|

市场调查报告书

商品编码

1687944

图形处理单元 (GPU):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Graphics Processing Unit (GPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

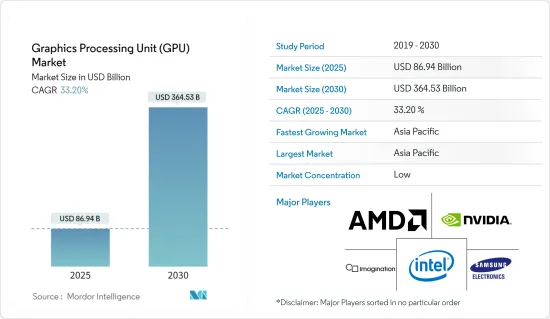

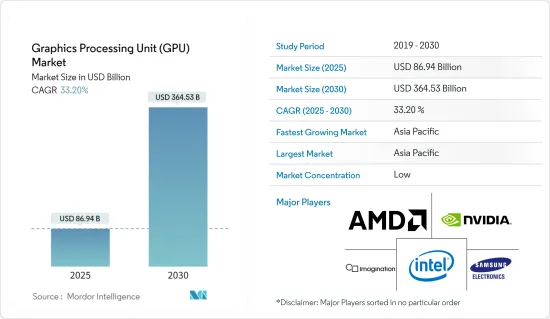

图形处理单元 (GPU) 市场规模预计在 2025 年为 869.4 亿美元,预计到 2030 年将达到 3,645.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 33.2%。

图形处理单元 (GPU) 市场受到对专用处理器日益增长的需求的推动,用于管理主要与 2D 和 3D 图形相关的复杂数学计算。此外,製造业、汽车业、房地产业和医疗保健等各个行业对支援图形应用和 3D 内容的处理器的使用不断增加也推动了市场的成长。

近年来,高阶个人运算设备和游戏机的需求激增,推动了研究市场的发展。投资图形附加板对于微处理公司来说是有益的,因为 GPU 是成品的关键元件。

此外,个人电脑(PC)和笔记型电脑等运算产品的高普及率以及游戏产业的投资不断增加是推动近年来研究市场成长的关键因素。在预测期内,对高图形和计算应用程式的需求成长、人工智慧等技术的兴起以及即时分析的趋势主要推动了 GPU 技术的范围。

此外,GPUaaS 可用于多种用途,例如训练多语言 AI 语音引擎和识别糖尿病相关失明的早期指标。现代 GPU 即服务是实现机器学习系统所需速度的一种方式,它为传统通用处理器提供了一种引人注目的替代方案,具有可变定价和无资本支出。

然而,熟练劳动力的短缺对采用这项技术的公司构成了重大挑战。一些製造商表示缺乏经验丰富的工程师和开发人员。跟上复杂且快速发展的技术并转向自动化非常困难,从而增加成本并限制市场成长。

随着美国衝突的持续,包括印度和东南亚国家在内的其他国家的製造业和工业部门也开始吸引更多投资,因为中国企业正在寻求实现製造地多元化。预计这些趋势将为该市场带来进一步的商机。

图形处理单元 (GPU) 市场趋势

行动装置将经历巨大成长

- 图形处理单元(GPU)是智慧型手机中的关键元件,负责管理复杂的视觉任务,例如渲染图形、渲染动画、玩电玩游戏和显示高解析度影像。 CPU 可以处于空閒状态以节省电池,而 GPU 可用于处理密集型图形任务。这对于视频游戏等密集型应用程式尤其重要,因为如果不进行最佳化,这些应用程式可能会非常耗电。

- 过去十多年来,行动装置产业发展迅速,随着科技的进步,3D图形与行动电话的融合也加速发展。 GPU 在行动装置和 PC 中发挥着至关重要的作用,可提供更好的图形效能、更长的电池寿命并卸载 CPU 任务。有了专用的 GPU,行动装置可以更轻鬆、更快地渲染高品质的动画、图形和特效,从而带来更好的使用者体验,尤其是对于经常使用高要求应用程式或玩视讯游戏的消费者而言。

- 智慧型手机技术的最新进步和对 5G 智慧型手机不断增长的需求正在推动这一领域的成长。三星、苹果、小米、Oppo 和 Vivo 等智慧型手机製造商对产品的创新努力也推动了对行动 GPU 的需求。

- 爱立信预计,2019年至2028年间,全球5G用户数将大幅成长,从1,200多万增至45亿多万。按地区划分,预计印度、尼泊尔和不丹的合约数量将出现最大增幅。智慧型手机OEM将在 2024 年加大对人工智慧智慧型手机的投入,并增加额外的储存容量,从而推动未来几年智慧型手机的需求。

- 此外,相机和影像品质的不断发展将吸引新的消费者。人工智慧和机器学习技术快速融入行动电话和笔记型电脑将推动对更快 GPU 的需求。

亚太地区成长强劲

- 鑑于该地区各行业不断变化的动态,预计亚太地区将继续成为研究市场成长的主要贡献者。多年来,中国、日本和韩国等主要经济体以外的地区对数位技术的采用显着增长,创造了市场机会。例如,「数位印度」计画对印度数位科技的采用产生了显着影响,并推动了该国各个终端用户领域对 GPU 的需求。

- 过去几十年来,中国已成为半导体及相关产品的主要生产国和消费国。中国对半导体晶片的需求主要受到其不断扩大的数位生态系统的推动。

- 政府也采取措施支持数位科技在中国的传播。例如,「中国製造2025」是中国政府的一项倡议,旨在推动将机器人、物联网、自动化、人工智慧、AR/VR、机器学习等先进技术和其他先进的ICT解决方案引入工业领域。

- 中国在公共部门采用数位化技术提高公共服务效率方面也处于亚太地区领先地位。因此,该国对云端运算和相关服务的采用日益增加,创造了一个需求友善的生态系统,并使其成为资料中心基础设施的关键组成部分。

图形处理单元 (GPU) 产业概览

图形处理单元 (GPU) 市场分散,主要企业包括英特尔公司、超微半导体公司、英伟达公司、Imagination Technologies Group 和三星电子。市场参与者正在采取合作和收购等策略来增强其产品供应并获得永续的竞争优势。

2024 年 1 月,NVIDIA 宣布推出 GeForce RTX 40 SUPER 系列 GPU,其中包括 GeForce RTX 4080 SUPER、GeForce RTX 4070 Ti SUPER 和 GeForce RTX 4070 SUPER。基于 NVIDIA Ada Lovelace 架构的 GPU 的最新版本可提供高达 52 着色器 TFLOPS、121 RT TFLOPS 和 836 AI TOPS,让您能够增强游戏效能并开发新的娱乐世界和体验。

2023 年 11 月, VMware Inc. 宣布与英特尔公司合作,透过在资料中心、公共云端和边缘环境中启用私有 AI 来扩展公司的创新,以帮助客户加速在资料中心、公共云端和边缘环境中采用 AI。 VMware Cloud Foundation 与英特尔的 AI 软体套件、内建 AI 加速器的英特尔至强处理器以及英特尔 Max 系列 GPU 相结合,提供经过验证和检验的AI 堆迭,用于资料准备、模型训练、微调和推理,以加速科学发现并丰富商业和消费者服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章 市场动态

- 市场驱动因素

- 游戏图形的演变

- 扩大 AR、VR 和 AI 的用途

- 市场限制

- 初期投资高

第六章 市场细分

- 按类型

- 独立 GPU

- 整合 GPU

- 混合 GPU

- 按应用

- 行动装置

- 个人电脑和工作站

- 伺服器/资料中心

- 汽车/自动驾驶汽车

- 游戏机

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Advanced Micro Devices Inc.

- Nvidia Corporation

- Imagination Technologies Group

- Samsung Electronics Co. Ltd

- Arm Limited(Soft Bank Group)

- EVGA Corporation

- SAPPHIRE Technology Limited

- Qualcomm Technologies Inc.

第 8 章供应商市场占有率

第九章投资分析

第 10 章:市场的未来

The Graphics Processing Unit Market size is estimated at USD 86.94 billion in 2025, and is expected to reach USD 364.53 billion by 2030, at a CAGR of 33.2% during the forecast period (2025-2030).

The graphics processing unit market is primarily driven by the growing demand for specialized processors to manage complex mathematical calculations related to 2D and 3D graphics. The augmenting use of processors to support graphics applications and 3D content in several industry verticals, including manufacturing, automotive, real estate, and healthcare, is also increasing the market's growth.

The demand for high-end personal computing devices and gaming consoles has surged in recent years, driving the studied market. Hence, investing in a graphics add-in board is helpful for micro-processing companies, as GPU forms a vital component of the finished product.

Moreover, the high adoption of computing products, such as personal computers (PCs) or laptops, and the increasing investment in the gaming industry have been significant factors driving the studied market's growth in recent years. The growing demand for high graphics and computing applications and the expansion of technologies, like AI, along with the trend of real-time analysis, are mainly expanding the scope of GPU technology over the forecast period.

In addition, GPUaaS may be utilized for various purposes, including training multilingual AI speech engines and identifying early indicators of diabetes-related blindness. Modern GPUaaS, which provides a compelling alternative to traditional general-purpose processors with variable pricing and no CAPEX, is one way to achieve the speed required for machine learning systems.

However, the lack of a skilled workforce has been a significant challenge for companies adopting the technology. Several manufacturing companies cite a shortage of experienced engineers and developers; it becomes challenging to keep up with the complex and rapidly evolving technology and switch to automation, thereby increasing costs and restricting the market's growth.

Owing to the ongoing US-China dispute, other countries, including India and some Southeast Asian countries, have started to witness a higher inflow of investments in the manufacturing and industrial sector as companies in China look to diversify their manufacturing base. Such trends, in turn, are expected to drive further opportunities in the market studied.

Graphics Processing Unit (GPU) Market Trends

Mobile Devices to Witness Major Growth

- The Graphics Processing Unit (GPU) is a vital component of smartphones, accountable for rendering graphics and managing complex visual tasks, including rendering animations, playing video games, and displaying high-resolution images. The CPU can remain idle and conserve battery power using the GPU to handle intensive graphical tasks. This is especially important for demanding applications like video games, which can consume a lot of battery life if not optimized.

- The mobile devices industry evolved rapidly in the past decade, and the integration of 3D graphics on mobile phones accelerated with the technological evolution. The GPU plays a key role in mobile devices and PCs, providing better graphics performance, enhanced battery life, and offloading CPU tasks. Mobile devices can render high-quality animations, graphics, and special effects with more ease and faster speed with a dedicated GPU, resulting in a better user experience, specifically for consumers who regularly use demanding apps and play video games.

- The recent advancement in smartphone technologies and rising demand for 5G smartphones drive the segment's growth. Efforts by smartphone makers such as Samsung, Apple, Xiaomi, Oppo, and Vivo to innovate their products are also driving up demand for Mobile GPUs.

- As per Ericsson, 5G subscriptions are forecast to increase drastically worldwide from 2019 to 2028, from over 12 million to over 4.5 billion subscriptions respectively. India, Nepal, and Bhutan are expected to have the most subscriptions by region. Smartphone OEMs are ramping up Artificial intelligence-enabled smartphones in 2024, with an additional storage capacity, boosting the demand for smartphones in coming years.

- Furthermore, continuous development in camera and picture quality attracts new consumers. Rapid AI and machine learning technology integration in mobile phones and laptops drives demand for faster GPUs.

Asia-Pacific to Witness Significant Growth

- The Asia-Pacific region is anticipated to remain among the prominent contributors to the growth of the market studied, considering the changing dynamics of various industries in the region. Over the years, the adoption of digital technologies has grown significantly outside significant countries such as China, Japan, and South Korea, creating opportunities in the market studied. For instance, the "Digital India" mission is one such initiative that had a notable impact on the uptake of digital technologies in India, driving the demand for GPUs across various end-user verticals in the country.

- In the last few decades, China has become the primary producer and consumer of semiconductors and related products. The demand for semiconductor chips in China is driven primarily by the expanding digital ecosystem.

- Government initiatives also support the growth in the uptake of digital technologies in China. For example, "Made in China 2025" is an initiative by the Chinese government to promote the adoption of advanced technologies, such as robotics, IoT, automation, and advanced ICT solutions, such as AI, AR/VR, ML, etc., in the industrial sector.

- Furthermore, China has also emerged among the leaders in the Asia-Pacific region in adopting digital technologies in the public sector to improve the efficiency of public services. As a result, the adoption of cloud and related services has been increasing in the country, creating a favorable ecosystem for demand and becoming a vital component of data center infrastructure.

Graphics Processing Unit (GPU) Industry Overview

The graphics processing unit market is fragmented with the presence of major players like Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, Imagination Technologies Group, and Samsung Electronics Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2024, NVIDIA announced the GeForce RTX 40 SUPER Series family of GPUs, including the GeForce RTX 4080 SUPER, GeForce RTX 4070 Ti SUPER, and GeForce RTX 4070 SUPER, which supercharges the latest games and forms the core of AI-powered PCs. This newest iteration of NVIDIA Ada Lovelace architecture-based GPUs delivers up to 52 shader TFLOPS, 121 RT TFLOPS, and 836 AI TOPS to supercharge gaming and provide the power to develop new entertainment worlds and experiences.

In November 2023, VMware Inc. announced a partnership with Intel Corporation to extend their innovation by enabling private AI across data centers, public clouds, or Edge environments to help customers accelerate the adoption of AI in data centers, public clouds, and edge environments. The combination of VMware Cloud Foundation and Intel's AI software suite, Intel Xeon processors with built-in AI accelerators, and Intel Max Series GPUs will deliver a validated and benchmarked AI stack for data preparation, model training, fine-tuning and inferencing to accelerate scientific discovery and enrich business and consumer services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Graphics in Games

- 5.1.2 Growing Applications of AR, VR, and AI

- 5.2 Market Restraints

- 5.2.1 High Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Discrete GPU

- 6.1.2 Integrated GPU

- 6.1.3 Hybrid GPU

- 6.2 By Applications

- 6.2.1 Mobile Devices

- 6.2.2 PCs and Workstations

- 6.2.3 Servers/Data Centers

- 6.2.4 Automotive/Self-driving Vehicles

- 6.2.5 Gaming Consoles

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Advanced Micro Devices Inc.

- 7.1.3 Nvidia Corporation

- 7.1.4 Imagination Technologies Group

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Arm Limited (Soft Bank Group)

- 7.1.7 EVGA Corporation

- 7.1.8 SAPPHIRE Technology Limited

- 7.1.9 Qualcomm Technologies Inc.