|

市场调查报告书

商品编码

1631626

美国硬质 PET 包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Rigid PET Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

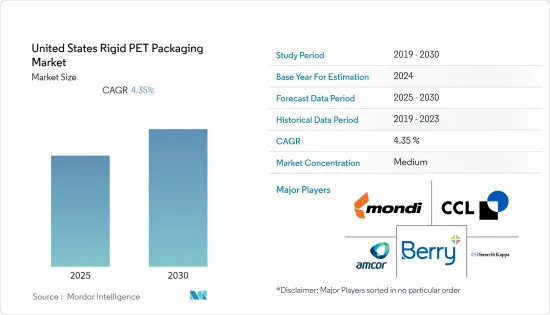

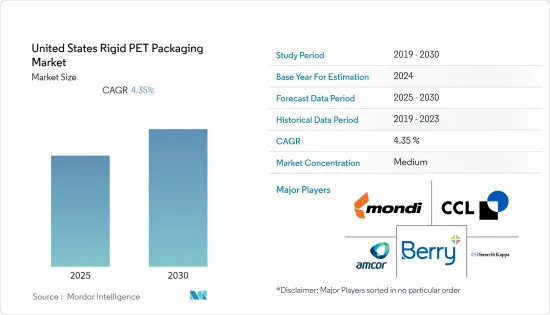

预计美国硬质 PET 包装市场在预测期内的复合年增长率为 4.35%。

国际瓶装水协会的报告显示,2021年美国消耗了156亿加仑瓶装水,比2020年成长4.5%(前年成长4.2%)。这意味着2020年,每个美国人平均消耗46.9加仑瓶装水(与前一年同期比较增长3.8%)。此外,2021年瓶装水零售额将成长4.4%,达到379亿美元。这种成长趋势可能会持续下去,瓶装水包装用硬质PET的需求预计将进一步增加。

在硬质塑胶包装中,翻盖式包装是零售商的热门选择,因为产品从两侧都可见。它可以悬挂或独立,包装比里面的产品大,因此不太可能被盗窃。它比纸板和其他替代品轻得多,在运输过程中节省能源,生产成本更低,并且更耐用。

与其他塑胶包装产品相比,製造商更喜欢 PET,因为它可以最大限度地减少製造过程中的原材料损失。它们是可回收的,并且可以定制多种颜色和设计,使其成为受欢迎的选择。随着消费者对环境议题的了解越来越多,可再填充产品变得越来越受欢迎且需求强劲。例如,2022年2月,长荣投资2亿美元并进行多次收购,成为北美食品级rPET的着名製造商之一。

几十年来,药品包装已经从塑胶转变为行业的主要设计和製造材料。然而,由于聚对苯二甲酸乙二醇酯(PET)可以在分子层面上分解为PET,因此工业界很可能会继续使用PET。

2022 年 4 月,再生材料产品和阻隔性保护包装製造商 Klockner Pentaplast 将扩建其位于西维吉尼亚州比佛市耗资数百万美元的生产设施,以扩大其在北美的消费后再生材料 (PCR) 足迹)决定增加PET产能。一条挤出生产线和两台热水瓶成型机的安装将扩大公司在消费者健康、製药和食品包装市场的可持续创新,创造 15,000 吨新的 rPET/PET 产能。目前,Klockner Pentaplast 超过 20% 的产品由 PCR 材料製成。

美国硬质PET包装市场趋势

硬质 PET 瓶盖和瓶盖强劲成长

根据硅谷银行的数据,2020年美国优质酒庄的毛利率为56.8%,平均每瓶价格为28美元。因此,使用刚性 PET 瓶盖具有节省成本的优势,比软木更坚固且不易染色,这就是为什么 PET 瓶盖和瓶盖进一步推动该地区销售成长的原因。

根据美国国家医学图书馆的数据,2021年美国整体药品支出为5,769亿美元,比2020年增加7.7%。到 2022 年,整体处方药支出预计将比 2021 年增长 4.0% 至 6.0%,而诊所和医院预计将分别增长 7.0% 至 9.0% 和 3.0% 至 5.0%。由于医药产品的高消费量,对更多瓶子的需求大幅增加,推动了瓶盖和封口市场的成长。

此外,奈米技术在简便食品製造中在改善储存程序、包装方法和成品加工等关键功能方面发挥重要作用。因此,这一趋势预计将在增加包装食品容器的使用方面发挥重要作用,并有望增加对各种类型的瓶盖的需求。

大多数製造商正在考虑用于防密封包装和产品保护的瓶盖和封闭件,从而推动市场成长。根据美国农业部2020年对外农业服务报告,新鲜水果出口包括苹果、葡萄、柳橙、草莓和樱桃,总合31亿美元,主要市场包括加拿大和墨西哥。瓶盖通常用于盛装果汁,这会增加对瓶盖的需求。

此外,考虑到环境问题和增强品牌吸引力,各製造商正在将其外包装产品替换为由再生塑胶製成的硬质PET盖和封闭件,并专注于品牌设计和高吸引力。根据美国工业理事会统计,2017年至2020年美国宣布了52个新塑胶回收计划,计划总合金额48亿美元。美国对先进回收技术的投资增加意味着我们可以比以往重复使用更多类型的塑胶。

食品是市场成长的关键因素之一

果酱、蛋黄酱和腌菜等包装食品通常储存在由各种类型的硬质 PET 瓶盖保护的瓶子中。随着工作人口的增加,对易于准备的包装食品的需求显着增加。根据《全球有机贸易指南》,到2026年,该地区有机包装食品消费预计将达到213.9亿美元。预计这将推动硬质 PET 包装的成长。

各国政府和相关监管机构针对食品安全程序和环境问题采取了各种倡议,导致对现有食品包装程序进行审查。这样做是为了鼓励包装行业寻求更好的包装材料选择,遵守环境法规并提供环境可持续的包装,以推动市场参与企业。

例如,Fabri-Kal 产品至少采用 20-50% 的消费后回收 (PCR) PET 材料製成。可回收产品在美国製造。 PET 船盖专为在旅途中携带冷饮而设计,可防止使用吸管并确保安全运输而不会溅出。该公司的绿色陶瓷产品由植物来源聚乳酸树脂製成。

此外,许多政府对药品和食品的标籤和包装制定了严格的法律法规,进一步扩大了硬质 PET 包装市场的范围。例如,在美国,食品业对硬包装的需求正在增加,因为该地区的一些公司没有内部包装设备。

2021 年,食品包装的趋势是透明化。消费者希望在购买前看到实际的产品,而不仅仅是标籤上列出的成分。在单份番茄酱、调味品和烧烤酱市场中,聚对苯二甲酸乙二醇酯 (PET) 瓶正在取代玻璃瓶。许多公司选择聚对苯二甲酸乙二醇酯 (PET) 瓶,因为 PET 与玻璃一样透明且不易破碎。

美国硬质PET包装产业概况

美国硬质宝特瓶包装市场适度整合,有几家大型企业。公司不断投资于策略联盟和产品开发,以扩大市场占有率。近期市场发展趋势如下。

2021 年 4 月,Berry Global Group, Inc. 宣布投资超过 7,000 万美元,以支持消费包装薄膜的持续成长,主要用于电子商务、食品和饮料应用。该投资将支援新的多层吹膜生产线、基础设施升级和其他设备,这些设备将于 2021 年和 2022 年在北美製造系统的多个地点上运作。除了传统的基础设施升级之外,薄膜生产线还将支援客户对回收材料需求的预期成长。

2021 年 2 月,Berry Global 推出了用于电子商务业务的由聚对苯二甲酸乙二醇酯 (PET) 製成的烈酒瓶。这款 50 毫升宝特瓶满足了烈酒(主要是杜松子酒)在线销售日益增长的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业供应链分析

- 市场驱动因素

- 扩大宝特瓶和容器在製药领域的使用

- 最新材料相关进展和再生 PET 的使用

- 市场问题

- 环境问题与原物料价格波动

- 市场机会

- 替代PET的主要材料—PO、PS等

- 主要标准和法规

- 灌装技术的主要类型—热填充、冷灌装、无菌灌装等。

第五章评估 COVID-19 对美国塑胶包装产业的影响

第六章 市场细分

- 依产品类型

- 瓶子和罐子

- 盖子和封口

- 托盘

- 其他的

- 按最终用户产业

- 食物

- 饮料

- 药品

- 化妆品

- 其他最终用户(工业/农业)

第七章 竞争格局

- 公司简介

- CCL Industries, Inc.

- Amcor Limited

- Mondi Group

- Smurfit Kappa Group PLC

- Berry Plastics Group

- Graham Packaging Company

- Dunmore Group

第八章投资分析

第9章市场的未来

The United States Rigid PET Packaging Market is expected to register a CAGR of 4.35% during the forecast period.

The International Bottled Water Association reports that Americans consumed 15.6 billion gallons of bottled water in 2021, up 4.5% from 2020 (compared to a 4.2% increase the previous year). That means that each American consumed 46.9 gallons of bottled water on average in 2020, up 3.8% from the prior year. Furthermore, retail dollar sales of bottled water increased by 4.4% in 2021, reaching USD 37.9 billion. With this rising trend likely to continue, it is set to propel the demand for Rigid PET in bottled water packaging.

Clamshell packaging remains popular with retailers among rigid plastic packaging because the product is visible on both sides. It can be hung or freestanding, and it's harder to shoplift since the package is bigger than the product inside. It's much lighter than cardboard or other alternatives, saving energy during transport, cheaper to make, and more durable.

Manufacturers prefer PET over other plastic packaging goods because it minimizes the loss of raw material throughout the manufacturing process. Its recyclability and ability to customize it with numerous colors and designs make it a popular choice. Refillable items have risen in popularity as consumer knowledge of environmental issues has grown, increasing demand for the product. For instance, in February 2022, Evergreen is one of the prominent producers of food-grade rPET in North America, having its USD 200 million investment and multiple acquisitions.

For decades, pharma packaging has likely migrated away from plastic, the industry's main design and manufacturing material. However, the industry will continue to use polyethylene terephthalate (PET) because of its capacity to break down to PET at the molecular level.

In April 2022, Klockner Pentaplast, a manufacturer of recycled content products and high-barrier protective packaging, decided to expand its multi-million dollar production facility in Beaver, West Virginia, to add post-consumer recycled content (PCR) PET capacity in North America. Installing an extrusion line and two thermos formers will increase the company's sustainable innovation in the consumer health, pharmaceutical, and food packaging markets, producing 15,000 metric tonnes of new rPET/PET capacity. Over 20% of Klockner Pentaplast volumes are currently made with PCR material.

US Rigid PET Packaging Market Trends

Rigid PET Caps and Closures will Observe a Significant Growth

According to Silicon Valley Bank, premium wineries in the United States had a gross margin of 56.8 % as of 2020, with the average bottle price being USD 28. Hence, the usage of Rigid PET closures can be an advantage in reducing cost, being stronger than cork, and not susceptible to taint, which is why PET caps and closures are further fueling the growth of sales in the region.

According to the National Library of Medicine, in 2021, overall pharmaceutical expenditures in the US grew 7.7% compared to 2020, for a total of USD 576.9 billion. By 2022, overall prescription drug spending is expected to rise by 4.0% to 6.0%, whereas in clinics and hospitals it is anticipated to increase from 7.0% to 9.0% and 3.0% to 5.0%, respectively, compared to 2021. Due to the high consumption of drugs, there is a considerable rise in demand for more bottles, driving the growth of the caps and closures market.

Furthermore, nanotechnology in convenience food manufacturing has played a crucial role in improving critical functions, including preservation procedures, packaging methods, and finished goods processing. Thus, this trend is anticipated to play a significant role in increasing the usage of containers for packaged food products, which is expected to increase the demand for various kinds of closures.

Most manufacturers are considering caps and closures to provide seal-proof packaging and product protection, driving the market's growth. According to the USDA Foreign Agricultural Service 2020 report, fresh fruit export commodities included apples, grapes, oranges, strawberries, and cherries, which accounted for a combined USD 3.1 billion, with top markets including Canada and Mexico. The requirement for caps can be increased since they are most often used in juices.

Moreover, concerning the environmental issue and enhancing brand appeal, various manufacturers are replacing outer box products with rigid PET caps and closures made from recycled plastic and are concentrating more on design and high appeal for their brands. According to American Chemistry Council, 52 new plastics recycling projects have been announced in the United States between 2017 and 2020, with the combined value of projects being USD 4.8 Billion. The growing investments in the US advanced recycling technologies are making it probable to reuse more plastic types than was possible.

Food is One of the Significant Factor for Market Growth

Packaged food products, such as jams, mayonnaise, pickles, etc., are usually stored in bottles protected using various kinds of airtight Rigid PET closures. With an increase in the working population, there has been a substantial increase in the demand for easy-to-cook and packaged food. According to Global Organic Trade Guide, organic packaged food consumption in the region is expected to reach USD 21.39 Billion by 2026. It is expected to fuel the growth of rigid PET packaging.

Various initiatives were taken by the governments and the related regulatory bodies regarding food safety procedures and environmental issues that have led to the revision of the existing food packaging procedures. It has been done to promote the packaging industry to look for better options in terms of packaging materials, which is expected to drive the market players to comply with environmental regulations and provide environmentally sustainable packaging.

For instance, Fabri-Kal products are made with a minimum of 20-50% post-consumer recycled (PCR) PET material. Recyclable products are made in the United States. The PET Sip Lids are created for on-the-go consumption of cold drinks and transport safely without splashing, preventing the use of straws. The company's greenware products are made from PLA resin derived from plants.

Also, many governments are mandating stringent laws and regulations on the labeling and packaging of drugs and food products, further expanding the scope of the Rigid PET packaging market. For instance, the United States witnessed an increase in the demand for rigid packaging in the food industries, owing to the inability of an in-house packaging facility for a few companies in this region.

In 2021, transparency in food packaging had been trending. Beyond just the listed ingredients on the label, consumers also want to see the physical product before purchasing. Polyethylene terephthalate (PET) bottles are taking over for glass in the single-serve ketchup, condiments, and barbecue sauce markets. Many companies are choosing polyethylene terephthalate (PET) bottles, as PET is as clear as glass and less likely to break.

US Rigid PET Packaging Industry Overview

US rigid pet packaging market is moderately consolidated, with a few major companies. The companies continuously invest in strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are

April 2021: Berry Global Group, Inc. announced an investment of more than USD 70 million to support continued growth in consumer packaging films, primarily for e-commerce, food, and beverage applications. The investment supports new multi-layer blown film lines, infrastructure upgrades, and other equipment that will come online in 2021 and 2022 across multiple sites in the North American manufacturing system. Beyond the traditional infrastructure upgrade, the film lines will support the anticipated increased customer demand for recycled content.

February 2021: Berry Global launched a polyethylene terephthalate (PET) spirit bottle for e-commerce businesses. The 50ml PET bottle addressed the increasing demand for online spirit sales, especially gin.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Anlaysis

- 4.3 Market Drivers

- 4.3.1 Growing use of PET bottles & containers in the Pharmaceutical sector

- 4.3.2 Recent material-related advancements and use of recycled PET

- 4.4 Market Challenges

- 4.4.1 Environmental concerns & fluctuations in raw material pricing

- 4.5 Market Opportunities

- 4.6 Key alternatives to the use of PET - PO, PS, etc.

- 4.7 Key Standards & Regulations

- 4.8 Maior types of filling technology - Hot Fill, Cold Fill, Aseptic Fill, etc.

5 ASSESSMENT OF COVID-19 IMPACT ON THE US PLASTIC PACKAGING INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles & Jars

- 6.1.2 Caps & Closures

- 6.1.3 Trays

- 6.1.4 Others

- 6.2 By End-User Industry

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Pharmaceuticals

- 6.2.4 Cosmetics

- 6.2.5 Other End-user verticals (Industrial & Agriculture)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CCL Industries, Inc.

- 7.1.2 Amcor Limited

- 7.1.3 Mondi Group

- 7.1.4 Smurfit Kappa Group PLC

- 7.1.5 Berry Plastics Group

- 7.1.6 Graham Packaging Company

- 7.1.7 Dunmore Group