|

市场调查报告书

商品编码

1626301

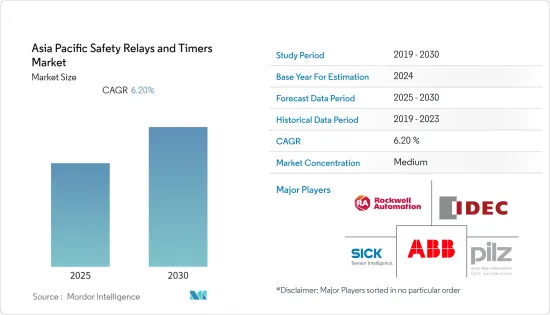

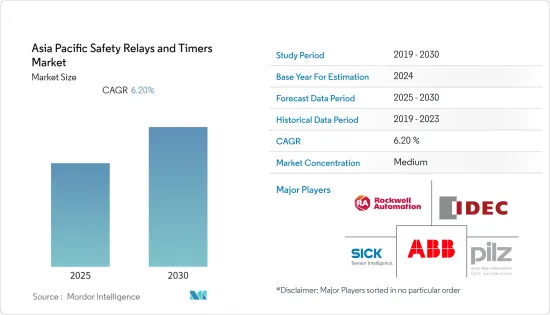

亚太地区安全继电器和定时器:市场占有率分析、产业趋势、统计和成长预测(2025-2030)Asia Pacific Safety Relays and Timers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

亚太地区安全继电器和定时器市场预计在预测期内复合年增长率为 6.2%

主要亮点

- 安全继电器是电子机械开关装置,用于防止关键开关操作期间发生故障。继电器设计用于隔离电路或用低功率讯号控制高功率电路。包裹在线圈中的磁芯、安装在铁轭上的可动衔铁以及至少一组触点组成了一个简单的继电器。当电流流过线圈时,它会产生一个磁场,驱动电枢,导致触点移动并建立或断开连接。

- 典型的继电器利用线圈和金属触点的机械运动来打开和关闭负载。经过几个操作週期后,金属触点可能会焊接闭合。在这种情况下,即使操作员按下急停按钮,机器也会继续运行,这对操作员来说是危险的。因此,许多国家和国际规范和安全标准禁止在危险机器中使用简单继电器和接触器。

- 另一方面,安全继电器具有设计为正向驱动的线圈和接点。强制驱动触点系统可确保常开 (NO) 和常闭 (NC) 触点不会同时开启或关闭,从而消除了故障的可能性。有些安全继电器内建监控装置,可以提前侦测故障。

- 这些特性使安全继电器适用于关键开关应用,例如紧急机器停止(E-stop)。如果开关或继电器在此类应用中发生故障,则可能会发生机械或身体伤害。安全继电器的其他用途包括安全门、双手控制器、光栅和安全垫。

- 然而,由于原料价格波动,安全继电器的设计和製造成本可能很高。此外,COVID-19 大流行扰乱了全球供应链,并导致原物料价格波动。

亚太地区安全继电器和定时器市场趋势

电力消耗增加推动市场成长

- 亚太地区的能源使用量正在稳定增加,电网的规模和复杂性也持续成长。对电力的需求正在迅速增加,特别是在工业领域。随着该地区许多国家工业化的影响日益增强,改善现有电力基础设施已成为主要驱动力。

- 作为回应,ABB 于 2021 年 5 月发布了 REX610,这是 Relion 产品系列的新成员,旨在支援安全、智慧和永续的电气化。 REX610利用ABB经过验证的可配置多功能继电器和保护演算法,提供为所有基本配电应用提供最佳保护的解决方案,帮助保护电网、工业流程和人员,让保护变得更加轻鬆。它也面向未来性,可以适应不断发展的电网。随着市场变化和需求变化,可以轻鬆添加、移除或更换模组,而无需更改整个继电器。

- 此外,中东地区的发展,包括製造业向亚洲的转移、中阶被动收入的增加以及印度政府的「印度製造」宣传活动,必将显着增加该地区的电力消耗。此外,印度政府「人人有电」的目标正在促使该国增加电力供给能力。

- 印度统计与规划部(MoSPI)公布的资料显示,2021年10月印度工业生产指数(IIP)与前一年同期比较去年同期成长3.2%。製造业生产与前一年同期比较%,发电量较上年成长3.1%。

- 该地区製造、建设业和采矿活动的增加以及发电和消费量的增加预计将为安全继电器和定时器市场提供利润丰厚的机会。

各个最终用户行业不断增长的需求推动了市场

- 汽车继电器用于整个汽车的线束和盒子模组,包括后部、前部、乘客、引擎区域、车身控制、动力传动系统、车顶、座椅、车门和风扇模组。汽车继电器的类型包括插入式、PCB式、高电流和高电压,也包括汽车接触器。随着亚太地区汽车产量的增加,对安全继电器的需求预计将会增加。

- 根据国际汽车工业协会(OICA)的数据,2020年中国乘用车产量为1,999万辆,其次是日本,产量为696万辆。此外,2019年亚太地区乘用车销量为3,536万辆,2020年为3,200万辆。此外,对省油车的需求不断增长以及车载电子技术的进步正在推动对汽车安全继电器的需求。

- 此外,安全继电器和定时器也用于控制、启动和保护石油和天然气领域的电路。工业定时器适用于物料输送、工具机和各种加工机器的製程控制。

- 海上石油和天然气探勘活动的大幅扩展导致该地区製程设备的部署大幅增加。根据贝克休斯统计,截至2021年10月,亚太地区共有190座石油和天然气钻井钻机,其中70座为海上钻机。

- 在化学和石化行业,安全继电器越来越多地在泵送和储存过程中使用。化工厂和石化厂的增加将推动安全继电器和定时器市场。

亚太地区安全继电器和定时器产业概况

亚太安全继电器和定时器市场竞争激烈,主要参与者包括罗克韦尔自动化、欧姆龙工业自动化、SICK AG、伊顿公司和西门子公司。技术进步和创新、策略联盟和业务扩张预计将推动所研究的市场。

- 2021 年 10 月 - 施耐德电气宣布与 Savant Power 合作开发一款远端控制连网型继电器,使住宅能够更好地管理住宅能源使用情况。连接到电路断流器的继电器可控制住宅电力负载,包括在停电期间最大限度地提高备用电源的设定。透过为每个备用电源(电池、太阳能等)建立一个虚拟可配置的关键负载面板,您可以透过仅向关键电路发送电力来最大化可用电力,直到市电恢復为止。

- 2021 年 3 月 - IDEC Corporation 推出 HR5S 安全继电器模组。这是 IDEC 安全设备系列的最新成员,旨在为设计师和OEM提供更高的最终用户安全性,同时降低机器和设备成本并提高生产率,为您提供多种选择。 HR5S 安全继电器模组专为满足 ISO 13849 2 类要求而设计。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 价值链分析

- COVID-19 对产业价值链的影响

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 需要灵活的模组化设计

- 业界安全标准

- 集成功能要求

- 市场限制因素

- 市场竞争激烈

- 标准复杂度

第六章 市场细分

- 按类型

- 单功能安全继电器

- 模组化和可配置的安全继电器

- 透过联繫

- 常闭、定时开启 (NCTO)

- 常闭、时闭 (NCTC)

- 常开、时开(NOTO)

- 常开、时闭(NOTC)

- 按最终用户

- 车

- 能源和电力

- 製造业

- 药品

- 建造

- 半导体

- 石油和天然气

- 其他最终用户

- 按国家/地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Rockwell Automation, Inc.

- OMRON Corporation

- Sick AG

- Pilz GmbH & Co. KG

- Eaton Corporation PLC

- Siemens AG

- IDEC Corporation

- ABB Ltd

- TE Connectivity

- Altech Corporation

第八章投资分析

第9章 未来展望

简介目录

Product Code: 47140

The Asia Pacific Safety Relays and Timers Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- Safety relays are electromechanical switching devices used to prevent failures during critical switching operations. Relays are designed to isolate circuits or control high-powered circuits with a low-power signal. A magnetic core encased in a wire coil, a movable armature attached to an iron yoke, and at least one set of contacts comprise a simple relay. When an electric current passes through the coil, it creates a magnetic field that activates the armature, causing the contacts to move to make or break a connection.

- A normal relay switches the load on and off using a wire coil and the mechanical movement of the metal contacts. After several operation cycles, the metal contacts may weld shut. If this happens, the machine will continue running if the operator presses the emergency stop pushbutton, which would be dangerous for the operator. As a result, many national and international norms and safety standards prohibit using simple relays or contactors on hazardous machines.

- Whereas safety relays have coils and contacts that are designed to be positively driven. A positively driven contact system ensures that the normally open (NO) and normally closed (NC) contacts can never be opened or closed simultaneously, eliminating the possibility of faulty operation. Some safety relays include built-in monitoring equipment to detect faults before they occur.

- Due to these characteristics, safety relays are appropriate for use in critical switching applications such as an emergency machine stop (E-stop). Mechanical or physical human damage could occur if a switch or relay fails to operate in one of these applications. The other applications for safety relays also include safety gates, two-hand control, light curtains, safety mats, etc.

- However, designing and manufacturing safety relays is could be expensive due to the fluctuations in prices of raw materials. Further, the COVID-19 pandemic has disrupted the supply chains globally, contributing to the volatility in raw materials prices.

APAC Safety Relays & Timers Market Trends

Increasing Power Consumption to Drive the Market Growth

- With the energy usage in the Asia Pacific region rising steadily, power distribution networks continue to grow in size and complexity. Electricity demand has soared, particularly in the industrial sector. With the rising influence of industrialization across many countries in the region, improving the existing electrical setup has gained considerable traction.

- In response, in May 2021, ABB is launched REX610, a new addition to its Relion product family designed to support safe, smart, and sustainable electrification. REX610 makes protecting grids, industrial processes, and people more effortless as it draws on ABB's heritage of configurable multifunctional relays and protection algorithms to create a solution that provides optimal protection for all basic power distribution applications. It is also futureproofed for an evolving grid. As the market shifts and requirements change, the modules can be easily added, removed, or replaced without changing the entire relay.

- Further, the shift of manufacturing industries to Asia, the growing dispensable income among the middle class, and the developments in South East Asia, including the 'Make in India' campaign by the Indian government, are bound to increase the power consumption of the region considerably. Further, the Indian government's aim of achieving 'Power for All' has sped up capacity addition in the country.

- According to the data released by the Ministry of Statistics & Programme (MoSPI), India's index of industrial production (IIP) grew by 3.2% in October 2021, as compared to the previous year. The manufacturing sector output jumped 2% y-o-y, and electricity generation grew 3.1% y-o-y in October 2021.

- The increasing manufacturing, construction, and mining activities, coupled with rising power generation and consumption in the region, are expected to provide lucrative opportunities for the safety relays and timers market.

The Rising Demand in Various End-user Industries to Drive the Market

- Automotive relays are used in harnesses and box modules throughout a vehicle, including rear and front, passenger and engine areas, body control, powertrain, roof, seat, door, and fan modules. The automotive relay types include plug-in, PCB, high-current, and high-voltage, including automotive contactors. With the increase in automotive production in the Asia Pacific region, the demand for safety relays is expected to rise.

- According to The International Organization of Motor Vehicle Manufacturers (OICA), China produced 19.99 million passenger cars in 2020, followed by Japan with 6.96 million. Further, the number of passenger cars sold in the Asia Pacific region totaled 35.36 million in 2019 and 32 million in 2020. Also, the rising demand for fuel-efficient vehicles, and technological advancements in-vehicle electronics, are driving the demand for safety relays in automobiles.

- Further, safety relays and timers are used in controlling, starting, and protecting circuits in the oil and gas sector. The industrial timers are suitable for material handling, machine tools, and process control in various process machines.

- Due to the significant expansion in offshore oil and gas exploration activities, the deployment of process equipment has significantly increased in the region. According to Baker Hughes, the Asia Pacific region had 190 oil and gas rigs as of October 2021, of which 70 were offshore rigs.

- Safety relays are increasingly being used during pumping and storage in the chemical and petrochemical industries. Increasing chemical and petrochemical plants boosts the safety relays and timers market.

APAC Safety Relays & Timers Industry Overview

The Asia Pacific Safety Relays and Timers Market is moderately competitive and consists of prominent players like Rockwell Automation, OMRON Industrial Automation, SICK AG, Eaton Corp., Siemens AG, Etc. Technological advancements and innovations, coupled with strategic collaborations and expansions, are expected to drive the studied market.

- October 2021 - Schneider Electric announced a partnership with Savant Power to develop a remote-controlled connected relay to enable homeowners better manage their residential energy use. When connected to a circuit breaker, the relay would provide control of residential power loads, including configurations to maximize backup power in the event of an outage. By constructing a virtual configurable critical load panel for each backup power source (battery, solar, etc.), available power can be maximized by sending it to only crucial circuits until the utility power is restored.

- March 2021 - IDEC Corporation launched the HR5S safety relay module, a new addition to IDEC's family of safety devices that offers designers and OEMs more options to provide better end-user safety while cutting costs and improving productivity of machines and equipment. The HR5S safety relay module is explicitly designed to meet ISO 13849 Category 2 requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 COVID-19 Impact on Industry Value Chain

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Flexible Modular Designs

- 5.1.2 Industry Safety Standards

- 5.1.3 Integrated Functionality Requirements

- 5.2 Market Restraints

- 5.2.1 High Market Competition

- 5.2.2 Complexity of Standards

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-Function Safety Relays

- 6.1.2 Modular & Configurable Safety Relays

- 6.2 By Contacts

- 6.2.1 Normally Closed, Time Open (NCTO)

- 6.2.2 Normally Closed, Time Closed (NCTC)

- 6.2.3 Normally Open, Time Open (NOTO)

- 6.2.4 Normally Open, Time Closed (NOTC)

- 6.3 By End-users

- 6.3.1 Automotive

- 6.3.2 Energy and Power

- 6.3.3 Manufacturing

- 6.3.4 Pharmaceutical

- 6.3.5 Construction

- 6.3.6 Semiconductors

- 6.3.7 Oil and Gas

- 6.3.8 Other End-user Applications

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.4.6 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation, Inc.

- 7.1.2 OMRON Corporation

- 7.1.3 Sick AG

- 7.1.4 Pilz GmbH & Co. KG

- 7.1.5 Eaton Corporation PLC

- 7.1.6 Siemens AG

- 7.1.7 IDEC Corporation

- 7.1.8 ABB Ltd

- 7.1.9 TE Connectivity

- 7.1.10 Altech Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219