|

市场调查报告书

商品编码

1549861

可食用包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Edible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

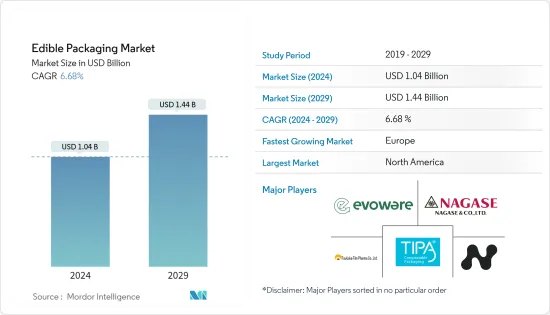

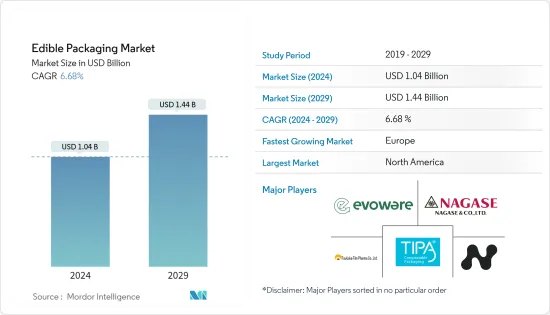

可食用包装市场规模预计到 2024 年为 10.4 亿美元,预计到 2029 年将达到 14.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.68%。

由植物来源製成的可食用包装可以直接食用,不需要加工或回收。随着越来越多的人意识到环保,这种新型包装是传统包装的绝佳替代品。满足对环保产品的需求并帮助减少垃圾掩埋场的废弃物。

可食用包装可保护食品免受二氧化碳、脂肪、水分、氧气和异味的影响。它可以保持食品新鲜并延长其保质期。主要优点之一是它们可以含有多种改善食品安全和营养的活性成分。可食用包装材料包括大豆蛋白、小麦麸质、乳清和明胶,吸引了该领域的投资。

2023 年 10 月,Gousto(SCA Investments Limited)推出了世界上第一个基于豌豆蛋白的可食用包装,该包装是与剑桥大学的衍生公司 Xampla 合作开发的。这种包装的作用类似于塑料,可以保留食品的味道和保质期,但它是纯素、无麸质且环保的。

各国政府和主要製造商正在投资食品和药品的可食用包装。例如,美国农业部和美国化学会正在开发酪蛋白(一种乳蛋白质膜)的可食用包装材料。这种材料在保护食品免受氧气侵害方面效果好 500 倍。

随着世界各地禁止使用塑胶製品,可食用袋、吸管和容器等环保产品越来越受欢迎。这增加了包装行业的需求和成长。生产食用产品的公司正在扩大业务以满足这一需求,从而导致该行业的投资增加。

来自卡达门格洛尔的非居住印度人 (NRI) 开发了一种名为「EnviGreen」的环保手提包。虽然这个袋子看起来像塑料,但它是由天然淀粉和植物油衍生物製成的。它在常温水中一天内溶解,在沸水中 15 秒内溶解。预计此类技术创新将在未来几年提振市场需求。

然而,可食用包装的生产成本比传统包装更高。高成本和需要二次包装来防止污染带来了市场挑战。製造商必须在防护措施上投入更多资金,从而增加整体包装成本。

食用包装市场趋势

对永续解决方案的需求不断增长以及延长产品保质期的需求推动了市场成长

玻璃、纸张、纸板、金属和塑胶用于食品包装。然而,塑胶包装造成许多环境问题。为了解决这个问题,製造商现在转向透过薄膜和涂层来使用生物分解性和可食用的食品包装。

可食用包装材料包括各种淀粉、胶原蛋白、玉米蛋白和麸质材料。通常在成膜过程中会向这些材料中添加添加剂,以提高其保护品质。每种类型的薄膜都有特定的功能,主要充当延长食品保质期的屏障。可食性包装的主要优点是可以与食品一起食用,减少废弃物和对环境的影响。与合成包装相比,它还具有物理和营养优势。

消费者的健康意识越来越强,对植物来源食品的兴趣也越来越大。对此,食品生产商正在努力改进包装技术,以延长保质期,确保食品安全和保质期。

同时,研究人员和技术机构正在开发含有各种成分的新型可食用薄膜,这正在推动市场成长。例如,2023 年 8 月,食品科技Start-UpsFoodberry 用果皮创造了一种可食用植物来源涂层。这些覆盖物有助于延长冰淇淋和鹰嘴豆泥等对水分敏感的食品的保质期。

随着人们对气候变迁和塑胶污染等环境问题的日益关注,永续包装成为最佳选择。公司可以透过使用生物分解性或可再生材料(例如植物来源的材料)来显着减少对环境的影响。

此外,越来越多的消费者为永续包装支付额外费用。根据便利商店和燃料零售商全球贸易组织全国便利商店协会 (NACS) 的数据,大约 80% 的消费者现在担心其购买的产品对环境的影响,到 2023 年这一比例将增加到 68%。于2022 年的66%。预计这将对受调查的市场产生相应的影响。

欧洲地区的永续革命有助于市场成长

研究与发展 (R&D) 力度不断加大,尤其是在英国等地区。这些努力通常集中在用海藻等材料製造可食用的包装。这些创新者的主要目标是创造食用方便且安全的包装,避免传统的垃圾掩埋场和海洋污染。英国的永续包装公司 Knotpla Limited 就是一个很好的例子。 Notopura 因其海藻製成的包装赢得了着名的 Earthshot永续包装奖。

2023年4月,Notpla的产品「Ooho」在哥德堡举办的马拉松赛事上走红。 Ooho 取代了 20,000 多个普通塑胶杯,为跑步者提供了一种在旅途中保持水分的环保方式。其天然且可食用的设计改善了跑步者的体验,并显着减少了一次性塑胶的使用。

例如,德国新兴企业Traceless 开发了一种新工艺,可将淀粉和啤酒残渣等农业废弃物转化为塑胶薄膜和刚性材料等产品。这些材料由植物残渣製成,完全可堆肥。根据其厚度,它会在家庭堆肥箱中或透过厌氧消化分解,在两到九週内产生沼气。这些创新预计将推动可食用包装市场的发展。

欧盟 (EU) 对杯子和吸管等一次性塑胶产品的禁令对市场趋势产生了巨大影响。包装製造商迅速做出反应,推出可食用吸管作为永续的替代品。 2023 年 4 月,永续食品解决方案的领导者 EdibleStraws 将推出最新产品可食用吸管,进一步支持摆脱传统塑胶和纸吸管。

随着该地区面临日益增长的永续性问题和有关一次性塑胶的更严格的法规,可食用包装市场正在发生重大变化。随着众多企业进入市场并加大研发投入,市场可望稳定成长。

食用包装行业概况

由于市场上的公司数量有限,可食用包装市场处于半固体。参与市场的主要公司包括Nagase America LLC (Nagase Sangyo)、Evoware (PT. Evogaia Karya Indonesia)、Notpla Limited、Tipa Corp Ltd、TSUKIOKA FILM PHARMA、Devro PLC (Saria Nederland BV)、JRF Technology LLCs等。公司专注于扩大市场占有率并投资研发 (R&D) 来开发创新产品。

2023 年 7 月 - Notpla Limited 透过扩大海藻涂层板材的供应并扩展到比荷卢经济联盟地区,扩大其在欧洲的业务。海藻基涂层板材越来越受到具有环保意识的公司的青睐。

2023 年 5 月 - Nagase America LLC 宣布成立新兴技术团队,以推动产品开发的探索阶段,专注于开拓高潜力的新业务并降低风险。透过新团队,我们将提供以下技术、产品和服务,以推动美洲的业务转型:

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 需要消除产品类型废弃物循环并延长产品保质期

- 禁止使用一次性塑胶以及对永续性的兴趣日益浓厚

- 市场限制因素

- 生产成本高

第六章 市场细分

- 按来源

- 植物

- 动物

- 按原料分

- 蛋白质

- 多醣

- 脂质

- 其他原料

- 按最终用户产业

- 食品

- 饮料

- 药品

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Devro PLC(Saria Nederland BV)

- Nagase America LLC(Nagase & Co., Ltd.)

- JRF Technology, LLC

- Evoware(PT. Evogaia Karya Indonesia)

- Notpla Limited

- Tipa Corp Ltd.

- Amtrex Nature Care Pvt. Ltd.

- Envigreen Biotech India Private Ltd.

- TSUKIOKA FILM PHARMA CO., LTD.

- ECOLOTEC LIMITED

- Glanbia plc

第八章投资分析

第9章 市场的未来

The Edible Packaging Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 1.44 billion by 2029, growing at a CAGR of 6.68% during the forecast period (2024-2029).

Edible packaging, made from plant-based ingredients, can be eaten directly, eliminating the need to process or recycle. With more people caring about the environment, this new type of packaging is an excellent alternative to traditional options. It meets the demand for eco-friendly products and helps reduce waste in landfills.

Edible packaging protects food from carbon dioxide, fats, moisture, oxygen, and smells. It keeps food fresh and extends its shelf life. One significant advantage is that it can include various active ingredients that improve food safety and nutrition. Edible packaging materials include soybean protein, wheat gluten, whey, and gelatine, attracting businesses to invest in this area.

In October 2023, Gousto (SCA Investments Limited) introduced the world's first edible pea protein-based packaging, developed with Xampla, a spinout from Cambridge University. This packaging works like plastic, preserving food taste and shelf life, but it is vegan, gluten-free, and eco-friendly.

Governments and major manufacturers are investing in edible packaging for food and pharmaceutical products. For example, the U.S. Department of Agriculture and the American Chemical Society are developing edible packaging from casein, a milk protein film. This material is 500 times better at protecting food from oxygen.

With the global ban on plastic, eco-friendly options like edible bags, straws, and containers are becoming more popular. This has increased demand and growth in the packaging sector. Companies making edible products are expanding to meet this demand, leading to more investments in the field.

A Non-Resident Indian (NRI) from Mangalore, based in Qatar, has created EnviGreen, an eco-friendly carrier bag. These bags look like plastic but are made from natural starch and vegetable oil derivatives. They dissolve in room-temperature water within a day and in boiling water within 15 seconds. Such innovations are expected to boost market demand in the coming years.

However, edible packaging is more expensive to produce than traditional packaging. The higher cost and the need for secondary packaging to protect against contamination are challenges for the market. Manufacturers have to spend more on protective measures, increasing overall packaging costs.

Edible Packaging Market Trends

The Increasing Demand for Sustainable Solutions and the Need for Extended Product Shelf-Life are helping drive market growth

Food packaging uses glass, paper, cardboard, metals, and plastic. However, plastic packaging causes many environmental problems. To address this, manufacturers are now focusing on biodegradable and edible food packaging from films and coatings.

Edible packaging materials vary, including starch, collagen, zein, and gluten-based options. Additives are often added to these materials during film formation to improve their protective qualities. Each type of film has a specific function, mainly acting as a barrier to extend the food's shelf life. The main benefit of edible packaging is that it can be eaten along with food, reducing waste and environmental impact. It also offers physical and nutritional benefits compared to synthetic packaging.

Consumers are becoming more health-conscious and interested in plant-based foods. In response, food manufacturers are working harder to extend shelf life and improve packaging technology to ensure food safety and preservation.

At the same time, researchers and technological institutions are developing new edible films using different components, which helps the market grow. For example, in August 2023, the food tech startup Foodberry created plant-based edible coverings from fruit skins. These coverings help extend the shelf life of moisture-sensitive foods like ice cream and hummus.

With growing concerns about climate change, plastic pollution, and other environmental issues, sustainable packaging is the best option. Businesses can significantly reduce their environmental impact using biodegradable or renewable materials like plant-based options.

Additionally, more consumers are willing to pay extra for sustainable packaging. According to the National Association of Convenience Stores (NACS), a leading global trade association for convenience and fuel retailing, about 80% of consumers are now concerned about the environmental impact of their purchases, up from 68% in 2023 and 66% in 2022. This is expected to have a fair effect on the studied market.

A Sustainable Revolution in the European Region Aids the Market Growth

Research and development (R&D) efforts are growing, particularly in regions like the United Kingdom. These efforts focus on creating edible packaging, often from materials like seaweed. The main goal for these innovators is to make packaging that's useful and safe to eat, avoiding traditional landfills and ocean pollution. Notpla Limited, a UK-based sustainable packaging company, is a great example. Notpla's work in seaweed-based packaging earned it the prestigious Earthshot Prize, a well-known award in the sustainable packaging field.

Showing the practicality of these innovations, in April 2023, Notpla's product, Ooho, was a hit at a marathon in Gothenburg. Ooho replaced over 20,000 regular plastic cups, giving runners an eco-friendly way to hydrate on the go. Its all-natural, edible design improved the runners' experience and significantly reduced single-use plastic use.

For example, Traceless, a German startup, has developed a new process that turns agricultural waste, like starch and brewery residues, into various products, from plastic films to hard materials. These materials, made from plant residues, are fully compostable. Depending on their thickness, they can break down in 2-9 weeks, either in a home compost bin or through anaerobic digestion, producing biogas. Such innovations are expected to boost the edible packaging market.

The European Union's ban on single-use plastic products, including cups and straws, has dramatically affected market trends. Packaging manufacturers have quickly responded by introducing edible straws as a sustainable alternative. In April 2023, EdibleStraws, a leader in sustainable food solutions, launched its latest product, edible straws, further supporting the move away from traditional plastic and paper straws.

The edible packaging market is significantly changing as the region faces growing sustainability concerns and stricter rules on single-use plastics. The market is set for solid growth with many players and increased R&D investments.

Edible Packaging Industry Overview

The edible packaging market is semi-consolidated due to limited market players. The key players operating in the market include Nagase America LLC (Nagase & Co. Ltd), Evoware (PT. Evogaia Karya Indonesia), Notpla Limited, Tipa Corp Ltd, TSUKIOKA FILM PHARMA CO. LTD, Devro PLC (Saria Nederland BV), and JRF Technology LLC, among others. The players focus on expanding their market share and investing in research and development (R&D) to develop innovative products.

July 2023 - Notpla Limited expanded its presence in Europe by scaling up the availability of seaweed-based coated boards and launching into the Benelux region. The availability of seaweed-based coated boards would gain traction among environmentally-conscious businesses.

May 2023 - Nagase America LLC announced the formation of its Emerging Technologies Team that will focus on exploring and de-risk new business opportunities with high potential and drive the exploratory phase of product development. The formation of a new team will help the company Deliver the Next technology, products, and services in the Americas and drive the business's transformation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need to Eliminate Type Waste Cycle and Increase Shelf-Life of the Product

- 5.1.2 Ban on Single-Use-Plastic and Growing Sustainability Concern

- 5.2 Market Restraints

- 5.2.1 High Cost of Production

6 MARKET SEGMENTATION

- 6.1 By Source

- 6.1.1 Plant

- 6.1.2 Animal

- 6.2 By Raw Material

- 6.2.1 Protein

- 6.2.2 Polysaccharides

- 6.2.3 Lipids

- 6.2.4 Other Raw Materials

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.2 Bevergae

- 6.3.3 Pharmaceutical

- 6.4 By Region

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Devro PLC (Saria Nederland BV)

- 7.1.2 Nagase America LLC (Nagase & Co., Ltd.)

- 7.1.3 JRF Technology, LLC

- 7.1.4 Evoware (PT. Evogaia Karya Indonesia)

- 7.1.5 Notpla Limited

- 7.1.6 Tipa Corp Ltd.

- 7.1.7 Amtrex Nature Care Pvt. Ltd.

- 7.1.8 Envigreen Biotech India Private Ltd.

- 7.1.9 TSUKIOKA FILM PHARMA CO., LTD.

- 7.1.10 ECOLOTEC LIMITED

- 7.1.11 Glanbia plc