|

市场调查报告书

商品编码

1549798

CPO(共封装光学)的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Co-packaged Optics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

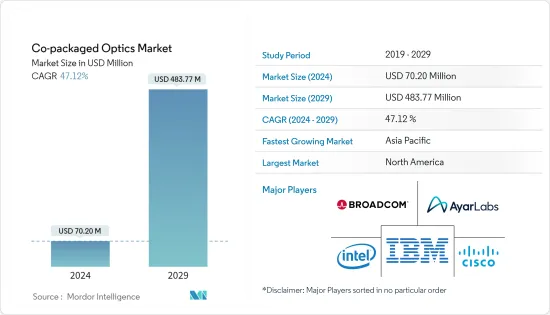

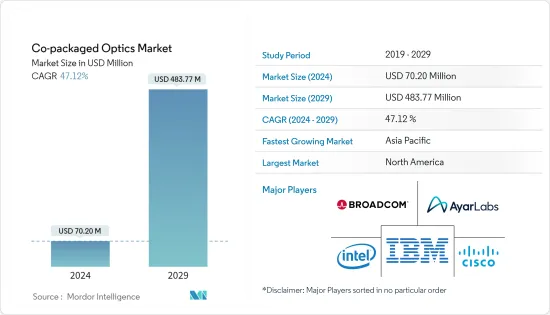

预计2024年全球CPO(共封装光学)市场规模为7,020万美元,2029年达4.8377亿美元,在预测期间(2024-2029年)复合年增长率为47.12。

主要亮点

- 由于高速资料传输需求的加速以及资料中心和云端服务的快速成长,CPO(共封装光学)市场正在迅速扩大。透过将光学和电子元件整合到一个封装中,CPO 缩短了电讯号的传播距离,从而最大限度地减少了延迟和功耗。这使您能够解决传统铜互连的频宽限制,并满足下一代资料中心架构日益增长的要求。

- 此外,资料中心网路不断向 400G、800G 及更高标准转变也是推动 CPO(共封装光学)市场的关键因素。这些高速标准需要 CPO 能够提供的创新,例如改进的讯号完整性和能源效率。资料中心需要更快、更有效率的资料处理和传输能力,而CPO技术可以支援这些资料中心的扩展需求。

- CPO(共封装光学)市场受益于光电和半导体製造业领导者之间的合作。英特尔、思科和博通等公司正大力投资 CPO 研发。这种合作对于推进技术、降低成本和确保不同平台之间的互通性至关重要。

- CPO 的采用得到了行业标准和法律规范的製定的支持,这些标准和监管框架确保了这些解决方案的兼容性和可靠性。电气和电子工程师协会 (IEEE) 和光互联网论坛 (OIF) 等标准机构正在努力製定指导方针,以促进 CPO 技术的广泛部署。

CPO(共封装光学)市场趋势

高效能运算的成长

- 由于对资料中心、复杂模拟、大规模资料处理和先进科学研究的需求不断增长,高效能运算(HPC)正在快速成长。这种成长在很大程度上推动了协同封装运算 (CPC) 的趋势和发展,它将处理器、记忆体和其他关键元件整合到一个封装中。 HPC 应用通常需要大规模资料处理能力,而各个晶片之间的传统互连可能成为瓶颈。 CPC 透过紧密整合组件、减少延迟和提高资料吞吐量来解决这个问题,这对于 HPC 工作负载至关重要。

- 透过将计算元素打包在一起,CPC 提高了效能和效率。这种整合缩短了资料传输的距离,降低了能耗并提高了整体效能。这对于高功率运作且需要最佳能源利用的 HPC 系统至关重要。 CPC 透过提供更有效率的热感解决方案来帮助管理这个问题。由于组件封装紧密,因此可以专门针对 HPC 环境量身订做更好的散热策略。

- 可扩展性是 HPC 系统的另一个重要因素,需要能够处理不断增加的计算负载。 CPC 提供了一种模组化方法,可让您增加处理能力,而无需传统多晶片设定的复杂性。这种模组化支援 HPC 基础设施的可扩充性。此外,在 HPC 需求的推动下,半导体製造的进步使 CPC 更加实用且更具成本效益。为了满足 HPC 严格的性能和整合要求,3D 堆迭和高级互连等技术正在开发中,进一步推动了 CPC 的采用。

- 减少处理器和记忆体之间的通讯开销对于保持 HPC 的高效能至关重要。 CPC 透过将这些元件整合到一个套件中,显着减少了这种开销,从而实现更快、更有效率的资料交换。儘管最初价格昂贵,但 HPC 需求带来的规模经济正在降低与 CPC 技术相关的成本。随着 HPC 的发展,容量的增加和持续的进步有助于降低成本,并使 CPC 更容易获得和流行。

亚太地区预计将占据主要市场占有率

- 由于资料中心、通讯和高效能运算领域的快速发展,亚太地区 CPO(共封装光学)市场正在显着成长。

- 中国、日本和韩国等国家处于领先地位,大力投资下一代网路基础设施,以支持资料流量的指数增长以及对更快、更有效率的资料传输解决方案的需求。例如,2023年11月,中国三大通讯业者公布的5G套餐用户总合增加约2,600万户。至此,5G套餐用户总数达到约13.48亿户。截至11月底,5G套餐用户占中国通讯和中国电信行动用户总数的比例分别为78.6%和77.3%。

- 该地区强大的製造基础,加上支持性的政府政策和大量的研发投资,正在推动原棕油技术的创新。此外,亚太地区是主要高科技公司和半导体製造商的所在地,加速了这些先进光学解决方案的采用和开发。

- 5G 网路部署的增加、云端服务的扩展以及人工智慧和物联网应用的持续发展将进一步推动这一市场成长,使亚太地区成为全球共封装光学 (CPO) 领域的关键参与者。爱立信预计,到2028年终,东南亚和大洋洲的5G用户数将达到约6.2亿。

CPO(共封装光学)产业概览

全球 CPO(共封装光学)市场高度分散,有许多重要公司。从市场占有率来看,目前大公司占据市场主导地位。凭藉显着的市场份额,这些领先公司专注于扩大全球客户群。这些公司利用策略合作倡议来提高市场占有率和盈利。

- 2024 年 3 月:在 2024 年光纤通讯大会(OFC)上,AI/ML 基础设施先进光电互连解决方案领先开发商 Lanovas 宣布与联发科合作推出联发科下一代 ASIC 设计平台,宣布将提供 6.4。 (共封装光学)解决方案该解决方案旨在支援 AI/ML SoC 和乙太网路应用的 6.4Tbps 高基数光连接模组。

- 2023 年 3 月:思科宣布其共封装光学 (CPO) 愿景,不仅展示了其可行性,还展示了其克服实施挑战的必要性和策略。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

- 延迟敏感流量对 CPO 需求的影响

- 资料中心中的人工智慧和机器学习

- 对 5G、CPO 和资料中心的影响

- 视讯会议和线上活动

第五章市场动态

- 市场驱动因素

- 智慧型设备的普及和资料流量的增加

- 超级资料中心的重要性日益增长

- 高效能运算的成长

- 市场限制因素

- 网路复杂度

- 设备相容性和永续性问题

第六章 市场细分

- 按资料速率

- 1.6T以下

- 1.6T

- 3.2T

- 6.4T

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Ayar Labs Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- TE Connectivity

- Furukawa Electric Co. Ltd

- Hisense Broadband Multimedia Technology Co. Ltd

- POET Technologies

- Kyocera Corporation

- Huawei Technologies Co. Ltd

- SENKO Advanced Components Inc.

- Sumitomo Electric Industries Ltd

第八章投资分析

第九章 市场未来展望

The Co-packaged Optics Market size is estimated at USD 70.20 million in 2024, and is expected to reach USD 483.77 million by 2029, growing at a CAGR of 47.12% during the forecast period (2024-2029).

Key Highlights

- The co-packaged optics (CPO) market is growing rapidly due to the accelerating demand for high-speed data transmission and the exponential growth of data centers and cloud services. Co-packaged optics integrate optical and electronic components into a single package, reducing the distance that electrical signals need to travel and minimizing latency and power consumption. This addresses the bandwidth limitations of traditional copper interconnects and meets the growing requirements of next-generation data center architectures.

- Moreover, the ongoing shift toward 400 G, 800 G, and beyond in data center networking is a key factor propelling the co-packaged optics market. These higher-speed standards require innovations that CPOs can deliver, such as improved signal integrity and energy efficiency. Data centers require faster, more efficient data processing and transmission capabilities, and CPO technology can support the scaling needs of these data centers.

- The co-packaged optics market is benefiting from collaborations between industry leaders in photonics and semiconductor manufacturing. Companies such as Intel, Cisco, and Broadcom are investing heavily in CPO research and development. These collaborations are essential for advancing the technology, reducing costs, and ensuring interoperability across different platforms.

- The adoption of co-packaged optics is supported by the development of industry standards and regulatory frameworks that ensure the compatibility and reliability of these solutions. Standards associations, including the Institute of Electrical and Electronics Engineers (IEEE) and the Optical Internetworking Forum (OIF), are working to establish guidelines that facilitate the broader deployment of CPO technology.

Co-packaged Optics Market Trends

Growth in High-performance Computing

- High-performance computing (HPC) is rapidly growing due to increasing demands for data centers, complex simulations, large-scale data processing, and advanced scientific research. This growth significantly drives the trend and development in co-packaged computing (CPC), where processors, memory, or other critical components are integrated into a single package. HPC applications often require massive data processing capabilities, and traditional interconnects between separate chips can become bottlenecks. CPC addresses this by integrating components closely, reducing latency, and increasing data throughput, which is essential for HPC workloads.

- By packaging computing elements together, CPC enhances performance and efficiency. This integration reduces the distance data needs to travel, cutting energy consumption and improving overall performance, which is crucial for HPC systems that operate at high power and require optimal energy utilization. High-performance computations generate significant heat, and CPC helps manage this by allowing for more efficient thermal solutions. Since components are packaged in proximity, better heat dissipation strategies can be tailored specifically for HPC environments.

- Scalability is another critical factor for HPC systems, which demand the ability to handle increasing computational loads. CPC offers a modular approach where additional processing power can be added without the complexities associated with traditional multi-chip setups. This modularity supports the scalable nature of HPC infrastructures. Moreover, advances in semiconductor fabrication, driven by the needs of HPC, are making CPC more viable and cost-effective. Techniques like 3D stacking and advanced interconnects are being developed to meet the stringent performance and integration requirements of HPC, further propelling the adoption of CPC.

- Reducing communication overhead between processors and memory is crucial for maintaining high performance in HPC. CPC significantly reduces this overhead by integrating these components within a single package, enabling faster and more efficient data exchanges. While initially expensive, the economies of scale driven by HPC demand are reducing the costs associated with CPC technologies. As HPC grows, the larger volumes and continuous advancements help reduce costs, making CPC more accessible and widespread.

Asia-Pacific is Expected to Hold Significant Market Share

- The co-packaged optics market in Asia-Pacific is experiencing significant growth, driven by rapid advancements in data centers, telecommunications, and high-performance computing sectors.

- Countries like China, Japan, and South Korea are at the forefront, investing heavily in next-generation network infrastructure to support the exponential increase in data traffic and the demand for faster, more efficient data transmission solutions. For instance, in November 2023, China's three main telecom operators reported a combined net increase of around 26 million 5G package subscribers. This brought their total 5G package subscriber base to nearly 1.348 billion. By the end of November, 5G package subscribers made up 78.6% and 77.3% of China Mobile's and China Telecom's total mobile subscriber bases, respectively.

- The region's strong manufacturing base, coupled with supportive government policies and substantial R&D investments, is fostering innovation in co-packaged optics technology. Additionally, the presence of major tech companies and semiconductor manufacturers in Asia-Pacific is accelerating the adoption and development of these advanced optical solutions.

- This market's growth is further propelled by the increasing implementation of 5G networks, the expansion of cloud services, and the continuous evolution of AI and IoT applications, positioning Asia-Pacific as a critical player in the global co-packaged optics landscape. According to Ericsson, 5G is projected to reach approximately 620 million subscriptions in Southeast Asia and Oceania by the end of 2028.

Co-packaged Optics Industry Overview

The global co-packaged optics market is highly fragmented due to several significant players. In terms of market share, the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base worldwide. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- March 2024: At the 2024 Optical Fiber Communication Conference (OFC), Ranovus, a leading developer of advanced photonics interconnect solutions for AI/ML infrastructure, announced its collaboration with MediaTek to deliver a 6.4 Tbps co-packaged optics solution for MediaTek's next-generation ASIC design platform. This solution is designed to support a 6.4 Tbps high-radix optical interconnect for AI/ML SoC and ethernet applications.

- March 2023: Cisco presented its vision for co-packaged optics, demonstrating not only their feasibility but also the necessity for them and the strategies to overcome deployment challenges.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Impact of Latency-Sensitive Traffic on Demand for CPO

- 4.5.1 AI and Machine Learning in Data Centers

- 4.5.2 5G, CPO, and the Impact on Data Centers

- 4.5.3 Video Conferencing and Online Events

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Adoption of Smart Devices and Rise in Data Traffic

- 5.1.2 Growth in the Importance of Mega Data Centers

- 5.1.3 Growth in High-performance Computing

- 5.2 Market Restraints

- 5.2.1 Increase in Network Complexity

- 5.2.2 Device Compatibility and Sustainability Issues

6 MARKET SEGMENTATION

- 6.1 By Data Rates

- 6.1.1 Less than 1.6 T

- 6.1.2 1.6 T

- 6.1.3 3.2 T

- 6.1.4 6.4 T

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ayar Labs Inc.

- 7.1.2 Broadcom Inc.

- 7.1.3 Cisco Systems Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Intel Corporation

- 7.1.6 Microsoft Corporation

- 7.1.7 TE Connectivity

- 7.1.8 Furukawa Electric Co. Ltd

- 7.1.9 Hisense Broadband Multimedia Technology Co. Ltd

- 7.1.10 POET Technologies

- 7.1.11 Kyocera Corporation

- 7.1.12 Huawei Technologies Co. Ltd

- 7.1.13 SENKO Advanced Components Inc.

- 7.1.14 Sumitomo Electric Industries Ltd