|

市场调查报告书

商品编码

1624579

北美分散式发电:市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America Distributed Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

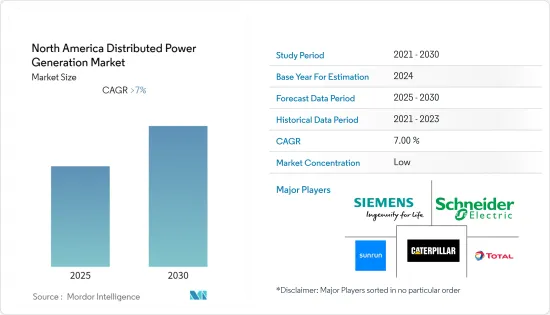

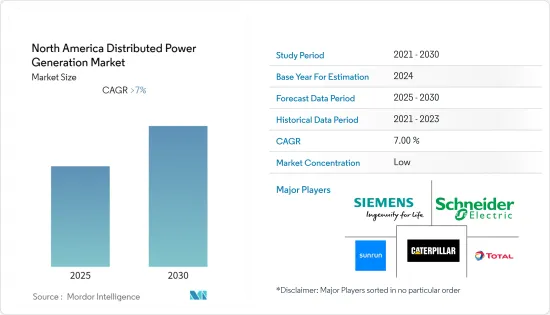

预计北美分散式发电市场在预测期内复合年增长率将超过 7%。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从长远来看,人们对环境问题的认识不断提高,政府对太阳能板安装的激励和税收优惠政策不断增加,以及电网扩建高成本,预计将显着推动市场发展。

- 然而,从 2022 年开始,美国太阳能发电税额扣抵的减少预计将略微阻碍预测期内的市场成长。

- 由于其多种经济效益,商业和工业部门对分散式太阳能发电越来越感兴趣。分散式太阳能还可作为恆定能源来源,消除传统电网因电压波动造成的停机和设备损坏。这些因素预计将在该地区的分散式发电市场创造重大商机。

- 由于日益增长的环境问题和国内分散式发电的经济效益,预计美国将主导市场。

北美分散式发电市场趋势

太阳能发电领域正在经历显着的成长。

- 预计太阳能产业在预测期内将出现显着成长。相对较低的安装成本、不断下降的太阳能电池板製造价格以及不断增加的政府补贴使其成为最受欢迎的分散式发电形式。

- 对清洁能源的需求不断增长是该地区分散式太阳能发电市场的主要驱动力之一。 2021年美国小型太阳能装置容量增加5.4吉瓦,比2020年的水准(4.4吉瓦)增加23%。 2021年新增的小型太阳能发电容量大部分安装在住宅中。 2021 年住宅安装量超过 3.9GW,而 2020 年为 2.9GW。

- 屋顶太阳能为无法用电的家庭提供现代电力服务的好处,减少岛屿和其他依赖燃油发电的偏远地区的电费,并为居民、中小企业提供发电。

- 商业和工业系统仍然是最大的成长部分,因为它们通常较便宜且具有相对稳定的日间负载曲线。

- 根据太阳能产业协会 (SEIA) 2022 年 9 月进行的一项研究,美国太阳能市场预计在未来五年内将成长约两倍。最近,美国总统拜登还签署了该国最大的气候变迁法案,这可能进一步推动该国太阳能市场的成长。

- 因此,这些因素预计将在预测期内推动北美分散式发电市场的发展。

预计美国将主导市场

- 2021年,北美分散式发电市场由美国主导。预计该国将在未来几年保持其主导地位。美国在扩展分散式能源系统(DES)方面具有巨大潜力,特别是离网和住宅太阳能发电。电网基础设施效率低、供不应求以及分散技术的扩充性正在为该国的部署铺平道路。

- 加州在分散式太阳能发电方面处于全国领先地位,2021 年住宅太阳能安装量将超过 1,000 兆瓦。该州住宅太阳能发电容量总合超过5,000MW。

- 可再生能源目标因州而异。例如,夏威夷设定了2045年实现100%可再生能源的目标,亚利桑那州设定了2030年实现45%可再生能源的目标,到2045年实现100%清洁能源的目标。这些具体目标预计将有助于进一步振兴国内分散式太阳能发电市场。

- 2021年,美国太阳能新增装置容量达到约23.6GW。太阳能占该国新增发电能力的最大份额。

- 2021年11月,Orsted和Eversource选择西门子能源为美国一座924兆瓦离岸风力发电提供输电服务。该发电厂将位于纽约蒙托克角以东 30 多英里处,将产生清洁能源,为纽约州约 60 万户家庭供电。预计于 2025 年开始营运。

- 2022年5月,Green Lantern Solar在佛蒙特州韦瑟斯菲尔德开发了500kW太阳能发电工程。该计划将为佛蒙特州当地的退休社区提供清洁能源。该太阳能发电工程预计每年向承购商分配约 15 万美元的信贷。

- 由于这些发展,预计美国将在预测期内主导北美分散式发电市场。

北美分散式发电产业概况

北美分散式发电市场较为分散。主要企业(排名不分先后)包括 Caterpillar Inc.、Total SA、Seimens AG、Schneider Electric SE 和 Sunrun Inc.。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027 年之前的市场规模与需求预测

- 最新趋势和发展

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 技术领域

- 太阳能

- 风力

- 热电联产 (CHP)

- 其他技术

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Total SA

- Caterpillar Inc.

- Ballard Power Systems Inc.

- Total SA

- Seimens AG

- Toshiba Fuel Cell Power Systems Corporation

- Sunrun Inc.

- Capstone Turbine Corporation

- Cummins Inc.

- Schneider Electric SE

第七章 市场机会及未来趋势

简介目录

Product Code: 46344

The North America Distributed Power Generation Market is expected to register a CAGR of greater than 7% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, rising environmental concerns, increasing government policies for incentives and tax benefits for solar panel installation, and the high cost of grid expansion are expected to significantly drive the market.

- However, a reduced tax credit for solar power generation in the United States from 2022 is expected to slightly hamper the growth of the market during the forecast period.

- Commercial and industrial sectors are showing a growing interest in distributed solar power generation due to various economic benefits. Distributed solar power also acts as a constant source of energy to eliminate downtimes and equipment damage due to voltage fluctuations in conventional power grids. This factor is expected to create a huge opportunity for distributed power generation market in the region.

- The United States is expected to dominate the market over rising environmental concerns and economic benefits of domestic distributed power generation.

North America Distributed Power Generation Market Trends

Solar PV Sector to Witness Significant Growth

- The solar PV sector is expected to witness significant growth during the forecast period. It is the most popular form of distributed power generation due to its relatively low setup cost, declining prices of solar panel manufacturing, and increasing government subsidies.

- Increasing demand for clean energy is one of the primary drivers for the region's distributed solar power generation market. The small-scale solar capacity installations in the United States increased by 5.4 GW in 2021, up by 23% from the 2020 level (4.4 GW). Most of the small-scale solar capacity added in 2021 was installed on homes. Residential installations totaled more than 3.9 GW in 2021, compared to 2.9 GW in 2020.

- Rooftop solar offers the benefits of modern electricity services to households with no access to electricity, thus reducing electricity costs on islands and in other remote locations that are dependent on oil-fired generation and enabling residents and small businesses to generate their electricity.

- Commercial and industrial systems remain the largest growth segment as they are usually more inexpensive and have a relatively stable load profile during the day, which can enable larger savings on electricity bills, depending on the policy scheme in place.

- According to the survey by the Solar Energy Industries Association (SEIA),conducted in September 2022, the US solar market is expected to nearly triple over the next five years. Recently, the US President Joe Biden also signed the largest climate bill in the country, which may further boost the growth of the country's solar energy market.

- Therefore, such factors are expected to drive the North American distributed power generation market during the forecast period.

United States is Expected to Dominate the Market

- The United States dominated the North American distributed power generation market in 2021. The country is expected to continue its dominance in the coming years as well. The United States holds vast potential for the expansion of distributed energy systems (DES), notably in the form of off-grid and residential solar. Inefficiencies in the power grid infrastructure, power supply shortages, and the scalability of decentralized technology pave the way for the deployment in the country.

- California leads the distributed solar PV sector in the country, with more than 1,000 MW residential solar PV installations in 2021. The state has a total residential installed capacity of over 5,000 MW.

- Different states have set different goals to increase their individual renewable energy targets. For example, Hawaii has set a 100% renewable target by 2045, while Arizona has set a 45% renewable by 2030 and 100% clean energy by 2045. These individual targets are expected to help further boost the country's distributed solar power generation market.

- In 2021, the new solar photovoltaic capacity installations in the United States reached approximately 23.6 gigawatts. Solar had the largest share of new electricity-generating capacity in the country.

- In November 2021, Orsted and Eversource selected Siemens Energy to supply transmission system for a 924-MW Offshore Wind Farm in the United States. The plant is located more than 30 miles east of Montauk Point, New York, and will generate clean energy to power nearly 600,000 homes in New York. It is expected to be operational in 2025.

- In May 2022, Green Lantern Solar developed a 500-kW solar project in Weathersfield, Vermont. The project will supply clean energy to a local retirement community in Vermont. The solar project is estimated to generate approximately USD 150,000 annually in credits divided among the off-takers.

- Hence, due to such developments, the United States is expected to dominate the North American distributed power generation market during the forecast period.

North America Distributed Power Generation Industry Overview

North America's distributed power generation market is fragmented. Some of the major companies (in no particular order) include Caterpillar Inc., Total SA, Seimens AG, Schneider Electric SE, and Sunrun Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar PV

- 5.1.2 Wind

- 5.1.3 Combined Heat and Power (CHP)

- 5.1.4 Other Technologies

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Total SA

- 6.3.2 Caterpillar Inc.

- 6.3.3 Ballard Power Systems Inc.

- 6.3.4 Total SA

- 6.3.5 Seimens AG

- 6.3.6 Toshiba Fuel Cell Power Systems Corporation

- 6.3.7 Sunrun Inc.

- 6.3.8 Capstone Turbine Corporation

- 6.3.9 Cummins Inc.

- 6.3.10 Schneider Electric SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219