|

市场调查报告书

商品编码

1639351

中东和非洲的奈米感测器 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Middle-East and Africa Nanosensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

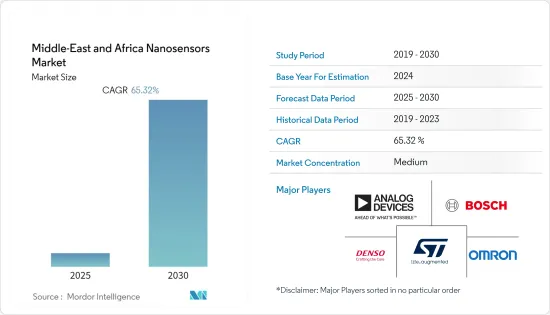

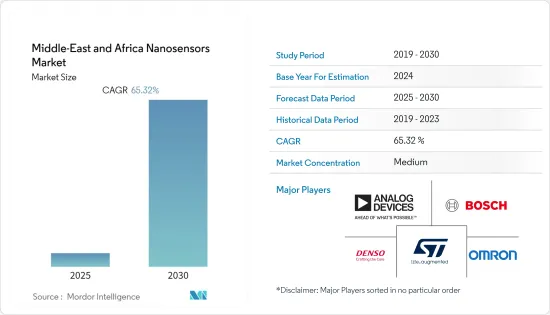

中东和非洲奈米感测器市场预计在预测期内复合年增长率为 65.32%

主要亮点

- 奈米感测器是奈米技术领域的着名发明之一。感测器是在奈米尺度上製造的,旨在收集奈米尺度的资讯。自发明以来,奈米感测器已进入多个产业。在中东的一些行业中,此类感测器可能会造成破坏以及经济和环境影响。

- 推动中东和非洲汽车领域奈米感测器市场的主要趋势是小型化和改进的通讯能力,从而可以在不破坏车辆基本功能的情况下整合到车辆中。另一方面,推动非洲奈米感测器市场成长的因素是在汽车和医药等各种应用中的使用不断增加。

- 根据阿联酋线上商品买卖市场 Dubizzle 的数据,大约十分之六的阿联酋消费者正在考虑在未来六个月内购买汽车。由于中东汽车产业是高性能汽车的主要市场,这些趋势预计将推动对奈米感测器的需求。

- 此外,奈米技术的进步正在彻底改变石油和天然气行业的许多方面。据欧佩克称,沙乌地阿拉伯持有全球已探明石油蕴藏量的约17%。石油和天然气产业约占国内生产总值的50%和出口收益的70%。

- 奈米感测器在石油和天然气领域用于测量温度和压力。此外,化学品和气体污染也是石油生产的方面。人们正在探索奈米感测器在石油和天然气领域的广泛应用,特别是提高油田的采收率。

- COVID-19大流行对中东地区产生了重大影响。这场流行病主要影响了支持该地区经济的国家汽车和石油和天然气产业。据 OECD 称,中东和北非地区已登记超过 220 万例 COVID-19 感染病例。在阿拉伯经济体中,伊拉克确诊病例数最多,其次是沙乌地阿拉伯和摩洛哥。

- 然而,该地区各国政府很早就为解决 COVID-19 健康危机做出了巨大努力,这有助于限制病毒的传播。随着局势走向正常化,预计中东和非洲将在预测期内为奈米感测器市场的成长创造有利的环境。

中东和非洲奈米感测器市场趋势

医疗占较大市场占有率

- 由于该地区国家的经济成长,中东地区的医疗保健领域正在蓬勃发展。在大多数国家,有效率、有效地利用卫生资源是改善健康结果的关键策略。

- 例如,根据世界银行的数据,2018年阿拉伯联合大公国的医疗保健支出达到1,82亿美元,预计2021年将增加至213亿美元。总体而言,到 2026 年,医疗支出预计将占该国 GDP 的 4.6%,高于 2018 年的 4.27%。

- 人口结构变化、生活方式变化和人口成长是该国医疗保健产业成长的主要驱动力。根据世界银行预测,阿联酋人口将从2017年的940万增加到2030年的1105.5万人。

- 奈米技术在包括医学和製药在内的各个领域提供了重大的科学和技术进步。此外,技术发展以及智慧和医疗系统的加速正在朝着新的医疗保健方法和模式发展,例如奈米感测器、智慧型手机和智慧型手錶。

- 奈米感测器检测关键分子(例如与疾病相关的代谢物、蛋白质、核酸、病原体和细胞)的能力预计将推动中东和非洲医疗领域的需求。

沙乌地阿拉伯占主要市场占有率

- 沙乌地阿拉伯是中东地区最大的国家,人口超过3500万。此外,根据ITA的数据,沙乌地阿拉伯已探明的石油蕴藏量位居世界第二(约2,660亿桶)。

- 随着全球能源消费量逐年增加,奈米感测器在石油天然气产业的应用不断扩大。产业需要创新来满足这项迫切需求。

- 奈米感测器可以发挥多种功能。例如,它可以与流体一起注入储存,帮助工作团队获得有关储存孔隙度、渗透率和温度的更多资讯。此外,奈米感测器还可用于温度感测、磁感和光学成像应用。

- 此外,沙乌地阿拉伯是最大的汽车市场之一,预计将为该地区的奈米感测器市场创造成长机会。据ITA称,2020年,沙乌地阿拉伯占波湾合作理事会(GCC)汽车销售量的近52%,占中东和北非地区汽车销售量的35%。

- 沙乌地阿拉伯国家工业发展中心(NIDC)的目标是,根据该国2030年愿景的目标,到2030年每年生产30万辆汽车,本地生产率达到40%。家目标商标产品製造商和电动车价值链。

- 同样,该国的食品和饮料、智慧城市基础设施以及用水和污水管理领域预计也将在预测期内推动奈米感测器的需求。

中东和非洲奈米感测器产业概况

中东和非洲奈米感测器市场竞争适中,在各个最终用户领域的应用不断扩大,推动了新进入者的发展。在这个市场上运营的主要企业都专注于实现大批量生产能力,以保持较低的产品成本。市场上的一些主要企业包括 Analog Devices Inc.、Robert Bosch GmbH、Denso Corporation 和 STMicroElectronics。

- 2021 年 9 月 - 奈米气体感测器製造商 AeroNos 宣布推出新的开发套件,帮助客户开发气体感测功能并将其整合到各种产品线中。该套件将建造和测试各种应用的气体感测应用所需的多种技术组合在一起,包括消防安全、空气品质以及环境和温室气体检测。

- 2021 年 7 月 - 以色列理工学院 - 以色列理工学院的研究小组透露,他们已经生产并测试了一种结核病检测皮肤贴片,贴在皮肤上一小时后即可做出诊断。该贴片包含由奈米颗粒製成的感测器。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响分析

第五章市场动态

- 市场驱动因素

- 活性化奈米感测器产业的研发活动

- 扩大汽车、医疗等各种用途

- 市场限制因素

- 製造奈米感测器的复杂性

- 缺乏检测极限和工业规范

第六章 市场细分

- 按类型

- 力传感器

- 生物感测器

- 辐射感测器

- 化学感测器

- 热感应器

- 按行业分类

- 家用电子电器

- 发电

- 车

- 石化

- 航太/国防

- 医疗保健

- 工业

- 其他行业

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 以色列

- 南非

- 其他国家

第七章 竞争格局

- 公司简介

- Analog Devices Inc.

- Robert Bosch GmbH

- Denso Corporation

- Omron Corp.

- STMicroelectronics

- Agilent Technologies

- Sensonor AS

- Silicon Designs Inc.

- Honeywell International Inc.

- Toshiba Corp.

- Flir Systems Inc.

- Texas Instruments

- GE Sensing

第八章投资分析

第9章市场的未来

The Middle-East and Africa Nanosensors Market is expected to register a CAGR of 65.32% during the forecast period.

Key Highlights

- Nanosensors are among the notable inventions in the field of nanotechnology. The sensors are manufactured on the nanoscale and are designed to collect information on the nanoscale. Since their invention, nanosensors have made inroads into several industries. There are several industries where these sensors can contribute to offer disruption and economic and environmental impacts in the Middle East.

- The major trends driving the Middle-East and Africa nanosensors market in the automotive sector are miniaturizations and improved communication capabilities, enabling their integration into vehicles without interfering with the basic functionalities of the vehicle, while the factor driving the growth of the nanosensors market in Africa is its growing use in various applications, such as automotive and medical.

- According to Dubizzle, an online buy marketplace to buy and sell products in the UAE, about six in 10 UAE consumers are considering whether to buy a car in the next six months. As the Middle Eastern automotive sector is a key market for high-performance cars, such trends are expected to drive the demand for nanosensors.

- Furthermore, advancements in nanotechnology have revolutionized many aspects of the oil and gas industry. According to OPEC, Saudi Arabia possesses around 17% of the world's proven petroleum reserves. The oil and gas sector accounts for about 50% of gross domestic product and about 70% of export earnings.

- Nanosensors are used in the oil and gas sector for temperature and pressure measurement. Furthermore, pollution by chemicals or gases is also a difficult aspect of petroleum production. The vast sea of applications of nanosensors is being explored for effective utilization in the oil and gas sector, especially in improving the recovery efficiency of the oilfield.

- The global outbreak of COVID-19 had a significant impact on the Middle-Eastern region. The pandemic primarily impacted the automotive and oil and gas sector of the countries in this region, which is the backbone of the economies in this region. According to OECD, more than 2.2 million COVID-19 infections have been registered in the MENA region. Among Arab economies, Iraq has the most confirmed cases, followed by Saudi Arabia and Morocco.

- However, the governments in the region had made important efforts to address the COVID-19 health crisis early on, which helped them contain the spread of the virus. With the condition moving toward normalcy, the MEA region is anticipated to create a favorable environment for the growth of the nanosensors market during the forecast period.

MEA Nanosensors Market Trends

Healthcare to Hold a Significant Market Share

- The Middle-Eastern region is seeing a boom in the healthcare sector, owing to the economic growth of the countries in the region. In most countries, efficient and effective utilization of healthcare resources is the key strategy for improving health outcomes.

- For instance, according to the World Bank, healthcare expenditures in the UAE reached USD 18.2 billion in 2018 and were expected to rise to USD 21.3 billion by 2021. Overall, healthcare spending was projected to account for 4.6% of the country's GDP by 2026, up from 4.27% in 2018.

- Demographic shifts, changing lifestyles, and population growth are among the key drivers for the growth of the healthcare sector in the country. According to the World Bank, the UAE's population would grow from 9.4 million people in 2017 to 11.055 million by 2030.

- Nanotechnology stands to produce significant scientific and technological advances in diverse fields, including healthcare and pharma. Furthermore, acceleration in developing technologies and intelligence healthcare systems is moving toward novel approaches and models of healthcare based on nanosensors, smartphones, smartwatches, etc.

- The ability of nanosensors to detect important molecules, such as disease-related metabolites, proteins, nucleic acids, pathogens, and cells, is expected to drive the demand from the healthcare sector of the MEA region.

Saudi Arabia to Hold a Significant Market Share

- Saudi Arabia is the largest country in the Middle-Eastern region, with a population of over 35 million. Furthermore, according to ITA, Saudi Arabia has the second-largest proven oil reserves in the world (about 266 billion barrels).

- The applications of nanosensors in the oil and gas industry are increasing, as global energy consumption is constantly increasing every year. The industry needs technological innovations to meet this immediate demand.

- The nanosensors can perform several functions, such as they can be injected into a reservoir with fluid and can help the operation teams obtain more information about the porosity, permeability, and temperature of the reservoir. Furthermore, nanosensors can also be used for temperature sensing, magnetic sensing, and optical imaging applications.

- Furthermore, Saudi Arabia is among the largest automotive market, which is expected to create opportunities for the growth of the nanosensors market in the region. According to ITA, Saudi Arabia accounted for almost 52% of the vehicles sold in the Gulf Cooperation Council (GCC) and 35% in the MENA region in 2020.

- In accordance with the Kingdom's vision 2030 goals, the National Industrial Development Center (NIDC) aims to attract 3-4 original equipment manufacturers across the ICE and EV value chain, with the goal of producing 300,000 vehicles annually, with a 40% local content by 2030.

- Similarly, the country's food and beverage, smart city infrastructure, and water and wastewater management sectors are also expected to drive the demand for nanosensors during the forecast period.

MEA Nanosensors Industry Overview

The Middle-East and Africa nanosensors market is moderately competitive, with growing applications across various end-user verticals encouraging new players to enter the market. The key players operating in the market are focusing on achieving bulk manufacturing capability to keep the cost of the product low. Some of the major players operating in the market include Analog Devices Inc., Robert Bosch GmbH, Denso Corporation, and STMicroelectronics.

- September 2021 - The nano gas sensor manufacturer AeroNos unveiled a new development kit to help customers develop and integrate gas sensing capabilities into various product lines. The kit groups together multiple technologies required to build and test gas sensing applications for a variety of applications, such as fire safety, air quality, and environmental and greenhouse gas detection.

- July 2021 - A research team from the Technion-Israel Institute of Technology revealed that it produced and tested a tuberculosis-detecting skin patch that gives a diagnosis an hour after it is attached to the skin. The patch contains sensors made from nanoparticles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact Analysis of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased R&D Activities in the Nanosensor Industry

- 5.1.2 Growing Use in Various Applications Such as Automotive and Medical

- 5.2 Market Restraints

- 5.2.1 Manufacturing Complexity of Nanosensors

- 5.2.2 Detection Limit and Lack of Industry Specification

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Force Sensor

- 6.1.2 Biosensors

- 6.1.3 Radiation Sensors

- 6.1.4 Chemical Sensors

- 6.1.5 Thermal Sensors

- 6.2 By Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Power Generation

- 6.2.3 Automotive

- 6.2.4 Petrochemical

- 6.2.5 Aerospace and Defense

- 6.2.6 Healthcare

- 6.2.7 Industrial

- 6.2.8 Other Industries

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Israel

- 6.3.4 South Africa

- 6.3.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Robert Bosch GmbH

- 7.1.3 Denso Corporation

- 7.1.4 Omron Corp.

- 7.1.5 STMicroelectronics

- 7.1.6 Agilent Technologies

- 7.1.7 Sensonor AS

- 7.1.8 Silicon Designs Inc.

- 7.1.9 Honeywell International Inc.

- 7.1.10 Toshiba Corp.

- 7.1.11 Flir Systems Inc.

- 7.1.12 Texas Instruments

- 7.1.13 GE Sensing