|

市场调查报告书

商品编码

1629778

安全继电器和定时器:市场占有率分析、行业趋势和成长预测(2025-2030)Safety Relays And Timers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

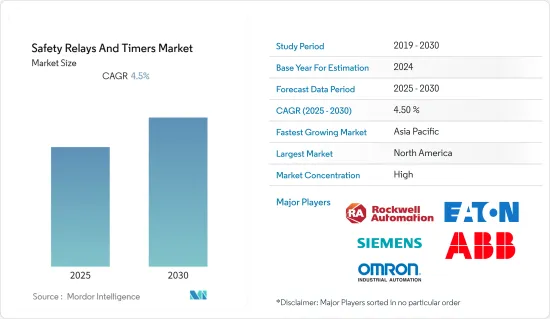

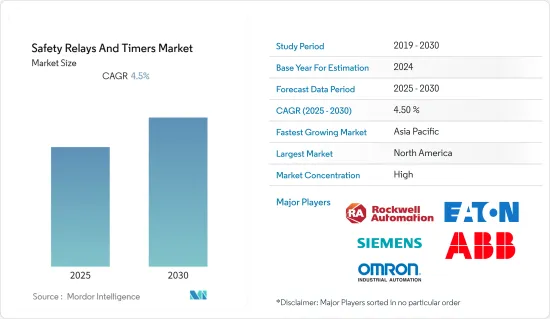

安全继电器和定时器市场预计在预测期内复合年增长率为 4.5%

主要亮点

- 安全继电器有助于检查和监控安全系统,并允许执行机器启动或停止命令。安全继电器的最新设计显着减少了机器启动时间和体力劳动。

- 与模组化和可配置的安全继电器相比,单功能安全继电器是最经济的。前者适用于需要专用逻辑装置来完成安全功能的小型机器,后者适用于需要大型且多样化的保护装置和最小区域控制的情况。

- 石油和天然气、化学和石化行业越来越多地使用安全继电器和定时器设备,以及汽车和食品和饮料行业对这些设备的高需求将推动市场成长。

- 工业继电器和定时器在储存和泵送等应用中的使用不断增加,以及模组化和可配置的监控安全继电器的可用性等因素可能会推动该行业未来的发展,预计将有助于成长。

- 然而,标准的复杂性和日益激烈的市场竞争预计将阻碍安全继电器和定时器市场的成长。

安全继电器和定时器市场趋势

预计安全继电器在各行业的需求量大

- 在石油和天然气领域,安全继电器和定时器用于电路控制、启动和保护等应用。安全继电器是石油和天然气行业的重要组成部分,因为重型机械必须由安全继电器控制。工业定时器适用于物料输送、工具机和各种加工机器的製程控制。

- 海上石油和天然气探勘活动的显着增加导致加工机械的部署增加。海上石油和天然气探勘活动需要复杂的钻井作业,并带来许多物流和营运挑战。

- 在化学和石化行业,安全继电器用于泵送和储存等应用。越来越多的化工厂和石化厂正在推动安全继电器和计时器的使用。

- 由于连网电子设备的增加,电力产业的发电量正在增加。此外,随着生产线变得更加自动化,对安全继电器和计时器的需求也在增加。

- 在英国,由于建筑、製造、石油和天然气、能源和电力以及半导体行业的使用量增加,继电器的销售量与往年相比有所增加。

亚太地区是一个快速成长的市场

- 在亚太地区,由于建筑、能源电力、汽车和製造业的快速发展,中国和印度等国家成为安全继电器和定时器的主要市场。

- 製造业向亚洲的转移、中阶被动收入的增加以及中东市场的发展(包括印度政府的「印度製造」宣传活动)可能会推动亚洲安全继电器和定时器市场的发展。

- 例如,2018年5月,在衡量综合实力的指数中,印度在亚太地区25个国家中排名第四。印度电力产业正在经历重大变革时期,正在重新定义产业格局。持续的经济成长继续推动印度的电力需求。

- 印度政府以实现「人人有电」为重点,正在加速扩大印度国内发电能力。同时,市场和供给面(燃料、物流、资金、人力资源)的竞争也在加剧。截至 2019 年 2 月,印度发电厂总设备容量为 350.16 吉瓦 (GW)。因此,电力产业也在推动安全继电器和定时器市场。

安全继电器和定时器产业概述

主要企业包括罗克韦尔自动化、欧姆龙工业自动化、SICK AG、伊顿公司、西门子股份公司、ABB 集团、TE Connectivity、Altech Corp、Pilz GmbH &Co.KG。

- 2019 年 3 月 - Pilz 推出 PNOZ、PNOZmultith,它代表图形配置软体工具令人兴奋且轻鬆的操作。您可以使用我们自动化系统 PS 4000 的 PLC 控制系统 PSS Universal PLC 直观地对复杂过程进行程式设计。

- 2019 年 1 月 - 罗克韦尔自动化公司收购了 Emulate3D,这是一家创新工程软体开发商,可对工业自动化系统进行数位模拟。透过使用准确的模拟模型来改善系统规划和决策,然后在安装前进行模拟试验来测试控制系统,Emulate3D 的软体可以帮助客户避免製造和自动化成本,您可以在提交最终设计之前对机器和系统设计进行虚拟测试。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 业界安全标准

- 功能安全要求

- 最少的时间和精力

- 具有成本效益的系统

- 市场限制因素

- 市场竞争激烈

- 标准复杂度

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场区隔

- 按类型

- 单功能安全继电器

- 模组化和可配置的安全继电器

- 透过联繫

- 常闭、定时开启 (NCTO)

- 常闭、时闭 (NCTC)

- 常开、时开(NOTO)

- 常开、时闭(NOTC)

- 按最终用户

- 车

- 能源/电力

- 製造业

- 製药

- 建造

- 半导体

- 石油和天然气

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Rockwell Automation

- OMRON Industrial Automation

- SICK AG

- Eaton Corp.

- Siemens AG

- ABB

- Pilz GmbH & Co. KG

- TE Connectivity

- Altech Corp.

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 56494

The Safety Relays And Timers Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Safety Relays help in checking and monitoring a safety system and allows the machine to either start or execute the commands to stop the machine. The upcoming designs of safety relays have made it capable of saving up on a lot of machines startup time as well as manual efforts.

- The Single-Function Safety Relays are most economical when compared to the modular & configurable safety relays. The former is preferred for smaller machines that require dedicated logic devices to complete the safety functions, while the latter is preferable where large and diverse safeguarding devices and minimal zone controls are required.

- The increasing use of safety relays and timer devices in the oil and gas, chemical, and petrochemical industries and high demand for these devices in the automotive and food and beverage industries will drive the market growth.

- Factors such as the growing usage of industrial relays and timers for applications such as storage and pumping and the availability of modular and configurable monitoring safety relays will contribute to the growth of this industry segment in the future.

- However, the complexity of standards and high market competition will hinder the growth of safety relay and timers market.

Safety Relays & Timers Market Trends

Safety Relays to Have High Demand Across Various Industries

- In the oil and gas sector, safety relays and timers are used in applications such as controlling, starting, and protecting circuits. Safety relays is an integral component of the oil and gas industry as it requires heavy machinery that must be controlled through safety relays. Industrial timers are suitable for use in material handling, machine tools, and process control in various process machines.

- The deployment of process machines has increased due to the considerable rise in offshore oil and gas exploration activities. Offshore oil and gas exploration activities require complex drilling operations, making it challenging in terms of logistics and operations.

- In the chemical and petrochemical industry, the safety relay is used in the application such as pumping and storage. Increase in chemical and petrochemical plants boost the use of safety relays and timers.

- In the power industry, with the increase in connected and electronic devices, there has been a rise in power generation. Also, industries are widely using automation in their process line which is creating demand for safety relay and timers.

- In the United Kingdom, there was an increase in sales of relays over the past few years compared to previous years due to the increase in usage in construction, manufacturing, oil and gas, energy and power and semiconductors industries.

Asia-Pacific to be the Fastest Growing Market

- In APAC, countries like China, India are the major market for the safety relay and timers due to rapid development in construction, energy and power, automotive, manufacturing sectors.

- The shift of manufacturing industries to Asia, the growing dispensable income among the middle class, and the developments in South East Asia, including the 'Make in India' campaign by the Indian government, will boost the safety relays & timers market in Asia.

- For instance, In May 2018, India ranked 4th in the Asia Pacific region out of 25 nations on an index that measures their overall power. The Indian power sector is undergoing a significant change that has redefined the industry outlook. Sustained economic growth continues to drive electricity demand in India.

- The Government of India's focus on attaining 'Power for all' has accelerated capacity addition in the country. At the same time, the competitive intensity is increasing at both the market and supply sides (fuel, logistics, finances, and manpower). The total installed capacity of power stations in India stood at 350.16 Gigawatt (GW) as of February 2019. Thus, power sector drives the safety relays and timers market too.

Safety Relays & Timers Industry Overview

The safety relays and timers market are consolidated due to a major share of the market that isoccupied by top players.Some of the key players includeRockwell Automation, OMRON Industrial Automation, SICK AG,Eaton Corp.,Siemens AG,ABB Group,TE Connectivity,Altech Corp., Pilz GmbH & Co. KG, among others.

- March 2019 - Pilz launchedPNOZ, PNOZmultithat stands for refreshingly easy operation by a graphics configuration software tool. Complex processes can be programmed intuitively with our PLC control system PSS Universal PLCof automation system PS 4000.

- January 2019 -Rockwell Automation, Inc. acquired Emulate3D, an innovative engineering software developer whose products digitally simulate and emulate industrial automation systems. By using accurate simulation models to improve systems planning and decision-making, followed by emulation trials that test the control system before installation, Emulate3D's software enables customers to virtually test machine and system designs before incurring manufacturing and automation costs and committing to a final design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry Safety Standards

- 4.2.2 Demand for Functional Safety

- 4.2.3 Minimal Time & Labor Effort Requirements

- 4.2.4 Cost-effective Systems

- 4.3 Market Restraints

- 4.3.1 High Market Competition

- 4.3.2 Complexity of Standards

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Single-Function Safety Relays

- 5.1.2 Modular & Configurable Safety Relays

- 5.2 By Contact

- 5.2.1 Normally Closed, Time Open (NCTO)

- 5.2.2 Normally Closed, Time Closed (NCTC)

- 5.2.3 Normally Open, Time Open (NOTO)

- 5.2.4 Normally Open, Time Closed (NOTC)

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Energy & Power

- 5.3.3 Manufacturing

- 5.3.4 Pharmaceutical

- 5.3.5 Construction

- 5.3.6 Semiconductors

- 5.3.7 Oil & Gas

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation

- 6.1.2 OMRON Industrial Automation

- 6.1.3 SICK AG

- 6.1.4 Eaton Corp.

- 6.1.5 Siemens AG

- 6.1.6 ABB

- 6.1.7 Pilz GmbH & Co. KG

- 6.1.8 TE Connectivity

- 6.1.9 Altech Corp.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219