|

市场调查报告书

商品编码

1626321

北美化学感测器:市场占有率分析、产业趋势、统计、成长预测(2025-2030)NA Chemical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

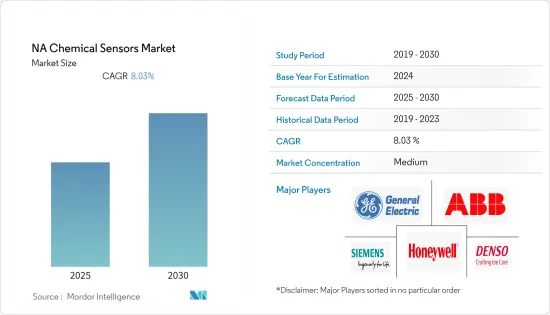

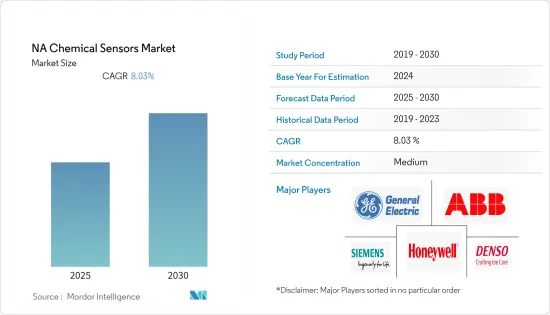

北美化学感测器市场预计在预测期内复合年增长率为 8.03%

主要亮点

- 化学感测器分析各种材料化学成分的能力正在推动其应用。化学感测阵列和高阶正交感测器是该产业的两大发展方向。化学感测器由于其低成本和便携性预计将变得更加流行。

- 撇开环境问题不谈,在化学工业製程中使用化学感测器来检测分析物正受到越来越多的关注。感测器在国防部门、实验室和医疗保健领域被用作先进工具,推动了市场的发展。

- 随着人口增长和人们对医学的兴趣日益浓厚,这些感测器用于治疗疾病的用途预计将显着增加。这增加了血糖值监测等各种临床应用中使用的感测器的需求,并有助于製药应用的开发。

- COVID-19 的爆发导致汽车、石油和天然气等多个行业的成长放缓。基于化学的感测器最常用于石油和天然气领域。由于 COVID-19 的爆发,石油和天然气行业的许多现有和计划中的计划在计划规划和执行方面面临挑战,导致化学感测器的贡献减少。

北美化学感测器市场趋势

化学感测器在医疗领域的快速普及

- 感测器是一种检测物理、化学或生物讯号并允许测量和记录这些讯号的设备。它已被应用于医疗、研究、环境监测、自动化生产等各个领域。例如,化学感测器用于检测体液的成分和浓度,例如Ca+浓度、PH值和葡萄糖浓度。抗原、酵素、抗体、DNA、RNA、荷尔蒙、微生物等都可以透过生物感测器来检测。

- 肺癌等疾病是全球癌症相关死亡率最高的疾病。患者的预后和治疗方法取决于癌症的阶段、组织学和遗传变化。使用交叉反应化学感测器奈米阵列来识别呼出气样本和体外肺癌细胞株顶部空间中的挥发性生物标记。

- 此外,虽然吸收和萤光是光学化学感测中最常见的物理现象,但化学发光、拉曼散射和等离子体共振也被利用。光的强度直接由要研究的参数(具有光学性质)或透过化学转换器来调节,化学转换器的光学性质随着要研究的参数的浓度而变化。

化学感测器在各行各业的有益用途

- 强劲的消费者需求和购买力平价支撑了美国汽车产业的潜在需求模式。汽车产业中感测器和测量技术的加强使用提高了引擎性能、提高了能源经济性并减少了污染排放。

- 一种用于汽车空调控制的新型空气品质感测器已开发出来。此化学感测器适用于具有活性碳过滤器和进气风门的空调系统。 NOx和CO是检测空气污染最重要的标记。

- 汽车内燃机的有效管理需要高度灵敏的化学感测器。用于氧气监测的各种陶瓷氧感知器已在汽油和柴油应用中广泛应用。随着污染法规变得更加严格以及车载诊断技术的出现,人们对监测新废气类型的兴趣持续增长。由于这一进步,新一代废气感测器正在开发中,特别是针对柴油应用。

北美化学感测器产业概况

北美化学感测器市场部分分散。该市场的主要企业包括霍尼韦尔国际公司、电装公司、ABB 有限公司、西门子公司和通用电气公司。该领域的策略性倡议包括:

- 2021 年 6 月,通用电气正在开发一款紧凑型蒸气化学剂侦测器 (CVCAD),它将在所有天气和现场条件下向初期应变人员提供危险化学品存在的早期预警。

- 2021 年 6 月,美国的紧凑型蒸气化学剂探测器 (CVCAD) 专案向 Teledyne Technologies Incorporated 旗下子公司 Teledyne FLIR 授予了一份製造美国军方首个大规模佩戴的化学剂探测器的合约。该公司获得初始投资400万美元。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 化学感测器技术的技术发展加快

- 化学感测器应用的增加

- 市场限制因素

- 技术复杂性

第六章 市场细分

- 依产品类型

- 电化学

- 光学的

- 帕利斯特/触媒珠

- 其他产品类型

- 按用途

- 医疗用途

- 石油和天然气

- 环境监测

- 车

- 工业的

- 其他的

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

第七章 竞争格局

- 公司简介

- Honeywell International Inc.

- Denso Corporation

- ABB Ltd.

- Siemens AG

- General Electric Co.

- Teledyne Technologies Incorporated

- Smiths Detection Inc.

- Chemring Group PLC

- Bosch Sensortec GmbH

- Smart Sensors, Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 47458

The NA Chemical Sensors Market is expected to register a CAGR of 8.03% during the forecast period.

Key Highlights

- The capacity of chemical sensors to analyze the chemical composition of various materials is driving their adoption. Chemical sensing arrays and higher-order orthogonal sensors are two major industry developments. Chemical sensors are projected to expand in popularity due to their low cost and portability.

- Aside from environmental concerns, the use of chemical sensors for analytes in chemical industrial processes is gaining traction. Sensors are being used as advanced tools in the defense sector, research labs, and healthcare operations, which is driving the market.

- The rising population and growing medical concerns are expected to result in a significant increase in the use of these sensors to heal illnesses. This will increase demand for sensors used in a variety of clinical applications, such as blood glucose monitoring, and will aid in the development of pharmaceutical applications.

- The COVID-19 epidemic has slowed the growth of several sectors, including automobiles, oil and gas, and others. Chemical-based sensors are most often used in the oil and gas sector. Many existing and planned projects across the oil and gas sector are encountering issues in terms of project planning and execution as a result of the COVID-19 epidemic, leading to a diminished contribution of chemical-based sensors.

North America Chemical Sensors Market Trends

Rapid Growing Adoption of Chemical Sensors in Medical

- Sensors are devices that detect physical, chemical, and biological signals and allow for the measurement and recording of such signals. They've been employed in a variety of sectors, including medical, research, environmental monitoring, and automated production. A chemical sensor, for example, is used to detect the constituent and concentration of bodily fluids such as Ca+ concentration, PH value, glucose concentration, and so on. Antigen, enzyme, antibody, DNA, RNA, hormone, and microorganism are all detected by the biosensor.

- Disease like Lung cancer is the most common cancer-related mortality in the world. The prognosis and therapy of a patient are determined by cancer's stage, histology, and genetic alterations. Cross-reactive chemical sensor nanoarrays were used to identify volatile biomarkers in breath samples and the headspace of in-vitro lung cancer cell lines.

- Furthermore, absorption and fluorescence are the most common physical phenomena utilized in optical chemical sensing; however, chemical luminescence, Raman scattering, and plasmon resonance have also been used. The intensity of the light is directly regulated by the parameter being researched (which possesses optical characteristics) or by a chemical transducer whose optical properties fluctuate with the concentration of the parameter under examination in optical sensors.

Beneficial Usage of Chemical Sensors in Wide-ranging Industries

- Strong consumer demand, along with purchasing power parity, is boosting underlying demand patterns in the automobile industry in the United States, which is, in turn, impacting the expansion of chemical sensors in this industry. Enhanced usage of sensor and measuring technologies in the automobile industry has resulted in improved engine performance, increased energy economy, and lower pollution emissions.

- A novel air quality sensor for automotive climate control has been developed. The chemical sensor is intended for use in air conditioning systems with a charcoal filter and an air intake flap. NOx and CO are the most important markers for detecting air pollution.

- Chemical sensors with high sensitivity are required to manage automobile combustion engines effectively. Various types of ceramic lambda probes for oxygen monitoring are well established for both gasoline and diesel applications. Interest in monitoring new exhaust gas species continues to develop in the face of stricter pollution laws and on-board diagnostics. As a result of this advancement, new generations of exhaust gas sensors are being developed, particularly for diesel applications.

North America Chemical Sensors Industry Overview

North America Chemical Sensors Market is partially fragmented. Some of the major players in the market are Honeywell International Inc., Denso Corporation, ABB Ltd., Siemens AG, General Electric Co., and others. Some of the strategic initiatives made in this sector are:

- In June 2021, General Electric is developing a Compact Vapor Chemical Agent Detector (CVCAD) that will give first responders an early warning of the presence of harmful chemicals in all weather and field circumstances.

- In June 2021, Under the Pentagon's Compact Vapor Chemical Agent Detector (CVCAD) program, Teledyne FLIR, a division of Teledyne Technologies Incorporated, was awarded a contract to build the first mass-wearable chemical detector for US troops. The firm received an initial investment of US$ 4.0 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Development in Chemical Sensing Technologies

- 5.1.2 Increasing Applications for adoption of Chemical Sensors

- 5.2 Market Restraints

- 5.2.1 Technical Complications

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Electrochemical

- 6.1.2 Optical

- 6.1.3 Pallister/Catalytic Bead

- 6.1.4 Other Product Types

- 6.2 By Application

- 6.2.1 Medical

- 6.2.2 Oil and Gas

- 6.2.3 Environmental Monitoring

- 6.2.4 Automotive

- 6.2.5 Industrial

- 6.2.6 Others

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

- 6.3.4 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Denso Corporation

- 7.1.3 ABB Ltd.

- 7.1.4 Siemens AG

- 7.1.5 General Electric Co.

- 7.1.6 Teledyne Technologies Incorporated

- 7.1.7 Smiths Detection Inc.

- 7.1.8 Chemring Group PLC

- 7.1.9 Bosch Sensortec GmbH

- 7.1.10 Smart Sensors, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219