|

市场调查报告书

商品编码

1637827

IoC(汽车互联网):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Internet Of Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

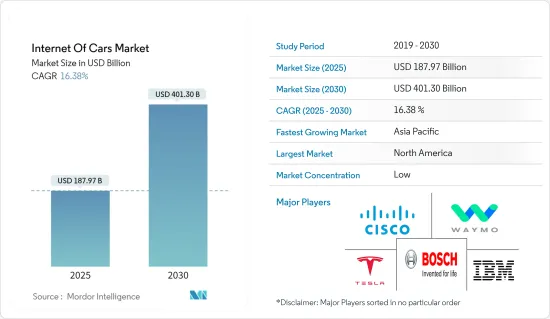

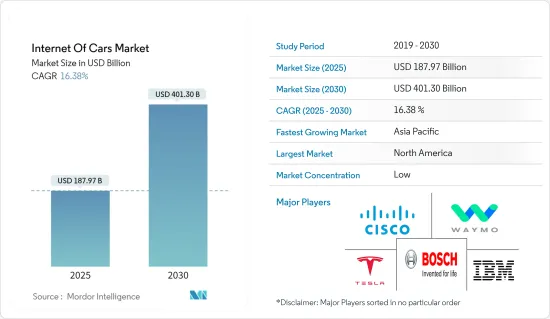

预计 2025 年车联网 (IoC) 市场规模将达到 1,879.7 亿美元,到 2030 年将达到 4,013 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.38%。

主要亮点

- 由于对驾驶员和车辆追踪的需求不断增加以及物联网和云端服务的快速采用,车联网 (IoC) 市场正在扩大。

- 整个汽车产业对安全性、舒适性和便利性的需求推动了对能够应对即时事故情况的更有效的车辆安全系统的需求。

- 行动管理受到与云端整合的物联网应用日益增长的需求的推动,并且有可能节省维护成本,同时提高资产可用性和可靠性。

- 连网汽车融合了机电一体化、远端资讯处理、人工智慧和其他物联网元素,使其能够与其他车辆和智慧型装置通讯。这些连接功能可以交换即时资料,以提高用户的舒适度、安全性、娱乐性和安全性。

- 缺乏法规和法律,或法规和法律的模糊性,是市场面临的最大障碍之一。此外,最终用户也担心隐私和资料安全。他们担心收集到的资料可能会洩露有关其行为的重要信息,甚至对他们造成伤害,例如身份盗窃或保险诈骗。

- COVID-19为车联网技术行业和销售带来了重大打击。 COVID-19 疫情严重影响了客户的财务收入,因为他们更注重满足自己的需求,而不是追求自己的慾望和愿望,例如购买连网汽车。

IoC(车联网)市场趋势

汽车产业预计将成长

- 汽车内建的技术将使其能够连接到互联网、设备甚至其他车辆和系统。汽车物联网让驾驶者享受更快、更安全、更具吸引力的驾驶体验。驾驶员现在可以获得交通状况、道路状况、燃油消费量、车辆诊断和驾驶行为等驾驶资讯。

- 由于技术进步、M2M(机器对机器)的发展趋势以及巨量资料分析,物联网在汽车产业的应用正在迅速增加。与其他技术一样,连网汽车的不断扩张趋势是该行业发展的主要驱动力。

- 这些连接的功能可以即时通讯资料,以确保用户的舒适、安全、娱乐和安全。目前,BMW、宾士、福特和通用等汽车製造商均已推出连网汽车。

- 此外,联网汽车的可靠连接可以支援遥测、主动维护和事故避免。 5G 和车联网 (V2X) 连接的发展将提供全新的驾驶体验,实现自动驾驶。

预测期内北美将出现最快成长

- 资讯科技的发展和物联网在汽车应用中的日益广泛使用为该领域的业务运营带来了新的维度。

- 汽车相关企业可以透过实施基于物联网方法的更智慧的功能係统来建立和管理业务流程。北美电动车的扩张以及电子元件含量的增加(特别是车辆管理系统),也使得车辆的排放控制更加严格、安全性能增强,为该行业创造了长期成长机会。

- 由于互联网普及率不断提高、连网设备数量不断增长、汽车行业自动化解决方案日益增多以及物流 4.0 的部署等因素,连网汽车市场正在不断增长。

- 许多企业和个人开始拥抱车联网 (IoC),因为它可以更轻鬆地追踪车队车辆。车联网采用感测器、现已可存取的行动电话和其他技术来提高行动性。此外,行驶中的车辆在行驶过程中通讯大量资料,而云端服务则提供了必要的平台。这反过来又鼓励该地区拥抱车联网(IoC)。

车联网(IoC)产业概况

车联网(IoC)市场竞争激烈,只有少数主要参与者。目前,少数几家公司在市场占有率份额上占据主导地位。然而,随着跨互联运输平台物联网服务的发展,新的参与者正在新兴经济体中扩大其市场影响力和商业性足迹。

- 2023 年 4 月 - 博世正在扩大其电池生产製造设备组合,包括针对回收业务定制的硬体和软体。 REMONDIS 子公司 TSR Recycling 与 Rhenus Automotive 成立的合资企业正在利用博世力士乐的技术在马德堡建设欧洲首家全自动电池回收工厂。

- 2023 年 2 月-思科和 NEC 宣布根据全球系统整合协议 (GSIA) 扩展其可扩展 5G xHaoultransport 网路解决方案。 NEC 在欧洲、中东和非洲 (EMEA) 和拉丁美洲 (LATAM) 的 5G 传输卓越中心汇集了本地和区域工程能力以及全球经验,在帮助客户建立端到端网路方面发挥着重要作用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

第五章 市场动态

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 增加政府对互联交通系统的资金和投资

- 汽车智慧应用需求不断成长

- 市场限制

- 新兴经济体联网系统普及率下降

- 智慧交通系统初始成本高

第六章 市场细分

- 按软体解决方案

- 即时交通管理系统

- 安全解决方案

- 远端监控系统

- 网路频宽管理

- 车辆管理

- 按应用

- 行动管理

- 车辆管理

- 综合娱乐

- 按最终用户产业

- 运输和物流

- 汽车

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Cisco Systems, Inc.

- IBM Corporation

- Bosch Software Innovations GmbH.

- Waymo LLC(Alphabet Inc.)

- Tesla Motors. Inc.

- Infineon Technologies AG.

- Oracle Corporation

- SAP SE

- General Electric Company

- Microsoft Corporation

- Symantec Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Internet Of Cars Market size is estimated at USD 187.97 billion in 2025, and is expected to reach USD 401.30 billion by 2030, at a CAGR of 16.38% during the forecast period (2025-2030).

Key Highlights

- The market for the Internet of Cars is expanding as a result of the rising demand for driver and vehicle tracking, as well as the rapid use of IoT and cloud services.

- The demand for more effective safety systems in cars that can deal with real-time accident situations is growing in response to the demand for safety, comfort, and convenience across the automotive industry.

- Mobility management has been spurred by the rising need for IoT applications via cloud integration, which has the potential to save maintenance costs while increasing asset availability and reliability.

- Mechatronics, telematics, artificial intelligence, and other IoT elements built into connected automobiles enable them to communicate with other vehicles and smart devices. Real-time data is exchanged through these connected features, improving user comfort, security, entertainment, and safety.

- The lack of regulations and laws, or the ambiguity around them, is one of the market's biggest obstacles. Additionally, end users have privacy and data security worries. They worry that the data acquired may reveal crucial information about their behavior or harm them, for example, through identity theft or insurance fraud.

- COVID-19 has significantly harmed the industry and sales of connected automobile technology. Due to the epidemic, customers' financial incomes have been considerably impacted because they are now more concerned with meeting needs than pursuing wants and aspirations, such as getting a connected car.

Internet of Vehicle Market Trends

Automotive Sector to Witness the Growth

- Embedded technology in automobiles allows them to link to the internet, devices, and even other vehicles or systems. Drivers will benefit from a faster, safer, and more engaging driving experience thanks to IoT in automobiles. Driving information such as traffic, road conditions, fuel consumption, car diagnostics, driving behavior, and more are now accessible to drivers.

- The adoption of IoT in the automobile industry has increased quickly due to technological advancements, developing trends in Machine to Machine (M2M), and big data analytics. Together with other technologies, the continuously expanding connected automobile trend significantly drives the industry.

- These connected features communicate real-time data for the user's comfort, security, entertainment, and safety. IoT-connected automobiles are currently available from some automakers, including BMW, Mercedes, Ford, General Motors, and others.

- Also, connected cars' reliable connectivity can support telemetry, proactive maintenance, and accident avoidance. The development of 5G and V2X (vehicle to everything) connectivity, which will offer a new driving experience, will enable autonomous driving.

North America to Register the Fastest Growth During the Forecast Period

- The development of information technology and the rising use of IoT in automotive applications have given corporate operations in this area a new dimension.

- Automotive companies can build and manage an operational process with the aid of the deployment of smarter functional systems based on IoT approaches. Along with the rise in electronics content, notably in vehicle management systems, the expansion of electric vehicles in North America also creates a long-term growth opportunity for the industry, enabling it to expand emission control and enhance safety features in automobiles.

- The market for connected automobiles is growing due to factors such as expanding internet penetration, linked device growth, the increased presence of automation solutions in the automotive industry, and the rollout of Logistics4.0.

- Many businesses and individuals are embracing the Internet of cars because it makes tracking fleet vehicles easier. IoV employs sensors, currently accessible mobile phones, and other technology to increase mobility. Additionally, cloud services offer the necessary platform as moving cars communicate a lot of data while on the road. This, in turn, encourages the region to adopt the internet of automobiles.

Internet of Vehicle Industry Overview

The Internet of cars market is highly competitive and has a few significant players. Some of the players now control the market in terms of market share. However, new players are growing their market presence and commercial footprint throughout emerging nations due to the development of IoT services across the linked transportation platform.

- April 2023 - Bosch has expanded its portfolio of manufacturing equipment for battery production to include hardware and software specifically for recycling operations. Where a Joint venture between REMONDIS subsidiary TSR Recycling and Rhenus Automotive has built Europe's first fully automated battery recycling plant in Magdeburg using Bosch Rexroth technology

- February 2023 - Cisco and NEC have announced the expanded areas of collaboration under their Global Systems Integrator Agreement (GSIA) with augmented solutions for scalable 5G xHaoultransport networks, such as enhanced capabilities for end-to-end automation and routed optical networking to support operators' monetization of 5G, As part of the new collaboration, NEC will leverage its vast ecosystem and expertise as a global network integrator to overcome the complexity of multi-vendor networks. The company's 5G Transport Centers of Excellence in EMEA and LATAM, with local and regional engineering capabilities and a pool of global experience, will play a central role in navigating customers' end-to-end network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definiton

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshots

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increased Government Funding and Investments in Connected Transport System

- 5.2.2 Growing Demand for Smart Applications in Cars

- 5.3 Market Restraints

- 5.3.1 Slower Rate of Penetration of Connected Systems across the Developing Economies

- 5.3.2 High Initial Cost of Smart Transportation System

6 MARKET SEGMENTATION

- 6.1 By Software Solutions

- 6.1.1 Real time Transit Management System

- 6.1.2 Security Solution

- 6.1.3 Remote Monitoring System

- 6.1.4 Network Bandwidth Management

- 6.1.5 Fleet Management

- 6.2 By Applications

- 6.2.1 Mobility Management

- 6.2.2 Vehicle Management

- 6.2.3 Integrated Entertainment

- 6.3 By End-user Industry

- 6.3.1 Transportation and Logistics

- 6.3.2 Automotive

- 6.3.3 Others End User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems, Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Bosch Software Innovations GmbH.

- 7.1.4 Waymo LLC (Alphabet Inc.)

- 7.1.5 Tesla Motors. Inc.

- 7.1.6 Infineon Technologies AG.

- 7.1.7 Oracle Corporation

- 7.1.8 SAP SE

- 7.1.9 General Electric Company

- 7.1.10 Microsoft Corporation

- 7.1.11 Symantec Corporation