|

市场调查报告书

商品编码

1690880

过程分析仪器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Process Analytical Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

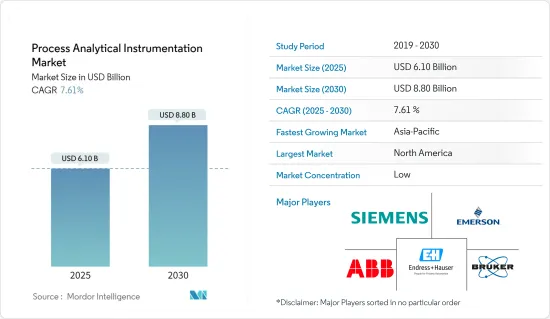

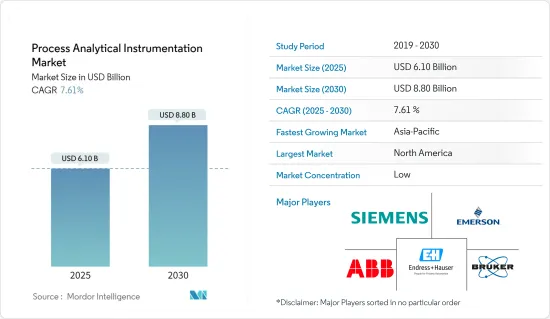

过程分析仪器市场规模预计在 2025 年为 61 亿美元,预计到 2030 年将达到 88 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.61%。

关键亮点

- 製程气体层析法是程式工程广泛应用的分析方法。它是最广泛使用的气体分析方法,因为它可以同时分析多种成分。气相层析的停机时间很长,需要大量监控。气相层析由製程模组化炉组成,可透过单一模组进行维修或更换。此外,它还可以减少设备停机时间并提高流程生产力。

- 製造业自动化程度的提升有助于调查市场的发展。由于工业4.0世界的影响,製造业正走向自动化。过程分析仪器非常适合此发展趋势。例如,基础现场汇流排和电子设备说明语言等数通讯技术和标准的整合使得仪器收集的资讯结构化且易于访问,从而增强流程并提供持续的准确性。

- 近年来,程式工程中仪器仪表的使用不断增加、全球製药业的投资不断增加、药品安全法规越来越严格、对食品品质的日益重视、原油和页岩气产量不断增加以及质谱仪技术的进步等因素正在推动研究市场的成长。光谱仪在环境、石化、食品安全、冶金、地球化学和临床毒理学研究领域中已广泛应用。这些产品主要用于中国、印度和拉丁美洲等市场,帮助这些市场满足日益严格的国际环境和消费者安全法规。

- 分析仪器的软体授权应被视为所调查市场的主要挑战之一,因为许可证因公司而异。例如,有些软体允许您在其他电脑上使用该软体进行资料处理,而有些则要求您为此目的购买第二个许可证。因此,这些问题可能会对预测期内的市场成长产生负面影响。

- 在新冠疫情期间,全球经济承受压力。经过多年的强劲成长之后,世界贸易已经放缓,主要原因是欧洲和美国的建筑问题。未来新兴国家也可能出现类似的问题。然而,这些短期动态应该揭示全球贸易体系的长期结构性变化,预计这将有利于所研究的市场。

过程分析仪器市场趋势

製药和生物技术领域市场显着成长

- 生物製药製造业依靠分析测试来提高生产力、优化和监控流程、表征生技药品和生物相似药,并提供即时产品品管。所有这些对于创建更精简的生物製药製造流程都至关重要,从而降低成本、提高产品品质的一致性并提高整体生产效率。

- 製药业一直在寻找提高产品品质的方法。随着设备变得越来越精密和准确,製药业越来越注重效率。因此,预计对药品研发的投资增加将为所研究市场的成长提供良好的前景。

- 此外,层析法和光谱法等重要的分析工具也正在取得新的进展。层析法(GC)仪器用于后製,因为 GC 仪器可以分析小而轻的化合物。换句话说,GC 是品管中的标准流程。然而,挥发性杂质的鑑定是气相层析在製药工业中的一个主要应用。

- 光学光谱技术有多种,每种技术在生产的不同阶段都有出色的表现。虽然一些技术,例如近红外线(NIR) 和傅立叶转换红外线(FTIR) 吸收光谱,已被广泛接受,但製药製造业也将受益于较新技术的广泛采用,例如兆赫光谱。

- 最近,光谱学也开始关注药物的结构组成和分布。它也用于品管,帮助检验製造过程和最终产品是否符合严格的合规性和监管控制。预计这些趋势将有利于研究市场未来的成长。

- 2023年4月,印度科技部长宣布了SUPREME计画。该倡议旨在为该部支持建立的分析仪器设施(AIF)的维护和升级提供资金支持。透过 SUPREME,政府不仅将协助维护和修復这些设施,还将透过购买额外的附件来帮助加强这些设施。

预计北美将占据较大的市场占有率

- 在过去几年中,北美製程分析技术 (PAT) 仪器供应商不断提高其技术的易用性、准确性、可靠性和有效性。该行业的公司已经实施了技术开发和其他创新,以更好地支援实验室和 QA/QC业务。

- 在石油和天然气、金属和采矿以及製药等行业,传统的製造流程包括生产成品,然后在实验室中进行分析以确认其品质。然而,这些传统方法有缺点,包括重复製造困难、需要不断优化製程以及批次被拒的可能性。为了克服这些缺陷,美国食品药物管理局(FDA)引入了一项名为PAT的新技术,并改变了其操作方式。

- 美国FDA 已经制定了 PAT 实施的法规结构。透过这个框架,FDA 试图激励製药业加强其生产流程。由于美国和加拿大的存在,北美占据了全球製程分析设备市场的很大份额,这两个国家在研发上投入了大量资金,并在生命科学、石油和天然气、材料科学、製药和生物製药行业占有重要份额。根据《製药商业》报道,美国医药市场正在崛起。

- 全部区域新药核准不断增加,推动了对医药解决方案的需求。这种激增凸显了製程分析仪器的必要性。这些仪器在药品生产过程中分析溶液的化学成分和物理性质方面发挥关键作用。 2024 年 6 月,沃特世公司推出了最新创新产品 Xevo MRT。这款桌上型质谱仪(MS)不仅树立了新的标桿,而且还满足了大规模人口和流行病学研究的需求。 Xevo MRT MS 将多反射器飞行时间(MRT) 和混合四极飞行时间(QTof) 技术结合在一个多功能桌上型格式。 Waters 的 Xevo MRT 质谱仪利用新一代 MRT 技术提供无与伦比的解析度和速度,以确保最佳的分析效能。

製程分析仪器产业概况

过程分析设备市场较为分散,有几位主要参与者。这些公司不断投资于策略伙伴关係和产品开发,以扩大市场占有率。市场的主要企业包括 ABB 有限公司、西门子股份公司、布鲁克公司、艾默生电气公司和 Endress & Hauser。近期市场走势如下:

- 2024 年 4 月 -美国药典 (USP) 宣布将创建有关製程分析技术 (PAT) 的专门章节。该倡议旨在定义 PAT、概述其主要特征、确定其推动因素并强调其在製药行业的实际应用。本章的主要目标是与目前的科学和监管基准相协调,重点关注药品製造中的即时监控、控制和品质保证。它也深入探讨了 PAT 在增强流程理解和最佳化方面的作用,尤其是在连续流程检验(CPV) 和即时发布测试 (RTRT) 中的作用。

- 2024 年 4 月-维美德宣布已完成对西门子股份公司製程气体层析法与整合业务的收购。西门子股份公司该部门专门负责 MAXUM II气相层析的平台、系统整合和客户服务。气相层析在分析各个生产阶段的气体和蒸发液体的化学成分方面发挥着至关重要的作用。该企业利用其在化学加工、液化天然气 (LNG)、精製和生质燃料的丰富专业知识,为客户提供关键见解,以提高全球品质、永续性和安全性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 微观经济因素如何影响市场

第五章市场动态

- 市场驱动因素

- 引入高效率马达

- 越来越多地采用电源管理和预测性维护解决方案

- 市场问题

- 充满活力的全球经济

第六章市场区隔

- 按类型

- 气相层析

- 气体分析仪

- 液体分析仪

- 光谱仪

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 製药和生物技术

- 金属与矿业

- 用水和污水

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章竞争格局

- 公司简介

- ABB Ltd

- Siemens AG

- Bruker Corporation

- Emerson Electric Co.

- Endress & Hauser AG

- Extrel CMS LLC

- Focused Photonics Inc.

- Hach Company

- Horiba Ltd

- Mettler Toledo

- MKS Instruments Inc.

- Neo Monitors AS

- Schneider Electric SE

- ServomexGroup Limited

- SICK AG

第八章投资分析

第九章:市场的未来

The Process Analytical Instrumentation Market size is estimated at USD 6.10 billion in 2025, and is expected to reach USD 8.80 billion by 2030, at a CAGR of 7.61% during the forecast period (2025-2030).

Key Highlights

- Process gas chromatography is a vastly used analysis for process engineering. It is the most utilized method for gas analysis since it permits multiple components to be analyzed alongside. Gas chromatographs have plenty of downtime and need a lot of supervision. The gas chromatograph consists of a process modular oven choice that another module may fix and replace. Furthermore, this may decrease equipment downtime and improve process productivity.

- The growth of automation in the manufacturing industry has driven the development of the market studied. With the worldwide impact of Industry 4.0, the manufacturing industry is going toward automation. Process analytical instruments are a good fit with this evolving trend. For instance, integrating digital communication technologies and standards such as foundation fieldbus and electronic device description language constructs the information collected by the instruments and makes it readily accessible to enhance the process and deliver persistent accuracy.

- In current years, the growth in the market studied has been driven by factors like the increasing use of the equipment in process engineering, high investments in pharmaceuticals worldwide, strict regulations on drug safety, growing emphasis on the quality of food products, rising crude and shale gas production, and technological advancements in mass spectrometers. Spectrometers are discovering applications in environmental, petrochemical, food safety, metallurgical, geochemical, and clinical toxicology research. These products are primarily used in markets such as China, India, and Latin America to help comply with growing stringent international environmental and consumer safety regulations.

- Software licensing of analytical instrumentation should be considered among the major challenges to the market studied, as different companies have different licenses. For instance, some allow the use of software on other computers for data processing, while others require the purchase of a second license for this purpose. Hence, such issues may negatively impact the growth of the market studied during the forecast period.

- During the COVID-19 pandemic, the global economy was under stress. After many years of strong growth, global trade slowed, mainly due to the accumulation of problems in Europe and the United States. Similar issues might arise in emerging economies in the future. However, these short-term dynamics should clarify the longer-term structural changes in the global trading system, which is anticipated to work in favor of the market studied.

Process Analytical Instrumentation Market Trends

Pharmaceutical and Biotechnology Segment Observing Significant Market Growth

- The biopharmaceutical manufacturing industry relies on analytical testing to help improve productivity, optimize and monitor processes, characterize biologics and biosimilars, and provide real-time product quality control. All these are essential in creating a more streamlined process within biomanufacturing, resulting in lower costs, more consistent product quality, and more efficient manufacturing across the board.

- The pharmaceutical industry has always searched for ways to improve product quality. Over time, as instrument accuracy and precision have improved, the industry has begun focusing more on efficiency. Hence, the growing investments in pharmaceutical research and development are expected to create a favorable outlook for the growth of the market studied.

- Furthermore, crucial analytical tools like chromatography and spectroscopy are gaining new ground. Since chromatography (GC) machines can analyze tiny and light compounds, GC is used in post-production. In other words, GC is a standard process during quality control. However, identifying volatile impurities is the primary use of GC within the pharmaceutical industry.

- There are several optical spectroscopy techniques, and each excels at various manufacturing stages. While some methods enjoy wide acceptance, such as near-infrared (NIR) and Fourier transform infrared (FTIR) absorption spectroscopy, broader adoption of newer techniques, such as terahertz Raman spectroscopy, can also benefit pharmaceutical production.

- More recently, spectroscopy has also begun to focus on the structural composition and distribution of pharmaceutical products. It has additional applications in quality control, which help validate that manufacturing processes and end products meet strict compliance and regulatory controls. Such trends will favor the growth of the market studied in the future.

- In April 2023, India's Science and Technology Minister unveiled the SUPREME program. This initiative aims to offer financial backing to maintain and upgrade analytical instrumentation facilities (AIFs) established with the ministry's backing. Through SUPREME, the government will not only aid in the maintenance and repair of these facilities but also support their enhancement by acquiring additional attachments.

North America Projected to Hold a Significant Market Share

- Process analytical technology (PAT) and instrument vendors across North America have continually advanced their technology's usability, accuracy, reliability, and efficacy in the past few years. Companies in this industry have introduced technological developments and other innovations to better support lab and QA/QC operations.

- In industries such as oil and gas, metal and mining, and pharmaceuticals, the traditional production processes involve manufacturing the finished products and laboratory analysis to verify their quality. However, these traditional methods have some drawbacks, such as recurring manufacturing difficulties, constant process optimization, and the probability of failed batches. Thus, to overcome these glitches, the new technology known as PAT was introduced by the US Food and Drug Administration (FDA) to change the mode of operation.

- The US FDA has outlined a regulatory framework for PAT implementation. With this framework, the FDA tries to motivate the pharmaceutical industry to enhance the production process. Owing to the existence of the United States and Canada, which are countries that spend a substantial amount on research and development and hold a prominent share in the life sciences, oil and gas, materials sciences, pharma, and biopharma industries, North America holds a major share of the global process analytical instrumentation market. According to Pharmaceutical Commerce, the pharmaceutical market is on the rise in the United States.

- The approval of new drugs is on the rise across regional countries, propelling the demand for pharmaceutical solutions. This surge underscores the need for process analytical instruments. These instruments play a crucial role in analyzing the chemical composition and physical properties of solutions during drug manufacturing. In June 2024, Waters Corporation introduced its latest innovation, the Xevo MRT. This benchtop mass spectrometer (MS) not only sets new benchmarks but also caters to the demands of large-scale populations and epidemiology studies. The Xevo MRT MS is a fusion of multi-reflecting time-of-flight (MRT) and hybrid quadrupole time-of-flight (QTof) technologies housed in a versatile benchtop design. By harnessing next-generation MRT technology, the Waters Xevo MRT Mass Spectrometer achieves exceptional resolution and speed, ensuring top-notch analytical performance.

Process Analytical Instrumentation Industry Overview

The process analytical instrumentation market is fragmented, with several major companies operating in it. These companies continuously invest in strategic partnerships and product developments to increase their market share. Major players in the market include ABB Ltd, Siemens AG, Bruker Corporation, Emerson Electric Co., and Endress & Hauser. Some of the recent developments in the market are:

- April 2024 - The United States Pharmacopeia (USP) announced that it was crafting a dedicated General Chapter on Process Analytical Technology (PAT). This initiative seeks to define PAT, outline its key attributes, identify its enablers, and shed light on its practical applications within the pharmaceutical industry. The chapter's primary goal is to harmonize with prevailing scientific and regulatory benchmarks, with a strong emphasis on real-time monitoring, control, and quality assurance across pharmaceutical manufacturing. It also delves into the realm of PAT's role in enhancing process understanding and optimization, notably in Continuous Process Verification (CPV) and Real-Time Release Testing (RTRT).

- April 2024 - Valmet announced that it had finalized its acquisition of Siemens AG's Process Gas Chromatography & Integration business. This sector of Siemens AG specializes in the MAXUM II Gas Chromatograph platform, Systems Integration, and Customer Services. Gas chromatographs play a pivotal role in analyzing the chemical composition of gases and evaporable liquids across various production phases. Leveraging extensive expertise in chemical processes, liquefied natural gas (LNG), refining, and biofuels, this business equips its clients with crucial insights to enhance quality, sustainability, and safety globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Impact of Microeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Introduction of High-efficiency Motors

- 5.1.2 Increasing Adoption of Power Management and Predictive Maintenance Solutions

- 5.2 Market Challenges

- 5.2.1 Dynamic Global Economy

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Gas Chromatographs

- 6.1.2 Gas Analyzers

- 6.1.3 Liquid Analyzers

- 6.1.4 Spectrometers

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals & Petrochemicals

- 6.2.3 Pharmaceutical & Biotechnology

- 6.2.4 Metal & Mining

- 6.2.5 Water & Wastewater

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Siemens AG

- 7.1.3 Bruker Corporation

- 7.1.4 Emerson Electric Co.

- 7.1.5 Endress & Hauser AG

- 7.1.6 Extrel CMS LLC

- 7.1.7 Focused Photonics Inc.

- 7.1.8 Hach Company

- 7.1.9 Horiba Ltd

- 7.1.10 Mettler Toledo

- 7.1.11 MKS Instruments Inc.

- 7.1.12 Neo Monitors AS

- 7.1.13 Schneider Electric SE

- 7.1.14 ServomexGroup Limited

- 7.1.15 SICK AG