|

市场调查报告书

商品编码

1687779

保险科技:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Insurtech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

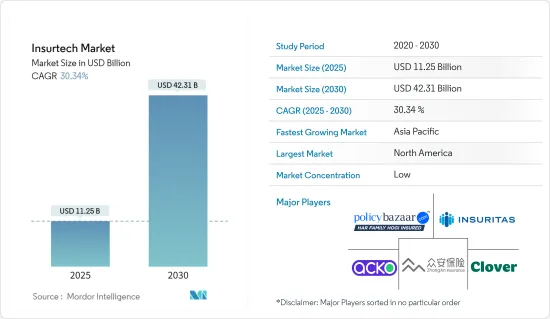

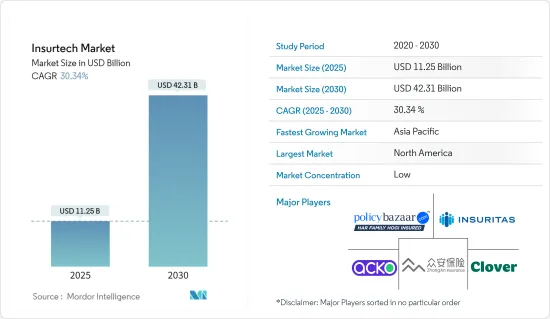

2025 年保险科技市场规模预计为 112.5 亿美元,预计到 2030 年将达到 423.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 30.34%。

在预测期内,由于索赔流程的简化、客户沟通的增强和自动化整合能力,InsurTech 市场预计将实现成长。保险科技在过去十年中不断涌现,但近年来其扩张速度显着加快。

这种成长的推动因素包括:对数位解决方案的需求不断增长、资料分析和人工智慧的使用增加以及消费者对无摩擦、易于使用的保险体验的偏好改变。保险科技公司利用科技实现承保、索赔管理和客户服务等流程的自动化,帮助保险公司提高业务效率并降低成本。

预计未来几年健康保险业将实现最大成长,部分原因是与保险业的其他部分相比,保险科技的采用率明显更高。近年来,受保险业对人工智慧、机器学习和区块链技术等技术创新的日益偏好,交易量稳步增长。此外,许多客户更喜欢在线购买保险,原因包括更好的技术支援、更快的服务、更好的资讯和建议、独特的服务、顺畅的流程等。这就是为什么银行和保险公司都在投资最新的最尖端科技来改善客户体验。这将为保险技术提供者创造更多机会,并推动未来几年的市场成长。

保险科技市场趋势

汽车业引领保险科技市场

由于数位化,尤其是远端资讯处理技术,汽车保险业正在经历彻底的变革时期。远端资讯处理变得越来越普遍的原因有很多:驾驶员厌倦了支付高昂的汽车保险费。然而,最重要的因素是人们希望在确定保险费时采用传统模式的替代方案。此外,如果一个系统只因一次交通违规(如超速或轻微碰撞)就对司机施以严厉处罚,而对优秀司机却不给予任何实质性奖励,这让他们精疲力竭。

保险科技公司在汽车保险业中发挥关键作用,专门从事诈欺侦测和自动索赔处理。我们透过分析大量资料来侦测模式和异常,并使用复杂的人工智慧和机器学习演算法简化索赔流程,从而帮助保险公司打击诈欺行为。它服务于保险业的各个领域,在汽车保险方面,它可以实现更快、更准确的索赔评估,而其诈欺检测功能可确保公平付款,以最大限度地减少财务损失。

亚太地区是成长最快的保险科技市场

亚太地区的保险科技业受到中国、印度、香港、新加坡和印尼等新兴经济体和金融中心的推动。该地区的保险服务供应商专注于提供具有成本效益的保费计划。近年来,随着颠覆性技术改变保险业,亚太地区的保险科技投资不断增加。智慧型手机的兴起、网路普及率的提高以及客户偏好的变化推动了快速数位化和创新经营模式的采用。亚太地区保险科技投资在中国、印度和东南亚表现强劲。

有几个因素推动了亚太地区保险科技投资的激增。其中一个最重要的因素是快速的都市化,这增加了该地区许多人的可支配收入。由于数位化应用的不断增加、消费行为的变化以及有利于创新的法规环境的变化,亚太地区保险科技市场预计将实现成长。

保险科技业概况

保险科技市场高度分散。有许多利基市场参与者同时满足人寿和产物保险需求。主要企业包括 Banc Insurance Agency Inc. (Insuritas)、Policy Bazaar、众安线上财产保险、Clover Health Insurance 和 Acko General Insurance Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 市场覆盖

第二章调查方法

第三章执行摘要

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 增加对数位技术的投资,以降低营运成本、提高效率和客户体验

- 健康和人寿保险公司对区块链技术日益广泛的使用也有望推动成长。

- 市场限制

- 监管和经济不确定性是阻碍市场成长的主要挑战

- 网路安全风险

- 市场机会

- 新兴企业崛起推动市场成长

- 投资者与保险科技公司合作塑造市场成长的新趋势

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 深入了解流行和新兴的 InsurTech 应用使用案例

- 对 InsurTech 成长週期融资的见解

- 洞察影响市场的法规结构

- 洞察影响市场的技术进步

- COVID-19 市场影响

第五章 市场区隔

- 按保险线

- 健康保险

- 人寿保险

- 车

- 家庭财产保险

- 旅游保险

- 其他保险

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 亚太地区

- 印度

- 中国

- 澳洲

- 新加坡

- 香港

- 日本

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Banc Insurance Agency Inc(Insuritas)

- Policy Bazaar

- ZhongAn Online Property & Casualty Insurance Co. Ltd.

- Clover Health Insurance

- Acko General Insurance Limited

- Moonshot-Internet

- Sureify

- Lemonade

- Oscar Health

- Anorak

- BDEO

- Earnix

- Planck

- ThingCo

- Tractable

- Bima

- Metromile

- Collective Health*

第七章 市场机会与未来趋势

第八章 免责声明及发布者

The Insurtech Market size is estimated at USD 11.25 billion in 2025, and is expected to reach USD 42.31 billion by 2030, at a CAGR of 30.34% during the forecast period (2025-2030).

During the forecast period, the insurtech market is anticipated to experience growth attributed to streamlining the claims procedure, enhancing client communication, and the capacity to integrate automation. Insurtech emerged in the past decade, but its expansion has surged notably in recent years.

Several reasons for this growth include a growing need for digital solutions, increased data analytics and AI use, and a shift in consumer preferences towards smooth, easy-to-use insurance experiences. Insurtech companies are using technology to automate processes like underwriting, claims administration, and customer service to improve operational efficiency and reduce costs for insurers.

The health insurance sector is poised to witness the most substantial growth in the coming years, primarily due to the significantly higher adoption of Insurtech compared to other segments of the insurance industry. In recent years, there has been a steady rise in transaction volumes, fueled by a growing preference for technological innovations such as artificial intelligence, machine learning, and blockchain technology within the insurance sector. Also, many customers prefer to purchase insurance policies online due to better technology support, faster service, better information and advice, unique service, and a smooth process. Therefore, banks and insurance companies invest in the most up-to-date and cutting-edge technologies to improve the customer experience. This will create more opportunities for insurance technology providers and drive the market growth over the next few years.

Insurtech Market Trends

Automotive Segment is Driving the Insurtech Market

The automotive insurance industry is undergoing a complete revolution thanks to digitization, particularly telematics technology. There are many reasons why telematics is becoming more common, and drivers are tired of paying too much for their car insurance. Still, the most important factor is that they want alternatives to traditional models in determining premiums. Moreover, the system of no visible rewards to good drivers while harsh penalties are imposed on those who engage in a single traffic violation, like speeding tickets or small fender benders, is exhausting them.

Insurtech companies play an important role in the automotive insurance industry, specializing in fraud detection and automated claims processing. It analyses vast volumes of data to detect patterns and anomalies and helps insurance companies fight fraud by streamlining their claims processes through its sophisticated AI and ML algorithm. Serving multiple sectors in the insurance industry, auto insurance enables faster and more accurate claims assessments while ensuring fair settlements to minimize financial losses through its fraud detection capabilities.

Asia Pacific Has the Fastest Growing Insurtech Market

The insurtech industry in the Asia-Pacific is growing due to several emerging economies and financial centers such as China, India, Hong Kong, Singapore, and Indonesia. Insurance service providers in this region are focused on providing cost-effective insurance premium plans. In recent years, Insurtech investments in the APAC region have increased as disruptive technologies transform the insurance industry. The rapid digitization and adoption of innovative business models are driven by smartphone penetration, increasing internet penetration, and changing customer preferences. Insurtech investment in APAC has been solid in China, India, and Southeast Asia.

The APAC region has seen a surge in insurtech investments due to several factors. One of the most important is the rapid urbanization, which has increased disposable income for many people in the region. The APAC Insurtech market is expected to grow, driven by increased digital adoption, changing consumer behavior, and a changing regulatory environment conducive to innovation.

Insurtech Industry Overview

The market for insurtech is highly fragmented. There are a large number of niche players that serve the needs of both life and non-life insurance. Banc Insurance Agency Inc. (Insuritas), Policy Bazaar, ZhongAn Online Property & Casualty Insurance Co. Ltd, Clover Health Insurance, and Acko General Insurance Limited are major players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Investments in Digital Technologies to Reduce Operational Costs and Improve Efficiency & Customer Experience

- 4.2.2 Growth in the Use of Blockchain-Based Technology Among Health and Life Insurance Companies is Also Expected to Drive the Growth

- 4.3 Market Restraints

- 4.3.1 Regulatory and Economic Uncertainty is a Significant Challenge Hindering Market Growth

- 4.3.2 Cybersecurity Risks

- 4.4 Market Opportunities

- 4.4.1 Rising Number of Startups is Driving the Growth of the Market

- 4.4.2 Investors Collaborating with InsurTech Firms is an Emerging Trend Shaping the Market Growth

- 4.5 Industry Attractiveness: Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Used Cases of Prominent and Emerging Insurtech Applications

- 4.7 Insights on Financial Infusions into the Insurtech Growth Cycle

- 4.8 Insights on Regulatory Framework Shaping the Market

- 4.9 Insights on Technological Advancements Shaping the Market

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Insurance Line

- 5.1.1 Health

- 5.1.2 Life

- 5.1.3 Automotive

- 5.1.4 Home And Property

- 5.1.5 Travel Insurance

- 5.1.6 Other Insurance Lines

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 Spain

- 5.2.2.4 United Kingdom

- 5.2.2.5 Rest of Europe

- 5.2.3 South America

- 5.2.3.1 Brazil

- 5.2.3.2 Argentina

- 5.2.3.3 Rest of South America

- 5.2.4 Asia-Pacific

- 5.2.4.1 India

- 5.2.4.2 China

- 5.2.4.3 Australia

- 5.2.4.4 Singapore

- 5.2.4.5 Hong Kong

- 5.2.4.6 Japan

- 5.2.4.7 Rest of Asia-Pacific

- 5.2.5 Middle East & Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Banc Insurance Agency Inc (Insuritas)

- 6.2.2 Policy Bazaar

- 6.2.3 ZhongAn Online Property & Casualty Insurance Co. Ltd.

- 6.2.4 Clover Health Insurance

- 6.2.5 Acko General Insurance Limited

- 6.2.6 Moonshot-Internet

- 6.2.7 Sureify

- 6.2.8 Lemonade

- 6.2.9 Oscar Health

- 6.2.10 Anorak

- 6.2.11 BDEO

- 6.2.12 Earnix

- 6.2.13 Planck

- 6.2.14 ThingCo

- 6.2.15 Tractable

- 6.2.16 Bima

- 6.2.17 Metromile

- 6.2.18 Collective Health*