|

市场调查报告书

商品编码

1549805

5G基地台:市场占有率分析、产业趋势/统计、成长预测(2024-2029)5G Base Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

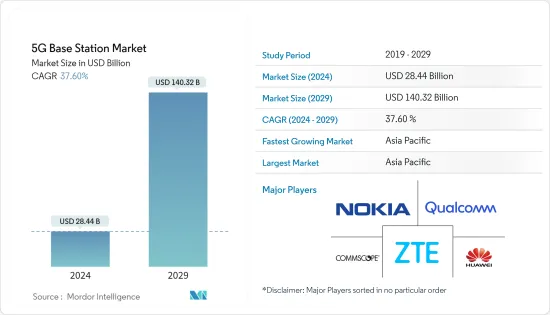

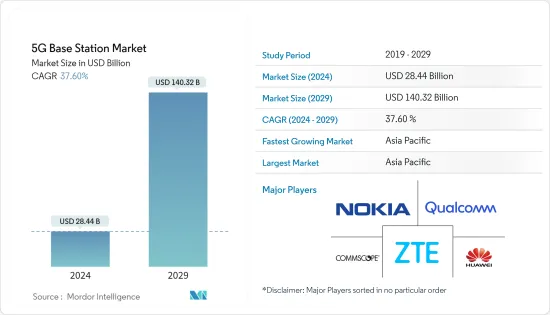

5G基地台市场规模预计到2024年为284.4亿美元,预计到2029年将达到1403.2亿美元,在预测期内(2024-2029年)复合年增长率预计为37.60%。

由于对高速网路连线的强烈需求,5G基地台市场近年来经历了显着成长。在已开发国家和新兴国家,智慧型手机拥有率每年都在稳定上升。透过利用AR、VR等先进技术,品牌可藉助5G网路提升顾客的购物体验,协助顾客找到最适合自己需求的产品。

主要亮点

- 5G技术显着降低了延迟率,即发送和接收讯息所需的时间。较低的整体延迟可提高用户满意度并为创造性应用程式开闢新的可能性。

- 此外,在5G网路设计领域,出现了向超可靠低延迟通讯(URLLC)发展的趋势。此功能可以优化资料交换的组织。我们支援工厂自动化、工业互联网、智慧电网、自动驾驶、机器人手术等高水准服务。因此,上述应用对更快反应时间的需求不断增长,大大推动了全球5G基地台产业的扩张。

- 5G科技可以显着增强智慧城市的公共和保障。透过快速有效的 5G 网络,智慧城市网路可以从各种来源收集和查询大量信息,包括摄影机、智慧交通号誌和其他物联网 (IoT) 设备。

- 此外,由5G技术支援的物联网网路将使互连设备之间的通讯更快,因为5G通讯速度可达1Gbps。因此,5G 连接的物联网系统和设备在执行时间敏感的任务时将非常准确。

- 由于提供持续的5G服务需要大量的BTS单元,因此建造必要的5G基础设施和软体升级的成本将相当高。 5G 网路的成功部署可能需要对行动通信基地台、连接节点、中央交换器、软体和行动装置进行重大升级。

5G基地台市场趋势

智慧城市实现显着成长

- 智慧城市中越来越多的5G使用案例将推动对5G基地台的需求,因为5G技术是物联网的使能技术,而智慧城市从根本上依赖物联网。

- 此外,5G技术所提供的高密度和低延迟的结合将深刻改变智慧城市,进一步体现全球智慧城市应用对5G基地台的强劲需求。

- 按类型分析小型蜂窝基站在预测期内在智慧城市领域占据重要份额。小型基地台是低功耗基地台,对于在街道、建筑物和购物中心等特定位置提供覆盖和容量至关重要,并且在智慧城市应用中获得了巨大的吸引力。

- 此外,小型基地台5G基地台的角色对于在智慧城市中部署 5G 等技术至关重要。市场供应商已经认识到需要部署小型基地台来扩大密集城市中行动网路的容量和覆盖范围。分析这些新兴市场的开拓,以支持市议会的智慧城市规划并促进市场成长。

亚太地区成长强劲

- 以华为、中兴等公司主导的亚太地区对5G技术的大力投资,正在推动5G基地台的快速部署。此外,亚太国家的政府措施、数位化的提高以及智慧型手机的高普及率正在推动对 5G基地台的需求。

- 根据工业和资讯化部的报告,到2023年终,中国5G用户将达到8.05亿人。 GSMA也预测,到2025年,40-50%的中国行动用户将使用5G网路。这些统计数据证实了中国市场厂商对5G基地台的强劲部署。

- 在亚太地区,工业部门预计将推动 5G基地台的成长,特别是在日本、中国和韩国。这些国家越来越多地采用物联网和工业4.0,增加了对5G基地台的需求,以实现工业自动化和智慧工厂解决方案。

- 亚太地区可望见证全球 5G基地台市场的强劲成长。这一增长受到多种因素的支持,包括政府对快速 5G 部署的大力支持、不断增长的 5G 用户群、最终用户行业对该技术的采用增加,以及整个行业对高速、低延迟连接的需求激增。全部区域正在。

5G基地台行业概况

5G基地台市场被多家厂商瓜分,包括华为科技公司、中兴通讯公司、诺基亚公司、康普控股公司和高通技术公司。由于多家公司认为该市场是全球扩张的机会,预计公司集中度在预测期内将进一步提高。

- 2024 年 2 月,戴尔科技集团与诺基亚宣布延长策略伙伴关係。该合作伙伴关係利用戴尔的基础设施解决方案和诺基亚的专用无线连接专业知识来推进开放网路架构并为企业提供专用5G应用。诺基亚在开发5G网路基地台产品方面拥有专业知识,透过此次合作将巩固其在5G基地台市场的地位。

- 2023年9月,爱立信与西班牙电信签署了关于基于开放RAN架构的Cloud RAN演进的谅解备忘录。爱立信的Cloud RAN为通讯服务供应商建立巨集网路以将5G扩展到企业应用提供了巨大的机会,展示了市场对基于大型基地台的5G基础设施的需求,并支援未来的微型蜂巢式基地台。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 提高智慧型手机普及率

- 5G 提供的主要优势

- 市场挑战

- 设计和营运挑战

- 市场机会

- 持续努力在新兴国家引入5G

第六章 市场细分

- 按类型

- 小型基地台

- 大型基地台

- 按最终用户

- 商业的

- 住宅

- 工业的

- 政府机构

- 智慧城市

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Nokia Corporation

- CommScope Holding Company Inc.

- QUALCOMM Incorporated

- Qorvo Inc.

- Alpha Networks Inc.

- NEC Corporation

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co. Ltd

第八章投资分析

第9章市场的未来

The 5G Base Station Market size is estimated at USD 28.44 billion in 2024, and is expected to reach USD 140.32 billion by 2029, growing at a CAGR of 37.60% during the forecast period (2024-2029).

The 5G base station market has experienced significant growth in recent years because of the strong need for high-speed network connectivity. The smartphone ownership rate steadily rises each year in advanced and emerging economies. Utilizing advanced technologies such as AR and VR, brands can enhance their customers' shopping experience with the help of 5G networks, assisting them in finding the most suitable product for their requirements.

Key Highlights

- 5G technology provides a much lower latency rate, which is the time it takes to receive and send information. Reducing overall latency enhances user satisfaction and opens up new possibilities for creative applications.

- Additionally, there is a movement toward ultra-reliable low latency communications (URLLC) within the 5G network design realm. This feature allows for optimal organization of data exchanges. It supports high-level services like factory automation, industrial internet, smart grid, autonomous driving, and robotic surgeries. Therefore, the increasing need for faster response times in the mentioned applications is greatly driving the expansion of the worldwide 5G base station industry.

- 5G technology can significantly enhance public safety and security in smart cities. Intelligent city networks can gather and examine vast quantities of information from different origins, such as video cameras, intelligent traffic lights, and other Internet of Things (IoT) devices, through the fast and effective 5G network.

- Additionally, IoT networks utilizing 5G technology would enable faster communication among interconnected devices due to 5G speeds reaching up to 1 Gbps. Therefore, IoT systems and devices linked to 5G will be extremely precise when performing time-sensitive tasks.

- The expenses for setting up the necessary 5G infrastructure and upgrading software are significantly high due to the large number of BTS units needed for continuous 5G service delivery. Successful implementation of the 5G network could necessitate significant upgrades in cell sites, connective nodes, central switches, software, and mobile devices.

5G Base Station Market Trends

Smart Cities to Witness Major Growth

- 5G technology is an enabling technology for IoT, and as smart cities essentially rely on IoT, the demand for 5G base stations is driven by the growing use cases of 5G in smart cities.

- In addition, the combination of high density and low latency offered by 5G technology will deeply transform smart cities, thus further indicating strong demand for 5G base stations in smart city applications worldwide.

- Small cells are analyzed by type to hold a significant share in the smart cities segment during the forecast period. The small cells are low-power base stations vital to providing coverage and capacity in specific locations, such as streets, buildings, and malls, thus gaining significant traction in smart city applications.

- Further, the role of a small cell 5G base station is becoming paramount to roll out technologies such as 5G in smart cities. Market vendors recognize the need to deploy small cells to increase the capacity and coverage of mobile networks in dense cities. Such developments are analyzed to help city councils in smart city planning and subsequently drive the market's growth.

Asia-Pacific to Register Major Growth

- Asia-Pacific's robust investments in 5G technology, spearheaded by companies like Huawei and ZTE Corporation, fuel the rapid deployment of 5G base stations. Additionally, government initiatives, a push for digitization, and high smartphone penetration in Asia-Pacific nations are bolstering the demand for 5G base stations.

- By the close of 2023, China had a staggering 805 million 5G users, as the Ministry of Industry and Information Technology (MIIT) reported. Also, the GSMA predicts that by 2025, 40-50% of China's mobile users could be on 5G networks. These statistics underscore the robust deployment of 5G base stations by market vendors in China.

- The industrial sector, particularly in Japan, China, and South Korea, is expected to drive 5G base station growth in Asia-Pacific. The rising adoption of IoT and Industry 4.0 in these countries fuels demand for 5G base stations, enabling industrial automation and smart factory solutions.

- Asia-Pacific is poised for robust growth in the global 5G base station market. This growth is underpinned by several factors, including strong governmental support for rapid 5G deployment, an expanding 5G user base, increasing tech adoption in end-user industries, and a surging demand for high-speed, low-latency connectivity across the region.

5G Base Station Industry Overview

The 5G base station market is fragmented with several players like Huawei Technologies Co. Ltd, ZTE Corporation, Nokia Corporation, CommScope Holding Company Inc., and Qualcomm Technologies Inc. The firm concentration ratio is expected to grow more during the forecast period because several firms consider this market a lucrative opportunity to expand globally.

- In February 2024, Dell Technologies and Nokia announced an extension of their strategic collaboration. This partnership leverages Dell's infrastructure solutions and Nokia's expertise in private wireless connectivity to propel open network architectures and enable private 5G applications for businesses. This move is set to bolster Nokia's position in the 5G base station market, given its prowess in developing base station products for 5G networks.

- In September 2023, Ericsson and Telefonica signed an MoU for Cloud RAN evolution based on Open RAN architecture, showing that Ericsson Cloud RAN would offer significant opportunities for communications service providers to build macro networks to expand their 5G into enterprise applications, showing the demand for macro cell-based 5G infrastructure demand in the market, which would support the growth of microcell base stations in the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Penetration Rate of Smartphones

- 5.1.2 Key Benefits Offered by 5G over its Predecessors

- 5.2 Market Challenges

- 5.2.1 Design and Operational Challenges

- 5.3 Market Opportunities

- 5.3.1 Ongoing Efforts Toward The Introduction of 5G in Emerging Countries

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Small Cell

- 6.1.2 Macro Cell

- 6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Residential

- 6.2.3 Industrial

- 6.2.4 Government

- 6.2.5 Smart Cities

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies Co. Ltd

- 7.1.2 ZTE Corporation

- 7.1.3 Nokia Corporation

- 7.1.4 CommScope Holding Company Inc.

- 7.1.5 QUALCOMM Incorporated

- 7.1.6 Qorvo Inc.

- 7.1.7 Alpha Networks Inc.

- 7.1.8 NEC Corporation

- 7.1.9 Telefonaktiebolaget LM Ericsson

- 7.1.10 Samsung Electronics Co. Ltd