|

市场调查报告书

商品编码

1628773

亚太地区奈米感测器:市场占有率分析、产业趋势和成长预测(2025-2030)APAC Nano Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

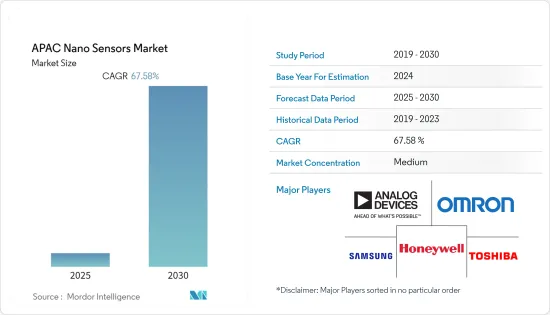

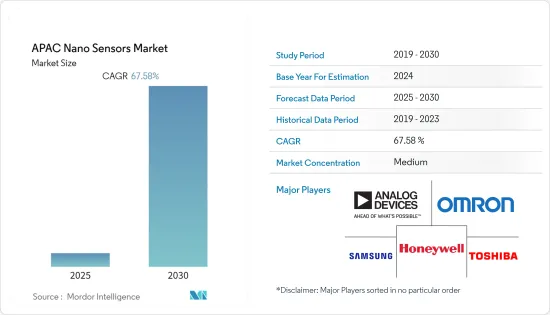

亚太奈米感测器市场预计在预测期内复合年增长率为67.58%

主要亮点

- 亚太地区的奈米感测器市场预计在预测期内将显着成长。该地区还占有全球市场的很大份额。此外,预计在预测期内,亚太地区奈米感测器的采用率最高。

- 亚太地区在奈米感测器技术的发展方面处于领先地位。韩国在奈米技术市场的专利数量位居全球第二,其次是日本、中国和台湾。奈米技术专利数量的增加预计将推动该地区奈米感测器市场的成长。

- 中国是全球最大的汽车市场,也是全球最大的汽车生产基地,其中包括电动车。马来西亚还有27家汽车製造和组装厂。预计该地区的汽车工业也将大幅成长。

- 该地区不断增长的经济状况和投资鼓励许多奈米感测器供应商在市场上进行创新。来自中国和新加坡的研究人员开发了一种新型光机械奈米感测器,为讯号处理提供了新的可能性。

亚太地区奈米感测器市场趋势

预计电化学领域在预测期内将占据显着份额

- 化学奈米感测器测量特定化学物质的浓度和成分,以产生所需的效果。此类感测器中使用奈米碳管来吸收或吸附(取决于所使用的技术),以检测化学变化。

- 测量的属性包括化学成分、键结和分子水平浓度。这些感测器的优点包括高灵敏度、高选择性、高吸附性和大表面积。对即时护理 (POC) 设备不断增长的需求预计将推动化学感测器的发展。石油天然气和石化产业严重依赖此类设备来确保安全的操作环境。

- 在食品工业中,化学奈米感测器具有多种应用,具有多种电极类型,用于检测水中的糖、葡萄、葡萄酒和亚硫酸盐等化合物。因此,随着化学等各种行业释放污染物和化学物质废弃物,对这些感测器的需求预计会增加,从而进一步增加对监测解决方案的需求。

医疗保健支出的增加预计将增加对奈米感测器的需求

- 在亚太地区,由于对快速、准确、紧凑和便携式诊断感测系统的需求不断增长,生物医学和生物医学领域是奈米感测器最大的新兴市场。奈米感测器有能力满足这项需求。

- 此外,奈米感测器和奈米整合系统预计将在不久的将来用于大量人口的初步诊断和筛检。医疗保健支出的增加也促进了市场的显着成长。

- 除此之外,从北美和欧洲等地区到亚太地区的医疗保健旅行的增加也进一步推动了对创新医疗保健解决方案的需求。例如,根据马来西亚医疗旅游理事会的数据,冠状动脉绕道手术手术在美国的费用约为 92,000 美元,而在印度的费用不到 10,000 美元。

- 该地区正在进行各种材料开发和技术研究,预计将推动市场需求。例如,2021年6月,中国科学院上海高等研究院的研究团队报告了一种利用石墨烯-PDMS(聚二甲基硅氧烷)微球进行微结构感知的新型柔性压阻感测器。

亚太地区奈米感测器产业概况

儘管很少有大公司在该地区的奈米感测器市场上占有较大份额,但许多正在推进市场发展的公司正在开发基于奈米技术的解决方案。市场尚未整合,但在预测期内正走向整合。

- 2021 年 8 月 -OMRON宣布推出业界首个影像处理技术,可实现电子基板检查流程自动化,无需专业技能,以满足第五代行动通讯、电动车和自动驾驶等需求。 。该公司的新提案旨在维持和提高品质和安全。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 小型化趋势以及各行业越来越多地使用小型化产品

- 加大创新材料的研发力度

- 市场限制因素

- 奈米感测器製造的复杂性

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 光学感测器

- 电化学感测器

- 电子机械感应器

- 按最终用户产业

- 家用电子产品

- 发电

- 车

- 石化

- 航太/国防

- 卫生保健

- 产业

- 其他最终用户产业

第六章 竞争状况

- 公司简介

- Analog Devices Inc

- OMRON Corporation

- Samsung Electronics co Limited

- Toshiba Corp.

- Honeywell International Inc

- STMicroelectronics

- Toshiba Corp.

- Teledyne Technologies

- Agilent Technologies

- Nippon Denso Corp.

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 53794

The APAC Nano Sensors Market is expected to register a CAGR of 67.58% during the forecast period.

Key Highlights

- The Asia-Pacific nanosensor market is estimated to grow significantly during the forecast period. The region also accounts for a significant market share in the global market. Also, the adoption of nanosensors is expected to be highest in Asia-Pacific during the forecast period.

- The APAC region leads in the development of nanosensor technology. South Korea has the second-highest patents in the nanotechnology market in the world, followed by Japan, China, and Taiwan. The increasing number of patents in Nanotechnology is estimated to grow the market for nanosensors in the region.

- China has become both the world's largest car market and the world's largest production site for cars, including electric cars. Also, there are 27 automotive manufacturing and assembly plants in Malaysia. The automotive industry is also expected to grow significantly in the region.

- The growing economic condition and investments in the region have motivated many nanosensor vendors to innovate in the market. The researchers from China and Singapore have developed a new Optomechanical Nanosensor, which offers fresh possibilities for signal processing.

APAC Nano Sensors Market Trends

The electrochemical segment is expected to command prominent share over the forecasted period

- Chemical nanosensors measure the concentration and composition of a particular chemical and provide the desired effect. Carbon nanotubes are used in such sensors to absorb or adsorb, depending on the technique used, to detect the chemical changes.

- The measuring attributes include chemical composition and bonding and molecular-level concentration, among others. The benefits of these sensors include high sensitivity, high selectivity, high adsorption, and larger surface area coverage. Growing demand for point-of-care devices is expected to act as a driver for the chemical sensors, as these devices offer an attractive option in this field due to their small footprint and potential for high sensitivity. Oil and gas and petrochemical industries are highly dependent on such devices to ensure a safe environment for the conduction of operations.

- In the food industry, chemical nanosensors have versatile applications with an array of electrode types being used to detect compounds, like Sulfite in sugar, grapes, wine, and water. Thus, the demand for these sensors is expected to increase as various industries, such as chemicals, release pollutants and chemicals as waste, which further increases the need for monitoring solutions.

Growing spending in healthcare is expected to augment the demand for nano sensors

- The biomedical and biomedical sector is the largest initial market for nanosensors in the Asia Pacific region, owing to a growing requirement for rapid, accurate, compact, and portable diagnostic sensing systems. Nanosensors have the capabilities to address this requirement.

- Moreover, nanosensors and nano-enabled integrated systems are expected to be used in large populations in the near future for preliminary diagnosis or screening. The increasing spending on healthcare treatments is also aiding the market in growing significantly.

- In addition to this, the growing healthcare travel towards the Asia Pacific from regions such as North America and Europe is further fueling demand for innovative healthcare solutions. The price parity of healthcare is augmenting the growth of healthcare tourism; for instance, according to the Malaysia Healthcare Travel Council, a coronary artery bypass graft which would cost about USD 92,000 in the United States costs less than USD 10,000 in India.

- Various material development and technology research are underway in the region, which is expected to propel the market demand. For instance, in June 2021, a research team from the Shanghai Advanced Research Institute of the Chinese Academy of Sciences reported a novel flexible piezoresistive sensor with graphene-PDMS (polydimethylsiloxane) microspheres for microstructure perception.

APAC Nano Sensors Industry Overview

The nanosensors market in the region has few major players who command significant shares; however, various other players in the market are developing solutions based on nanotechnology. The market is not consolidated but moving towards consolidation beyond the forecasted period.

- Aug 2021 - Omron launches the "VTS10 Series PCB Inspection System", the industry's first imaging and artificial intelligence technology that automates the electronic substrate inspection process, eliminating the need for specialized skills to meet the needs of fifth-generation mobile communications, electric vehicles, and autonomous driving. The company's new proposal aims to maintain and improve quality and safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Trend of Miniaturization and Use of Miniaturized Products Across Various Industries

- 4.2.2 Increasing research and development in innovative materials

- 4.3 Market Restraints

- 4.3.1 Complexity in Manufacturing Nanosensors

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Optical Sensor

- 5.1.2 Electrochemical Sensor

- 5.1.3 Electromechanical Sensor

- 5.2 By End-User Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Power Generation

- 5.2.3 Automotive

- 5.2.4 Petrochemical

- 5.2.5 Aerospace and Defense

- 5.2.6 Healthcare

- 5.2.7 Industrial

- 5.2.8 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Analog Devices Inc

- 6.1.2 OMRON Corporation

- 6.1.3 Samsung Electronics co Limited

- 6.1.4 Toshiba Corp.

- 6.1.5 Honeywell International Inc

- 6.1.6 STMicroelectronics

- 6.1.7 Toshiba Corp.

- 6.1.8 Teledyne Technologies

- 6.1.9 Agilent Technologies

- 6.1.10 Nippon Denso Corp.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219