|

市场调查报告书

商品编码

1686633

药品包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

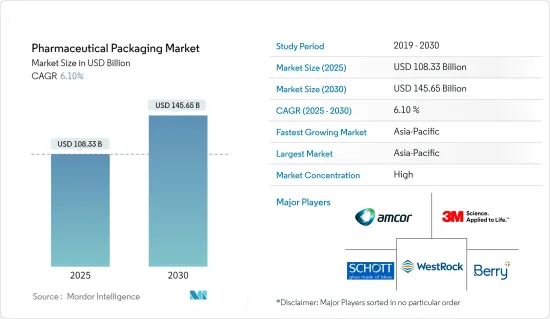

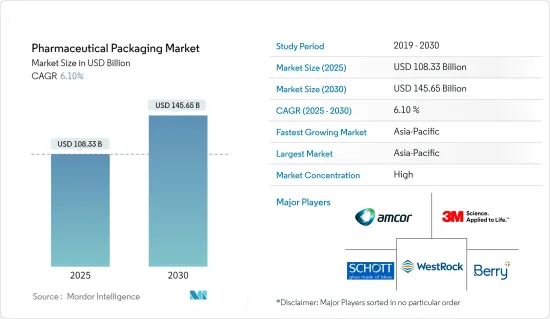

预计2025年医药包装市场规模为1,083.3亿美元,预计2030年将达到1,456.5亿美元,预测期间(2025-2030年)的复合年增长率为6.1%。

监理环境影响包装创新:

由于严格的监管标准和仿冒品措施,药品包装市场正在经历显着成长。世界各国政府都实施了严格的法规来确保产品安全并打击假药。欧盟 (EU) 指令要求所有药品必须序列化,美国、中国、印度和土耳其也有类似的规定。这些措施正在推动先进封装解决方案的采用。

主要亮点

- FDA 指南:FDA 已製定了非处方产品的儿童安全、防篡改包装指南。

- 认证技术:製药公司正在投资全像图和隐藏批号等认证技术。

- 序列化方法:序列化方法包括线性条码、二维条码和无线射频识别 (RFID)。

- 智慧包装:使用 RFID 和 NFC 标籤的智慧包装在产品追踪和病人参与越来越受欢迎。

奈米技术彻底改变了包装解决方案:

奈米技术对药品包装的影响正在透过新一代创新解决方案改变该产业。这些进步不仅可以打击仿冒品,还可以提高整个供应链中的产品安全性和可追溯性。

主要亮点

- 可追溯性:奈米技术使得创建智慧包装成为可能,使产品从製造到最终用户都可以被追踪。

- 开发智慧包装:Schott AG 等公司正在开发智慧包装封盖解决方案,以实现清晰的容器为基础的可追溯性。

- 产品发布:ENTOD Pharmaceuticals 在印度推出了一系列基于奈米技术的眼科美容产品,展示了奈米包装的多功能性。

- 生物医学应用:奈米粒子在生物医学中用于疾病检测、预防和药物传输。

市场趋势与成长动力:

由于几个关键驱动因素,医药包装市场正在经历强劲成长。製药业的扩张和新兴国家医疗支出的增加正在推动市场成长。

主要亮点

- 塑胶产业:预计到 2028 年塑胶产业规模将达到 544.5 亿美元,复合年增长率为 6.17%。

- 瓶子部分:2022 年瓶子部分的价值为 182.4 亿美元,预计到 2028 年将达到 273 亿美元。

- 外国直接投资成长:印度等新兴经济体正在经历显着成长,其中製药业的外国直接投资预计在 2020-21 年将成长 200%。

- 亚太地区成长:预计 2023 年至 2028 年亚太地区的复合年增长率为 6.99%,2028 年达到 545.9 亿美元。

竞争格局与主要企业:

医药包装市场较为分散,几家大公司占据主导地位。为了维持市场地位,这些公司专注于创新、永续性和策略性扩张。

主要亮点

- Amcor PLC:成立于 1860 年。提供广泛的包装解决方案,包括口服剂型和医疗设备包装。

- Schott AG:该公司成立于 1853 年,专门从事医药管道和药物封装解决方案。

- Berry World Group:成立于1967年。提供医疗包装、瓶子和管瓶。

- Gerresheimer AG:Gerresheimer AG 宣布将向其美国生产设施投资 9,400 万美元,以提高管瓶生产能力。

永续性和未来趋势:

医药包装产业越来越关注永续性和环保解决方案。这一趋势是由监管压力和消费者对更环保包装的需求所推动的。

主要亮点

- GlaxoSmithKline Plc消费者保健计画已加入 Pulpex 纸瓶合作伙伴联盟,共同探索可回收纸瓶。

- 投资生质塑胶:公司正在投资生质塑胶和其他生物分解性材料作为传统塑胶的替代品。

- 先进的印刷技术:先进的印刷技术,例如 Essentra Packaging 的 Landa S10 奈米印刷机,正在提升包装能力。

- 3D视觉化:3D 视觉化和印刷策略的采用正在突破初级和次级包装设计的界限。

医药包装市场趋势

塑胶领域在材料类别中占据主导地位

塑胶已成为医药包装市场最大的材料类别。 2022年,该部分占据41.84%的市场占有率,价值380.3亿美元。预计到 2028 年该部分将达到 541.5 亿美元,预测期内的复合年增长率为 6.17%。这一成长由多种因素推动,包括该领域的多功能性、成本效益以及塑胶包装解决方案的持续创新。

- 市场占有率2022年塑胶将占医药包装市场的41.84%。

- 成本效益:塑胶价格实惠,是药品包装的热门选择。

- 创新解决方案:公司正在引入生物分解性和可回收的塑胶解决方案,以满足永续性标准。

- 未来成长:预计到 2028 年该产业规模将达到 541.5 亿美元。

- 监管标准推动塑胶包装创新:严格的监管标准和仿冒品规范正在推动塑胶药品包装的进步。公司正在开发创新的解决方案来满足这些要求。例如,2022 年 5 月,Bormioli Pharma推出了永续包装产品标籤 EcoPositive,包括再生塑胶、生物基、生物分解性和可堆肥的塑胶解决方案。该倡议标誌着该行业对监管压力和对永续包装选择日益增长的需求的回应。

- EcoPositive倡议Bormioli Pharma 的 EcoPositive 展示永续包装选择,包括生物基和可堆肥塑胶。

- 防伪:塑胶包装的防伪措施日益复杂,以满足全球标准。

- 监管压力:全球范围内不断提高的监管标准正在影响医药塑胶包装领域。

- 致力于永续性:增加生物分解性塑胶解决方案的投资符合环境法规。

- 奈米技术对塑胶包装发展的影响:奈米技术的影响正在推动塑胶领域新一代包装解决方案的发展。这些技术进步使得能够创造出具有增强性能的包装材料,例如改进的阻隔性和抗菌能力。预计奈米技术与塑胶药品包装的结合将在未来几年为该领域的成长和市场主导地位做出重大贡献。

- 阻隔功能:奈米技术可以增强塑胶药品包装的阻隔性能。

- 抗菌解决方案:公司正在整合抗菌奈米技术来提高包装的安全性和使用寿命。

- 增强性能:奈米技术创新正在被用于使塑胶包装更加智慧、更有效率。

- 未来展望:奈米技术的整合将推动塑胶包装产业的成长。

亚太地区占很大份额

亚太地区是医药包装市场成长最快的地区。 2022 年,该地区的市场占有率为 40.12%,市场规模为 366 亿美元。预计到 2028 年市场规模将达到 545.9 亿美元,预测期内复合年增长率将达到 6.99%。这一成长率超过其他地区,使亚太地区成为全球医药包装市场的主要动力。

- 市场占有率:亚太地区占全球医药包装市场的40.12%。

- 成长率:预计 2023 年至 2028 年期间该地区的复合年增长率为 6.99%。

- 区域优势:中国和印度引领亚太地区的医药包装市场。

- 新兴趋势:该地区的快速成长是由对创新和永续包装的不断增长的需求所推动的。

医药包装行业概况

全球企业主导综合市场

医药包装市场的特点是全球企业凭藉多元化的产品系列占据主导地位。 Amcor PLC、Schott AG 和 Berry Global Group Inc. 等公司是市场领导者,提供从瓶子和管瓶到泡壳包装和注射器等广泛的包装解决方案。市场结构似乎相当巩固,大型企业凭藉其广泛的产品线、全球影响力和技术力占据了相当大的市场占有率。

Amcor PLC:医药包装领域的全球领导者,提供从泡壳包装到儿科瓶等广泛的解决方案。

肖特股份公司(SCHOTT AG):专注于玻璃包装和药管,推动密封解决方案的创新。

Berry World Group 提供从瓶子到预填充注射器等各种塑胶包装解决方案。

整合市场:市场由拥有技术专长和产品多样化的大型公司主导。

创新和永续性推动市场领导地位:

市场领先的公司专注于创新和永续性。例如,Amcor PLC 在 22 财政年度推出了用于医疗保健应用的纸基 AmFiber 系列和不含 PVC 的 AmSky泡壳系统。 Berry World Group 推出了儿童安全、防篡改糖浆和液体药品包装的完整捆绑解决方案。这些公司也大力投资永续包装解决方案,安姆科的目标是到 2030 年其产品组合中的再生材料占比达到 30%。其市场领导地位透过策略扩张进一步加强,例如 Berry World 在印度班加罗尔的新製造工厂,增强了其先进医疗解决方案在区域和全球范围内的可及性。

注重永续性:为了实现永续性目标,公司优先考虑可回收和环保材料。

创新解决方案:不含 PVC 的泡壳包装和儿童防护瓶作为更安全、更永续的替代品越来越受欢迎。

策略扩张:在新兴市场开设新工厂使全球公司能够满足当地需求并增加市场占有率。

研发投入:主要企业正在投资研发,以推动药品包装的永续创新。

未来市场的成功因素:

市场参与者取得成功并增加市场占有率的几个关键因素如下。首先,对研发的投入是关键,安姆科推出的创新产品就是一个例子。其次,扩大新兴市场的製造能力(例如 Berry World 在印度的新工厂)对于满足不断增长的需求至关重要。第三,对永续性的关注变得越来越重要,Klockner Pentaplast 推出了可回收的 PET泡壳膜。最后,策略性收购和联盟,例如 Aptar Pharma 收购 Metaphase Design Group,可增强产品供应和服务能力。对于任何希望在未来几年巩固其地位或颠覆市场的公司来说,此类策略都至关重要。

研发投资:为了在快速发展的产业中保持竞争力,公司必须不断创新。

新兴市场:向亚太等高成长地区扩张对于未来的市场成功至关重要。

永续性:公司必须优先使用可回收和生物分解性的材料来解决环境问题。

策略性收购:收购和伙伴关係可以帮助扩大医药包装产品供应并加速创新。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 包装监管标准和严格的仿冒品措施

- 奈米技术对新一代创新包装解决方案的影响

- 监理环境影响包装创新

- 市场挑战

- 原料成本因供应商议价能力而波动

第六章 市场细分

- 按材质

- 塑胶

- 玻璃

- 其他材料

- 依产品类型

- 瓶子

- 注射器

- 管瓶/安瓿瓶

- 管子

- 瓶盖和瓶塞

- 标籤

- 其他产品类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- 3M Company

- Schott AG

- WestRock Company

- Berry Global Group Inc.

- McKesson Corporation

- AptarGroup Inc.

- Klockner Pentaplast Group

- CCL Industries Inc.

- FlexiTuff International Ltd

- Gerresheimer AG

- West Pharmaceutical Services Inc.

- Becton, Dickinson and Company

- Vetter Pharma International GmbH

- Catalent Inc.

- WL Gore & Associates Inc.

- Nipro Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Pharmaceutical Packaging Market size is estimated at USD 108.33 billion in 2025, and is expected to reach USD 145.65 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

Regulatory Landscape Shapes Packaging Innovation:

The pharmaceutical packaging market is experiencing significant growth driven by stringent regulatory standards and anti-counterfeit measures. Governments worldwide are implementing strict regulations to ensure product safety and combat counterfeit drugs. The European Union's Directive mandates serialization numbers on all pharmaceutical products, while similar regulations exist in the United States, China, India, and Turkey. These measures are propelling the adoption of advanced packaging solutions.

Key Highlights

- FDA Guidelines: The FDA has established guidelines for child-resistant packaging and tamper-resistant packaging for OTC products.

- Authentication Technologies: Pharmaceutical companies are investing in authentication technologies like holograms and hidden batch numbers.

- Serialization Methods: Serialization methods include linear barcodes, two-dimensional barcodes, and radio frequency identification (RFID).

- Smart Packaging: Smart packaging with RFID and NFC tags is gaining traction for product tracking and patient engagement.

Nanotechnology Revolutionizes Packaging Solutions:

The impact of nanotechnology on pharmaceutical packaging is transforming the industry with innovative and new-generation solutions. These advancements not only combat counterfeiting but also enhance product safety and traceability throughout the supply chain.

Key Highlights

- Tracking Capability: Nanotechnology enables the creation of smart packaging that can track products from manufacturing to end-user.

- Smart Packaging Development: Companies like Schott AG are developing smart packaging containment solutions for clear container-based traceability.

- Product Launches: ENTOD Pharmaceuticals launched a nanotechnology-based ocular aesthetic range in India, showcasing the versatility of nano-packaging.

- Biomedicine Applications: Nanoparticles are being utilized in biomedicine for disease detection, prevention, and drug delivery.

Market Drivers and Growth Trends:

The pharmaceutical packaging market is witnessing robust growth, fueled by several key drivers. The expansion of the pharmaceutical industry in emerging economies, coupled with increasing healthcare spending, is propelling market growth.

Key Highlights

- Plastics Segment: The plastics segment is expected to reach USD 54.45 billion by 2028, growing at a CAGR of 6.17%.

- Bottles Segment: The bottles segment was valued at USD 18.24 billion in 2022 and is projected to reach USD 27.30 billion by 2028.

- FDI Growth: Emerging economies like India are experiencing significant growth, with a 200% increase in FDI in the pharmaceutical industry in 2020-2021.

- Asia-Pacific Growth: The Asia-Pacific region is expected to grow at a CAGR of 6.99% from 2023 to 2028, reaching USD 54.59 billion by 2028.

Competitive Landscape and Key Players:

The pharmaceutical packaging market is fragmented, with several major players dominating the industry. These companies are focusing on innovation, sustainability, and strategic expansions to maintain their market positions.

Key Highlights

- Amcor PLC: Established in 1860, Amcor offers a wide range of packaging solutions, including oral dose formats and medical device packaging.

- Schott AG: Founded in 1853, Schott specializes in pharmaceutical tubing and drug containment solutions.

- Berry Global Group: Established in 1967, Berry Global provides medical packaging, bottles, and vials.

- Gerresheimer AG: Gerresheimer AG announced a USD 94 million investment in a US production facility to increase its vial production capacity.

Sustainability and Future Trends:

The pharmaceutical packaging industry is increasingly focusing on sustainability and eco-friendly solutions. This trend is driven by both regulatory pressures and consumer demand for more environmentally responsible packaging.

Key Highlights

- GSK's Initiative: GlaxoSmithKline Consumer Healthcare joined the Pulpex paper bottle partner consortium to explore recyclable paper bottles.

- Bioplastics Investment: Companies are investing in bioplastics and other biodegradable materials as alternatives to traditional plastics.

- Advanced Printing Technologies: Advanced printing technologies, such as Essentra Packaging's Landa S10 Nanographic Printing Machine, are enhancing packaging capabilities.

- 3-D Visualization: The adoption of 3-D visualization and printing strategies is pushing the boundaries of both primary and secondary packaging design.

Pharmaceutical Packaging Market Trends

Plastics Segment Dominates Material Category

The Plastics segment emerges as the largest material category in the Pharmaceutical Packaging Market. In 2022, this segment accounted for 41.84% of the market share, valued at USD 38.03 billion. The segment is projected to reach USD 54.15 billion by 2028, growing at a CAGR of 6.17% during the forecast period. This growth is driven by several factors, including the segment's versatility, cost-effectiveness, and ongoing innovations in plastic packaging solutions.

- Market Share: Plastics accounted for 41.84% of the pharmaceutical packaging market in 2022.

- Cost-Effectiveness: The affordability of plastics makes it a popular choice in pharmaceutical packaging.

- Innovative Solutions: Companies are introducing biodegradable and recyclable plastic solutions to meet sustainability standards.

- Future Growth: The segment is projected to reach USD 54.15 billion by 2028.

- Regulatory Standards Drive Plastic Packaging Innovation: Stringent regulatory standards and norms against counterfeit products are propelling advancements in plastic pharmaceutical packaging. Companies are developing innovative solutions to meet these requirements. For instance, Bormioli Pharma launched EcoPositive in May 2022, a label for sustainable packaging offerings, including recycled plastics, bio-based, biodegradable, and compostable plastic solutions. This initiative demonstrates the industry's response to regulatory pressures and the growing demand for sustainable packaging options.

- EcoPositive Initiative: Bormioli Pharma's EcoPositive showcases sustainable packaging options, including bio-based and compostable plastics.

- Counterfeit Prevention: Anti-counterfeit measures in plastic packaging are becoming increasingly sophisticated to meet global standards.

- Regulatory Pressure: The rise of global regulatory standards is shaping the pharmaceutical plastic packaging segment.

- Sustainability Efforts: Increased investment in biodegradable plastic solutions aligns with environmental regulations.

- Nanotechnology Impacts Plastic Packaging Development: The impact of nanotechnology is driving the development of new-generation packaging solutions in the plastics segment. This technological advancement is enabling the creation of packaging materials with enhanced properties, such as improved barrier functions and antimicrobial capabilities. The integration of nanotechnology in plastic pharmaceutical packaging is expected to contribute significantly to the segment's growth and market dominance in the coming years.

- Barrier Functions: Nanotechnology enables the creation of enhanced barrier properties in plastic pharmaceutical packaging.

- Antimicrobial Solutions: Companies are integrating antimicrobial nanotechnology to improve the safety and longevity of packaging.

- Enhanced Properties: Nanotech innovations are being used to make plastic packaging smarter and more efficient.

- Future Prospects: The integration of nanotechnology is set to propel growth in the plastic packaging sector.

Asia-Pacific to Occupy Major Share

The Asia-Pacific region stands out as the fastest-growing segment in the Pharmaceutical Packaging Market. In 2022, this region held a 40.12% market share, valued at USD 36.60 billion. The market is projected to reach USD 54.59 billion by 2028, exhibiting a robust CAGR of 6.99% during the forecast period. This growth rate outpaces other regions, positioning Asia-Pacific as a key driver of the global pharmaceutical packaging market.

- Market Share: Asia-Pacific holds 40.12% of the global pharmaceutical packaging market.

- Growth Rate: The region is expected to grow at a CAGR of 6.99% from 2023 to 2028.

- Regional Dominance: China and India lead the pharmaceutical packaging market in Asia-Pacific.

- Emerging Trends: The region's rapid growth is driven by increasing demand for innovative and sustainable packaging.

Pharmaceutical Packaging Industry Overview

Global Players Dominate Consolidated Market:

The pharmaceutical packaging market is characterized by the dominance of global players with diverse product portfolios. Companies like Amcor PLC, Schott AG, and Berry Global Group Inc. lead the market, offering a wide range of packaging solutions from bottles and vials to blister packs and syringes. The market structure appears fairly consolidated, with these major players holding significant market share due to their extensive product lines, global presence, and technological capabilities.

Amcor PLC: A global leader in pharmaceutical packaging, with solutions ranging from blister packs to child-resistant bottles.

Schott AG: Specializes in glass-based packaging and pharmaceutical tubing, driving innovation in containment solutions.

Berry Global Group Inc.: Offers extensive plastic packaging solutions, from bottles to prefillable syringes, and is expanding in emerging markets.

Consolidated Market: The market is dominated by large companies with significant technological expertise and product diversity.

Innovation and Sustainability Drive Market Leadership:

Market leaders are distinguished by their focus on innovation and sustainability. Amcor PLC, for instance, introduced the AmFiber family of paper-based products and the PVC-free AmSky blister system for healthcare applications in FY22. Berry Global Group launched a complete bundle solution for child-resistant and tamper-evident syrup and liquid medicine packaging. These companies are also investing heavily in sustainable packaging solutions, with Amcor targeting 30% recycled material across its portfolio by 2030. Their market leadership is further solidified by strategic expansions, such as Berry Global's new manufacturing facility in Bangalore, India, enhancing regional and global access to advanced healthcare solutions.

Sustainability Focus: Companies are prioritizing recyclable and eco-friendly materials to meet sustainability goals.

Innovative Solutions: PVC-free blister packs and child-resistant bottles are gaining traction as safer, sustainable alternatives.

Strategic Expansions: New facilities in emerging markets enable global players to tap into regional demand and grow market share.

R&D Investment: Leading companies invest in R&D to drive sustainable innovation in pharmaceutical packaging.

Factors for Future Success in the Market:

For market players to succeed and grow their market share, several key factors emerge. Firstly, investment in research and development is crucial, as exemplified by Amcor's introduction of innovative products. Secondly, expanding manufacturing capabilities in emerging markets, like Berry Global's new facility in India, is essential for tapping into growing demand. Thirdly, a focus on sustainability is becoming increasingly important, with companies like Klockner Pentaplast introducing recyclable PET blister films. Lastly, strategic acquisitions and partnerships, such as Aptar Pharma's acquisition of Metaphase Design Group, can enhance product offerings and service capabilities. These strategies will be critical for companies looking to strengthen their position or disrupt the market in the coming years.

R&D Investment: Companies must continue to innovate to stay competitive in a rapidly evolving industry.

Emerging Markets: Expansion in high-growth regions like Asia-Pacific is crucial for future market success.

Sustainability Mandate: Companies must address environmental concerns by prioritizing recyclable and biodegradable materials.

Strategic Acquisitions: Acquisitions and partnerships will help expand product offerings and accelerate innovation in pharmaceutical packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Assessment of Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulatory Standards on Packaging and Stringent Norms Against Counterfeit Products

- 5.1.2 Impact of Nanotechnology due to Innovative and New- generation Packaging Solutions

- 5.1.3 Regulatory Landscape Shapes Packaging Innovation

- 5.2 Market Challenges

- 5.2.1 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastics

- 6.1.2 Glass

- 6.1.3 Other Materials

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Syringes

- 6.2.3 Vials and Ampoules

- 6.2.4 Tubes

- 6.2.5 Caps and Closures

- 6.2.6 Labels

- 6.2.7 Other Product Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 3M Company

- 7.1.3 Schott AG

- 7.1.4 WestRock Company

- 7.1.5 Berry Global Group Inc.

- 7.1.6 McKesson Corporation

- 7.1.7 AptarGroup Inc.

- 7.1.8 Klockner Pentaplast Group

- 7.1.9 CCL Industries Inc.

- 7.1.10 FlexiTuff International Ltd

- 7.1.11 Gerresheimer AG

- 7.1.12 West Pharmaceutical Services Inc.

- 7.1.13 Becton, Dickinson and Company

- 7.1.14 Vetter Pharma International GmbH

- 7.1.15 Catalent Inc.

- 7.1.16 W. L. Gore & Associates Inc.

- 7.1.17 Nipro Corporation