|

市场调查报告书

商品编码

1640345

北美安全仪器系统市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)NA Safety Instrumented Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

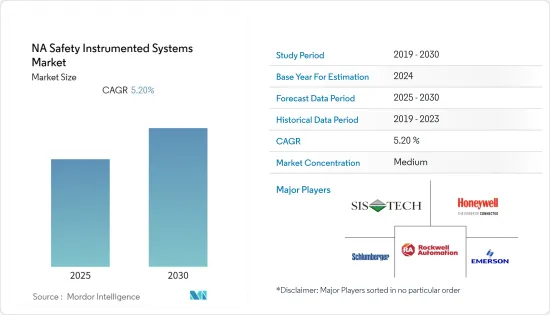

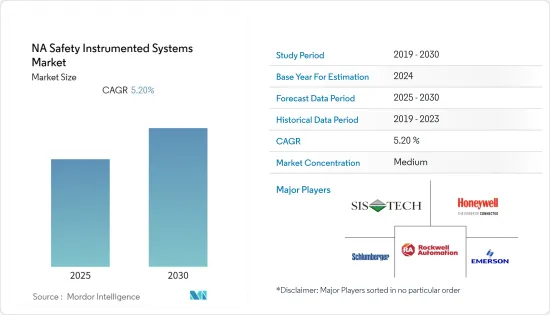

预计预测期内北美安全仪器系统市场复合年增长率将达到 5.2%。

主要亮点

- 因此,公司必须对其流程进行危害分析,以确定确保最高安全水准所需的措施。而随着製程工业逐渐采用更高的安全要求,在满足不断变化的需求的同时保持盈利,控制系统必须能够适应蒸气涡轮、压缩机、变速驱动器等的变化。

- 化学、石化、采矿、气体压缩和许多其他类型的灾难使化学、石化和工业设施极其危险,因为可能会发生火灾、爆炸、储罐溢流、气体洩漏和化学品暴露。地方。

- 为了减轻此类风险,美国职业安全与健康管理局(OSHA)、多家化学公司、ISA 和其他国际组织都采用了将风险定义为与製程功能相关,而不是单一製程管线或储槽相关的概念。

- ISA 84 和 IEC 61508 标准是使用功能安全概念编写的。这两个标准随后合併形成了 ISA-84/IEC-61511 标准,在美国称为 ISA,在欧洲称为 IEC。透过建立独特的、设计良好的安全仪器系统来管理设施的功能安全,以避免功能危险。

- 由于政府实施的多项限制措施,大多数企业被迫暂停或缩减营运规模,新冠肺炎疫情也严重影响了多个产业的发展。疫情对安全仪器系统的实施产生了重大影响。

- 例如,新冠疫情导致全球景气衰退,石油市场崩坏,美国基准原油价格一度跌至历史低点,对石油主要终端用户之一的美国石油公司产生了重大影响。负面影响。

- 根据国际能源总署的最新分析,到 2026 年,石油消费量预计将成长 1.04 亿桶/日,较 2019 年成长 4%,未来安全仪器系统 (SIS) 市场将迅速扩大。

北美安全仪器系统市场趋势

化工和石化行业预计将占据主要市场占有率

- 安全仪器系统由感测器、逻辑控制器和最终控制组件组成,在违反指定条件之前使製程处于安全状态。

- 安全仪器系统相对于传统系统的优势日益增强,正在刺激市场需求。人们认为化学和石化行业正在不断增长,因此扩大和升级老化的基础设施和安全问题至关重要。传统的安全措施是透过电气控制系统硬接线和部署的,这很容易导致事故发生,从而对人员、财产和环境造成危害。

- 因此,石化行业对安全仪器系统的需求可能会激增,从而延长现场使用寿命,减少计划外停机时间,降低年度维护成本,消除计划外维修成本并减少因当前停机时间而带来的多种好处,包括遵守规范和标准。安全仪器系统相对于传统系统的优势日益增强,可能刺激市场扩张。

- 化学工业是一个危险的工作环境,因为气体、油和灰尘会在机械内部和周围形成爆炸性环境。此外,由于监管问题、地缘政治风险、自然资源使用的法律限制、股东积极性和公众监督力度加大,该行业也面临进一步的挑战。因此,安装SCADA、HIPPS、气体和火灾监测和侦测设备等安全设备极为重要。

预计美国将占较大市场占有率

- 在预测期内,由于都市化和工业化进程加快以及全球能源消耗和工业事故风险的上升,美国安全仪器系统市场预计将快速扩张。因此,安全预防措施变得越来越必要。使用者对安全系统的要求正在从安全性角度和相对于其他系统和系统功能(包括 DCS 和操作和监控功能)的易用性方面不断发展。

- COVID-19 疫情给许多行业带来了不利影响,包括消费性电子、石油和天然气、製造业、化学和石化以及汽车等。然而,製药、零售、食品和农业领域已经大幅扩张。

- 例如,佩科斯小径输油管计划、宾州酵母输油管计划、大西洋海岸输油管等管道建设计划预计将在未来几年内完工。预计这些措施将在未来几年推动国内对超音波非破坏性检测设备的需求大幅成长。

- 美国生产了全球30%以上的核能发电,是全球最大的核能发电。根据世界核能协会统计,美国现有92座运作中核子反应炉,总发电量为94,718 MWe。 2021年,核能发电约占全国总能源生产能力的8%,约占所有公共规模电力生产的19%。

北美安全仪器系统产业概况

北美安全仪器系统市场竞争中等,主要企业有罗克韦尔自动化、Honeywell国际和艾默生电气。目前,市场占有率被少数几家大公司占据。这些大公司凭藉其主导的市场占有率,正致力于将基本客群扩展到其他国家。这些公司正在利用策略合作措施来增加市场占有率和盈利。预计竞争、快速的技术进步以及消费者偏好的频繁变化将在预测期内威胁市场成长。

- 2023 年 1 月 - 罗克韦尔自动化是全球最大的工业自动化和数位转型公司,将为巴西石油公司的 FPSO 船 P-79 提供自动化和综合控制与安全系统 (ICSS) 系统。罗克韦尔自动化技术和 Sensia Solutions 之所以被选中,是因为他们在石油和天然气行业拥有良好的业绩记录和强大的互通性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

- 市场驱动因素

- 产业法规环境不断改善

- 强大的SIS服务生态系统

- 市场限制

- 操作复杂,维护成本高

第五章 市场区隔

- 按应用

- 紧急停机系统 (ESD)

- 火灾和气体监控系统 (F&GC)

- 高完整性压力保护系统 (HIPPS)

- 燃烧器管理系统 (BMS)

- 涡轮机械控制

- 其他用途

- 按最终用户

- 化工和石化

- 发电

- 药品

- 饮食

- 石油和天然气(上游、下游和中游占比)

- 其他最终用户

- 按国家

- 美国

- 加拿大

第六章 竞争格局

- 公司简介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- SIS-TECH Solutions LP

- Schlumberger Limited

- INTECH Process Automation

- Yokogawa Electric Corporation

- ABB Ltd

第七章投资分析

第 8 章:市场的未来

The NA Safety Instrumented Systems Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Therefore, companies must do a process hazard analysis to identify the actions necessary for the highest level of safety. In addition, as the process industry moves closer to adopting higher safety requirements, control systems that can accommodate changes, including steam turbines, compressors, and variable speed drives, could be required to retain profitability while accommodating changing demands.

- Chemical, petrochemical, mining, gas compression, and many other sorts of catastrophes can make chemical, petrochemical, and industrial facilities very dangerous places to work because of the potential for fire, explosion, tank overflow, gas release, or chemical exposure.

- The idea of defining risks as those associated with processing functions rather than isolated processing lines or tank risks has been adopted by the Occupational Safety and Health Administration (OSHA), several chemical companies, ISA, and other professional groups to reduce such risks.

- The ISA 84 and IEC 61508 standards were created using functional safety ideas. Later, the ISA-84/IEC-61511 standard, known as ISA in the United States and IEC in Europe, was created by combining the two standards. Functional safety would be managed at a facility by establishing a distinctive, well-designed safety instrumented system to avoid functional hazards.

- The COVID-19 pandemic also substantially influenced the development of several sectors as most businesses were forced to halt or curtail their operations due to several government-imposed regulations. The pandemic significantly impacted the adoption of safety instrumented systems.

- For instance, the COVID-19 pandemic-driven worldwide economic downturn and the collapse of the oil market, which temporarily brought the benchmark price for US crude oil to a record low, had unprecedented negative effects on the oil and gas industry, one of the main end users of SIS.

- The latest IEA analysis predicts that by 2026, oil consumption will rise by 104 million barrels per day or 4% more than it did in 2019, suggesting that the market for safety instrumented systems (SIS) will experience rapid expansion in the future.

North America Safety Instrumented Systems Market Trends

Chemical and Petrochemical Industry Expected to Hold Major Market Share

- A safety instrumented system comprises sensors, logic solvers, and final control components to bring the process to a safe state before violating specified conditions.

- The expanding advantages of safety instrumented systems over conventional systems stimulate market demand. The chemicals and petrochemicals sectors are recognized as constantly growing, making it crucial to expand and update old infrastructure and safety issues. Traditional safety measures are hardwired and deployed through an electrical control system, which can result in incidents that might harm people, property, and the environment.

- As a result, there may be a surge in demand for safety instrumented systems in the petrochemical industry, which will provide several benefits, including increased field life, decreased unplanned downtime, lower annual maintenance costs, elimination of unforeseen repair costs, and compliance with current codes and standards. The growing benefits of safety instrumented systems over conventional ones may fuel market expansion.

- Chemical industries have dangerous working conditions as gas, oil, or dust create an explosive atmosphere inside and around machinery. In addition, the sector has faced extra difficulties because of problems with regulations, geopolitical risks, legal restrictions on the use of natural resources, shareholder activism, and growing public scrutiny. Therefore, installing safety equipment like SCADA, HIPPS, and equipment for monitoring and detecting gas and fire is crucial.

The United States Expected to Hold Significant Market Share

- During the forecast period, the US market for safety instrumented systems is anticipated to expand quickly due to rising urbanization and industrialization, along with rising global energy consumption and industrial disaster risks. As a result, safety precautions are becoming increasingly necessary. Safety system user demands have evolved from a safety perspective and the ease of use in relation to other systems and system functions, including DCSs and operation and monitoring functions.

- Due to the COVID-19 pandemic, many industries, including consumer electronics, oil and gas, manufacturing, chemical and petrochemicals, and automotive, were adversely affected. However, the pharmaceutical, retail, food, and agricultural sectors expanded significantly.

- For instance, pipeline construction projects, including the Pecos Trail Pipeline Project, the Penn East Pipeline Project, and the Atlantic Coast Pipeline, are anticipated to be completed in the coming years. Over the next several years, these initiatives are anticipated to significantly increase demand in the nation for ultrasonic non-destructive testing equipment.

- The nation generates more than 30% of the world's nuclear electricity, making it the greatest nuclear power producer in the world. According to the World Nuclear Association, the United States has 92 active nuclear reactors with a total net capacity of 94,718 MWe. In 2021, nuclear power accounted for roughly 8% of the nation's total energy-producing capacity and about 19% of all utility-scale electricity production.

North America Safety Instrumented Systems Industry Overview

The North American safety instrumented systems market is moderately competitive with several major players like Rockwell Automation Inc., Honeywell International Inc., Emerson Electric Company, etc. A few significant players currently dominate in terms of market share. With a prominent share in the market, these major players are focusing on expanding their customer base across other countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the market's growth during the forecast period.

- January 2023 - Rockwell Automation Inc., the largest company in the world specializing in industrial automation and digital transformation, announced that it had been selected to provide the automation and Integrated Control and Safety Systems (ICSS) systems for P-79, an FPSO vessel in the Petrobras fleet. Rockwell Automation Technology and Sensia Solutions were chosen for their well-established histories in the oil and gas industry and their robust interconnectivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

- 4.5 Market Drivers

- 4.5.1 Growing Regulatory Environment in the Industry

- 4.5.2 Presence of Robust SIS Service Ecosystem

- 4.6 Market Restraints

- 4.6.1 Operational Complexity and High Maintenance Costs

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Emergency Shutdown Systems (ESD)

- 5.1.2 Fire and Gas Monitoring and Control (F&GC)

- 5.1.3 High Integrity Pressure Protection Systems (HIPPS)

- 5.1.4 Burner Management Systems (BMS)

- 5.1.5 Turbo Machinery Control

- 5.1.6 Other Applications

- 5.2 End User

- 5.2.1 Chemicals and Petrochemicals

- 5.2.2 Power Generation

- 5.2.3 Pharmaceutical

- 5.2.4 Food and Beverage

- 5.2.5 Oil and Gas (with a Percentage Breakdown by Upstream, Downstream, and Midstream)

- 5.2.6 Other End Users

- 5.3 Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation Inc.

- 6.1.2 Emerson Electric Company

- 6.1.3 Honeywell International Inc.

- 6.1.4 SIS-TECH Solutions LP

- 6.1.5 Schlumberger Limited

- 6.1.6 INTECH Process Automation

- 6.1.7 Yokogawa Electric Corporation

- 6.1.8 ABB Ltd