|

市场调查报告书

商品编码

1686309

无损检测 (NDT):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)NDT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

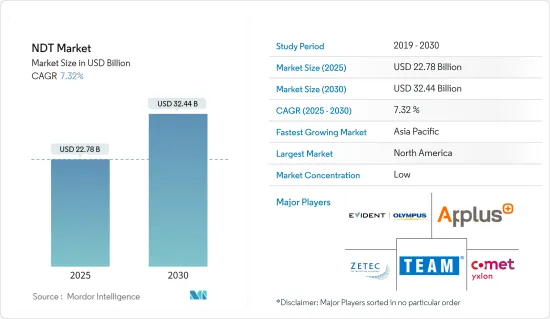

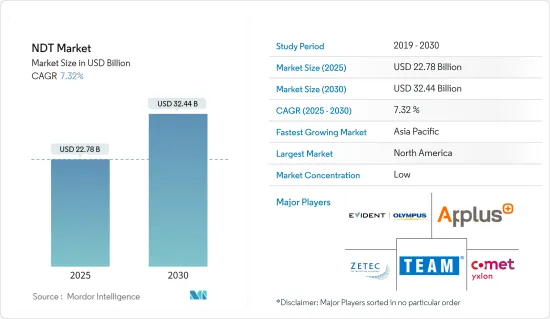

预计 2025 年无损检测 (NDT) 市场规模为 227.8 亿美元,到 2030 年将达到 324.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.32%。

主要亮点

- 预计无损检测 (NDT) 市场将见证强劲增长,原因包括对安全性、完整性和可靠性的日益重视、发电行业的扩张、AL、ML、工业 4.0 和工业IoT等技术进步以及製造业活动的激增。

- 此外,石油和天然气、建筑计划以及各国不断增加的国防支出都对无损检测 (NDT) 设备和服务产生了巨大的需求。此外,电动和自动驾驶汽车销售的不断增长也推动了汽车行业对无损检测设备和服务的需求。

- 在汽车工业中,无损检测 (NDT) 被广泛用于检查锻造、热处理和机械加工后的汽车零件,以确保它们符合既定的标准。无损检测 (NDT) 对于检查车身板和部件的焊接也很重要,以确保它们具有足够的渗透力、无夹杂物和其他可能影响车辆安全性或可靠性的缺陷。电动和自动驾驶汽车的需求不断增长,对无损检测 (NDT) 的需求巨大。

- 缺乏熟练人力和培训设施严重限制了该市场的成长。无损检测 (NDT) 市场面临的主要挑战之一是熟练人才的短缺。有效使用无损检测 (NDT) 需要高度的技术专业知识和解释和分析测试结果的熟练程度。

- 俄罗斯入侵乌克兰、美国竞争、选举以及以色列战争等地缘政治挑战对全球供应链产生重大影响,尤其是对传统工业、国防、高科技领域、航太和绿色能源至关重要的关键原料。

- 俄乌战争和经济放缓给无损检测行业造成了重大衝击。通货膨胀和利率上升减少了消费者支出,阻碍了行业需求并导致市场成长放缓。此外,美国贸易战也进一步扰乱了全球供应链。美国对华半导体设备进出口实施严格限制,阻碍了中国石油和天然气、电力和能源、建筑和汽车产业的生产。

无损检测市场趋势

预计可伸缩安全注射器市场在预测期内将出现显着成长

- 无损检测 (NDT) 技术在国防工业中至关重要,可确保从製造到组装的材料和连接製程的最高品质水准。即使是由于腐蚀或磨损造成的轻微缺陷也可能导致灾难性的故障,危及大笔投资。

- 透过无损检测(NDT)进行品管在军事装备製造中至关重要,并直接影响其可靠性。在战斗场景中,这些系统的有效性取决于细緻的超音波和涡流无损检测 (NDT) 测试,以确保组件符合规格并且更换或维修完美无缺。

- 储存槽在安全和防御领域广泛使用,主要用于储存航空和船用燃料,有时也用于储存标准车辆燃料。这些储罐具有多种配置,包括地上储罐、埋地储罐、半埋地储罐、卧式储罐和立式储罐。无损检测(NDT)技术被广泛用于这些油箱的检查,以避免将来出现缺陷。

- 飞机、飞弹和防御系统的製造、维护和修理过程中对品质保证和控制的需求推动了对无损检测 (NDT) 技术的需求。全球军事航空的兴起推动了对延长飞机寿命至关重要的例行检查、维护和无损检测 (NDT) 测试的需求不断增长。

- 例如,2024年7月,美国宣布计划部署数十架先进战斗机,以加强在日本的存在。该倡议是价值 100 亿美元的维修的一部分,旨在加强美日联盟、增强地区阻碍力并促进印度-太平洋地区的和平。具体来说,三泽空军基地的36架F-16将被48架最先进的F-35A战斗机取代。此外,36架新型F-15EX战机将部署到冲绳嘉手纳空军基地,取代将于2023年逐步淘汰的48架旧款F-15C/D战机。

- 欧洲北约盟国将在国防上投入总合3,800 亿美元,这是该支出案例达到总合GDP 的 2%。 2024年,美国国防支出预计将达到9,677亿美元,巩固其北约国家最大国防开支国地位。排名第二的是德国,总额为977亿美元,排名第三的是英国。

预计北美将在预测期内占据主要市场占有率

- 美国由于国内市场庞大且广泛采用大规模生产方式,在汽车市场中占有关键地位。美国汽车业是製造业的重要组成部分,多家汽车製造商在全国各地设有组装厂。该国是福特、雪佛兰和特斯拉等主要企业的所在地,在汽车创新,特别是自动化领域发挥主导作用,这支持了该国对无损检测服务的需求。

- 无损检测 (NDT) 在该国的汽车产业中至关重要,因为它可以在锻造、热处理和机械加工后检查零件,以确保符合规定。它们也用于评估连接车身板和部件的焊接质量,以确保正确的渗透、无夹杂物、无可能危及车辆安全性和可靠性的缺陷。

- 汽车电气化的日益普及和政府鼓励使用更清洁能源来源的法规也将推动市场成长。白宫宣布了一项公私联合承诺,支持拜登总统在 2030 年实现 50% 新车购买为电动车的目标。这些推动电动车普及的努力预计将对市场产生重大影响。

- 根据汽车创新联盟的报告,电动车(EV)将占 2024 年第一季新轻型车销量的 9.3%,略低于 2023 年第四季的 10.2%,但高于 2023 年第一季的 8.6%。在美国,2024 年第一季的电动车销量与 2023 年第一季相比成长了 13%,达到 344,000 多辆。

- 由于加拿大石油和天然气工业的成长,加拿大无损检测市场的需求正在增加。石油和天然气产业透过资本投资和出口主导加拿大的GDP。有吸引力的省级激励措施鼓励钻探、更多采用长水平井和页岩资源的多级压裂是加强加拿大石油和天然气工业的关键驱动力。

- 加拿大的石油和天然气产业遍及 13 个省和地区中的 12 个。根据加拿大统计局的数据,2023年9月至10月,原油产量增加了3.62%。

无损检测产业概况

无损检测(NDT)市场高度分散,既有全球参与者,也有中小型企业。该市场的主要参与者包括 Evident Corporation(Olympus Corporation)、Zetec Inc.(Eddyfi Technologies)、YXLON International GMBH(COMET Group)、Team Inc. 和 Applus Services SA。市场参与者正在采取合作和收购等策略来加强其产品供应并获得永续的竞争优势。

2024 年 6 月-TUV 莱茵北美宣布在麻萨诸塞州博克斯伯勒开设酵母技术与研发中心。这座现代化的设施体现了德国莱茵 TUV 集团的一项重大承诺。这个占地 65,000 平方英尺的最先进的设施包括电气安全、无线技术、EMC 测试、环境评估和医疗设备测试的基础设施。

2024 年 1 月 - Intertek Group PLC 推出 Intertek Inform,这是一项提供标准和法规以促进更快进入市场的服务。对品质、安全和永续性的日益增长的需求使得获取标准对于在现有和新兴市场中竞争和提供产品和服务的公司至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 严格规定安全标准

- 缺陷检测需求不断增加,以降低维修成本

- 市场限制

- 缺乏熟练劳动力和培训设施

第六章 市场细分

- 按类型

- 装置

- 服务

- 按检验技术

- 放射线摄影

- 超音波检查

- 磁粉检测

- 液体液体渗透探伤

- 目视检查

- 涡流检测

- 其他测试技术

- 按最终用户产业

- 石油和天然气

- 电力和能源

- 建造

- 汽车与运输

- 航太

- 防御

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Evident Corporation(Olympus Corporation)

- Zetec Inc.(Eddyfi Technologies)

- YXLON International GMBH(COMET Group)

- Team Inc.

- Applus Services SA

- Mistras Group Inc.

- SGS SA

- Fujifilm Corporation(Fujifilm Holdings Corporation)

- Bureau Veritas

- Nikon Metrology NV(Nikon Corporation)

- Intertek Group PLC

- TUV Rheinland AG

- Magnaflux Corp.(Illinois Tool Works Inc.)

第八章投资分析

第九章:市场的未来

The NDT Market size is estimated at USD 22.78 billion in 2025, and is expected to reach USD 32.44 billion by 2030, at a CAGR of 7.32% during the forecast period (2025-2030).

Key Highlights

- The non-destructive testing (NDT) market is anticipated to witness robust growth owing to several factors, such as increased emphasis on safety, integrity, and reliability, expansion of the power generation sector, technological advancements like AL, ML, industry 4.0, industrial IoT, and an upsurge in manufacturing activities.

- Furthermore, increased oil and gas, construction projects, and rising defense expenditures of various countries create significant demand for NDT equipment and services. Further, rising sales of electric vehicles and autonomous cars fuel demand for non-destructive testing equipment and services in the automotive sector.

- In the automotive industry, non-destructive testing (NDT) is widely adopted to inspect automotive components after forging, heat treatment, and machining to ensure they meet established standards. NDT is also critical for examining welds that join body panels and components, ensuring they have adequate penetration, are free of inclusions, and are devoid of defects that could compromise vehicle safety or reliability. The growing demand for electric and autonomous vehicles creates a huge demand for the NDT.

- The lack of skilled personnel and training facilities significantly restrains the growth of this market. One of the primary challenges faced by the NDT market is the shortage of skilled personnel. The effective utilization of NDT requires a high level of technical expertise and proficiency in interpreting and analyzing test results.

- Geopolitical challenges, including the Russian invasion of Ukraine, China-US competition, elections, and the war in Israel, significantly impact the global supply chain, especially critical raw materials vital for traditional industries, defense, high-tech sectors, aerospace, and green energy.

- The Russia-Ukraine war and economic slowdown caused significant disruption in the NDT industry. The increased inflation and interest rates reduced consumer spending, hampered the industry's demand, and led to slow growth in the market. Furthermore, the trade war between the United States and China further disturbed the global supply chain. Owing to strict export and import controls on China by the United States for semiconductor equipment hampers the production of oil and gas, power and energy, construction, and the automotive sector in China.

Non-Destructive Testing Market Trends

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- Non-destructive testing (NDT) technology is pivotal in the defense industry, guaranteeing top-tier quality in materials and joining processes, from fabrication to erection. It's instrumental in ensuring military forces are combat-ready, as even a minor flaw from corrosion or wear could lead to catastrophic failures, jeopardizing significant investments.

- Quality control through NDT is paramount in manufacturing military equipment, directly impacting its reliability. In combat scenarios, the efficacy of these systems hinges on meticulous ultrasonic and eddy current NDT testing, ensuring components meet specifications and any replacements or repairs are flawless.

- Storage tanks are prevalent in the security and defense sector, primarily housing aviation or ship fuel and, sometimes, standard vehicle fuel. These tanks come in various forms: above-ground, buried, or semi-buried, in both horizontal and vertical configurations. NDT technology is widely used to inspect these tanks to avoid future defects.

- The imperative for quality assurance and control in the manufacturing, maintenance, and repairing of aircraft, missiles, and defense systems propels the demand for NDT technologies. The global growth in military aircraft fleets underscores the rising demand for routine inspections, maintenance, and NDT testing, which is crucial for prolonging aircraft lifespans.

- For instance, in July 2024, the US military announced that it planned to deploy dozens of its latest fighter jets to bolster its presence in Japan. This initiative, part of a USD 10 billion upgrade, aims to fortify the US-Japan Alliance, heighten regional deterrence, and promote peace in the Indo-Pacific. Specifically, the plan entails replacing 36 F-16s at Misawa Air Base with 48 advanced F-35A fighters. Additionally, 36 new F-15EX jets will be stationed at Kadena Air Base in Okinawa, replacing 48 older F-15C/D models phased out in 2023.

- European NATO Allies are set to collectively invest USD 380 billion in defense, marking the first instance where this expenditure reaches 2% of their combined GDP. In 2024, the United States allocated an estimated USD 967.7 billion to defense, solidifying its position as the largest defense spender among all NATO nations. Germany trailed as the second-largest spender, allocating USD 97.7 billion, with the UK ranking third.

North America Expected to Hold Significant Market Share During the Forecast Period

- The United States holds a prominent position in the automotive market thanks to its large domestic market and widespread adoption of mass production methods. The automotive industry in the United States is a crucial part of the manufacturing sector, with multiple car manufacturers running assembly plants nationwide. Notable companies such as Ford, Chevrolet, and Tesla are based in the country, which has played a leading role in automotive innovation, particularly in automation, which supports the demand for non-destructive testing services in the country.

- Non-destructive testing (NDT) is essential in the country's automotive sector as it examines components post-forging, heat treating, and machining to verify compliance with regulations. It is also utilized to assess the quality of welds connecting body panels and components, ensuring proper penetration, the absence of inclusions, and the absence of defects that may jeopardize the safety and dependability of a vehicle.

- The market's growth is also driven by the increasing popularity of vehicle electrification and government regulations, which encourage cleaner energy sources. The White House announced a combination of public and private pledges that support President Biden's goal of having 50% of all new vehicle purchases be electric by 2030. These efforts, designed to promote the adoption of electric vehicles, are expected to influence the market significantly.

- According to the Alliance for Automotive Innovation Report, in the first quarter of 2024, electric vehicles (EVs) made up 9.3% of new sales of light-duty vehicles, a slight decrease from 10.2% in the fourth quarter of 2023 but an increase from 8.6% in the first quarter of 2023. The United States witnessed a 13% increase in EV sales in the first quarter of 2024, with over 344,000 EVs sold compared to Q1 2023.

- The demand for the non-destructive testing market in Canada is increasing due to the country's growing oil and gas industry. The oil and gas sector dominates the Canadian GDP, with capital investments and exports. Attractive provincial incentives to encourage drilling, increased implementation of long horizontal wells, and multistage fracturing in shale resources are the major drivers in enhancing the Canadian oil and gas industry.

- The oil and natural gas sector in Canada operates within 12 out of the 13 provinces and territories. Large companies are ramping up their spending to pump more oil out of the ground; there was a 3.62% increase in crude oil production between September and October 2023, according to Statistics Canada.

Non-Destructive Testing Industry Overview

The Non-Destructive Testing (NDT) market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Evident Corporation (Olympus Corporation), Zetec Inc. (Eddyfi Technologies), YXLON International GMBH (COMET Group), Team Inc., and Applus Services SA. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

June 2024 - TUV Rheinland North America announced the launch of its Northeast Technology and Innovation Center in Boxborough, MA. This modern facility signifies a substantial commitment for the prominent organization. Encompassing 65,000 square feet, this advanced facility has infrastructure for electrical safety, wireless technology, EMC testing, environmental assessments, medical device testing, and beyond.

January 2024 - Intertek Group PLC launched a service called Intertek Inform, which provides standards and regulations to facilitate quicker access to the market. Access to standards is becoming essential for companies wishing to compete and supply products and services in current and developing markets due to the growing demand for quality, safety, and sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations Mandating Safety Standards

- 5.1.2 Increase in Demand for Flaw Detection to Reduce Repair Cost

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Personnel and Training Facilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Equipment

- 6.1.2 Services

- 6.2 By Testing Technology

- 6.2.1 Radiography Testing

- 6.2.2 Ultrasonic Testing

- 6.2.3 Magnetic Particle Testing

- 6.2.4 Liquid Penetrant Testing

- 6.2.5 Visual Inspection Testing

- 6.2.6 Eddy Current Testing

- 6.2.7 Other Testing Technologies

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Power and Energy

- 6.3.3 Construction

- 6.3.4 Automotive and Transportation

- 6.3.5 Aerospace

- 6.3.6 Defense

- 6.3.7 Other End User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Evident Corporation (Olympus Corporation)

- 7.1.2 Zetec Inc. (Eddyfi Technologies)

- 7.1.3 YXLON International GMBH (COMET Group)

- 7.1.4 Team Inc.

- 7.1.5 Applus Services SA

- 7.1.6 Mistras Group Inc.

- 7.1.7 SGS SA

- 7.1.8 Fujifilm Corporation (Fujifilm Holdings Corporation)

- 7.1.9 Bureau Veritas

- 7.1.10 Nikon Metrology NV (Nikon Corporation)

- 7.1.11 Intertek Group PLC

- 7.1.12 TUV Rheinland AG

- 7.1.13 Magnaflux Corp. (Illinois Tool Works Inc.)