|

市场调查报告书

商品编码

1637777

亚太地区车联网 (IoC):市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia Pacific Internet Of Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

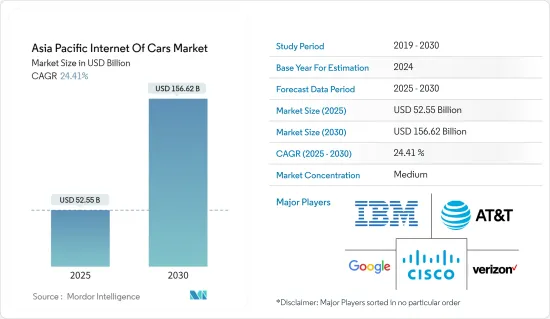

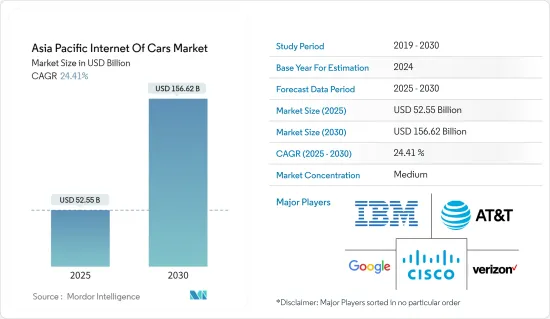

亚太地区车联网 (IoC) 市场规模预计在 2025 年达到 525.5 亿美元,在预测期内 (2025-2030 年),预计在 2030 年达到 1566.2 亿美元。

现今的汽车配备了各种各样的电子设备和技术。然而,过去十年的重大技术进步推动了联网汽车的普及,这一趋势预计将持续下去。

主要亮点

- 联网汽车可以侦测潜在危险并将该资讯传递给附近的其他车辆,从而降低发生事故的风险。联网汽车可以提供广泛的线上服务,包括即时交通资讯、天气预报和即时 GPS 导航。联网汽车处理来自各种来源的资料以实现自动驾驶。这可以显着减少事故并使驾驶更加安全。它还可以分析驾驶模式并向驾驶员提供如何提高燃油经济性的回馈。

- 对于更安全、更有效率、更便利的驾驶体验的需求日益增长,以及政府为减少道路事故发生频率而采取的措施是推动车联网市场需求的主要因素。

- 推动亚太地区车联网(IoV)需求的关键因素之一是自动驾驶汽车(AV)销售的增加以及对其优势的认识不断提高。此外,致命道路交通事故的增加导致人们对驾驶和乘客的安全更加重视,从而推动了对车联网的需求,以减少伤害并降低与其他车辆碰撞的严重程度。

- 转向、煞车、GPS、加速器和警报器等车辆部件都可以远端访问,成功入侵或骇客攻击可能会导致致命事故。这些因素是市场成长的一些限制因素。

- 疫情对消费者的财务收入产生了重大影响,导致人们转向满足自己的需求,而不是追逐慾望和愿望,例如购买联网汽车。

亚太地区车联网 (IoC) 市场趋势

5G、巨量资料解决方案和人工智慧等新技术将推动对网路汽车的需求

- 联网汽车和汽车相关的物联网功能越来越受到消费者的欢迎。品牌正在为其现有和预期型号添加新功能,以增强用户体验、便利性和安全性。但为了让这些功能能如预期发挥作用,它们还需要更好的连结性。因此,在亚太地区这个日益发展的技术中心,通讯业者正在提供网路和综合解决方案。

- 例如,Vodafone Idea 在印度提供 Vi Smart Mobility,为汽车OEM製造商提供完全整合的联网汽车解决方案。该公司继续在该地区提供类似的服务。汽车的连网功能需要快速、可靠的网路。 5G的引入预计将推动整体市场的成长。

- 预期的订阅数量可能会鼓励网路供应商升级其现有设施和基础设施,以满足对 5G 的需求。高速网路可能会缩短反应时间并提高车载网路驱动功能的效能。

- 根据 GSMA 的《2023 年行动经济》报告,5G 的普及将在亚太地区扩大,预计到 2030 年 5G 连接率将超过 93%。这鼓励汽车製造商为现有和即将推出的汽车配备适合其市场的兼容 5G频宽,以确保其产品具有面向未来的特性。

- 随着感测器和资料技术的使用增加,人工智慧对于快速且准确的决策变得至关重要。虽然有些汽车正在使用人工智慧实现 3 级自动驾驶,但要使产业达到 5 级,亚太国家将需要对其车辆和基础设施进行重大改进。

中国占很大市场占有率

- 鑑于最新车型的连接功能有所改进,中国可能会引领亚太市场。随着中国国内市场的成长,稳定的产业投资、专门的产业策略、中央政府的支持,以及资讯通讯技术、资料处理和平台服务方面更大的技术优势,将有助于推动连网汽车产业的未来发展。

- 汽车市场是汽车产业的一个重要且快速成长的领域。随着连网技术和物联网的日益普及,该地区的汽车产业正在取得巨大的进步和创新机会。

- 根据中汽协统计,2023年8月,中国乘用车销量约230万辆,商用车销量约31万辆,较上季成长。

- 中国各地电动车的普及率不断提高,显示人们已经准备好接受新技术。由于大多数新时代电动车都配备了联网汽车技术,包括云端电源功能,电动车销量的成长反映了中国人与这些功能和技术的互动日益增加。

- 在中国等新兴经济体中,联网汽车的需求可能会受到 5G 和 4G LTE 等通讯和资讯技术基础设施成长的推动。此外,由于安全、保护和许可方面的安全法规不断增加,政府的优惠政策可能会刺激市场的成长。

亚太地区车联网(IoC)产业概况

亚太地区的车联网(IoC)市场已半固体,参与者众多。随着该地区对联网系统和物联网的需求不断增长,汽车製造商正在组建合资企业和合作伙伴关係,推出配备先进技术的新产品,以保持领先于竞争对手。这也包括为汽车行业预计引入的功能和技术奠定网路基础。

- 2023 年 4 月——梅赛德斯·奔驰宣布。为了与特斯拉和来自中国的后来参与企业竞争,该公司宣布与谷歌在导航方面建立合作伙伴关係,并将为其所有汽车配备与电脑相当的自动驾驶感测器功能。

- 2023 年 2 月-思科宣布与梅赛德斯·奔驰 Inroader 合作,在梅赛德斯·奔驰 E-Class 中提供最佳行动办公室体验。凭藉梅赛德斯·奔驰和 Webex 客户习惯的直觉功能和现代豪华,此次伙伴关係将帮助人们在车内安全、舒适地工作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第 2 章执行摘要

第三章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济趋势对市场的影响

- 产业政策

- 技术简介

第四章 市场动态

- 市场驱动因素

- 网路连线人口不断增加

- 巨量资料解决方案的采用日益增多

- 5G、巨量资料解决方案和人工智慧等新技术将推动对网路汽车的需求

- 市场限制

- 该技术尚未发挥作用

- 初期成本高

第五章 市场区隔

- 按组件

- 硬体

- 软体

- 服务

- 依技术分类

- Wi-Fi

- Bluetooth

- NFC

- 蜂窝网路

- 其他技术类型

- 透过通讯设备

- Car-to-Car

- Car-to-Infrastructure

- 其他通讯设备

- 按国家

- 中国

- 印度

- 日本

- 韩国

- 其他地区

第六章 亚太车联网(IoC)市场预测

- 亚太地区

- 概述

- 市场预测与分析

- 分析师观点

第七章 竞争格局

- 公司简介

- Cisco System Inc.

- Google LLC

- IBM Corporation

- AT&T Inc.

- Verizon Communications Inc.

- Toyota Connected Asia-Pacific Limited

- Volvo

- Tesla Motors

- Telefonaktiebolaget LM Ericsson

第 8 章:亚太地区车联网 (IoC) 市场的未来潜力

The Asia Pacific Internet Of Cars Market size is estimated at USD 52.55 billion in 2025, and is expected to reach USD 156.62 billion by 2030, at a CAGR of 24.41% during the forecast period (2025-2030).

Vehicles nowadays are outfitted with a variety of electronics and technology. However, considerable technical advancements over the last decade have resulted in connected cars being used, and this trend is projected to continue.

Key Highlights

- Connected cars can detect potential dangers and relay this information to other vehicles in the area, reducing the risk of accidents. As they offer access to an wide range of online services, such as live traffic updates, weather forecasts, and real-time GPS navigation. Connected cars can process data from various sources to enable autonomous driving. This can significantly reduce accidents and make driving safer. They may also analyse driving patterns and provide feedback on fuel efficiency improvement to the driver, which would lead to savings of costs and reduced ecological impacts.

- The growing need for safer, more efficient, and convenient driving experiences and government measures to reduce the frequency of road accidents are key drivers driving demand for the Internet of cars market.

- One of the critical causes driving demand for IoV (Internet of Vehicles) around the Asia Pacific is the increasing sales of autonomous vehicles (AVs) and growing awareness of their benefits. Furthermore, the increased emphasis on driver and passenger safety due to the growing number of fatal road accidents is fueling demand for IoV to reduce the severity of injuries and collisions with other cars.

- Vehicle components such as the steering wheel, brakes, GPS, accelerator, and alarms can be remotely accessed, and a successful breach or hack can result in fatalities. Such factors are a few factors restraining the growth of the market.

- The pandemic situation created major impact of the customer's financial incomes as people are now looking to complete needs rather than going after wants and desires such as buying a connected car.

APAC Internet of Cars Market Trends

New Technologies like 5G, Big Data Solutions, and AI to Boost the Demand for Internet-Enabled Cars

- The connected cars and related IoT features in automobiles are gaining popularity among the audience. Brands are adding new features to existing and expected models for enhanced user experience, convenience, and safety. But this also demands better connectivity for these features to perform as they desire. Hence, Asia Pacific, as a growing technology hub, is also witnessing telecom providers offering network and integrated solutions.

- For instance, Vodafone Idea provides Vi Smart Mobility in India, offering fully-integrated, connected car solutions for automotive OEMs. The company continues to provide the same in the region. The connected features in cars require fast and consistent internet. The introduction of 5G will bolster the overall growth of the market.

- The expected number of subscriptions will likely encourage the network providers to upgrade the existing facilities and infrastructure to facilitate the demand for 5G, IoT systems, both protective and regularly functioning, to receive the necessary network support. The high-speed internet would allow faster response time, increasing the effectiveness of in-car internet-driven features.

- According to the Mobile Economy 2023 report by the GSMA, 5G adoption will grow across Asia-Pacific, with more than 93% Percentage 5G connections, by 2030. This also encourages the automakers to install the existing and upcoming vehicles with compatible 5G bandwidths in respective markets for future-ready products.

- The increasing use of sensors and data technologies makes AI essential for quick and precise decision-making. Some automobiles use AI for Level 3 autonomous driving, but for the automotive industry to reach Level 5, significant enhancements must be made to the cars and infrastructure in Asia Pacific countries.

China Will Hold A Significant Market Share

- Owing to the increase in the connectivity features of the latest car models, China is likely to lead the market in the Asia-Pacific. As China's domestic market grows, In addition to securing industry investment, a dedicated Industrial Strategy and support from the Central Government, it will shape future connected vehicle sectors with higher technical advantages in ICT, data processing and platform services.

- The automotive market is a significant and rapidly growing segment within the automotive industry. With the increasing adoption of connected technologies and the (IoT), the automotive sector in region has witnessed significant advancements and opportunities for innovation.

- According to CAAM, In August 2023, approximately 2.3 million passenger cars and 310,000 commercial vehicles were sold in China, an increase compared to the previous month.

- The increasing adoption of the electric vehicles aross China indicates people's readiness to adopt new technologies. As most of the new-age electric vehicles feature connected car tech, including cloud-powered features, the rising sale of electric vehicles signifies the increasing interaction of the Chinese population with these features and technologies.

- In developing country like China, The demand for connected cars is likely to be driven by the growth of communication and information technology infrastructure, such as 5G or 4G LTE. In addition, due to the increase in safety regulations for security, protection and authorisation, the growth market will be stimulated by favourable government policies.

APAC Internet of Cars Industry Overview

The Asia-Pacific Internet of Cars market is semi-consolidated with different players. As the demand for connected systems and the Internet of Things are growing in the region, car manufacturers are trying to have an edge over their competitors by making joint ventures and partnerships and launching new products with advanced technology. This includes laying down the network foundation for the expected features and technologies to be introduced in the automotive industry.

- April 2023 - Mercedes-Benz hs announced In order to compete with Tesla and China's new entrants, the company has formed a partnership with Google on navigation as well as offering every vehicle equipped with an autonomous driving sensor performance that is computerlike.

- February 2023 - Cisco has announced it is working with Mercedes-Benz inoder to provide an optimal mobile office experience in its Benz E Class vehicles, With the intuitive features and modern luxury that Mercedes Benz and Webex customers are used to, this partnership will help people work safely, securely and comfortably in their vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers/Consumers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Impact of Macro Economic Trends on the Market

- 3.4 Industry Policies

- 3.5 Technology Snapshot

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing number of people connected to internet

- 4.1.2 Growth in adoption of Big Data solutions

- 4.1.3 New Technologies like 5G, Big Data Solutions, and AI to Boost the Demand for Internet-Enabled Cars

- 4.2 Market Restraints

- 4.2.1 Technology yet to become fully functional

- 4.2.2 Initial Costs are high

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Service

- 5.2 By Technology

- 5.2.1 Wi-FI

- 5.2.2 Bluetooth

- 5.2.3 NFC

- 5.2.4 Cellular

- 5.2.5 Other Technology Types

- 5.3 By Communication Equipment

- 5.3.1 Car-to-Car

- 5.3.2 Car-to-Infrastructure

- 5.3.3 Other Communication Equipment

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 ASIA-PACIFIC INTERNET OF CARS MARKET - FORECAST

- 6.1 Asia-Pacific

- 6.1.1 Overview

- 6.1.2 Market Forecast and Analysis

- 6.1.3 Analyst View

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco System Inc.

- 7.1.2 Google LLC

- 7.1.3 IBM Corporation

- 7.1.4 AT&T Inc.

- 7.1.5 Verizon Communications Inc.

- 7.1.6 Toyota Connected Asia-Pacific Limited

- 7.1.7 Volvo

- 7.1.8 Tesla Motors

- 7.1.9 Telefonaktiebolaget LM Ericsson