|

市场调查报告书

商品编码

1548955

MOSFET 功率电晶体:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)MOSFET Power Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

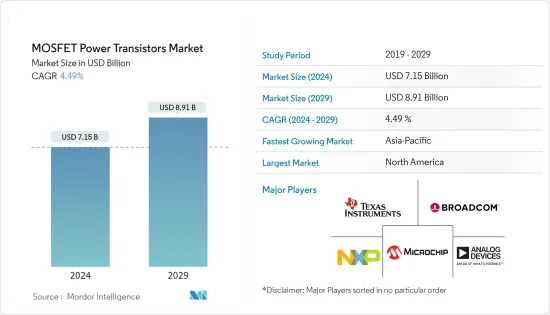

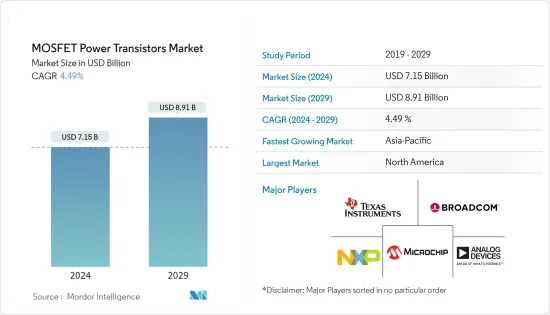

MOSFET功率电晶体市场规模预计到2024年为71.5亿美元,预计到2029年将达到89.1亿美元,在预测期内(2024-2029年)复合年增长率为4.49%。

主要亮点

- 金属氧化物半导体场效电晶体,也称为MOSFET,被广泛认为是场效电晶体(FET)的主流类型。 MOSFET 既充当电力开关又充当放大器,根据施加到其闸极端子的电压调节其源极端子和漏极端子之间的电流。 MOSFET 因其低功耗、高开关速度、高效小型化和高密度封装等优异特性而成为积体电路的首选元件。

- 功率MOSFET在电路中扮演调节大电流和功率的功能。该组件通常是单独封装的单一晶体管。常见于开关电源和马达控制器。电子产业严重依赖 MOSFET 功率电晶体。功率 MOSFET 广泛整合到各种消费性电子产品中。预计消费电子产业将出现显着成长,并且预测期为市场研究提供了机会。

- 同样,MOSFET 由于在能源和电力行业的快速采用而变得越来越受欢迎。人们越来越重视节能,随着石化燃料的消耗,人们开始转向使用可再生电力源。因此,对功率 MOSFET 的需求正在迅速增加。根据国际能源总署(IEA)预测,根据目前的政策设置,预计到2030年可再生能源将占新增发电量的80%。这些重大进步预计将进一步推动 MOSFET 的需求。

- 供应商也大力投资其各种产品的技术创新。例如,东芝电子欧洲有限公司于 2023 年 6 月宣布推出新的 N 通道功率 MOSFET 系列。 TK055U60Z1是600V DTMOSVI系列中的首款产品,采用东芝尖端製程-超接面结构。它可用于多种应用,包括资料中心的高效能开关电源、太阳能发电的功率调节器以及不断电系统系统。

- 此外,MOSFET功率电晶体在航太和国防领域的使用也显着增加。由于客运量和军事开支的增加,全球航太业正在经历显着增长,预计这将推动对 MOSFET 功率晶体管的需求。此外,研究人员也正在探索新的应用领域,从而开发创新解决方案。例如,2023年6月,GE研究中心的科学家成功展示了一种SiC MOSFET,可以承受超过800摄氏度的温度,高于先前演示的温度。这项突破凸显了 SiC MOSFET 在极端工作条件下支援未来应用的潜力。

- 千禧世代电子设备、医疗保健设备的普及以及混合动力汽车和电动车(HEV 和 EV)的出现有力地支持了电子和汽车行业的快速成长。此外,由于技术的不断进步和创新技术的引入,MOSFET功率电晶体市场预计将蓬勃发展。这表明MOSFET功率电晶体在可预见的未来具有为不断扩大的电子和汽车领域做出贡献的巨大潜力。

- 此外,分立功率 MOSFET 是工业、汽车和家庭中常用的电晶体元件,用于控制高电压、高电流讯号。这些产业对高效能电源解决方案的需求日益增长,带来了更高开关频率、更小尺寸、更轻重量和更好的热控制等挑战。

- 2020 年初,COVID-19 的广泛爆发对所研究市场的供应链和生产造成了重大干扰。此外,市场的许多最终用户部门受到了 COVID-19 大流行的影响,为市场带来了不利的后果。然而,随着2021年停工规定的逐步放鬆,采用MOSFET的产品需求明显激增,对市场产生了正面影响。

MOSFET功率晶体管市场趋势

汽车和交通运输预计将占据主要市场占有率

- 由于全球对电动车的需求不断增长并确保驾驶员的安全,MOSFET功率电晶体广泛应用于汽车。 MOSFET 功率电晶体有望推动市场需求,因为它们改善了驱动器连接性、驾驶和安全创新。汽车的快速电气化正在推动汽车MOSFET功率电晶体市场的成长。

- ADAS(高级驾驶辅助系统)的日益普及以及全球范围内对 ADAS 的政府法规的不断增加也正在扩大该细分市场的范围。车载资讯娱乐系统采用率的持续增加预计也将提供成长机会。然而,汽车数位应用日益复杂,需要 MOSFET 功率电晶体和技术不断发展。

- 在汽车产业,电气化和自动驾驶技术日益普及,车辆配备了更多的电子和控制单元。例如,比亚迪将在2022年超越特斯拉,成为插电式电动车的最大製造商。年内,比亚迪销售插电式电动车约185万辆。此外,人工智慧和物联网的引入等技术进步,以及有利于自动驾驶、连网型和低排放气体车辆生产的政府标准,也进一步推动了市场的成长。

- 此外,汽车领域对 MOSFET 不断增长的需求和用例也推动供应商开发创新解决方案,预计将进一步推动所研究市场的成长。例如,2022年7月,东芝电子元件及储存装置宣布开发出低导通电阻并显着降低开关损耗的碳化硅(SiC)MOSFET。目前,SiC功率装置越来越多地应用于铁路逆变器,但更广泛的应用前景正在显现,包括汽车电气化和工业设备的小型化。

亚太地区预计将占据主要市场占有率

- 预计亚太地区将占据 MOSFET 功率电晶体市场的最高份额。这一成长的推动因素包括消费性电子产品的普及、该地区消费者可支配收入的增加、技术进步的不断发展、基础设施的蓬勃发展以及该地区技术进步的不断进步。

- 亚太市场的成长预计也将受到该地区多家功率 MOSFET 製造商的存在以及买家获得产品的便利性等因素的影响。此外,该地区拥有庞大的消费群体、不断增长的家电需求以及稳步增长的汽车工业,为MOSFET功率电晶体的发展创造了合适的市场。

- 近几十年来,由于工业部门的快速发展,中国已成为该地区的主要经济体。根据世界银行统计,过去几十年来,中国工业部门以年均近10%的速度成长,使中国成为全球製造地,并使MOSFET功率电晶体广泛应用于多种工业部门的产品和设备中。了对MOSFET 功率电晶体的需求。

- 此外,日本在 MOSFET 功率电晶体市场中占有重要地位,是多家主要製造商以及电子和医疗保健设备行业的所在地。根据日本财务省的数据,2023 年医疗和药品出口价值为 1,018.15 亿日圆(680.86 美元)。此外,近年来,为了振兴半导体产业,该国开始专注于吸引半导体企业并与其他国家结盟,这有望促进市场研究机会。

MOSFET功率晶体管产业概况

MOSFET 功率晶体管市场竞争中等,有许多地区性和全球性公司的存在。专注于创新的大公司的各种收购和联盟预计很快就会发生。主要市场参与者包括 Analog Devices Inc.、德州仪器 (Texas Instruments)、博通 (Broadcom) Inc. 和恩智浦半导体 (NXP Semiconductors)。

- 2023年10月,东芝电子欧洲公司(以下简称「东芝」)推出了采用最新U-MOS IX-H製程的汽车级40V N通道功率MOSFET。新装置采用新封装S-TOGLTM(小型电晶体轮廓鸥翼引线),为汽车应用提供了许多优势。

- 2023 年 7 月 Micro Commercial Components Corp. 推出创新 TO 无引线 (TOLL) 封装,可在小型 N 通道 MOSFET 中实现高电流。该公司表示,这四款新型 TOLL 高功率 MOSFET 是满足工业应用严苛需求的智慧解决方案。此外,这些解决方案还具有额外的功能,可消除尺寸作为设计限制,降低整体组件成本,并提供最大的运作效率。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估宏观趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 扩大 MOSFET 功率电晶体在消费性电子应用的使用

- 智慧型手机和平板设备的高渗透率以及MOSFET功率电晶体的需求不断增长

- 市场挑战

- 製造流程复杂

第六章 市场细分

- 按最终用户产业

- 汽车/运输设备

- 家电

- 工业的

- 製造业

- 卫生保健

- 航太/国防

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Infineon Technologies AG

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Microchip Technology Inc

- NXP Semiconductors.

- Broadcom Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Vishay Intertechnology Inc.

第八章投资分析

第9章市场的未来

The MOSFET Power Transistors Market size is estimated at USD 7.15 billion in 2024, and is expected to reach USD 8.91 billion by 2029, growing at a CAGR of 4.49% during the forecast period (2024-2029).

Key Highlights

- The metal-oxide-semiconductor field-effect transistor, also known as MOSFET, is widely recognized as the predominant type of field-effect transistor (FET). MOSFETs function as both electrical switches and amplifiers, regulating the flow of electricity between the source and drain terminals in response to the voltage applied to the gate terminal. MOSFETs are favored for their superior characteristics, such as lower power consumption, faster switching speeds, and the ability to be efficiently miniaturized and densely packed, rendering them ideal for integrated circuits.

- Power MOSFETs serve the purpose of regulating high current or power in circuits. These components are typically single transistors packaged individually. They are commonly found in switching power supplies and motor controllers. The electronics industry heavily relies on MOSFET power transistors. Power MOSFETs are extensively integrated into a broad spectrum of consumer electronics. With significant growth projected for the consumer electronics industry, the forecast period will offer opportunities for the market studied.

- Similarly, the rapid adoption of MOSFETs in the energy and power industry has made them increasingly popular. With a growing emphasis on energy conservation and the depletion of fossil fuels, there has been a shift toward utilizing renewable sources of electricity. Consequently, there has been a surge in demand for power MOSFETs. According to the International Energy Agency (IEA), renewables are projected to account for 80% of new power generation capacity by 2030, based on current policy settings. These substantial advancements are anticipated to further drive the demand for MOSFETs.

- Various vendors are also significantly investing in innovating various products. For instance, in June 2023, Toshiba Electronics Europe GmbH unveiled a fresh lineup of N-channel power MOSFETs. The inaugural addition to the 600 V DTMOSVI series is the TK055U60Z1, which incorporates Toshiba's cutting-edge process featuring a super junction structure. These MOSFETs are designed for various applications, including high-efficiency switching power supplies in data centers, power conditioners for photovoltaic generators, and uninterruptible power systems.

- In addition, there is a notable increase in the utilization of MOSFET power transistors in the aerospace and defense sectors. The global aerospace industry is experiencing substantial growth due to the rise in passenger traffic and military spending, which is expected to drive the demand for these transistors. Moreover, researchers are also exploring new application areas, leading to the development of innovative solutions. For example, in June 2023, scientists at GE Research successfully showcased SiC MOSFETs that can withstand temperatures exceeding 800o C, surpassing previous demonstrations. This breakthrough highlights the potential of SiC MOSFETs in supporting future applications in extreme operating conditions.

- The exponential growth of the electronics and automotive industries is strongly backed by the widespread use of electronic devices among millennials, healthcare devices, and the emergence of hybrid and electric vehicles (HEVs and EVs). Additionally, the power MOSFET transistors market is expected to flourish due to continuous technological advancements and the introduction of innovative technologies. This indicates that power MOSFET transistors have immense potential to contribute to the ever-expanding electronics and vehicle sectors in the foreseeable future.

- Additionally, discrete power MOSFETs are transistor components commonly used in industrial, automotive, and consumer settings to control high-voltage and high-current signals. The increasing need for efficient power solutions in these industries presents challenges like elevated switching frequencies, reduced sizes, lighter weights, and enhanced thermal control.

- The widespread outbreak of COVID-19 at the beginning of 2020 resulted in significant disturbances to the supply chain and production in the market studied. Additionally, numerous end-user sectors in the market were affected by the COVID-19 pandemic, causing detrimental consequences on the market. However, with the gradual relaxation of lockdown restrictions in 2021, there was a clear surge in the demand for products incorporating MOSFETs, leading to a favorable influence on the market.

MOSFET Power Transistors Market Trends

Automotive and Transportation is Expected to Hold Significant Market Share

- With the increasing demand for electric vehicles worldwide and to keep drivers safe, MOSFET power transistors are widely used in cars. MOSFET power transistors improve connectivity driving and safety innovation among drivers, which is expected to fuel market demand. The rapid electrification of vehicles is driving the growth of the automotive MOSFET power transistors market.

- The growing adoption of advanced driver-assistance systems (ADAS) and increasing government regulations globally mandating ADAS are also expanding the scope of this segment. Also, the ever-increasing adoption of vehicle infotainment is expected to provide growth opportunities. However, the growing complexity of automotive digital applications requires the constant evolution of MOSFET power transistors and technologies.

- With electrification and autonomous technologies becoming prevalent in the automotive industries, more electronic and control units are being installed, which, in turn, is driving the demand for MOSFET power transistors in the market studied. For instance, in 2022, BYD surpassed Tesla as the leading manufacturer of plug-in electric vehicles. Around 1.85 million plug-in electric vehicles were sold by BYD that year. Additionally, technological advancements, such as the implementation of AI, IoT, and favorable government standards for the production of autonomous, connected, and low-emission vehicles, are further fuelling the market's growth.

- Furthermore, the growing demand and use cases of MOSFETs in the automotive sector also encourage the vendors to develop innovative solutions, which is anticipated to further facilitate the studied market's growth. For instance, in July 2022, Toshiba Electronic Devices & Storage Corporation announced the development of silicon carbide (SiC) MOSFETs with low on-resistance and significantly reduced switching loss. While SiC power devices are now increasingly being utilized in inverters for trains, the broader application is on the horizon, coming in vehicle electrification and the miniaturization of industrial equipment.

Asia-Pacific Expected to Witness Significant Market Share

- Asia-Pacific is projected to account for the highest share of the MOSFET power transistors market. The growth can be attributed to factors such as the increasing adoption of consumer electronics devices, growing disposable income of consumers in the region, rising technological advancements, booming infrastructure, and rising technological advancements in the region.

- The growth of the Asia-Pacific market is also anticipated to be influenced by factors such as the presence of several manufacturers of power MOSFET in the region, making it easy for buyers to get the product. Furthermore, the presence of a large consumer base, the expanding demand for consumer electronics products, and the steady growth of automotive industries in the region together create a market suitable for developing MOSFET power transistors.

- In the last few decades, China has emerged as the major economy in this region owing to the rapid development of the industrial sector. According to the World Bank, the industrial sector in China has averaged almost 10% a year in the last few decades, making the country the global manufacturing hub while also driving the demand for MOSFET power transistors as they are widely used in products/equipment across various industries.

- Furthermore, Japan also holds a significant position in the MOSFET power transistors market, home to some substantial manufacturers and the electronics and healthcare equipment industry. According to the Ministry of Finance, Japan, in 2023, exports of medical and pharmaceutical products stood at JPY 101,815 million (USD 680,086). In recent years, the company has also started focusing on luring semiconductor companies and engaging in partnerships with other nations to boost its semiconductor industry, which is anticipated to drive opportunities in the market studied.

MOSFET Power Transistors Industry Overview

The MOSFET power transistors market is moderately competitive, with many regional and global players. Various acquisitions and collaborations of large companies are expected to take place shortly, focusing on innovation. Some key market players include Analog Devices Inc., Texas Instruments, Broadcom Inc., and NXP Semiconductors.

- October 2023: Toshiba Electronics Europe GmbH ("Toshiba") launched a pair of automotive grade 40 V N-channel power MOSFETs based upon its latest U-MOS IX-H process. The new devices use a new S-TOGLTM (Small Transistor Outline Gull-wing Leads) package that provides a number of advantages in automotive applications.

- July 2023: Micro Commercial Components Corp. launched an innovative TO-Leadless (TOLL) package designed to enable high currents in a small N-channel MOSFET. According to the company, the four new TOLL high-power MOSFETs are smart solutions for the stringent demands of industrial applications. Additionally, these solutions are equipped with additional features to remove size as a design constraint, reduce overall component costs, and provide maximum operational efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of MOSFET Power Transistor in Consumer Electronics Applications

- 5.1.2 High Adoption of Smartphones and Tablets and Growing Requirement for MOSFET Power Transistor

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Automotive and Transportation

- 6.1.2 Consumer Electronics

- 6.1.3 Industrial

- 6.1.4 Manufacturing

- 6.1.5 Healthcare

- 6.1.6 Aerospace and Defense

- 6.1.7 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Microchip Technology Inc

- 7.1.6 NXP Semiconductors.

- 7.1.7 Broadcom Inc.

- 7.1.8 Mitsubishi Electric Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Vishay Intertechnology Inc.