|

市场调查报告书

商品编码

1640386

北美安全继电器和定时器:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Safety Relay And Timers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

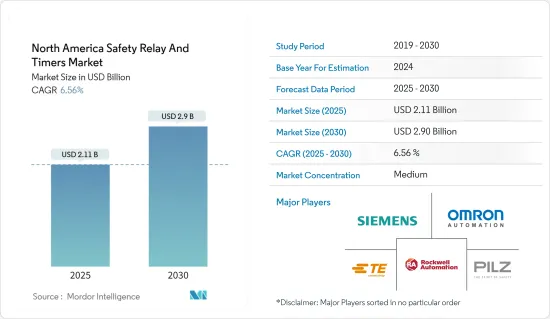

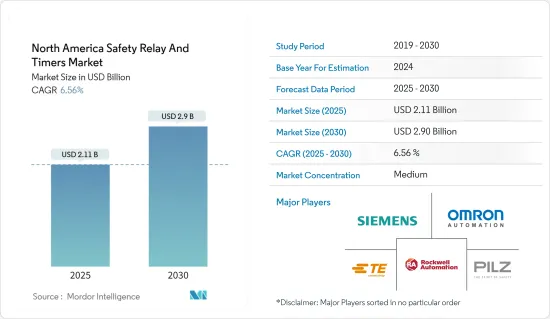

北美安全继电器和计时器市场规模预计在 2025 年为 21.1 亿美元,预计到 2030 年将达到 29 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.56%。

在过去的十年中,工业、汽车、能源基础设施、医疗保健和建筑设备对低成本、高精度、紧凑、无弹跳操作和长寿命保护系统的需求日益增加。在已开发国家,对升级电力基础设施以透过安全继电器散热来减少热量产生的需求不断增加,预计将推动市场的发展。

主要亮点

- 安全继电器对于保护机械和操作员至关重要,它透过监控安全相关输入并仅在确认正确和安全状态时透过输出启用设备。然而,传统的硬布线安全继电器功能有限,许多公司正在寻求升级的解决方案。

- 安全继电器和计时器用于石油和天然气工业中的控制、启动和保护电路等应用。各种各样的製程机械都使用工业计时器来进行物料输送、工具机和製程控制。据美国能源资讯署称,德克萨斯是美国重要的石油生产州。 2023年,德克萨斯州石油总合超过20亿桶。新墨西哥州则位居第二,当年产量为 6.675 亿桶。

- 贝克休斯称,截至2023年终,美国将有500座旋转石油钻井平台运作。由于俄罗斯和乌克兰战争导致燃料供应紧张,美国运作的石油和天然气钻井平台数量从疫情引发的低迷中有所上升。该地区海上石油和天然气探勘活动的大幅增加导致了製程机械部署的增加。由于钻井作业复杂,为物流和营运带来挑战,因此海上石油和天然气探勘活动需要安全继电器。

- 此外,工业 4.0 的显着优势正在说服OEM)和中小企业在其营运过程中采用物联网。物联网正在扩展到各个行业,包括能源电力、医疗保健、汽车和製药。因此,由于这些因素,工厂自动化技术的需求正在增加。

- 随着医疗保健和生命科学、食品和饮料等行业的技术不断发展,无尘室照明的采用率不断增长,参与者正在透过产品创新、扩张活动、合併、伙伴关係等方式适应这项技术。 。

- 例如,2023 年 2 月,ABB 启动了继电器改装计划,以其最新的保护和控制技术 REX610 取代部分 SPACOM 保护继电器。 REX610 是一款安全继电器,旨在适应电网不断变化的需求,使其成为灵活、永续且面向未来的选择。

- 然而,标准的复杂性和日益激烈的市场竞争预计将阻碍安全继电器和定时器市场的成长。此外,俄乌战争造成进一步混乱,影响了半导体供应链,导致电子设备价格进一步上涨。总体而言,预计竞争对电子产业的影响将是巨大的。这将阻碍安全仪器系统的生产。

北美安全继电器和定时器市场趋势

汽车领域可望引领市场

- 汽车继电器用于整个车辆的线束和盒式模组,包括后部、前部、乘客、引擎区域、动力传动系统、动力系统、车顶、座椅、车门和风扇模组。汽车继电器类型包括插入式、PCB、大电流、高电压和汽车接触器。

- 汽车产业有望成为安全功能的最大采用产业之一。根据阿贡国家实验室的数据,2023年12月,美国电池电动车和插电式混合动力车的市场占有率分别达到8.34%和2.82%。此外,凯利蓝皮书估计,电动车在美国汽车市场总量中的份额将从 2022 年的 5.9% 增长到 2023 年的 7.6%。这种扩张可能会为所研究的市场创造进一步的需求。

- 此外,北美的汽车产业也正在经历强劲成长。根据OICA预测,2023年北美汽车用户将购买约398万辆乘用车,其中美国购买量约312万辆。

- 此外,该地区的高压系统普及率越来越高,特别是随着电动车变得越来越普及。许多市场相关人员正在努力帮助系统设计人员解决复杂的隔离难题,确保在公司向 800V 电池过渡时车辆可靠、安全地运行,并降低解决方案尺寸和成本。先进的固态继电器可以在几微秒内断开并连接单一隔离屏障上的负载,而电子机械继电器则需要几毫秒,从而确保高压汽车系统的安全运作。

- 为了满足这一需求,富士通组件美国公司于 2023 年 4 月扩大了其在汽车继电器市场的产品阵容,提供 14V DC 印刷电路基板选项,非常适合空间有限的应用。 FTR-G3 采用尺寸为 6.6 毫米 x 13.7 毫米 x 14 毫米的极其紧凑的塑胶密封封装,能够切换 30A 电流,是 30A 级别中世界上最小的汽车继电器。此类技术创新可能会透过提供有利可图的扩张机会来推动所研究市场的成长。

预计美国将占较大市场占有率

- 美国是全球最重要和最发达的安全继电器和定时器解决方案市场之一。拥有显着能源和电力产业以及关键製造业指标的强劲经济体将推动製造业的显着成长,从而推动该地区所调查市场的需求。汽车、製药、石油和天然气以及製造等行业是该地区安全继电器解决方案最重要的需求驱动因素。

- 根据国际机器人联合会发布的《世界机器人报告2023》,美国是全球第三大工业机器人用户。根据IFR预测,美国製造业将大幅增加对自动化的投资,到2023年工业机器人的总安装基数将激增12%,达到44,303台。

- 此外,製造业和采矿业活动的增加、国家电力生产和消费量的增加预计将为安全继电器和定时器市场提供丰厚的机会。例如,根据美国能源资讯署的数据,美国的能源大致可分为一次能源和二次能源、可再生和不可可再生能源以及石化燃料。

- 根据美国能源资讯署的数据,石化燃料是美国的初级能源,2023 年消费量为 77.18 兆英热单位。美国紧随其后,消耗了8.24兆Btu的可再生能源。如此高的消费量预计将为市场创造巨大的成长机会。

- 此外,安全继电器和计时器也用于石油和天然气工业的控制、启动和保护电路。安全继电器是石油和天然气工业中必不可少的元件,因为所需的重型机械必须使用安全继电器进行维护。工业计时器适用于物料输送、机器仪器和各种製程机器的製程控制。

- 根据美国能源资讯署 (EIA) 的数据,2023 年天然气需求将达到每天 891 亿立方英尺。相较之下,美国居民天然气需求达到每天123亿立方英尺。在预测期内,这种案例可能会对安全继电器和计时器市场产生很大的需求。

北美安全继电器和定时器产业概况

北美安全继电器和计时器市场是一个半固体市场,主要企业包括罗克韦尔自动化、TE Connectivity 和OMRON工业自动化。为了保持市场竞争力,公司开发了全面且具竞争力的安全继电器和计时器。

- 2023年8月,西门子推出新一代线路监控继电器。 SIRIUS 3UG5 线路监控继电器将成熟的技术与新程序和应用相结合。继电器是按照标准监控电网稳定性和品质的最简单方法,可确保系统正常运作以及马达和压缩机等部件的长寿命。

- 2023年5月,全球最大的单一品牌继电器製造商OMRON推出了最新的工业6毫米电子机械继电器G2RV-ST。这种独特的设计为机器製造商和麵板製造商提供了紧凑面板和设备的理想解决方案。它们还提供工业应用所需的耐用性和可靠性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 汽车领域需求增加

- 功能安全系统在各行各业的采用日益广泛

- 市场限制

- 由于初始成本和维护成本高而导致的复杂性

第六章 市场细分

- 按类型

- 单功能安全继电器

- 模组化和可配置的安全继电器

- 透过联繫方式

- 常闭,定时开启 (NCTO)

- 常闭、定时关闭 (NCTC)

- 常开、定时开(NOTO)

- 常开、定时关闭 (NOTC)

- 按最终用户产业

- 车

- 能源和电力

- 製造业

- 药品

- 建造

- 半导体

- 石油和天然气

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Siemens AG

- Rockwell Automation

- OMRON Industrial Automation

- SICK AG

- Eaton Corp.

- Pilz GmbH & Co. KG

- TE Connectivity

- Altech Corp.

- ABB

- Phoenix Contact

第八章投资分析

第九章:市场的未来

The North America Safety Relay And Timers Market size is estimated at USD 2.11 billion in 2025, and is expected to reach USD 2.90 billion by 2030, at a CAGR of 6.56% during the forecast period (2025-2030).

Over the last decade, the demand for low-cost, accurate, small-sized, bounce-less operation and long shelf-life protective systems increased in industrial, automotive, energy and infrastructure, healthcare, and building equipment. Increased demand for upgrading the power infrastructure in developed countries to reduce heat generation through thermal dissipation using safety relays is expected to drive the market.

Key Highlights

- Safety relays are critical for monitoring safety-related inputs and protecting machines and operators by enabling equipment via outputs only when normal and safe conditions are confirmed. However, traditional hardwired safety relays have limited functionality, leading many to search for upgraded solutions.

- Safety relays and timers are employed in applications like controlling, starting, and protecting circuits in the oil and gas sector. Various process machines employ industrial timers for material handling, machine tools, and process control. According to the EIA, Texas is a significant oil-producing state in the United States. In 2023, Texas produced a total of over 2 billion barrels. In a distant second location was New Mexico, which recorded 667.5 million barrels in the same year.

- According to Baker Hughes, at the end of 2023, 500 active rotary oil rigs were in the United States. The number of operational US oil and gas rigs has increased from a pandemic-induced slump on the back of tighter fuel supplies due to the Russia-Ukraine War. The deployment of process machines has increased due to the considerable rise in the region's offshore oil and gas exploration activities. Offshore oil and gas exploration activities require complex drilling operations, making logistics and operations challenging, hence the need for safety relays.

- Furthermore, the significant advantages of Industry 4.0 have also persuaded OEMs and SMEs to adopt IoT across their operations. IoT is spread across various industries, such as energy and power, healthcare, and the automotive and pharmaceutical industries. Thus, factory automation technologies are witnessing increased demand due to these factors.

- With the increasing technological developments in segments such as healthcare and life sciences, food and beverage, and others, the adoption of cleanroom lighting has continuously increased, demanding the players to invest in this technology through product innovation, expansion activities, mergers, partnerships, etc.

- For instance, in February 2023, ABB launched a Relay Retrofit Program to replace select SPACOM protection relays with the latest protection and control technology, REX610. The REX610 is a safety relay designed to adapt to the requirements of evolving power grids, making it a flexible, sustainable, and future-proof choice.

- However, the complexity of standards and high market competition are expected to hinder the growth of the safety relay and timers market. Additionally, the Russia-Ukraine War caused an additional disruption and affected the supply chains of semiconductors, leading to further increases in the prices of electronics. Overall, the impact of the competition on the electronics industry is expected to be significant. This would hamper the production of safety instrumented systems.

North America Safety Relay and Timers Market Trends

The Automotive Segment is Expected to Drive the Market

- Automotive relays are utilized in harnesses and box modules throughout a vehicle, including rear and front, passenger and engine areas, body control, powertrain, roof, seat, door, and fan modules. The automotive relay types include plug-in, PCB, high-current, high-voltage, and automotive contactors.

- The automotive industry is expected to be one of the highest adopters of safety features. According to the Argonne National Laboratory, in December 2023, the market shares of battery and plug-in hybrid electric vehicles reached 8.34% and 2.82% in the United States, respectively. In addition, according to the Kelley Blue Book estimates, the share of electric vehicles in the overall US vehicle market was 7.6% in 2023, up from 5.9% in 2022. Such expansion may further create demand in the market studied.

- In addition, North America is witnessing robust growth in its automotive industry. According to the OICA, North American motorists purchased around 3.98 million passenger cars in 2023, whereas the United States accumulated approximately 3.12 million.

- Furthermore, high-voltage systems are becoming more prevalent, especially with the increased adoption of EVs in the region. Numerous market players are focused on finding new ways for system designers to solve complex isolation challenges, like ensuring reliable and safe car operation as the enterprise transitions to 800 V batteries and reducing solution size and cost. Advanced solid-state relays can disconnect and connect loads through a single isolation barrier in microseconds, compared to milliseconds for electromechanical relays, to enable the safer operation of high-voltage automotive systems.

- To cater to this requirement, in April 2023, Fujitsu Components America Inc. expanded its offering in the automotive relay market and offered an option of 14 VDC PCBs that are ideally suited to applications with limited space. With the capability to switch 30 A of current in a very compact, plastic-sealed package, measuring 6.6 mm x 13.7 mm x 14 mm, the FTR-G3 is the world's most miniature automotive relay in the 30 A class. Such innovations would drive the growth of the market studied by offering lucrative expansion opportunities.

United States is Expected to Hold Significant Market Share

- The United States is one of the most significant and advanced markets for safety relays and timer solutions in the world. The strong economy, with notable energy and power sector and key manufacturing indices, results in significant growth in manufacturing, and it is poised to drive the demand for the market studied in the region. Sectors, including automotive, pharmaceutical, oil and gas, and manufacturing, are the region's most significant sources of demand for safety relay solutions.

- According to the World Robotics Report 2023, published by the International Federation of Robotics, the United States is the world's third major industrial robot user. According to the IFR, manufacturing firms in the United States significantly increased their investment in automation, as the total installations of industrial robots surged by 12%, reaching 44,303 units in 2023.

- Furthermore, the increasing manufacturing and mining activities and rising power generation and consumption in the country are expected to provide lucrative opportunities for the safety relays and timers market. For instance, according to the United States Energy Information Administration, energy in the United States comes in a broad mixture of forms and sources, which can be broadly divided into primary and secondary, renewable and nonrenewable, and fossil fuels.

- According to EIA, fossil fuels are the primary energy source in the United States, with a consumption of 77.18 quadrillion Btu in 2023. Closely following this, the US had 8.24 quadrillion Btu of energy derived from renewable energy. Such massive consumption will significantly create an opportunity for the growth of the market studied.

- Moreover, in the oil and gas sector, safety relays and timers are used in applications such as controlling, starting, and protecting circuits. Safety relays are an integral component of the oil and gas industry as they require heavy machinery that must be maintained through safety relays. Industrial timers are suitable for material handling, machine instruments, and process control in various process machines.

- According to EIA, in 2023, the demand for natural gas reached 89.1 billion cubic feet per day. By comparison, residential natural gas demand amounted to 12.3 billion cubic feet per day in the United States. Such instances may create a high demand for the safety relays and timers market over the forecast period.

North America Safety Relay and Timers Industry Overview

The North American safety relay and timers market is a semi-consolidated market with significant players like Rockwell Automation, TE Connectivity, and OMRON Industrial Automation. The market players are innovating comprehensive and configurable safety relays and timers to stay competitive.

- In August 2023, Siemens launched a new generation of line monitoring relays. The SIRIUS 3UG5 line monitoring relays integrate proven technology with new procedures and applications. The relays are the easiest way to monitor standards-compliant grid stability and quality, ensuring proper system operation and long service life of components such as motors or compressors.

- In May 2023, OMRON, the world's significant single-brand relay manufacturer, launched its latest industrial 6 mm electromechanical relay - the G2RV-ST. This unique design offers the machine manufacturers and panel builders the ideal solution for compact panels and equipment. It also provides the durability and reliability required for industrial applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Automotive Segment

- 5.1.2 Increasing Adoption of Functional Safety Systems in a Wide Range of Industries

- 5.2 Market Restraints

- 5.2.1 Increasing Complexity Coupled with High Initial Costs and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-function Safety Relays

- 6.1.2 Modular and Configurable Safety Relays

- 6.2 By Contact

- 6.2.1 Normally Closed, Time Open (NCTO)

- 6.2.2 Normally Closed, Time Closed (NCTC)

- 6.2.3 Normally Open, Time Open (NOTO)

- 6.2.4 Normally Open, Time Closed (NOTC)

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Energy and Power

- 6.3.3 Manufacturing

- 6.3.4 Pharmaceutical

- 6.3.5 Construction

- 6.3.6 Semiconductors

- 6.3.7 Oil and Gas

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Rockwell Automation

- 7.1.3 OMRON Industrial Automation

- 7.1.4 SICK AG

- 7.1.5 Eaton Corp.

- 7.1.6 Pilz GmbH & Co. KG

- 7.1.7 TE Connectivity

- 7.1.8 Altech Corp.

- 7.1.9 ABB

- 7.1.10 Phoenix Contact