|

市场调查报告书

商品编码

1549578

PET 包装:市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)PET Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

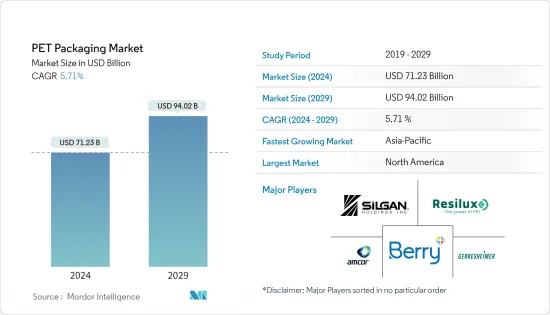

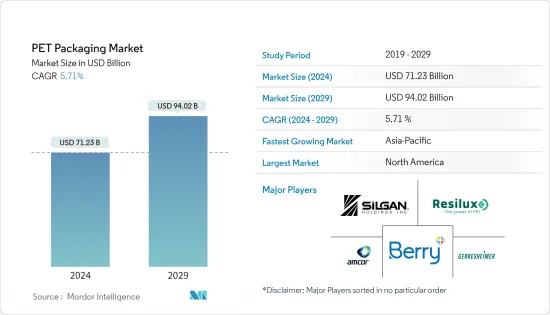

预计 2024 年 PET 包装市场规模将达到 712.3 亿美元,预计在预测期内(2024-2029 年)复合年增长率为 5.71%,到 2029 年将达到 940.2 亿美元。

对环保包装解决方案和 PET 优越性能的需求不断增长,预计将在预测期内推动全球 PET 包装市场的成长。

主要亮点

- 包装产业在环保技术方面不断取得长足进步,以满足客户对更永续的社会的需求。客户越来越认识到高性能包装可以延长产品的保质期。这种意识增加了对环保的消费后包装选择的需求,特别是 PET(聚对苯二甲酸乙二醇酯)包装解决方案。

- PET 比玻璃轻 90%,降低运输成本。 宝特瓶最近取代了笨重、易碎的玻璃瓶,为矿泉水等饮料提供可重复使用的包装。

- 公司和产品使用 PET 的一些进展和趋势显示了对 PET 的关注和市场的成长。 PET 有多种用途,由于它是透明的并且具有内置的 CO2 屏障,因此可以轻鬆吹製成瓶子或成型为片材。可以透过着色剂、紫外线防护剂、氧气阻隔剂/清除剂和其他添加剂来增强 PET 的性能,以製造出满足品牌需求的瓶子。

- PET 容器通常用于包装网球、果汁、沙拉酱、食用油、花生酱、液体洗手剂和苏打水等产品。 PET 主要用于製造单份和 2 公升瓶装的碳酸饮料和水,销往全国各地,包括美国。外带的预製家常小菜容器由特殊等级的 PET 製成,可在烤箱或微波炉中加热。

- 大多数水和软性饮料容器均由高度可回收的聚对苯二甲酸乙二醇酯 (PET) 製成。然而,随着全球宝特瓶使用量的增加,收集和回收它们以防止对海洋造成损害的努力却落后了。一项研究一次性和可重复使用汽水瓶的影响发现,例如,如果宝特瓶的回收率为 40% 至 60%,则与原生材料製成的瓶相比,其产生的排放将减少32% 。

- COVID-19 大流行让一次性包装供应商鬆了一口气。许多国家已逐渐禁止这些包装并推广可重复使用的包装,但疫情改变了消费者和政府的行为。 COVID-19 大大增加了对能量饮料和保健食品的需求。这些产品大多数采用 PET 等一次性塑胶包装。

PET包装市场趋势

瓶子领域显着成长

- 聚对苯二甲酸乙二醇酯 (PET) 因其对水蒸气、气体、稀酸、石油和酒精的高阻隔阻隔性而成为食品包装的常用材料。此外,PET易于回收,具有适度的柔韧性,且不易破碎。据地球日组织者称,美国每分钟购买一百万个宝特瓶。美国人平均每年用 167 个宝特瓶喝水。随着该地区饮用水需求的增加, 宝特瓶和机壳的市场正在扩大。

- PET衍生PE,与其他类型的塑胶相比具有卓越的刚度。此外,它还保持坚固的保护结构并具有出色的防潮性。 PET 用于製造一次性塑胶容器,也用于包装冷冻和已调理食品。 PET 是首选,因为它具有健康的油屏障,可以防止可能损害材料的化学物质。

- 电子商务领域的拓展也为全球市场的拓展做出了巨大贡献。许多品牌经常采用 PET ,宝特瓶和罐子易于携带。 宝特瓶重量轻,不需要小心搬运,这大大降低了运输成本。因此,预计在预测期内人们网路购物的成长趋势将支撑对PET包装的需求。

- 由于全球食品和饮料需求的增加,预计用于製造瓶子和罐子的 PET 需求将大幅增加。此外,医疗保健领域对干洗手剂宝特瓶包装的需求增加。预计这一趋势将持续保持在较高水平,从而支持用于干洗手剂包装的宝特瓶的扩张。

- 公司和产品使用 PET 的方式的一些进展和趋势表明,人们对 PET 的关注度和市场占有率不断增加。 PET有多种用途,很容易吹製成瓶和成型为片材。可以透过着色剂、紫外线防护剂、氧气阻隔剂/清除剂和其他添加剂来增强 PET 的性能,以製造出满足品牌需求的瓶子。

亚太地区市场成长显着

- 中国是全球最大的聚对苯二甲酸乙二醇酯(PET)市场之一。在过去的几年里,由于原材料的可用性和较低的製造成本,PET等工程塑胶的产量不断增长。中国对宝特瓶的需求不断增加。可见,无酒精饮品对于中国宝特瓶的成长有多么重要。瓶装水产业及其主要企业康师傅和农夫山泉,以及中国瓶装水消费量的年比大幅成长,也对宝特瓶的成长产生了重大影响。

- 由于 PET 相对于目前使用的传统包装聚合物的优越性,PET 产品在包装领域(特别是 PET 容器和瓶子)的使用正在增加。出口和国内消费的成长正在推动中国食品和饮料行业、消费品等行业对包装材料的需求。

- 印度生产多种塑料,包括聚丙烯(PP)、聚对苯二甲酸乙二醇酯(PET)和聚氯乙烯(PVC)。印度拥有庞大的PET生产能力,可以满足国内市场的大部分需求。但国内市场PET消费量也存在地区差异。由于大量的终端用户营运和庞大的分销网络,印度北部和西部占据了 PET 使用的大部分。

- 在印度,外出消费食品的趋势导致对 PET 和金属罐等材料包装的单份和小尺寸食品的需求激增。由于消费者专注于预算并寻求物有所值的产品,PET 等软包装材料在全国范围内仍然广泛使用。

- 然而,消费者开始倾向于替代包装材料,因为它们对环境友好。由于玻璃和铝材环保且可回收性高,因此在该地区的接受率很高。因此,消费者越来越远离塑胶。

PET包装产业概况

PET 包装市场较为分散,由多家大型企业组成,包括 Amcor Ltd、Gerresheimer AG、Berry Global Group Inc.、Silgan Holdings Inc. 和 Resilux NV。这些拥有重要市场占有率的市场公司致力于扩大其国际消费群。这些公司利用战术性合资企业来增加市场占有率和盈利。例如

- 2024 年 5 月,塑胶包装公司 LPLA 推出了由聚对苯二甲酸乙二醇酯 (PET) 製成的可回收酒瓶。这项创新解决方案可减少 50% 的碳排放,并节省高达 30% 的成本。它有 750 毫升和 1 公升容量可供选择,经过精心设计,可简化装瓶和运输操作。值得注意的是,750ml的宝特瓶仅重50g,相较于传统玻璃瓶仅重12.5%。

- 2024 年 4 月,可口可乐公司在美国和加拿大为其起泡饮料系列推出了重新设计且更轻的聚对苯二甲酸乙二醇酯 (PET) 瓶。此措施是公司促进包装领域循环经济总体目标的重要组成部分。特别值得注意的是创新的瓶子形状,大大减少了生产所需的原料。该公司为其可口可乐和雪碧瓶子采用独特的设计,同时为其其他气泡水品牌和美汁源瓶打造出统一的外观。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- PET的优异性能

- 对环保包装的需求不断成长

- 市场限制因素

- 部分地区禁止使用塑胶法规

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依产品类型

- 瓶子和罐子

- 包包/袋

- 托盘

- 盖子/盖子与封口装置

- 其他产品类型

- 按包装

- 难的

- 灵活的

- 按最终用户产业

- 饮食

- 药品

- 个人护理/化妆品

- 工业产品

- 家居用品

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Amcor Ltd

- Resilux NV

- Gerresheimer AG

- Berry Global Group Inc.

- Silgan Holdings Inc.

- Graham Packaging Company

- GTX Hanex Plastic Sp. zoo

- Dunmore Corporation

- Comar LLC

- Sonoco Products Company

- Huhtamaki OYJ

- Nampak Limited

第七章 投资分析

第八章 市场机会及未来趋势

The PET Packaging Market size is estimated at USD 71.23 billion in 2024, and is expected to reach USD 94.02 billion by 2029, growing at a CAGR of 5.71% during the forecast period (2024-2029).

The increasing demand for environmentally friendly packaging solutions and the outstanding properties of PET are expected to drive the growth of the global PET packaging market over the forecast period.

Key Highlights

- The packaging sector keeps making significant strides in environment-friendly technologies to satisfy customer demand for a more sustainable society. Customers increasingly know that high-performance packaging may lengthen a product's shelf life. This awareness has increased the need for environment-friendly end-of-life packaging options, particularly PET (polyethylene terephthalate) packaging solutions.

- PET can result in weight reductions of up to 90% compared to glass, making shipping more affordable. As they provide reusable packaging for beverages like mineral water, PET plastic bottles have increasingly replaced bulky, brittle glass bottles in recent years.

- Several advancements and trends in how companies and products use PET indicate the attention on PET and the market's growth. PET has many uses and is easily blown into bottles or shaped into sheets due to its clarity and built-in CO2 barriers. PET characteristics can be enhanced with colorants, UV blockers, oxygen barriers/scavengers, and other additives to create bottles that meet a brand's requirements.

- PET containers are often used for packaging goods, including tennis balls, juice, salad dressing, cooking oil, peanut butter, liquid hand soap, and soda. PET is primarily used to make single-serving and two-liter bottles of carbonated soft drinks and water distributed throughout the nation, including the United States. Containers for take-home prepared meals that may be warmed in the oven or microwave are made of exceptional grades of PET.

- Most water and soft drink containers are constructed of highly recyclable polyethylene terephthalate (PET). However, attempts to collect and recycle the bottles to prevent them from damaging the oceans are falling behind as their use increases globally. For instance, if a PET bottle had 40%-60% recycled content, its emissions would be decreased by 32%-48% compared to one made from virgin material, according to a study examining the effects of single-use and reusable bottles for carbonated soft drinks.

- The COVID-19 pandemic provided significant relief to single-use packaging vendors. Although many countries were slowly banning these packaging and promoting reusable packaging, the pandemic changed consumer and government behavior. Due to COVID-19, the demand for nutritional drinks and healthy food increased exponentially. Most of these products are packaged with single-use plastic, such as PET.

PET Packaging Market Trends

Bottles Segment to Witness Significant Growth

- The high barrier qualities of polyethylene terephthalate (PET) against water vapor, gases, diluted acids, oils, and alcohols make it a common material for food packing. Moreover, PET is easy to recycle, reasonably flexible, and shatterproof. According to Earth Day organizers, one million plastic bottles are purchased in the United States every minute. The average American drinks in 167 plastic water bottles annually. Due to the region's growing need for packaged drinking water, there is an increasing market for PET plastic tops and enclosures.

- PET, derived from PE, offers excellent stiffness compared to other types of plastic. In addition, it keeps a robust protective structure and possesses extraordinary moisture resistance abilities. PET is used to make disposable plastic containers that are also used for packaging frozen or ready-to-eat foods. PET is well-liked because it provides a sound oil barrier, which helps the material fend off chemicals that could harm it.

- The expanding e-commerce sector also contributes substantially to the market's expansion worldwide. Numerous brands are employing PET more frequently because it is simple to carry PET bottles and jars from a logistics perspective. Because PET bottles are lightweight and do not need to be handled carefully, the cost of transportation is greatly diminished. Therefore, it is projected that the demand for PET packaging will be supported over the forecast period by people's growing propensity toward online shopping.

- The demand for PET for creating bottles and jars is anticipated to increase significantly due to the rising demand for food and beverage items worldwide. In addition, the packaging of hand sanitizers in PET bottles saw a rise in demand in the healthcare sector. It is anticipated to stay high, fuelling the expansion of PET bottles for hand sanitizer packaging.

- Several advancements and trends in how companies and products use PET demonstrate the focus on PET and the expansion of its market share. PET has many uses and is easily blown into bottles or shaped into sheets. PET characteristics can be enhanced with colorants, UV blockers, oxygen barriers/scavengers, and other additives to create bottles that meet a brand's requirements.

Asia-Pacific to Register Significant Growth in the Market

- China is among the largest polyethylene terephthalate (PET) markets worldwide. For the past few years, the country's growing production of engineering plastics, such as PET, has been aided by the plentiful availability of raw materials and low cost of manufacture. The demand for PET bottles in China is constantly rising. It is obvious how critical soft drinks are to PET packaging's growth in China. It is significantly influenced by the bottled water industry and its key players, like Master Kong and Nongfu Spring, as well as the significant rise in bottled water consumption in China yearly.

- Due to PET's benefits over the currently utilized traditional packaging polymers, the usage of PET goods in the packaging sector (PET containers and bottles, among others) is increasing. Due to rising exports and domestic consumption, packing materials are in higher demand in China from sectors including the food and beverage industry, consumer goods, and others.

- A variety of plastics, including polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others, are produced in India. India has a massive capability for producing PET, and most of the domestic market's needs are met. However, regional differences also exist in the domestic market's consumption of PET. Due to numerous end-user businesses and a vast distribution network, the North and West of India account for most PET use.

- The demand for single-serve and small-sized goods packaged in materials like PET and metal cans has surged in India as the country adopts an on-the-go food consumption trend. Because consumers are budget-aware and look for products that provide value for money, flexible packaging materials like PET are still widely used nationwide.

- However, consumers have started gravitating toward alternate packaging materials because they have eco-friendly qualities. Due to their eco-friendliness and high capacity for recycling, glass and aluminum have seen significant acceptance rates in the region. As a result, customers are turning away from plastic in more significant numbers.

PET Packaging Industry Overview

The PET packaging market is fragmented and consists of several major players, such as Amcor Ltd, Gerresheimer AG, Berry Global Group Inc., Silgan Holdings Inc., and Resilux NV. These market players with a significant market share are concentrating on growing their international consumer base. These businesses use tactical joint ventures to raise their market share and profitability. For instance,

- In May 2024, LPLA, a plastic packaging company, unveiled a recyclable wine bottle crafted from polyethylene terephthalate (PET). This innovative solution slashes carbon footprints by a remarkable 50%, offering potential cost savings of up to 30%. Available in both 750 ml and one-liter capacities, these bottles are meticulously designed to streamline bottling and shipping operations. Notably, the 750 ml PET bottle weighs a mere 50 g, just 12.5% of the weight of its traditional glass counterparts.

- In April 2024, The Coca-Cola Co. rolled out redesigned, lighter polyethylene terephthalate (PET) bottles across its sparkling beverage range in the United States and Canada. This initiative is a key part of the company's overarching goal to foster a circular economy within its packaging realm. Notably, these bottles boast innovative shapes that significantly reduce the raw materials needed for their production. The company has crafted distinct designs for its Coca-Cola and Sprite bottles while unifying the look of its other sparkling brands and Minute Maid offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Outstanding Properties of PET

- 4.3.2 Rising Demand for Environment-friendly Packaging

- 4.4 Market Restraints

- 4.4.1 Regulations Against the Use of Plastics in Some Regions

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Types

- 5.1.1 Bottles and Jars

- 5.1.2 Bags and Pouches

- 5.1.3 Trays

- 5.1.4 Lids/Caps and Closures

- 5.1.5 Other Product Types

- 5.2 By Packaging

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.3 By End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceuticals

- 5.3.3 Personal Care and Cosmetic Industry

- 5.3.4 Industrial Goods

- 5.3.5 Household Products

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd

- 6.1.2 Resilux NV

- 6.1.3 Gerresheimer AG

- 6.1.4 Berry Global Group Inc.

- 6.1.5 Silgan Holdings Inc.

- 6.1.6 Graham Packaging Company

- 6.1.7 GTX Hanex Plastic Sp. z.o.o.

- 6.1.8 Dunmore Corporation

- 6.1.9 Comar LLC

- 6.1.10 Sonoco Products Company

- 6.1.11 Huhtamaki OYJ

- 6.1.12 Nampak Limited