|

市场调查报告书

商品编码

1626332

北美汽车互联网:市场占有率分析、行业趋势、统计和成长预测(2025-2030)NA Internet of Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

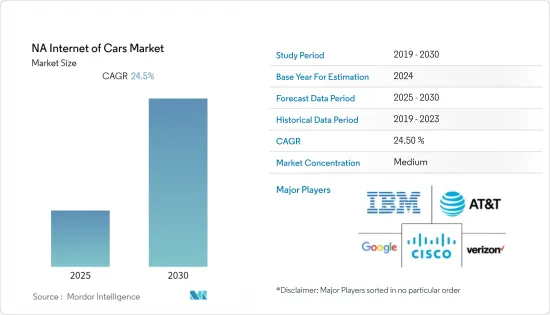

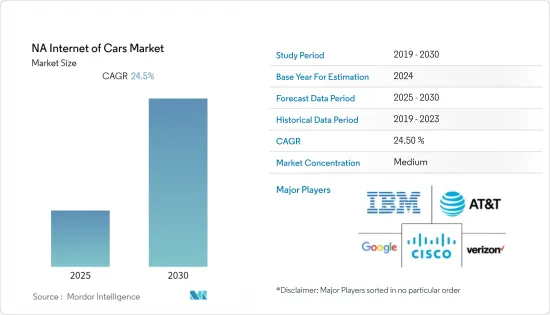

北美汽车互联网市场预计在预测期内复合年增长率为24.5%

主要亮点

- 现今的汽车配备了各种电子和机械装置。然而,过去十年的重大技术发展使得联网汽车如今面世。连网型汽车预计将继续发展。连网型汽车可改善道路安全,促进防盗功能,并透过在车辆与附近基础设施之间交换关键资讯来协助驾驶员。

- 这个市场由思科、Oracle等多家技术供应商,以及通用汽车等作为技术供应商崛起的汽车製造商所组成。该公司的 OnStar 订阅子公司提供通讯、安全、免持呼叫和远距离诊断系统,为雪佛兰、凯迪拉克和沃克斯豪尔等汽车製造商的各种车辆配备了其技术功能。

- 近年来,互联互通和道路安全法规的改善推动了汽车市场的变化。此外,物联网预计将进一步推动这项变革。包括宝马、梅赛德斯、福特和通用汽车在内的多家汽车製造商正在与技术供应商思科和博世合作,提供物连网型汽车。

- 为了在这个前所未有的时代保持竞争力,汽车公司必须投资更聪明的行动移动。例如,人工智慧(AI)和5G通讯等新技术有望融入汽车中。儘管全自动汽车 (AV) 的未来已成为新闻头条,但汽车製造商正在迅速将智慧连网型技术融入当前车型中,无论是电动车 (EV) 还是传统内燃机汽车 (ICE),都需要关注。是

- 2020 年上半年对汽车製造商来说是艰难的一年,大多数汽车製造商被迫关闭其生产设施以限制 COVID-19 的传播。特别是在美国,福特、通用、沃尔沃、丰田和本田等大多数OEM製造商自3月以来已停产近两个月。其他加剧生产延误的因素包括半导体短缺、美国墨西哥湾沿岸化工厂因二月风暴而关闭,以及寒冷天气导致大停电导致石化产品短缺。美国汽车销售延续復苏趋势,2020年下半年年减3%,较2020年上半年的21%下降。

北美汽车互联网市场趋势

北美市场预计将受到汽车安全标准的推动

- 美国市场的成长主要得益于车辆安全标准的提高、对车对车(V2V)连接技术的需求以及物联网与汽车产业的结合。

- 自动驾驶汽车技术在美国市场的出现是一个重要趋势,将增加对先进联网汽车功能的需求。市场已经见证了 ADAS 解决方案的快速成长。

- 由于联网汽车服务合约续签,对售后服务的需求增加预计将推动美国市场向前发展。此外,据估计,美国销售的所有汽车中 91% 以上都支援网路。

扩大云端技术和物联网的采用

- 行动网路营运商 (MNO) 越来越多地采用云端基础的机器对机器 (M2M) 平台,以减少产品和服务推出的资本支出和上市时间 (TTM)。

- 此外,这些平台还有助于跨零售和汽车等业务部门整合、开发、行销和支援 M2M 连接和云端服务。

- 例如,菲亚特克莱斯勒汽车公司宣布将使用哈曼的Ignite云端基础的平台为驾驶员提供各种连接服务。只需按一下按钮,系统即可定位加油站和充电站、接收交通和餐厅方向、预测维护需求,并为车主提供即时顾客关怀协助。该平台支援4G和5G网路连线。预计此类发展将推动市场成长。

- 透过与通讯业者合作,汽车製造商现在可以比以往更快地部署具有内建连接功能的车辆。超过 30 个品牌使用 AT&T 的网络,包括宝马、福特、雪佛兰、捷豹和本田。

- 同时,Verizon 的联网汽车产品组合包括少数OEM,包括丰田、福斯和马自达,很快就会有更多厂商加入。 AT&T 多样化的资料方案、针对车辆的定制以及与製造商的合作加速了联网汽车生态系统的研发,使 AT& 通讯业者。

北美汽车互联网产业概况

北美汽车互联网市场的现有参与者适度整合,包括:思科、Google、IBM、AT&T、Verizon、丰田、沃尔沃、特斯拉汽车随着该地区对互联繫统和物联网的需求不断增长,汽车製造商正试图透过建立合资企业来获得相对于竞争对手的优势。

- 2021 年 10 月 - Tesla 将所有 Model 3 和 Model Y 的高级连接期限缩短至 30 天。长期以来,所有特斯拉汽车都配备了网路连线。这通常是业内的优质选择。特斯拉正在广泛利用其连接性来实现许多功能,包括开发自动驾驶系统的驾驶员辅助功能。

- 2021 年 10 月 - 捷豹路虎北美公司和 SiriusXM 宣布,新款路虎探测车将标配 360L 动力的 SiriusXM,这是 SiriusXM 最新、最先进的音频娱乐平台。新款路虎探测车将是第一款配备 360L SiriusXM 的捷豹和路虎车,随后也将推出更多捷豹和路虎车款。配备 360L Sirius 的新款路虎探测车

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 推动市场的因素

- 上网人口的增加

- 扩大巨量资料解决方案的采用

- 市场限制因素

- 技术尚未完全发挥作用

- 初始成本高

- 价值链分析

- 产业吸引力-波特五力分析

- 当前的市场机会

- 产业政策

第五章技术概述

- 技术简介

- 未来科技

第六章 市场细分

- 按成分

- 硬体

- 软体

- 服务

- 依技术

- Wi-Fi

- Bluetooth

- NFC

- 细胞的

- 其他的

- 透过通讯设备

- 车与车之间

- 汽车与基础设施

- 其他的

- 按国家/地区

- 美国

- 加拿大

- 其他的

第七章 北美汽车网路市场预测

- 北美洲

- 概述

- 市场预测与分析

- 分析师观点

第八章 竞争格局

- 公司简介

- Cisco

- IBM

- AT&T

- Verizon

- Toyota

- Volvo

- Tesla Motors

第九章 北美汽车网路市场未来前景

简介目录

Product Code: 47699

The NA Internet of Cars Market is expected to register a CAGR of 24.5% during the forecast period.

Key Highlights

- Vehicles today are equipped with various electronics and machinery equipment. However, significant technological developments over the last decade have let rise to connected cars come into use today. It is expected to evolve in the future. Connected cars improve road safety, facilitate anti-theft features, and assist the driver by exchanging critical information between nearby infrastructure and vehicles.

- The market consists of numerous technology providers, such as Cisco and Oracle, and automakers, such as General Motors, which emerged as technology providers. The company's OnStar, a subscription-based subsidiary that provides communications, security, hands-free calling, and remote diagnostics systems, has automakers, such as Chevrolet, Cadillac, and Vauxhall, to build their technology features across a wide range of vehicles.

- Since the past few years, increasing connectivity and road safety regulations have been supportive of the changes in the automotive market. Furthermore, IoT is expected to drive this change further. Various automobile manufacturers, such as BMW, Mercedes, Ford, and General Motors, offer IoT-connected cars by partnering with technology providers Cisco and Bosch.

- To stay competitive in these unprecedented times, automotive companies will still need to make mobility smarter investments. For instance, embedding emerging technologies such as artificial intelligence (AI) and 5G telecommunications into vehicles is expected. While the idea of a future of fully autonomous vehicles (AVs) has captured headlines, it is essential to note that automakers are integrating smart, connected technologies at a rapid clip in their current models - in both electric vehicles (EVs) and traditional internal combustion engine (ICE) vehicles.

- The first half of 2020 turned out to be a pain for automakers, forcing most automakers to close their manufacturing facilities to curb the spread of COVID-19. Especially in the United States, most OEMs, including Ford, GM, Volvo, Toyota, and Honda, have stopped production for nearly two months since March. Other factors that exacerbated production delays included a shortage of semiconductors, a February storm that took the US Gulf chemical plant offline, and a major blackout due to the cold that led to a shortage of petrochemicals. US car sales continued to recover in the second half of 2020, down 3% year-on-year from 21% in the first half of 2020.

North America Internet of Cars Market Trends

North American Market is expected to be driven by Vehicle Safety Norms

- Growth in the US market is driven primarily by improved vehicle safety and security standards, demand for vehicle-to-vehicle (V2V) connectivity technology, and the incorporation of IoT into the automotive industry.

- The emergence of self-driving car technology in the US market is an important trend in increasing the demand for advanced connected car features. The market is already witnessing the high growth of ADAS solutions.

- Increasing demand for aftermarket services due to the renewal of connected car service subscriptions will drive the US market in the future. Moreover, it is estimated that more than 91% of the total cars sold in the United States were internet enabled.

Increasing adoption of cloud technology and IoT

- Mobile network operators (MNOs) are progressively taking on cloud-based machine-to-machine (M2M) platforms to diminish capital investment and time-to-market (TTM) for product and service launches.

- In addition, these platforms help operators integrate, develop, market, and support M2M connectivity and cloud services across business segments such as retail and automotive.

- For example, Fiat Chrysler Automobiles has announced that it will use Harman's Ignite cloud-based platform to provide drivers with various connectivity services. The system locates fuel and charging stations at the push of a button, receives traffic prompts and restaurant offers, predicts maintenance needs, and provides live customer care assistance to owners. The platform supports both 4G and 5G network connections. Such developments are expected to drive the growth of the market.

- Collaboration with carriers has allowed automakers to deploy vehicles with built-in connections faster than ever before. AT & T has more than 30 brands using its network, with BMW, Ford, Chevrolet, Jaguar, and Honda.

- Meanwhile, Verizon's connected car portfolio has a small number of OEMs, including Toyota, VW, and Mazda, which will be added shortly. AT & T has been the preferred carrier due to the variety of data plans, customization of specific vehicle models, and collaboration with manufacturers to speed up the research and development of the connected car ecosystem.

North America Internet of Cars Industry Overview

The North America Internet of cars market is moderately consolidated with existing players such as Cisco, Google, IBM, AT&T, Verizon, Toyota, Volvo, Tesla Motors. As the demand for connected systems and the Internet of Things are growing in the region, the cars manufacturers are trying to have the edge over their competitors by making joint ventures, partnerships, launching new products with advanced technology. Some of the recent developments include:

- October 2021 - Tesla has reduced the premium connectivity period to 30 days for all Model 3 and Model Y vehicles. For a long time, all Tesla cars included an internet connection. This is often a premium option in the industry. Tesla has made extensive use of its connectivity in many features, including driver assistance to develop autopilot systems.

- October 2021 - Jaguar Land Rover North America and SiriusXM announced that SiriusXM (SiriusXM's latest and most advanced audio entertainment platform) with 360L on the New Range Rover would be included as standard features. The New Range Rover will be the first Jaguar and Land Rover vehicle to offer the 360L SiriusXM, followed by additional Jaguar and Land Rover vehicles. The new Range Rover with SiriusXM with 360L will be available at Land Rover dealers across the United States, shipping in the spring of 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Factors Driving the Market

- 4.2.1 Increasing number of people connected to internet

- 4.2.2 Growth in adoption of Big Data solutions

- 4.3 Factors Restraining the Market

- 4.3.1 Technology yet to become fully functional

- 4.3.2 Initial Costs are high

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6 Current Opportunities in Market

- 4.7 Industry Policies

5 TECHNOLOGY OVERVIEW

- 5.1 Technology Snapshot

- 5.2 Upcoming Technologies

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Service

- 6.2 By Technology

- 6.2.1 Wi-FI

- 6.2.2 Bluetooth

- 6.2.3 NFC

- 6.2.4 Cellular

- 6.2.5 Others

- 6.3 By Communication Equipment

- 6.3.1 Car-to-Car

- 6.3.2 Car-to-Infrastructure

- 6.3.3 Others

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

- 6.4.3 Others

7 NORTH AMERICA INTERNET OF CARS MARKET - FORECAST

- 7.1 North America

- 7.1.1 Overview

- 7.1.2 Market Forecast and Analysis

- 7.1.3 Analyst View

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Cisco

- 8.1.2 Google

- 8.1.3 IBM

- 8.1.4 AT&T

- 8.1.5 Verizon

- 8.1.6 Toyota

- 8.1.7 Volvo

- 8.1.8 Tesla Motors

9 FUTURE OF NORTH AMERICA INTERNET OF CARS MARKET

02-2729-4219

+886-2-2729-4219