|

市场调查报告书

商品编码

1644616

全球介面 IC -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Interface IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

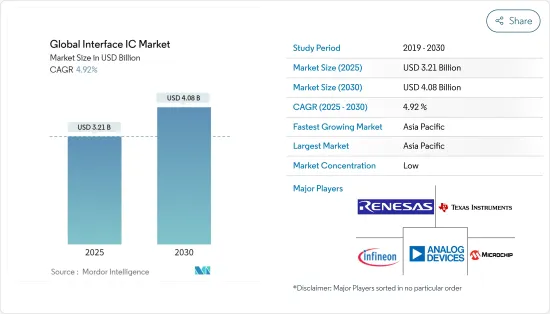

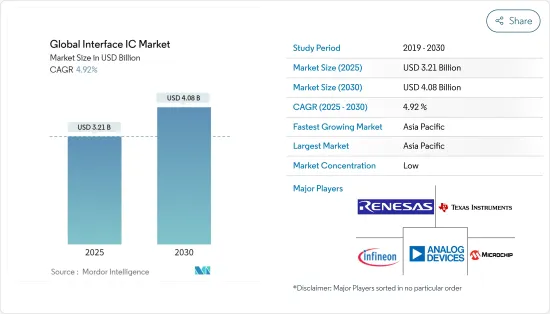

预计 2025 年全球介面 IC 市场规模为 32.1 亿美元,到 2030 年将达到 40.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.92%。

介面IC将整个电子介面电路的功能整合到单一晶片上,实现了设备之间经济高效且可靠的资讯共用。介面IC具有管理和控制各种电子系统之间通讯的功能,对于生物识别、电动车和通讯至关重要,从而刺激了电子电路基板对介面IC的需求。

关键亮点

- 积体电路 (IC) 介面是控制和促进设备之间讯息传输的半导体晶片。电源电压、资料速率、工作电流、功率损耗和结温等效能参数都是 IC 介面的重要考量。这些介面积体电路(IC)在管理不同电子系统之间的讯号通讯方面发挥着至关重要的作用。

- 介面IC促进了不同电子元件和系统之间的无缝通讯和高效协作。透过实现电子设备内资料、控制讯号和电源的顺畅交换,这些 IC 可确保最佳效能。它专门设计用于支援各种通讯协定和标准,包括 USB、HDMI、乙太网路、SPI、I2C 和 CAN。

- 介面积体电路 (IC) 的需求不断增长,主要原因是连网型设备的激增。随着物联网生态系统的快速扩展,越来越多的设备需要无缝通讯和资料传输,使得介面积体电路对于促进各种组件和系统之间的资料交换至关重要。从家用电子电器到工业自动化等各个领域的连网型设备数量的增加,推动了对这些关键晶片的需求。爱立信预计,到2029年,全球连网型设备总数将达到457.2亿人。

- 消费性电子市场正随着创新产品和功能而不断进步。智慧型手机、平板电脑、穿戴式装置和智慧家庭设备越来越多地配备多个感测器、摄影机和连接选项,需要能够无缝整合这些组件、提供高级功能并增强用户体验的介面 IC。

- 随着电子设备变得越来越复杂,从而导致先进的系统单晶片(SoC)设计,介面 IC 的整合带来了重大挑战。平衡 SoC 内的效能、功耗和空间限制需要仔细考虑介面 IC 的选择和放置,这会使设计週期复杂化并增加开发成本。

介面 IC 市场趋势

汽车产业是快速成长的终端用户

- 在汽车领域,电动和混合动力汽车市场正在经历显着的成长。汽车技术和製造业的进步也推动了对更小、更节能设备的需求。

- 高级驾驶辅助系统 (ADAS) 的使用日益增多以及全球范围内强制使用 ADAS 的政府法规的实施也提升了这一领域的潜力。车载资讯娱乐系统的日益普及也有望提供成长机会。车载数位应用的不断进步需要介面IC和技术的不断发展。

- 汽车产业是介面 IC 的主要终端使用者之一。汽车技术和製造技术的进步推动了对紧凑、节能电子产品的需求。 5G 网路的快速扩张以及驾驶辅助和智慧交通车对车通讯等物联网 (IoT) 应用的日益普及,预计将增加对介面 IC 的需求。

- 2023 年 1 月,Synaptics Incorporated 宣布推出 SmartBridge SB7900 局部调光 IC,可实现更大、更高对比度和更高解析度的汽车 LCD,同时降低成本和功耗。 SB7900 SmartBridge 可提高影像品质、增加系统灵活性、减少装置占用空间、降低功耗并降低高达 30 吋和高达 6K 解析度的显示器的复杂性。这是透过整合驱动多个触控和显示驱动器整合 (TDDI) 控制器的能力以及背光阵列的局部调光技术来实现的。

- 随着整个全部区域的乘用车产量增加,ADAS(高级驾驶辅助系统)的采用也显着增加。预计这一趋势将推动对介面积体电路(IC)的需求。这些组件确保各种感测器、处理器和致动器之间的无缝通讯和资料传输。

- 这些IC处理来自摄影机、雷达和光达感测器的高速资料,以确保准确、及时的资讯处理。根据国际汽车工业组织(OICA)的统计数据,2019年,中国乘用车产量位居世界第一,为261.2376万辆;日本位居第二,为77.6543万辆。

亚太地区实现强劲成长

- 亚太地区拥有大量全球半导体製造工厂,其中以台积电、三星电子等产业领导者为首。该地区的主要国家包括台湾、韩国、日本和中国,占了相当大的市场占有率。

- 由于半导体製造活动量庞大,该地区预计将占据相当大的市场份额。据 WSTS 称,受积体电路需求成长的推动,半导体销售额预计将在 2024 年与前一年同期比较成长 17.5%,2025 年成长 12.3%。

- 印度、中国和日本等各国对家用电子电器产业的投资不断增加,大大推动了对介面积体电路的需求。例如,印度家用电子电器产业预计将有庞大的需求。 「印度製造」、「数位印度」等倡议协助消费性电子产业扩张。这些策略旨在透过加强国内製造业和数位基础设施,减少进口依赖,提高印度人对电子设备的取得和负担能力。预计这些努力将增加市场机会。

- 根据 IBEF 的报告,印度已成为重要的製造地,国内电子产品产量预计将从 2014-15 年的 290 亿美元成长到 2022-23 年的 1,010 亿美元。近日,印度电子和资讯技术部发布了印度电子製造业愿景文件第二卷,预测电子製造业规模将从2020-2021年的750亿美元扩大到2025-26年的3000亿美元。这些实质因素预计将推动市场成长。

- 据IBEF称,预计将推动印度电子製造业成长的一些关键产品包括行动电话、笔记型电脑和平板电脑等IT硬体、电视和音讯设备等家用电子电器产品、工业电子产品以及穿戴式和非穿戴式装置。

- 根据Quess Corp.的研究报告,2024年3月印度电子产业整体就业人数显着成长,较去年同期成长154%。根据Limited的研究报告显示,2024年3月就业人数较去年同期成长了154%。该地区的这些重大进步预计将推动整个电子产业对介面积体电路的需求。

- 此外,该地区智慧型手机领域的重大发展也有望推动市场发展。根据IBEF统计,印度已成为继中国之后第二大行动电话製造国。过去10年,印度行动电话产量增加了20倍,达到493亿美元(4.1兆印度卢比)。这一令人印象深刻的成长主要归功于政府的倡议,例如生产连结奖励挂钩激励(PLI)计划。如此一来,印度目前已经能够满足该国97%的行动电话需求,创造了巨大的市场机会。

介面IC产业概况

由于全球参与企业和中小型企业的存在,介面 IC 市场高度细分。市场的主要企业包括英飞凌科技股份公司、瑞萨电子株式会社、德州仪器公司、ADI 公司和微晶片科技公司。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 7 月 - 全球半导体参与企业ADI 公司 (Analog Devices Inc.) 正在与生物平台创新先驱 Flagship Pioneering 合作,加速完全数位化生物领域的发展。透过将 ADI 在类比和数位半导体工程方面的卓越成就与 Flagship Pioneering 的应用生物学专业知识相结合,此次合作旨在深化生物学洞察、改进测量、增强诊断并引入创新干预措施。

- 2024 年 4 月-Microchip Technology 收购 Neuronix AI Labs,为其在现场可程式闸阵列(FPGA) 上节能、AI主导的边缘解决方案提供支援。 Neuronix AI Labs 专门从事神经网路的稀疏优化,帮助公司降低功耗、尺寸和运算复杂性,同时保持影像分类、物件侦测和语义分割等任务的高精度。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 分析新冠肺炎疫情和宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 连网型设备和通讯技术的使用增加

- 智慧型手机、平板电脑和穿戴式装置等消费性电子产品的需求不断增长,推动了市场需求

- 市场限制

- 设计复杂性与製造整合挑战

第六章 市场细分

- 依产品类型

- CAN 介面 IC

- USB介面积体电路

- 显示介面 IC

- 其他的

- 按最终用户产业

- 家用电子电器

- 电讯

- 工业的

- 车

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Infineon Technologies AG

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Microchip Technology Inc

- NXP Semiconductors Nv

- Broadcom Inc.

- SEIKO Epson Corporation

- Toshiba Corporation

- ON Semiconductor Corporation

第八章投资分析

第九章:未来展望

The Global Interface IC Market size is estimated at USD 3.21 billion in 2025, and is expected to reach USD 4.08 billion by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

Interface ICs consolidate entire electronic interface circuit functions onto a single chip, ensuring cost-effective and reliable information sharing between devices. Their capability to manage and control communications across diverse electronic systems makes them integral to biometrics, electric vehicles, and telecommunications, fueling the demand for interface ICs in electronic circuit boards.

Key Highlights

- Integrated circuit (IC) interfaces are semiconductor chips that regulate and facilitate the transfer of information between devices. Performance parameters such as supply voltage, data rate, operational current, power dissipation, and temperature junction are all important considerations for IC interfaces. These interface-integrated circuits (ICs) play a crucial role in managing signal communications between different electronic systems.

- Interface ICs facilitate seamless communication and efficient collaboration among diverse electronic components and systems. By enabling the smooth exchange of data, control signals, and power within electronic devices, these ICs ensure optimal performance. They are specially designed to support a wide range of communication protocols and standards, including USB, HDMI, Ethernet, SPI, I2C, and CAN.

- The increasing demand for interface ICs is primarily driven by the proliferation of connected devices. As the IoT ecosystem rapidly expands, more devices require seamless communication and data transfer, where interface ICs are essential for facilitating this data exchange among various components and systems. Consequently, as sectors ranging from consumer electronics to industrial automation experience a rise in connected devices, the demand for these critical chips intensifies. According to Ericsson, the total number of connected devices across the globe is expected to reach 45.72 billion by 2029.

- The consumer electronics market is advancing with innovative products and features. Smartphones, tablets, wearables, and smart home devices are now being incorporated with multiple sensors, cameras, and connectivity options, requiring interface ICs as they enable the seamless integration of these components, providing advanced functionalities and enhancing user experiences.

- The increasing complexities of electronic devices have led to sophisticated system-on-chip (SoC) designs, presenting significant challenges for interface IC integration. Balancing performance, power consumption, and space constraints within the SoC requires careful consideration of interface IC selection and placement, complicating design cycles and raising development costs.

Interface IC Market Trends

Automotive Industry to be the Fastest Growing End User

- The market for electric and hybrid vehicles in the automotive sector is experiencing significant growth. The advancements in automotive technology and manufacturing are also increasing the demand for compact, power-efficient devices.

- The increasing usage of advanced driver-assistance systems (ADAS) and the implementation of government regulations worldwide that require ADAS are also broadening the potential of this sector. The rising adoption of vehicle infotainment will offer growth opportunities. The ongoing advancements in automotive digital applications necessitate the continual development of interface IC and technologies.

- The automotive sector is one of the significant end users of interface IC. The advancements in automotive technology and manufacturing are increasing the need for compact, energy-efficient electronics. The swift expansion of 5G networks and the rising popularity of Internet of Things (IoT) applications like assisted driving and vehicle-to-everything communication for intelligent transportation are expected to increase demand for interface ICs.

- Synaptics Incorporated introduced the SmartBridge SB7900 local dimming IC in January 2023, enabling larger, higher-contrast, higher-resolution car LCDs at a reduced cost and power consumption. The SB7900 SmartBridge offers improved image quality, increased system flexibility, decreased device footprint, power usage, and complexity for displays up to 30 inches and resolutions up to 6K. This is achieved by integrating the capability to drive multiple touch and display driver-integrated (TDDI) controllers with local dimming technology for the backlight array.

- With the increasing production of passenger cars across the region, the adoption of Advanced Driver Assistance Systems (ADAS) has risen significantly. This trend is expected to drive the demand for interface integrated circuits (ICs), as these components ensure seamless communication and data transfer among various sensors, processors, and actuators.

- These ICs handle high-speed data from cameras, radars, and LiDAR sensors, ensuring accurate and timely information processing. According to the International Organization of Motor Vehicle Manufacturers (OICA), China was the largest producer of passenger cars with 26,123.76 units, followed by Japan with 7,765.43 units.

Asia-Pacific to Register Major Growth

- The Asia-Pacific region is home to a considerable number of global semiconductor manufacturing facilities, prominently featuring industry leaders such as TSMC and Samsung Electronics. Key nations within this region, including Taiwan, South Korea, Japan, and China, possess substantial market shares.

- The region is anticipated to capture a significant portion of the market due to a high volume of semiconductor manufacturing activities. According to WSTS, a remarkable increase in semiconductor sales is projected, with a year-on-year growth of 17.5% in 2024 and 12.3% in 2025, driven by the rising demand for integrated circuits.

- The growing investments in the consumer electronics industry across various countries like India, China, Japan, and others are significantly driving the growth of the demand for interface integrated circuits. For instance, the market is expected to witness a significant demand across India's consumer electronics industry. Initiatives such as "Make in India" and "Digital India" have catalyzed expansion within the consumer electronics industry. These strategies are designed to enhance domestic manufacturing and digital infrastructure, thereby decreasing reliance on imports and increasing the accessibility and affordability of electronics for the Indian population. Such initiatives are expected to boost the market opportunities.

- As reported by IBEF, India has established itself as a prominent manufacturing center, with its domestic electronics production increasing from USD 29 billion in 2014-15 to USD 101 billion in 2022-23. Recently, the Ministry of Electronics & Information Technology published the second volume of the Vision document on Electronics Manufacturing in India, which projects that the electronics manufacturing sector will expand from USD 75 billion in 2020-21 to USD 300 billion by 2025-26. These substantial factors are anticipated to enhance the growth of the market.

- According to IBEF, the primary products anticipated to propel growth in India's electronics manufacturing sector include mobile phones, IT hardware such as laptops and tablets, consumer electronics like televisions and audio devices, industrial electronics, as well as wearables and wearables, among others.

- The electronics industry in India has experienced a remarkable 154% increase in overall hiring in March 2024 compared to the same period last year, as reported by research from Quess Corp. Limited. These notable advancements in the region are projected to enhance the demand for interface ICs throughout the electronics industry.

- The region's significant developments in the smartphone segment are also expected to drive market opportunities. IBEF stated that India has emerged as the second-largest mobile phone manufacturing nation, following China. Over the past decade, mobile phone production in India has increased twenty-onefold, achieving a value of USD 49.3 billion (INR 4.1 lakh crore). This remarkable growth can be attributed primarily to government initiatives, including the Production Linked Incentive (PLI) scheme. As a result, India is now capable of fulfilling 97% of its domestic mobile phone demand, which will create enormous market opportunities.

Interface IC Industry Overview

The interface IC market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Infineon Technologies AG, Renesas Electronics Corporation, Texas Instruments Incorporated, Analog Devices Inc., and Microchip Technology Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2024 - Analog Devices Inc., a global player in semiconductors, teamed up with Flagship Pioneering, a pioneer in bio-platform innovations, to fast-track the evolution of a fully digitized biological realm. By merging ADI's prowess in analog and digital semiconductor engineering with Flagship Pioneering's applied biology expertise, the collaboration aims to unveil deeper biological insights, refine measurements, enhance diagnostics, and introduce innovative interventions.

- April 2024 - Microchip Technology acquired Neuronix AI Labs, enhancing its power-efficient, AI-driven edge solutions on field programmable gate arrays (FPGAs). Neuronix AI Labs specializes in neural network sparsity optimization, allowing for reduced power consumption, size, and computational needs in tasks like image classification, object detection, and semantic segmentation, all while ensuring high accuracy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact Analysis of COVID-19 and Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of Connected Devices and Communication Technologies

- 5.1.2 Increasing Demand for Consumer Electronics Such as Smartphones, Tablets, and Wearables, Driving Demand in the Market

- 5.2 Market Restraints

- 5.2.1 Complexity in Design and Integration Challenges in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 CAN Interface IC

- 6.1.2 USB Interface IC

- 6.1.3 Display Interface IC

- 6.1.4 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecom

- 6.2.3 Industrial

- 6.2.4 Automotive

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices, Inc.

- 7.1.5 Microchip Technology Inc

- 7.1.6 NXP Semiconductors Nv

- 7.1.7 Broadcom Inc.

- 7.1.8 SEIKO Epson Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 ON Semiconductor Corporation