.34% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, increasing industrial applications, expansions, and the development of new power plants will likely drive the market during the forecast period.

- On the other hand, increasing renewable energy, which rarely requires a heat exchanger, is expected to impact the market negatively.

- However, increasing industrialization and urbanization in developing countries, such as China and India, require more power generation, which is expected to create an opportunity for the heat exchanger market.

- Asia-Pacific is expected to dominate the heat exchanger market due to its increasing industrial development in China, Japan, South Korea, and India.

Heat Exchanger Market Trends

Power Generation Expected to Dominate the Market

- The power generation segment is expected to dominate the market due to the increasing demand for electricity from households and industrial operations. This segment may also dominate the heat exchanger market during the forecast period.

- Heat exchangers are widely used in power generation through fossil and thermal energy. Power generation plants employ heat exchangers to collect heat from hot waste gases to generate power. The growing demand in the energy sector may boost the heat exchanger market during the forecast period.

- According to the Energy Information Administration, the total electricity generation in the United States accounted for 4,178 terawatt-hours (TWh) in 2023. Compared to the previous year, power generation decreased by 50 TWh, but with increasing urbanization, the electricity demand is expected to grow further in the coming years.

- In a nuclear power plant, heat exchangers transfer heat from the primary side (reactor) to the secondary side steam generator. In April 2024, the United Arab Emirates announced that it would release a tender for constructing a new nuclear power plant that would double the small Gulf state's nuclear reactors. Such projects will boost the demand for heat exchangers in the power sector.

- Hence, such projects will positively impact the heat exchanger market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific dominated the heat exchanger market in the past. It will likely dominate the market during the forecast period due to several power projects under construction.

- As of July 2023, China had 1,142 operational coal power plants, and the government plans to include more large-scale coal-fired power plants. This factor is expected to drive the country's demand for heat exchangers.

- Several heat exchanger companies are investing to expand their regional presence, which is expected to drive the market. In June 2023, LU-VE Group, the world's largest operator in the field of air heat exchangers, agreed with Tianmen Prefecture (Hubei Province, China) to expand the LU-VE Tianmen production plant.

- Additionally, NTPC Ltd intends to begin the construction of additional coal plants this year. The country continues to rely on fuel to meet its expanding energy needs. The New Delhi-based NTPC is expected to award building contracts for approximately 4.5 gigatonnes of coal-fired capacity.

- Further, in the upcoming period, the market for heat exchangers will be in demand as countries like India and China focus on building new nuclear power plants. For example, in May 2023, Nuclear Power Corporation of India Ltd agreed to develop six 700 MW pressurized heavy water reactors (PHWRs) across two sites in India.

- Hence, such projects are expected to drive the Asia-Pacific heat exchanger market during the forecast period.

Heat Exchanger Industry Overview

The heat exchanger market is moderately fragmented. The key players in the market include (in no particular order) Alfa Laval AB, Danfoss AS, General Electric Company, Hisaka Works Ltd, and Kelvion Holding GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Industrialization across the World

- 4.5.1.2 Expansion and Development of New Power Plants

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Construction Type

- 5.1.1 Shell and Tube

- 5.1.2 Plate Frame

- 5.1.3 Other Construction Types

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Generation

- 5.2.3 Chemical

- 5.2.4 Food and Beverages

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 NORDIC

- 5.3.2.6 Italy

- 5.3.2.7 Spain

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Thailand

- 5.3.3.6 Indonesia

- 5.3.3.7 Malaysia

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 South Africa

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Barriquand Technologies Thermiques SAS

- 6.3.3 Danfoss AS

- 6.3.4 General Electric Company

- 6.3.5 Hisaka Works Ltd

- 6.3.6 Mersen SA

- 6.3.7 Thermax Limited

- 6.3.8 SPX Flow Inc.

- 6.3.9 Kelvion Holding GmbH

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Developing Heat Exchangers

02-2729-4219

+886-2-2729-4219