|

市场调查报告书

商品编码

1626342

亚太地区安全仪器系统:市场占有率分析、产业趋势和成长预测(2025-2030 年)APAC Safety Instrumented Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

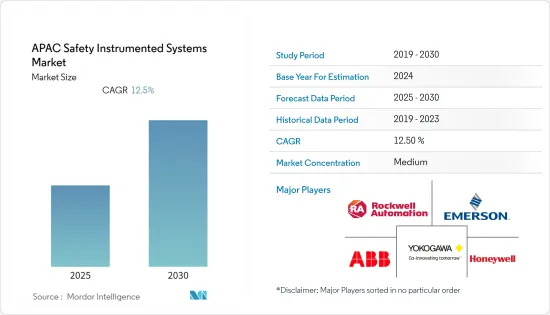

亚太安全仪器系统市场预计在预测期内复合年增长率为12.5%

主要亮点

- 随着工程环境变得更加跨学科,系统挑战不断增加,参与工程过程的工程师必须不断意识到操作和设计安全相关系统的影响。这也包括相关安全标准的知识。

- 安全仪器系统在为各种工业製程和自动化系统提供保护层方面发挥着重要作用。安全系统工程描述了一种规范的、系统的方法,其中包括危险识别、安全要求规范以及工厂生命週期内的系统维护和操作。安全仪器系统市场的成长高度依赖石化和能源产业的成长。

- 此外,随着製程工业逐渐采用更新的安全标准,对能够管理蒸气涡轮、压缩机、变速驱动装置等变化的控制系统的需求将满足敏捷要求并保持盈利。

- 自动化技术的进步正在推动工业 4.0 跨工业领域的发展,并迅速普及安全仪器系统,以便更好地控制驾驶和安全。

- 由于已开发国家工业成长停滞,对阀门和致动器的需求停滞不前。政府对建立新产业的更大支持和政治条件使该国有利于产业扩张。因此,国际公司正在考虑投资这个市场。此外,该地区还有正在进行和未来的用水和污水处理厂建设计划。

- 例如,柬埔寨政府与日本国际协力机构签署了在Dangkor地区建造污水处理厂的合约。该计划投资2500万美元,旨在改善该地区的排水系统,使废水直接流入工厂而不是流入河流。亚太地区的这些计划预计将推动该地区的安全仪器系统市场。

亚太地区安全仪器系统市场趋势

食品和饮料占据主要市场占有率

- 随着人口的增加,食品和饮料产业变得越来越自动化。推动自动化的其他因素包括缺乏合适的廉价劳动力、健康和安全立法以及机器人技术的进步。

- 食品和饮料业有保护工人的道德和监管义务。这些危险的范围从明显且现实的,如重型机械、有毒化学物质和湿滑的道路,到更微妙的威胁,如吸入灰尘、听力损失和重复性压力损伤。

- 饮料巨头可口可乐证实,东南亚地区对无糖和低糖饮料的需求正在增加。这种趋势在 COVID-19 大流行后变得更加明显。

在石油和天然气、化学和其他行业的使用迅速增加

- 由于工业活动的快速增长、成本压力和生产率的上升以及中国和印度等新兴国家的有利政府政策,预计亚太地区将经历快速增长。

- 由于需求因应用而异,製造商已开始生产针对特定应用的新产品。此外,随着安全仪器系统变得越来越普遍,先进的系统正在开发中。此外,这些系统在石油和天然气、化学和电力行业的使用正在迅速增加,因为它们有助于多方面的监控,例如运行时间、锅炉控制、烟囱温度、锅炉和燃料效率,这使得它们在该行业中非常重要它发挥作用。

亚太安全仪器系统产业概况

市场上的公司是整合的,并为消防安全(火灾和气体监测和控制)和压力安全(高可靠性压力保护系统)等每种应用提供专门的解决方案。

- 2020 年 10 月 - BP PLC 和亚马逊扩大了长期合作关係,以加速基础设施和营运的数位化。作为其数位转型计划的一部分,BP 将资料迁移到 Amazon Aurora 云端资料库,以提高营运弹性和效能。

- 2021年5月-横河电机公司宣布,其安全仪器系统ProSafe-RS已获得ISA安全合规研究所(ISCI)颁发的SASecure CSA 1级认证。此认证将有助于确保公司係统的网路安全并增加其在 SIS 市场的吸引力。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 产业法规环境的成长

- 存在强大的 SIS 服务生态系统

- 市场限制因素

- 操作复杂、维护成本高

第六章 市场细分

- 按成分

- 感应器

- 转变

- 可程式装置

- 致动器和阀门

- 其他组件

- 按用途

- 紧急关闭系统(ESD)

- 火灾与气体监测与控制 (F&GC)

- 高可靠性压力保护系统(HIPPS)

- 燃烧器管理系统 (BMS)

- 涡轮机械控制

- 其他用途

- 按最终用户

- 化工/石化

- 发电

- 製药

- 饮食

- 石油和天然气

- 其他最终用户

- 按国家/地区

- 印度

- 中国

- 日本

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- HIMA Paul Hildebrandt GmbH

- SIS-TECH Solutions LP

- Schlumberger Limited

第八章投资分析

第9章市场的未来

简介目录

Product Code: 47951

The APAC Safety Instrumented Systems Market is expected to register a CAGR of 12.5% during the forecast period.

Key Highlights

- Faced with an increasingly interdisciplinary engineering environment and ever-increasing system challenges, there is an increasing need for engineers involved in the engineering process to remain aware of the operational and design implications of safety-related systems. This also includes knowledge of relevant safety standards.

- Safety instrumented systems play an essential role in providing protective layer functions in various industrial processes and automation systems. Safety system engineering describes a disciplined and systematic approach that incorporates hazard identification, safety requirement specifications, and system maintenance and operation during the plant's life. The growth of the safety instrumented system market depends heavily on the growth of the petrochemical and energy sectors.

- In addition, as the process industry moves toward adopting newer safety standards, the need for control systems that can manage changes, such as steam turbines, compressors, and variable speed drives, may become essential to keep profitability up with agile requirements.

- The advancement in the technologies for automation is driving industry 4.0 across the industrial domains, making rapid growth for the adoption of safety instrumentation systems to get better control over operation and safety.

- The demand has stalled for valves and actuators due to stagnant industrial growth in developed countries. The growing government support towards establishing new industries and political conditions makes the country favorable for industrial expansion. This is driving international companies to consider this market for investments. Additionally, the region also includes running and upcoming projects for building water and wastewater treatment plants.

- For instance, the Cambodian government signed an agreement with the Japanese International Cooperation Agency to build a wastewater treatment plant in the Dangkor district. The project aims to improve the drainage system in the district for wastewater to flow directly to the plant rather than the river by investing USD 25 million. Such projects across the Asia-Pacific region are estimated to drive the market for safety instrumentation systems in the market.

APAC Safety Instrumented Systems Market Trends

Food and Beverage Hold the Major Market Share

- The food and beverage industry is becoming more automated as the population is growing. Other driving factors contributing to increased automation are the scarcity of suitable cheap labor, health and safety laws, and advancement in robotics.

- The food and beverage industry has a moral and regulatory obligation to safeguard its workers. The dangers vary from the clear and present, such as heavy machinery, toxic chemicals, and slippery surfaces, to the slower threats, such as dust inhalation, hearing loss, and repetitive strain injuries.

- Beverage giant Coca-Cola has observed increased demand for sugar-free and low-sugar beverages in the Southeast Asian region. This became even more pronounced after the COVID-19 pandemic hit.

Surge in usage in oil and gas, chemical, and other industries

- The Asia Pacific region is expected to grow fastest due to rapidly increasing industrial activity, rising cost pressures and production rates, and favorable government policies in developing countries like China and India.

- Varying demands based on utilization have led manufacturers to produce new products for specific applications. In addition, an increase in the proliferation of safety instrumented systems has led to the development of advanced systems. Moreover, there has been a surge in the use of these systems in oil & gas, chemicals, and power industries as they help monitor its usage hours, multiple aspects of boiler control, stack temperature, boiler, and fuel efficiency, which plays a vital role in this industry.

APAC Safety Instrumented Systems Industry Overview

Players in the market are consolidated and are offering solutions specific to each application, like fire safety (fire and gas monitoring and control), pressure safety (high integrity pressure protection systems), and also others, like asset safety (Emergency Shutdown Systems), in case of emergencies, which are an integrated hardware and software solution.

- October 2020 - BP PLC and Amazon extended their longstanding relationship for accelerating the digitalization of infrastructure and operations. BP is migrating its data to the Amazon Aurora cloud database for operational resiliency and performance improvements as part of the digital transformation plan.

- May 2021 - Yokogawa Electric Corporation, a prominent player in the market, announced that it obtained SASecure CSA Level 1 certification from the ISA Security Compliance Institute (ISCI) for its ProSafe-RS safety instrumented system. The certificate helps ensure cyber security for its system and assists in gaining traction in the market for SIS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Regulatory Environment in the Industry

- 5.1.2 Presence of Robust SIS Service Ecosystem

- 5.2 Market Restraints

- 5.2.1 Operational Complexity Coupled with High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Sensors

- 6.1.2 Switches

- 6.1.3 Programmable Devices

- 6.1.4 Actuators and Valves

- 6.1.5 Other Components

- 6.2 By Application

- 6.2.1 Emergency Shutdown Systems (ESD)

- 6.2.2 Fire and Gas Monitoring and Control (F&GC)

- 6.2.3 High Integrity Pressure Protection Systems (HIPPS)

- 6.2.4 Burner Management Systems (BMS)

- 6.2.5 Turbo Machinery Control

- 6.2.6 Other Applications

- 6.3 By End-User

- 6.3.1 Chemicals and Petrochemicals

- 6.3.2 Power Generation

- 6.3.3 Pharmaceutical

- 6.3.4 Food and Beverage

- 6.3.5 Oil and Gas

- 6.3.6 Other End-Users

- 6.4 By Country

- 6.4.1 India

- 6.4.2 China

- 6.4.3 Japan

- 6.4.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 Siemens AG

- 7.1.8 HIMA Paul Hildebrandt GmbH

- 7.1.9 SIS-TECH Solutions LP

- 7.1.10 Schlumberger Limited

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219