|

市场调查报告书

商品编码

1683833

PET 饮料包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pet Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

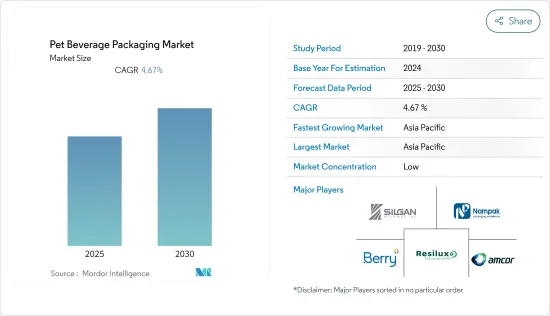

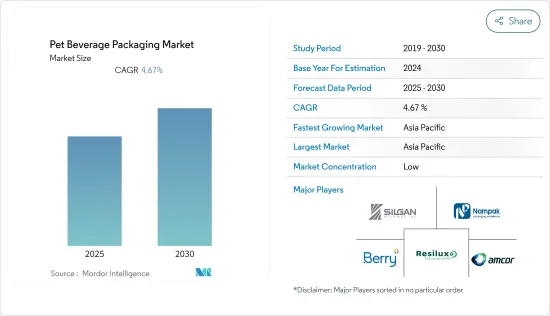

预测期内,PET 饮料包装市场预计将达到 4.67% 的复合年增长率。

聚对苯二甲酸乙二醇酯(PET)正在扩大宝特瓶的用途。宝特瓶、软水领域对PET包装的需求日益增加。目前已有许多创意、经济且环保的包装选择,其中PET是广受认可的材料。

主要亮点

- 聚对苯二甲酸乙二醇酯作为一种材料的优点在于它具有抗碎裂性,与饮料接触时不会发生反应,并且具有较高的强度重量比。其重量轻也降低了使用 PET 包装运送产品的成本。 PET塑胶是饮料产品的安全包装材料。 PET 塑胶已获得美国FDA 和北美类似监管机构的核准,可安全与食品和饮料接触。

- 俄罗斯与乌克兰战争导致多国遭受经济制裁,大宗商品价格上涨,供应链中断。针对这项衝突,一些公司已对俄罗斯实施制裁,暂停其在乌克兰和其他欧洲国家的营运活动。俄罗斯与乌克兰的衝突引发抗议活动,为石油和天然气市场带来巨大不确定性,进一步加剧了全球大宗商品市场本已较高的通膨压力。一些製造商也正在努力将需求从塑胶转向其他原料。

- 生活方式的改变以及由此产生的消费者对包装饮料的依赖正在推动宝特瓶包装产品的销售。这一趋势推动了具有优异阻隔性、便捷形式、高品质印刷性和谨慎使用材料资源的产品的销售。世界各地的消费者对饮用水包装的需求日益增加,这种包装比其他包装方式更耐用、更易于使用,能够更好地保护产品,并避免潜在的腐败因素。由于其成本低廉,它正在推动宝特瓶包装市场的发展。

- 由于监管规范的变化(主要是由于环境问题日益严重),预计市场将面临重大挑战。世界各国政府正在回应公众对塑胶包装废弃物的担忧,并实施法规以减少环境废弃物并改善废弃物管理流程。

- 然而,与其他包装产品相比,製造商更喜欢 PET,因为与其他塑胶材料相比,它在整个製造过程中产生的原材料浪费更少。它是可回收的,并且可以製成多种颜色和设计,因此是一个不错的选择。随着消费者环保意识的不断增强,可再填充产品也应运而生。这有助于创造对产品的需求。

PET 饮料包装市场趋势

瓶装水占据主要市场占有率

- 包装水和碳酸饮料的需求不断增长,推动了宝特瓶需求的激增。此外,日益增强的环保意识和对环保包装解决方案的需求促使消费者更喜欢宝特瓶而不是其他包装材料。

- 与其他塑胶相比,PET 具有优异的刚性。它还保持了坚固的保护结构并且具有防潮功能。它用于生产饮料和液体的宝特瓶。 PET 之所以广为人知,是因为它具有出色的油阻隔性,可以抵抗损害塑胶的化学物质。

- 饮料製造商正致力于创新新的解决方案。例如,三得利集团为了实现2030年实现100%再生植物来源宝特瓶的目标,推出了100%植物来源原料伙伴关係生产的宝特瓶。该瓶由三得利与美国公司 Anellotech 合作开发,将用于三得利在欧洲和日本市场销售的软性饮料品牌 Orangina 和 Tensen-sui。

- PET 因 100% 可回收且具有很强的永续性,被广泛用于製作宝特瓶(及其他用途)。 PET可以被收集并多次回收再利用成新产品,减少资源浪费。预计生物基塑料,尤其是 100% 生物基宝特瓶的市场占有率将在预测期内增加。

- 据饮料行销公司和国际瓶装水协会称,美国瓶装水销售趋势呈稳步增长。到 2022 年,销售量将从五年前 2017 年的每瓶 13.20 加仑飙升至每瓶 15.90 加仑。据加拿大农业及农业食品部称,美国调味瓶装水的零售也从 2015 年的 36.3 亿美元增长到 2022 年的 72.9 亿美元。预计这种成长将在预测期内持续,预计将显着提振宝特瓶水市场的需求。

亚太地区可望实现显着成长

- 随着中国经济的扩张和中阶的不断壮大以及购买力的不断增强,中国的包装产业一直在稳步增长。过去几年,中国饮料市场大幅成长,导致对饮料包装的需求增加。每种饮料类别都会面临各自的挑战和机会。

- 在都市区,非酒精饮料的消费量不断增加,推动了饮料的成长。受此机会的吸引,可口可乐等外国公司继续大力投资中国市场。可口可乐中国及其装瓶合作伙伴最近宣布,计划运作新的生产线和工厂,总投资预计为 5.2 亿元(7,530 万美元)。此外,2023年公司将投资工厂,提升业绩,加强线上线下通路布局与行销创新。这些因素预计将推动市场成长并吸引外国公司进入中国市场。

- 近年来,印度的饮料包装出现了显着的成长。推动市场成长的主要因素是全国饮料包装趋势的快速变化。该包装因采用创新技术而引人注目。新的饮料包装趋势集中在包装材料的结构改进、开发能够与产品及其环境相互作用的新型活性系统、提高客户接受度、安全性和某些饮料的保质期。

- 玻璃瓶和宝特瓶在日本被广泛使用。与传统玻璃瓶相比, 宝特瓶更受青睐,因为技术改进使 PET 瓶除了能盛装液体外,还能发挥其他功能。由于消费者工作繁忙、久坐不动的生活方式,即饮饮料(RTD)消费量不断增长,推动了日本饮料包装市场的发展。这些瓶子有助于延长产品的保质期和保存时间,并且具有经济高效的特性。

- 由于消费者越来越担心合成添加剂和防腐剂对健康的不利影响,饮料包装市场正在大幅扩张,推动了对有机饮料的需求。此外,都市化水准的提高和消费者生活水准的提高也推动了人均优质有机饮料的支出。

PET 饮料包装市场概况

PET 饮料包装市场分散,主要参与者包括 Amcor Ltd、Gerresheimer AG、Berry Global Group、Silgan Holdings Inc. 和 Huhtamaki Oyj。每个参与者都专注于透过在该行业的合作和投资来创新新的解决方案,从而扩大业务。

- 2023 年 7 月 - Amcor Rigid Packaging (ARP) 与 Ron Rubin Winery 合作推出“BLUE BIN”,这是第一款采用 100% 再生聚对苯二甲酸乙二醇酯 (rPET) 塑料製成的 750 毫升瓶包装的优质葡萄酒。

- 2023 年 6 月 - ALPLA 将在德班北部沿海城镇巴利托建造一座高科技回收厂,产能为 35,000 吨回收 PET 原料。该工厂标誌着 ALPLA 进军非洲回收市场的第一步,建设计划于 2023 年夏季开始,并于 2024 年秋季完工。 ALPLA 将投资约 6,000 万欧元(64,531,200 美元)来加强该地区的循环经济。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估乌克兰-俄罗斯衝突对塑胶包装市场的影响

- 法律规范

- 进出口分析

第五章 市场动态

- 市场驱动因素

- PET 的优异性能使其成为饮料包装的理想选择

- 永续包装需求不断成长

- 市场挑战

- 部分地区实施禁塑令

第六章 全球饮料产业概况

第七章全球饮料包装产业概况

第 8 章市场细分

- 按产品

- 瓶子

- 瓶子

- 盖子、盖子与封口装置

- 其他产品

- 按最终用户产业

- 碳酸饮料

- 汁

- 水瓶

- 酒精饮料

- 机能饮料

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 德国

- 义大利

- 西班牙

- 英国

- 亚洲

- 中国

- 印度

- 日本

- 拉丁美洲

- 中东和非洲

- 北美洲

第九章 竞争格局

- 公司简介

- Amcor PLC

- Resilux NV

- Nampak Ltd

- Berry Global Inc.

- Silgan Holdings Inc.

- Graham Packaging

- GTX Hanex Plastic Sp. ZOO

- Altium Packaging

- Comar LLC

- Apex Plastics

- Khs GmbH(Salzgitter Klckner-Werke GmbH)

- Esterform Packaging

- ALPLA Group

- Plastipak Holdings Inc.

- Retal Industries Limited

第10章 PET饮料包装生产企业

第十一章 投资分析

第十二章:投资分析市场的未来

The Pet Beverage Packaging Market is expected to register a CAGR of 4.67% during the forecast period.

Polyethylene terephthalate (PET) is broadening the use of plastic bottles. There is a rising demand for PET packaging in the bottled and soft water segments. Many creative, economical, and environmentally friendly packaging options are already available, and PET is a widely recognized material.

Key Highlights

- The benefits of polyethylene terephthalate as a material are that it is shatterproof, non-reactive when in contact with beverages, and delivers a high strength-to-weight ratio. Being lightweight also provides cost savings when transporting products using PET packaging. PET plastic is a secure packaging material for beverage products. PET plastic has been approved as safe for food and beverage contact by the FDA in the United States and similar regulatory bodies across North America.

- The war between Russia and Ukraine has resulted in economic sanctions against several countries, high commodity prices, and supply chain disruptions. Regarding the conflict, some companies have taken steps to sanction Russia by suspending their activities in Ukraine and other European countries. The Russia-Ukraine conflict has triggered a protest in crude oil and gas markets and a big dose of uncertainty, adding to the already high inflationary pressure on global commodity markets. Several manufacturers also fretted over the transformation in demand from plastics to other raw materials.

- The changing lifestyles and accompanying consumer reliance on packaged beverages boost sales of PET bottle packaging products. This trend is driving the sales of products with their superior barrier properties, convenient formats, high-quality printability, and careful use of material resources. Growing demand for packaged drinking water from consumers worldwide provides higher durability, ease of use, and improved product protection from potential spoilage factors than other packaging alternatives. Due to its low cost, it drives the market for PET bottles for packaging.

- The market is anticipated to be significantly challenged due to dynamic regulatory standard changes, mainly due to rising environmental concerns. Governments globally have been responding to public concerns regarding plastic packaging waste and implementing regulations to reduce environmental waste and improve waste management processes.

- However, manufacturers prefer PET over other packaging products, as it has a minimal loss of raw material during the entire manufacturing process compared to other plastic materials. Its recyclability and the feature of adding multiple colors and designs have made it a suitable choice. Refillable products have emerged with rising consumer awareness about the environment. This has helped in creating the demand for the product.

Pet Beverage Packaging Market Trends

Bottles to Hold Major Market Share

- The growing demand for packaged water and carbonated drinks has led to a spike in demand for PET bottles. In addition, increasing environmental awareness and demand for eco-friendly packaging solutions have led consumers to prefer PET bottles over other packaging materials.

- PET offers superior stiffness compared to other plastics. It also maintains a robust protective structure and has moisture resistance. It is used in the production of PET bottles for beverages and liquids. PET is well known because it provides a superior oil barrier that helps resist chemicals that can damage plastics.

- Beverage companies are focused on innovating new solutions. For instance, in line with its goal to transition to 100% recycled and plant-based PET bottles by 2030, the Suntory Group unveiled a prototype PET bottle made from a 100% plant-based materials partnership. The bottle was developed in collaboration with US-based Anellotech for Suntory's Orangina and Tennensui soft drinks brands in the European and Japanese markets.

- PET is widely favored for plastic bottles (and other uses) because it is 100% recyclable and highly sustainable. It can be recovered and recycled many times into new products, reducing the number of wasted resources. Over the projected period, bio-based plastics, particularly 100% bio-based PET bottles, are anticipated to increase market share.

- According to Beverage Marketing Corporation and International Bottled Water Association, the Sales volume of bottled water in the United States has witnessed a steady growth trend. The sale volume shot up to 15.90 gallons in 2022, starting from 13.20 gallons just five years back in 2017. Notably, according to Agriculture and Agri-Food Canada, the retail sales value of flavored bottled water in the United States also increased from USD 3.63 billion in 2015 to USD 7.29 billion in 2022. This growth is expected to be witnessed in the forecast period, also attributing to a substantial push to the market demand for PET water bottles.

Asia Pacific Expected to Witness Significant Growth

- China's packaging industry is growing steadily due to the nation's expanding economy and growing middle class with increased purchasing power. Beverage packaging demand is rising because China's beverage market has grown significantly over the last few years. Each beverage category will face its own set of challenges and opportunities.

- The growing consumption of non-alcoholic drinks in urban regions has propelled the growth of beverages. Such potential has attracted foreign companies like Coca-Cola to continue to invest heavily in the Chinese market. Recently, Coca-Cola China and its bottling partners have announced plans to inaugurate new production lines and a factory, following an estimated total investment of CNY 520 million (USD 75.3 million). Additionally, in 2023, the company invested in its plant to boost its performance and enhance its presence on online and offline channels and marketing innovations. These factors are projected to fuel market growth and attract foreign companies to the Chinese market.

- In India, beverage packaging has witnessed significant growth in recent years. The key factors that drive the market growth include the rapid changes in beverage packaging trends across the country. There has been significant adoption of novel techniques for packaging. New beverage packaging trends focus on the structure modification of packaging materials and the development of new active systems that can interact with the product or its environment, customer acceptability, security, and improving the conservation of several beverages.

- Glass and PET bottles are used extensively in Japan. PET bottles are still chosen over conventional glass bottles because of technical improvements that allow them to perform additional functions besides only retaining liquids. The market for beverage packaging in Japan is driven by the growing consumption of ready-to-drink (RTD) beverages due to busy consumer work schedules and sedentary lifestyles. These bottles help to improve the shelf life and preservation of the products and are available in cost-effective formats.

- The beverage packaging market is expanding significantly due to the growing consumer concerns about the negative health impact of synthetic additives, preservatives, etc., which augment the demand for organic beverages. Additionally, the elevating levels of urbanization and enhanced consumer living standards have propelled the country's per capita expenditures on high-quality, organic drinks.

Pet Beverage Packaging Market Overview

The PET Beverage Packaging market is fragmented with the presence of major players such as Amcor Ltd, Gerresheimer AG, Berry Global Group, Silgan Holdings Inc., and Huhtamaki Oyj. Players are focused on expanding their business by innovating new solutions through collaborations and investments in the industry.

- In July 2023 - Amcor Rigid Packaging (ARP) is to partner with Ron Rubin Winery for the launch of BLUE BIN, the first premium wine packaged in a 750mL bottle made from 100% recycled polyethylene terephthalate (rPET) plastic.

- In June 2023 - In Ballito, a coastal town north of Durban, ALPLA is constructing a high-tech recycling plant with a capacity of 35,000 tons of recycled PET material. The plant is ALPLA's first step in entering the African recycling market and will begin construction in the summer of 2023 with a planned completion date of autumn 2024. ALPLA is investing approximately EUR 60 million (USD 64.5312 million) to strengthen the regional circular economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of the Ukraine-Russia Standoff on the Plastic Packaging Market

- 4.5 Regulatory Framework

- 4.6 Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Outstanding Properties of Pet Suited to Beverage Packaging

- 5.1.2 Rising Demand for Sustainable Packaging

- 5.2 Market Challenges

- 5.2.1 Regulations Against the use of Plastics in Some Regions

6 GLOBAL BEVERAGE INDUSTRY LANDSCAPE

7 GLOBAL BEVERAGE PACKAGING INDUSTRY LANDSCAPE

8 MARKET SEGMENTATION

- 8.1 By Product

- 8.1.1 Bottles

- 8.1.2 Jars

- 8.1.3 Lids/Caps & Closures

- 8.1.4 Other Products

- 8.2 By End-user Industry

- 8.2.1 Carbonated Drinks

- 8.2.2 Juices

- 8.2.3 Water Bottles

- 8.2.4 Alcoholic Beverages

- 8.2.5 Energy Drinks

- 8.2.6 Other End-user Industries

- 8.3 By Geography

- 8.3.1 North America

- 8.3.1.1 United States

- 8.3.1.2 Canada

- 8.3.2 Europe

- 8.3.2.1 France

- 8.3.2.2 Germany

- 8.3.2.3 Italy

- 8.3.2.4 Spain

- 8.3.2.5 United Kingdom

- 8.3.3 Asia

- 8.3.3.1 China

- 8.3.3.2 India

- 8.3.3.3 Japan

- 8.3.4 Latin America

- 8.3.5 Middle East and Africa

- 8.3.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Amcor PLC

- 9.1.2 Resilux NV

- 9.1.3 Nampak Ltd

- 9.1.4 Berry Global Inc.

- 9.1.5 Silgan Holdings Inc.

- 9.1.6 Graham Packaging

- 9.1.7 GTX Hanex Plastic Sp. Z.O.O

- 9.1.8 Altium Packaging

- 9.1.9 Comar LLC

- 9.1.10 Apex Plastics

- 9.1.11 Khs GmbH (Salzgitter Klckner-Werke GmbH)

- 9.1.12 Esterform Packaging

- 9.1.13 ALPLA Group

- 9.1.14 Plastipak Holdings Inc.

- 9.1.15 Retal Industries Limited