|

市场调查报告书

商品编码

1624585

拉丁美洲化妆品包装:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Latin America Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

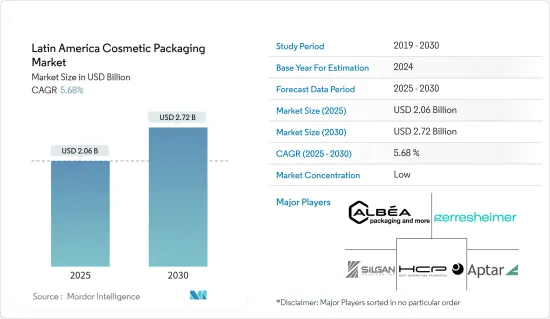

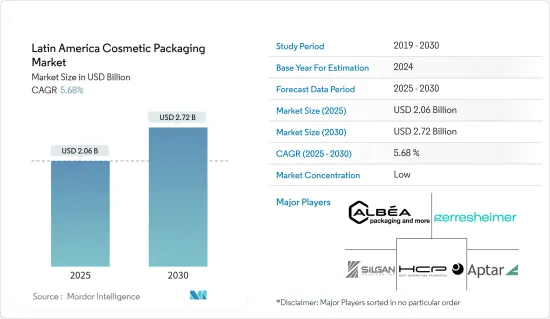

拉丁美洲化妆品包装市场规模预计到2025年为20.6亿美元,预计到2030年将达到27.2亿美元,预测期内(2025-2030年)复合年增长率为5.68%。

主要亮点

- 墨西哥和巴西的人口成长,加上小城市的都市化和人口老化等人口变化,预计将推动该地区的市场成长。越来越多的女性加入劳动市场预计将有助于墨西哥美容和个人护理市场的扩张。此外,考虑到墨西哥的竞争格局,技术创新对于企业从竞争对手中脱颖而出仍然至关重要。

- 近年来,拉丁美洲的化妆品包装经历了显着增长。在所有行业中,化妆品的包装需求最为多样化。近年来,该行业齐心协力对抗塑胶污染,采用创新的包装策略和改进配方。玻璃是一种古老的包装材料,具有无孔、不渗透的特性。由于其耐用性,它具有化学惰性,不会随着时间的劣化。除了其功能优势外,玻璃还赋予产品奢华的感觉,让消费者能够看到内容物和颜色。这种透明度是其广泛应用于化妆品包装的关键原因。

- 拉丁美洲成为化妆品和香水工厂生产的中心。这个时代意味着从天然成分到化学配方的转变。对香味化学的理解的进步导致了合成香水的诞生,彻底改变了传统香水产业。企业家开始建立自己的品牌,专注于有吸引力的包装、名人代言以及与消费者建立情感联繫。这些品牌产品已经从纯粹的功能性物品发展成为希望和愿望的容器。

- 随着消费者在整装仪容和美容产品上的支出增加,对奢侈品的需求也在增加,推动了玻璃瓶和容器的市场。这种趋势在化妆品和香水产业尤其明显,包装在产品知名度和品牌形像中发挥重要作用。玻璃包装通常是高端产品的首选,因为它具有良好的品质、可回收性以及保持产品完整性的能力。

- 事实证明,秘鲁、哥斯达黎加和巴拿马等市场对化妆品包装特别有利,进一步影响了玻璃包装产业的成长。这些国家正在经历经济的快速发展和中产阶级的扩大,导致个人护理和美容产品的消费增加。因此,国内外化妆品品牌正在扩大在这些市场的影响力,推动了对高品质包装解决方案(包括玻璃瓶和容器)的需求。

- 在拉丁美洲,政府对塑胶包装的法规不断增加,限制了市场。然而,这些法规也为永续实践提供了机会,特别是在化妆品包装领域。监管压力和消费者对环保产品的需求正在推动环保材料的转变。该地区的公司正在投资研发,以创造创新和永续的包装解决方案,以满足市场需求并遵守新法规。

拉丁美洲化妆品包装市场趋势

玻璃瓶及容器占较大市场占有率

- 玻璃容器和包装已在各种行业中流行,用于储存液体药品、化妆品和香水。这些容器由优质玻璃製成,并配有塑胶滴管,这使它们与传统药瓶不同。滴管可以精确分配液体并最大限度地减少浪费。在这些容器中使用玻璃具有多种优点,包括化学惰性、透明度和可回收性。

- 玻璃瓶广泛用于储存液体药品、护肤品、香水和其他需要精确剂量控制的应用。製药业尤其受益于玻璃包装,因为它可以保持产品完整性并延长保质期。化妆品和个人护理行业也利用玻璃瓶来生产奢侈品,充分利用其美学吸引力和感知品质。玻璃瓶的多功能性和滴管的功能使其在各种利基市场中采用,例如精油和香熏产品。

- 由于对天然香料的需求超过合成香料以及豪华香水的日益普及,预计玻璃瓶市场将在预测期内显着增长。顺应这一趋势,各公司正在投资玻璃香水瓶的创新设计,探索独特的形状、纹理和装饰,以增强其产品的吸引力。香水玻璃瓶因其匀称的形状和良好的反射率而被认为是奢侈品,有助于提升香味的整体感觉。

- 玻璃材质还有助于保持香味的完整性并延长其保质期。 2023年,墨西哥化妆品、香水和洗护用品用品的产量达82.5亿美元以上,高于2022年的76.9亿美元。这一增长反映出消费者对优质美容和香水产品的需求增加以及墨西哥在全球化妆品和香水行业中地位的增强。

- 消费者对其环境影响的认识不断提高,推动了对减少废弃物的永续产品的需求。这一趋势极大地推动了填充用玻璃瓶在香水行业的普及。填充用香水瓶消除了对一次性包装的需求并显着减少了塑胶废弃物,符合环保意识的价值观。玻璃可无限回收,且不会劣化质量,已成为填充用香水容器的首选材料。

- 这种向可再填充玻璃瓶的转变解决了环境问题,并为消费者提供了更奢华、更持久的产品体验。香水品牌正在响应这一趋势,推出流行香水的填充用,让顾客重复使用原始的瓶子并减少整体包装废弃物。此外,从长远来看,使用填充用的玻璃瓶可以为消费者节省成本,因为填充用通常比购买装有相同数量香水的新瓶子便宜。

巴西实现显着成长

- 巴西不断增长的女性人口是该地区化妆品需求的主要推动力。这种人口结构的变化预计将推动全国化妆品市场的发展。劳动力中女性人数的增加和可支配收入的增加正在促进化妆品行业的成长。巴西女性以其高度的美学意识和对个人保健产品的投资意愿而闻名,进一步推动了市场的扩张。

- 此外,在消费者维持生活品质意识的推动下,巴西是一个有前景的护肤品开发新兴市场。该国多样化的气候和环境条件创造了独特的护肤需求,促使製造商开发专门的产品。巴西消费者越来越多地寻求能够同时解决多种问题的多功能护肤解决方案,包括抗衰老、防晒和保湿。

- 随着素食主义在巴西年轻人和老年人中越来越流行,对有机和纯素护肤品的需求也增加。这一趋势是向更永续、更符合道德生产的化妆品的更广泛转变。消费者越来越意识到原料采购和环境影响,对天然、植物来源和无农药产品越来越感兴趣。本地和国际品牌正在透过满足巴西消费者不断变化的偏好并扩大其环保和纯素产品线来满足这一需求。

- 巴西从阿根廷、哥伦比亚和智利进口香水、化妆品和盥洗用品。我们也从法国和美国采购化妆品。巴西依赖进口生产製成品。为了鼓励本地生产,巴西政府征收进口税。 Alvea 等公司正致力于将化妆品包装业务在巴西本地化。 2023年,巴西美容及个人保健产品出口超过进口,出现贸易顺差。年内,巴西向国际市场出口化妆品及卫生用品价值9.11亿美元,较前一年大幅成长。 2020年之前,巴西在该市场出现亏损。巴西美容及个人护理市场的主要产品领域包括护肤品、防晒油、古铜色化妆品和护髮产品。

- 巴西以其高品质和多样化的护髮产品而闻名,目前正在扩大其在护肤市场的份额。巴西化妆品产业正在透过推出更广泛的护肤产品和永续包装来应对不断变化的消费者偏好。这个巴西护肤品牌专注于永续性和数位创新,开发适合巴西人多样化肤色和独特美容需求的产品。这些产品利用巴西丰富的生物多样性,并采用源自广大生态资源的天然成分。

- 巴西的专利权行业是世界上最大、最先进的行业之一,有专门的法律管理该行业。其特许专利权连锁店数量位居世界第五。在化妆品市场,香水领域呈现稳定成长,带动了对分配系统和喷雾盖等相关产品的需求。儘管对价格敏感,巴西消费者愿意投资高端化妆品。

拉丁美洲化妆品包装产业概况

拉丁美洲化妆品包装市场较为分散,多家全球和区域公司在竞争激烈的市场空间中争夺注意力,包括 Albea Group、Hcp Packaging、Aptar Group 和 Silgan Holdings Inc.。该市场的特征是产品差异化低、产品渗透率高、竞争激烈。

- 2024 年 5 月 分配器包装解决方案供应商 Aptar Beauty 推出了一款新型香水帮浦。该公司声称,它是首款采用高达 67% 机械 PCR(消费后回收树脂)和材料的产品。

- 2023 年 10 月 Gerresheimer 是一家为製药、生物技术和化妆品行业提供创新系统和解决方案的全球供应商,与专门从事生物基材料的新兴企业Rezemo 合作。该合作伙伴关係旨在为化妆品、食品和饮料以及製药行业的初级包装提供永续的密封件。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 扩大化妆品消费

- 越来越注重创新和有吸引力的包装

- 市场挑战

- 由于政府法规,永续性问题日益严重

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸板

- 依化妆品类型

- 头髮护理

- 彩妆品

- 护肤

- 男士美容

- 除臭剂

- 其他化妆品类型(香水、除毛剂、婴儿和儿童护理、防晒护理)

- 依产品类型

- 塑胶瓶/容器

- 玻璃瓶/容器

- 金属容器

- 折迭式纸盒

- 瓦楞纸箱

- 管和棒

- 盖子和塞子

- 泵浦和分配器

- 滴管

- 安瓿

- 软塑胶包装

- 按国家/地区

- 巴西

- 墨西哥

- 哥伦比亚

第七章 竞争格局

- 公司简介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group PLC(Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor Group GmbH

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Corp.

- Gerresheimer AG

- Raepak Ltd

第八章投资分析

第9章 市场的未来

The Latin America Cosmetic Packaging Market size is estimated at USD 2.06 billion in 2025, and is expected to reach USD 2.72 billion by 2030, at a CAGR of 5.68% during the forecast period (2025-2030).

Key Highlights

- The growing populations of Mexico and Brazil, coupled with demographic shifts such as urbanization in smaller cities and an aging population, are expected to drive the region's market growth. The increasing number of women joining the workforce is expected to contribute to expanding the Mexican beauty and personal care market. Moreover, given Mexico's competitive landscape, innovation remains critical for businesses to differentiate themselves from competitors.

- In recent years, cosmetic packaging in Latin America has experienced significant growth. Among all industries, cosmetics have the most diverse packaging needs. Recently, the industry has come together to address plastic pollution, adopting innovative packaging strategies and enhancing formulations. Glass, a time-honored packaging material, boasts nonporous and impermeable qualities. Its durability ensures it remains chemically inert and does not degrade over time. Beyond its functional benefits, glass lends a premium appeal to products, allowing consumers to see its content and color. This transparency is a crucial reason for its prevalent use in cosmetic packaging.

- Latin America became a hub for the factory-based production of cosmetics and perfumes. This era marked a shift from natural ingredients to chemical formulations. Advancements in understanding scent chemistry led to the creation of synthetic perfumes, revolutionizing the traditional fragrance industry. Entrepreneurs began establishing brands, focusing on attractive packaging, celebrity endorsements, and creating emotional connections with consumers. These branded products evolved from purely functional items to vessels of hope and aspiration.

- The increasing consumer expenditure on grooming and beauty products drives the demand for premium items, boosting the market for glass bottles and containers. This trend is particularly evident in the cosmetics and perfume industries, where packaging plays a crucial role in product perception and brand image. Glass packaging is often preferred for high-end products due to its perceived quality, recyclability, and ability to preserve product integrity.

- Markets such as Peru, Costa Rica, and Panama are proving to be particularly lucrative for cosmetics packaging, further influencing the growth of the glass packaging industry. These countries are experiencing rapid economic development and a growing middle class, leading to increased consumption of personal care and beauty products. As a result, local and international cosmetics brands are expanding their presence in these markets, driving the demand for high-quality packaging solutions, including glass bottles and containers.

- Increasing government regulations on plastic packaging in Latin America constrain the market. However, these regulations also present an opportunity for sustainable practices, particularly in cosmetic packaging. Regulatory pressures and consumer demand for environmentally responsible products drive the shift toward eco-friendly materials. The region's companies invest in research and development to create innovative, sustainable packaging solutions that comply with new regulations while meeting market needs.

Latin America Cosmetic Packaging Market Trends

Glass Bottles and Containers to Hold Significant Market Share

- Glass packaging has gained popularity for storing liquid medicines, cosmetics, and perfumes across various industries. These containers are crafted from high-quality glass and feature a plastic dropper, distinguishing them from traditional medicine bottles. The dropper enables precise dispensing of liquids and minimizes waste. Using glass for these containers offers several advantages, including chemical inertness, transparency, and recyclability.

- Glass bottles are widely used for storing liquid medicines, skincare products, perfumes, and other applications requiring accurate dosage control. The pharmaceutical industry, in particular, benefits from glass packaging because it maintains product integrity and extends shelf life. The cosmetics and personal care industries also utilize glass bottles for premium products, leveraging their aesthetic appeal and perceived quality. The versatility of glass packaging and the functionality of droppers has led to its adoption in various niche markets, such as essential oils and aromatherapy products.

- The market for glass bottles is expected to grow significantly during the forecast period, driven by the increasing demand for natural fragrances over synthetic-based ingredients and the rising popularity of luxury perfumes. This trend has prompted companies to invest in innovative designs for perfume glass bottles, exploring unique shapes, textures, and embellishments to enhance product appeal. Perfume glass bottles are considered high-end luxury items due to their well-rounded shapes and excellent reflectivity, which contribute to the overall sensory experience of the fragrance.

- The glass material also helps preserve the scent's integrity and extends its shelf life. In 2023, Mexico's production of cosmetics, perfumes, and toiletries reached over USD 8.25 billion, an increase from USD 7.69 billion in 2022. This growth reflects the increasing consumer demand for premium beauty and fragrance products and Mexico's strengthening position in the global cosmetics and perfume industry.

- Increasing consumer awareness of environmental impact has driven a growing demand for sustainable products that reduce waste. This trend has significantly boosted the popularity of refillable glass bottles in the perfume industry. Refillable perfume bottles align with eco-conscious values by eliminating the need for disposable packaging and substantially reducing plastic waste. Being infinitely recyclable without quality degradation, glass has emerged as the preferred material for refillable perfume containers.

- This shift toward refillable glass bottles addresses environmental concerns and offers consumers a more luxurious and long-lasting product experience. Perfume brands respond to this trend by introducing refill options for their popular fragrances, allowing customers to reuse their original bottles and reducing overall packaging waste. Additionally, using refillable glass bottles often results in cost savings for consumers in the long run, as refills are typically priced lower than purchasing a new bottle with the same amount of perfume.

Brazil to Register Significant Growth

- The expanding female population in Brazil significantly drives the demand for cosmetic products in the region. This demographic shift is expected to boost the makeup market across the country. The increasing number of women in the workforce and rising disposable incomes contribute to the growth of the cosmetics industry. Brazilian women are known for their beauty consciousness and willingness to invest in personal care products, further fueling market expansion.

- Additionally, Brazil presents a promising market for skin care product developments and launches, driven by consumer attitudes towards maintaining quality of life. The country's diverse climate and environmental conditions create unique skincare needs, prompting manufacturers to develop specialized products. Brazilian consumers are increasingly seeking multifunctional skincare solutions that address various concerns simultaneously, such as anti-aging, sun protection, and hydration.

- The demand for organic and vegan skin care products is also rising as veganism gains traction among young and older adults in Brazil. This trend is a broader shift towards more sustainable and ethically produced cosmetics. Consumers are becoming more aware of ingredient sourcing and environmental impact, leading to increased interest in natural, plant-based, and cruelty-free products. Local and international brands are responding to this demand by expanding their eco-friendly and vegan product lines, catering to the evolving preferences of Brazilian consumers.

- Brazil imports perfumes, cosmetics, and bath products from Argentina, Colombia, and Chile. The country also sources cosmetics from France and the United States. Brazil continues to rely on imports for the production of finished products. To encourage local production, the Brazilian government has implemented import taxes. Companies like Albea are focusing on localizing their cosmetic packaging operations in Brazil. In 2023, Brazil's exports of beauty and personal care products surpassed imports, resulting in a trade surplus. That year, Brazil exported cosmetics and hygiene products worth over USD 911 million to international markets, a significant increase from the previous year. Before 2020, Brazil recorded trade deficits in this market. Key product segments in the Brazilian beauty and personal care market include skin care products, sunscreen, bronzers, and hair care.

- Brazil, renowned for its high-quality and diverse hair products, is now expanding its presence in the skincare market. The country's cosmetics industry responds to changing consumer preferences by introducing a wider range of skincare products and sustainable packaging options. Brazilian skincare brands emphasize sustainability and digital innovation, developing products tailored to the diverse skin tones and unique beauty needs of the Brazilian population. These products leverage the country's rich biodiversity, incorporating natural ingredients sourced from its vast ecological resources.

- Brazil's franchising industry is among the world's largest and most advanced, with specific legislation governing the sector. The country ranks fifth globally in terms of franchise chain numbers. In the cosmetics market, the perfume segment shows consistent growth, driving demand for related products like dispensing systems and spray caps. Despite price sensitivity, Brazilian consumers are willing to invest in premium cosmetic products.

Latin America Cosmetic Packaging Industry Overview

The Latin American cosmetic packaging market is fragmented, with several global and regional players, such as Albea Group, Hcp Packaging Co. Ltd, Aptar Group, and Silgan Holdings Inc., vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- May 2024: Aptar Beauty, a provider of dispensing packaging solutions, launched a new fragrance pump. The company claims it is the first to incorporate up to 67% mechanical PCR (post-consumer recycled resin) Plus material.

- October 2023: Gerresheimer, a global provider of innovative systems and solutions for the pharmaceutical, biotech, and cosmetics industries, partnered with Rezemo, a start-up specializing in bio-based materials. This collaboration aims to offer sustainable closures for primary packaging in the cosmetics, food and beverage, and pharmaceutical industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Challenges

- 5.2.1 Growing Sustainability Concerns due to Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper and Paperboard

- 6.2 By Cosmetic Type

- 6.2.1 Hair Care

- 6.2.2 Color Cosmetics

- 6.2.3 Skin Care

- 6.2.4 Mens Grooming

- 6.2.5 Deodorants

- 6.2.6 Other Cosmetic Types (Fragrances, Depilatories, Baby and Child Care, and Sun Care)

- 6.3 By Product Type

- 6.3.1 Plastic Bottles and Containers

- 6.3.2 Glass Bottles and Containers

- 6.3.3 Metal Containers

- 6.3.4 Folding Cartons

- 6.3.5 Corrugated Boxes

- 6.3.6 Tubes and Sticks

- 6.3.7 Caps and Closures

- 6.3.8 Pump and Dispenser

- 6.3.9 Droppers

- 6.3.10 Ampoules

- 6.3.11 Flexible Plastic Packaging

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Colombia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group PLC (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging LP

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor Group GmbH

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Corp.

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd