|

市场调查报告书

商品编码

1626349

中东和非洲的保护性包装:市场占有率分析、行业趋势、统计和成长预测(2025-2030)Middle East And Africa Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

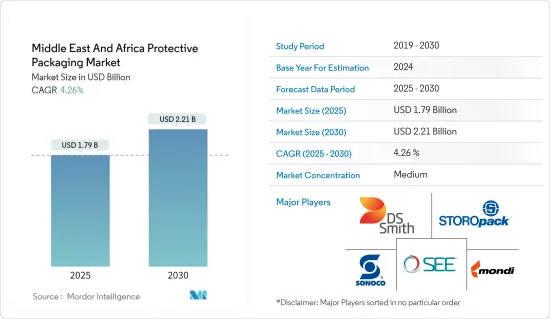

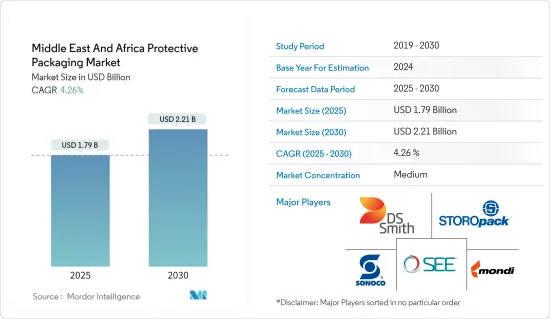

中东和非洲防护包装市场规模预计到 2025 年为 17.9 亿美元,预计到 2030 年将达到 22.1 亿美元,预测期内(2025-2030 年)复合年增长率为 4.26%。

保护性包装在家电、医药、汽车等各行业的产品保护中发挥着至关重要的作用。此技术可确保您的主力产品在运输或储存过程中不会损坏。

主要亮点

- 中东和非洲电子商务市场预计在预测期内将成长。网路和智慧型手机的普及率正在上升,低廉的价格、多样化的产品选择以及网路购物的便利性正在推动这一扩张。

- 选择正确的保护性包装取决于产品类型及其行业。例如,有些产品需要防静电包装。重要的选择标准包括产品类型、材质、尺寸规格、附加功能等。为了满足市场需求,供应商越来越重视永续性并提供可重复使用和可回收的材料。

- 包装製造商面临来自竞争对手、监管机构和消费者越来越大的压力,要求采用环保解决方案。其中,植物来源纸浆包装越来越受欢迎,因为与传统塑胶包装相比,它具有高度的生物分解性,并且因其减少能源、水的使用和二氧化碳排放的能力而受到认可。

- Sonoco Products Company、Storopack Hans Reichenecker GmbH 和 Sealed Air Corporation 等行业巨头支持永续性。这些公司正在投资可回收再生塑胶等最尖端科技,进一步推动市场成长。

- 替代方案,尤其是环保包装,由于强调永续性并减少对环境的影响而受到关注。然而,这一趋势对传统的保护性包装市场提出了挑战,传统的保护性包装市场传统上倾向于较不环保的材料。随着消费者和企业越来越重视永续性,预计传统防护材料将显着转变。

中东和非洲防护包装市场趋势

随着工业成长和电子商务繁荣,中东和非洲对泡沫包装的需求激增

- 在中东和非洲 (MEA),在社会经济和工业趋势的推动下,对泡沫包装的需求正在迅速增长。这一需求的核心是电子商务,该领域正在迅速扩张。随着网路购物在中东和非洲国家的普及,人们越来越依赖气泡膜等保护性包装。

- 电子商务营运商正在寻找高效且具有成本效益的解决方案,特别是确保易碎货物完好无损地到达。这种日益增长的信任证实了在运输过程中保护货物的气泡包装在物流链中发挥着至关重要的作用。

- 气泡包装以其保护性能而着称,充满空气的气泡可以巧妙地缓衝衝击和振动。这对于防止刮痕和凹痕以及保持精緻产品的完整性发挥着重要作用。此外,其重量轻降低了运输成本并简化了装卸和运输。

- 中东和非洲地区的工业扩张进一步推动了对泡沫包装的需求。电子、汽车和製造业等行业正在经历显着成长。这些行业通常需要坚固的包装来在运输和储存过程中保护精密设备,因此气泡包装成为重要的解决方案。支持这一趋势的是,世界银行资料显示,沙乌地阿拉伯製造业增加价值占GDP的比重已从2021年的13.21%上升至2023年的14.79%。

- 中东和非洲的都市化和基础设施发展正在增加对保护性包装的需求。随着大型建设计划的进行,对保护建材、家具和其他大型物品免受潜在损坏的材料的需求不断增长。在城市发展的复杂物流中,越来越多的开发商开始使用泡棉包装来保护材料。

中东和非洲电子商务的繁荣增加了对保护性包装解决方案的需求

- 中东和非洲的领先电子商务公司,如 Noon、Souq、Ounass 和 Nashimi,不仅仅依赖折扣价格。我们扩大了我们的产品范围,并使我们的交付选择多样化。当日和隔天送达等服务是吸引许多消费者进行网路购物的关键因素。

- 据国际贸易管理局和美国商务部称,到 2025 年,中东和非洲的电子商务销售额预计将达到 80 亿美元。这一激增的关键因素是人们几乎通用使用行动电话和网路。随着市场的扩大,对保护性包装解决方案的需求也不断增加,以确保产品安全地到达消费者手中。

- 由于电子商务平台提供从电子产品、化妆品到服饰和生鲜产品等广泛的产品,因此对专业包装的重视显而易见。这不仅是为了防止运输过程中的损坏,也是为了满足消费者不断增长的期望。未损坏、保存完好的产品可提高品牌声誉并提高客户满意度。因此,该公司正在大力投资保护性包装,以最大限度地减少退货,降低与损坏相关的成本,并遵守严格的国际运输标准。

- 中东和非洲面临独特的物流障碍。极端温度和长运输距离等因素凸显了保护性包装的重要性。例如,海湾合作委员会国家的气温可能超过50℃。在这里,对温度敏感的产品需要隔热包装以保持其品质。此外,非洲广阔的地区使安全运输变得复杂,凸显了对强大的保护性包装解决方案的需求。

- 在中东和非洲,政府和私人实体正在投资物流和分销网络,以加强电子商务格局。例如,沙乌地阿拉伯的2030年愿景旨在振兴物流业,并暗示电子商务市场的崛起将导致对保护性包装的需求增加。

中东和非洲防护包装产业概况

中东和非洲防护包装市场的特点是本地和全球公司,并且是半固体的。着名参与者包括 Sealed Air Corporation、Mondi Plc、DS Smith PLC、International Paper Company、Sonoco Products Company、Storopack Hans Reichenecker GmbH 和 Matco Packaging LLC。由于对永续性的担忧日益增加,这些市场中的公司越来越重视永续的保护性包装解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估地缘政治情境对市场的影响

第五章市场动态

- 市场驱动因素

- 不断增长的永续性趋势

- 该地区电子商务行业的成长

- 市场限制因素

- 替代包装格式

第六章 市场细分

- 依材料类型

- 塑胶

- 纸和纸板

- 其他材料类型

- 依产品类型

- 难的

- 纸浆模塑

- 纸板保护器

- 隔热运输货柜

- 软性(邮寄袋、纸满、气泡包装、空气枕)

- 泡棉底座

- 难的

- 按最终用户产业

- 饮食

- 药品

- 家电

- 美容/家庭护理

- 其他最终用户产业

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

第七章 竞争格局

- 公司简介

- Sealed Air Corporation

- Huhtamaki Oyj

- Mondi Plc

- DS Smith PLC

- International Paper Company

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Matco Packaging LLC

- Crateco Pack LLC

- Continental Packaging Material Industry LLC

第八章投资分析

第九章 市场机会及未来趋势

The Middle East And Africa Protective Packaging Market size is estimated at USD 1.79 billion in 2025, and is expected to reach USD 2.21 billion by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

Protective packaging plays a pivotal role in safeguarding products across various industries, including consumer electronics, pharmaceuticals, and automotive. This technique ensures core products remain undamaged during transportation and storage.

Key Highlights

- The e-commerce market in the Middle East and Africa is poised for growth in the forecast period. Rising internet and smartphone penetration, associated with the attraction of lower prices, diverse product selections, and the convenience of online shopping, are driving this expansion.

- Choosing the right protective packaging hinges on the product type and the industry it serves. For instance, some products may necessitate anti-static packaging. Critical selection criteria encompass product type, material, size specifications, and additional features. Responding to market demands, vendors increasingly prioritize sustainability, offering reusable and recyclable materials.

- Packaging producers face mounting pressure from competitors, regulators, and consumers to adopt eco-friendly solutions. Among these, plant-based pulp packaging is gaining traction, lauded for its biodegradability and reduced energy, water use, and CO2 emissions compared to traditional plastic packaging.

- Industry players like Sonoco Products Company, Storopack Hans Reichenecker GmbH, and Sealed Air Corporation champion sustainability. These companies invest in cutting-edge technologies, including recyclable and recycled plastics, further propelling market growth.

- Alternative methods, especially eco-friendly packaging, are gaining prominence for their emphasis on sustainability and reduced environmental impact. However, this trend poses challenges for the traditional protective packaging market, which has historically leaned on less eco-friendly materials. As consumers and businesses increasingly prioritize sustainability, a notable shift away from conventional protective materials is anticipated.

Middle East And Africa Protective Packaging Market Trends

Bubble Wrap Demand Surges in Middle East and Africa Amid Industrial Growth and E-commerce Boom

- The Middle East and Africa (MEA) are witnessing a burgeoning demand for bubble wrap, fueled by socio-economic and industrial trends. Central to this demand is the region's rapidly expanding e-commerce landscape. As online shopping gains traction across MEA nations, the reliance on protective packaging, notably bubble wrap, intensifies.

- E-commerce entities are looking for efficient, cost-effective solutions to ensure products, especially fragile ones, arrive in faultless condition. This growing reliance underscores bubble wrap's pivotal role in the logistics chain, safeguarding items during transit.

- Bubble wrap stands out for its protective feature; the air-filled bubbles adeptly cushion against shocks and vibrations. This shields against scratches and dents and is crucial for preserving the integrity of delicate products. Moreover, its lightweight nature curtails shipping costs and simplifies handling and transport.

- Industrial expansion in the MEA region further propels bubble wrap's demand. Sectors like electronics, automotive, and manufacturing are witnessing significant growth. These industries, often needing robust packaging to safeguard sensitive equipment during transit and storage, find bubble wrap an indispensable solution. Supporting this trend, World Bank data highlights Saudi Arabia's manufacturing sector's value addition percent of GDP, climbing from 13.21% in 2021 to 14.79% in 2023.

- Urbanization and infrastructure development across MEA amplify the need for protective packaging. With extensive construction projects underway, there's a heightened demand for materials that shield building supplies, furniture, and other sizable items from potential damage. Construction firms are increasingly turning to bubble wrap to protect materials amidst the intricate logistics of urban development.

UAE's E-commerce Boom Drives Need for Protective Packaging Solutions

- Major e-commerce players in the UAE, including Noon, Souq, Ounass, and Nashimi, are not just relying on discounted prices. They're enhancing product content and diversifying delivery options. Services like same-day and next-day delivery have become vital attractions, drawing more consumers to online shopping.

- According to the International Trade Administration and the U.S. Department of Commerce, the UAE's e-commerce sales are projected to reach USD 8 billion by 2025. This surge is primarily fueled by the population's near-universal mobile and internet access. As the market expands, so does the demand for protective packaging solutions, ensuring products reach consumers safely.

- With e-commerce platforms offering a wide range of products, from electronics and cosmetics to clothing and perishables, the emphasis on specialized packaging is transparent. This is not just about preventing damage during transit; it's about meeting rising consumer expectations. Undamaged, well-preserved products bolster brand reputation and enhance customer satisfaction. As a result, businesses are channeling significant investments into protective packaging to minimize returns, cut down on damage-related expenses, and adhere to stringent international shipping standards.

- The Middle East and Africa face distinct logistical hurdles. Factors like extreme temperatures and lengthy shipping distances underscore the importance of protective packaging. Take the GCC countries, where temperatures can soar beyond 50°C. Here, temperature-sensitive products demand insulated packaging to uphold their quality. Moreover, Africa's vast geography complicates safe deliveries, spotlighting the necessity for robust protective packaging solutions.

- In the MEA region, governments and private entities are pouring investments into logistics and distribution networks, bolstering the e-commerce landscape. For instance, Saudi Arabia's Vision 2030, which aims to uplift the logistics sector, hints at a rising demand for protective packaging as the e-commerce market flourishes.

Middle East And Africa Protective Packaging Industry Overview

The Protective packaging market in the Middle East and Africa is semi-consolidated, featuring local and global players. Notable participants include Sealed Air Corporation, Mondi Plc, DS Smith PLC, International Paper Company, Sonoco Products Company, Storopack Hans Reichenecker GmbH, and Matco Packaging LLC. These market players increasingly prioritise sustainable protective packaging solutions in response to rising sustainability concerns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyer

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Geopolitical Scenario on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Sustainability

- 5.1.2 Growing E-commerce Sector in the Region

- 5.2 Market Restraints

- 5.2.1 Alternative Forms of Packaging

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastics

- 6.1.2 Paper and Paperboard

- 6.1.3 Other Material Types

- 6.2 By Product Type

- 6.2.1 Rigid

- 6.2.1.1 Molded Pulp

- 6.2.1.2 Paperboard-based Protectors

- 6.2.1.3 Insulated Shipping Containers

- 6.2.2 Flexibles (Mailers, Paper Full, Bubble Wraps and Air Pillows)

- 6.2.3 Foam Based

- 6.2.1 Rigid

- 6.3 End-user Vertical

- 6.3.1 Food and Beverage

- 6.3.2 Pharmaceutical

- 6.3.3 Consumer Electronics

- 6.3.4 Beauty and Homecare

- 6.3.5 Other End-user Verticals

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sealed Air Corporation

- 7.1.2 Huhtamaki Oyj

- 7.1.3 Mondi Plc

- 7.1.4 DS Smith PLC

- 7.1.5 International Paper Company

- 7.1.6 Sonoco Products Company

- 7.1.7 Storopack Hans Reichenecker GmbH

- 7.1.8 Matco Packaging LLC

- 7.1.9 Crateco Pack LLC

- 7.1.10 Continental Packaging Material Industry LLC