|

市场调查报告书

商品编码

1626901

欧洲活性与智慧包装:市场占有率分析、产业趋势与成长预测(2025-2030)Europe Active And Intelligent Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

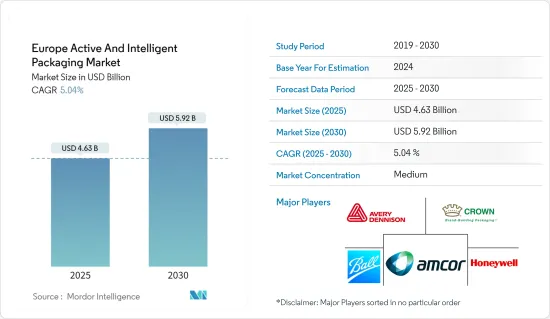

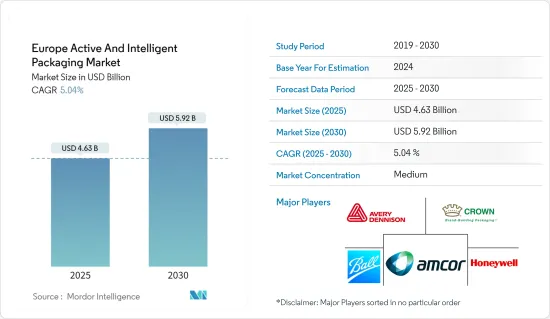

欧洲活性和智慧包装市场规模预计到 2025 年为 46.3 亿美元,预计到 2030 年将达到 59.2 亿美元,预测期内(2025-2030 年)复合年增长率为 5.04%。

主要亮点

- 为了应对不断变化的消费者偏好,製造商正在采取全面的包装方法。智慧包装市场参与企业正在整合 NFC 晶片、LED 和萤幕等技术,以提供有利于消费者、医疗保健专业人员、製造商和医疗机构的附加功能。

- 智慧包装系统包含小型、经济高效的智慧型装置、标籤和标记,可撷取、储存和传输有关包装内食品参数、特征和属性的资讯。

- 政府措施正显着推动德国智慧包装市场的发展。联邦食品和农业部致力于减少食品废弃物,并推出了多项措施来促进创新包装趋势。据该部称,德国每年产生约 1200 万吨食品废弃物。

- 各种计划已经到位,包括减少食品废弃物的国家战略。该策略旨在到 2030 年减少生产和供应链中的食品损失,包括收穫后损失,并减少德国零售和消费者层面的人均食品浪费。

- 欧盟委员会和德国政府致力于实现联合国永续目标( SDG)的目标12.3,其目标是到2030年减少生产链中的食品浪费,并将零售和消费者层面的食物浪费减少一半。这些活动预计将扩大主动智慧包装解决方案在零售和其他最终用户产业的部署,并支援智慧包装市场的成长。

- 活性和智慧包装市场的主要优势是其能够与封装产品相互作用并在其保存中发挥动态作用。该过程追踪整个供应链中的标记资讯。活性包装可以改变食品的成分或有机特性,前提是这种变化符合食品法规。

- 然而,这种包装也引起了污染问题,因为塑胶渗入食品可能会导致健康併发症。由于缺乏对其好处的认识,传统客户常常对此类包装解决方案犹豫不决。这是因为塑胶含有芳香胺和其他物质,包括残留单体和聚合副产物,这些物质会影响所含食品的品质。

欧洲活性和智慧包装市场趋势

医疗保健产业预计将显着成长

- 医疗保健产业面临众多包装挑战,包括产品法规、法规和指令。药品包装优先考虑防篡改和防儿童开启的设计。然而,仿冒品可以模仿这些包装特征,以显得真实。

- 在德国,随着医院更加重视医疗设备的无菌和消毒包装,医疗器材包装正在扩大。不断上升的病毒感染和严格的政府安全法规正在推动这一趋势。

- 技术正在迅速发展,以实现感测器、无线射频识别 (RFID)、可编程警报、电子防篡改保护和追踪系统等功能。发展可实现大规模生产并降低成本的供应链是将主动智慧包装推向市场的关键。

- 流程创新中心有限公司 (CPI) 报告医疗保健产业的重大变化。预期寿命的延长、慢性病盛行率的增加以及向先进、个人化治疗方法的转变等因素正在推动这些变化。随着越来越多的人服用多种药物,国家医疗服务体系 (NHS) 需要准确追踪药物分布和患者依从性。该行业越来越多地转向主动包装和智慧包装等技术来应对这些挑战。

- 先进封装可以变得智慧化,并透过结合感测和无线通讯等先进功能来提供关键功能。除了保护药品和提供资讯之外,这种包装还可以作为支援物联网的连网型系统的一部分提供更多功能。

- 根据GOV.UK的数据,英国政府医疗保健支出从2022-2023年的2,645.5亿美元增加到2023-2024年的2,748.8亿美元。这种支出的增加可能会创造对创新包装解决方案的需求,从而促进欧洲主动和智慧包装市场的成长。这些解决方案旨在提高医疗产品的安全性、可追溯性和效率,并有可能反映人们对医疗保健的日益关注,并推动包装技术的进步,以满足不断变化的行业需求。

英国正在经历显着的成长

- 英国活性智慧包装市场正在经历显着成长,主要由食品、饮料和製药业推动。特别是在食品和饮料领域,智慧包装解决方案正在被采用来延长冷冻食品的保质期,在全国范围内受到欢迎。

- 英国的消费者趋势表明,人们越来越偏好更健康的选择,并且越来越愿意花更多钱购买高品质食品。这项变化导致零售货架上健康食品的增加,从而推动食品和饮料行业对活性和智慧包装的需求。

- 英国WRAP的一项研究发现,60%的家庭食品浪费是由于消费者没有及时使用可食用物品而产生的。该报告还强调了消费者对在打开前后保持食品新鲜度的包装以及有关食品保存的更清晰的包装讯息的兴趣。

- 为了满足消费者对互动、智慧、用户友好、连网型和环保包装的需求,品牌越来越多地采用主动和智慧的包装解决方案。例如,英国跨国公司吉百利在其牛奶托盘包装上推出了带有MAXQ二维码的智慧包装,以加强与客户的联繫。

- 过去十年,亚马逊在英国的销售额大幅成长,净销售额从 2019 年的约 175 亿美元增加到 2023 年的近 336 亿美元。电子商务销售的激增增加了对包装解决方案的需求。主动智慧包装技术,包括 RFID 标籤、感测器和智慧标籤,对于确保电子商务产业安全且有效率的产品交付变得越来越重要。

欧洲活性与智慧包装产业概况

欧洲活性和智慧包装市场处于半固体,由 Amcor Group GmbH、Honeywell International Inc.、Crown Holdings Inc. 和 Ball Corporation 等几家主要参与者组成。公司持续投资于策略伙伴关係和产品开发,以增加市场占有率。

- 欧洲研发中心将于 2024 年 5 月在比利时开幕。该工厂将与区域品牌和零售商合作开发包装解决方案,以增强消费者体验和环境永续性。该中心旨在开拓新材料技术并创造更永续和高性能的包装设计。这些创新旨在提高产品在零售环境中的可见度并增强消费者的可用性。

- 2024 年 4 月 全球材料科学与数位辨识解决方案公司 Avery Dennison 与药品供应链数位转型专家 Controlant 建立伙伴关係。该合作伙伴关係旨在提高即时端到端可见度并支持製药业的永续措施。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 更长的保存期限和消费者生活方式的改变

- 对新鲜、高品质食品的需求不断增长

- 市场限制因素

- 智慧包装的安全和隐私问题

第六章 市场细分

- 按类型

- 活性包装

- 气体清除器/发送器

- 水分清除剂

- 微波基座

- 其他活性封装技术

- 智慧包装

- 编码和标记

- 天线(RFID 和 NFC)

- 感测器和输出设备

- 其他智慧包装技术

- 活性包装

- 按最终用户产业

- 食品

- 饮料

- 卫生保健

- 个人护理

- 其他行业

- 按国家/地区

- 英国

- 德国

- 法国

第七章 竞争格局

- 公司简介

- Amcor Group GmbH

- Honeywell International Inc.

- Crown Holdings Inc.

- Ball Corporation

- Sonoco Products Company

- Avery Dennison Corporation

- Timestrip UK Ltd

- Coveris Holdings SA

- Sealed Air Corporation

- Dessicare Inc.

- WestRock Company

第八章投资分析

第九章 市场未来展望

The Europe Active And Intelligent Packaging Market size is estimated at USD 4.63 billion in 2025, and is expected to reach USD 5.92 billion by 2030, at a CAGR of 5.04% during the forecast period (2025-2030).

Key Highlights

- Manufacturers are adopting a comprehensive approach to packaging in response to changing consumer preferences. Intelligent packaging market participants integrate technologies such as NFC chips, LEDs, and screens to provide additional functionalities that benefit consumers, healthcare professionals, manufacturers, and medical facilities.

- Intelligent packaging systems incorporate small, cost-effective smart devices, labels, or tags that acquire, store, and transfer information about the food's parameters, functions, and properties within the package.

- Government initiatives in Germany are significantly driving the intelligent packaging market. The Federal Ministry of Food and Agriculture's focus on reducing food waste has led to several initiatives promoting innovative packaging trends. According to the ministry, Germany generates approximately 12 million tonnes of food waste annually.

- Various programs have been implemented, including the National Strategy for Food Waste Reduction. This strategy aims to reduce food losses along production and supply chains, including post-harvest losses, and decrease per-capita food waste in Germany at retail and consumer levels by 2030.

- The European Commission and the German government are committed to the United Nations Sustainable Development Goal (SDG) target 12.3, which aims to reduce food waste along production chains and halve it at retail and consumer levels by 2030. These initiatives are expected to increase the deployment of active and intelligent packaging solutions in retail and other end-user industries, supporting the growth of the intelligent packaging market.

- The primary advantage of active and intelligent packaging is its ability to interact with the enclosed product, playing a dynamic role in preservation. The process tracks tagged information throughout the supply chain. Active packaging may alter food composition and organoleptic characteristics, provided the changes comply with food regulations.

- However, this packaging also raises contamination concerns, as plastic seepage into foods may lead to health complications. Due to limited awareness of its advantages, conventional customers are often uncomfortable with such packaging solutions. There have been genuine contamination cases, as plastics contain aromatic amines and other substances, including residual monomers and polymerization by-products, which can affect the food quality they contain.

Europe Active And Intelligent Packaging Market Trends

Healthcare Industry is Anticipated to Witness Significant Growth

- The healthcare industry faces numerous packaging challenges, including product regulations, stipulations, and instructions. Pharmaceutical packaging prioritizes tamper-proof and child-resistant designs. However, counterfeit operations can replicate these packaging features, creating the illusion of legitimate products.

- In Germany, healthcare device packaging is growing as hospitals focus more on the sterile and disinfected packaging of medical devices. Increased viral infections and stringent government safety regulations drive this trend.

- Rapid progress is being made in technologies enabling features such as sensors, radio-frequency identification (RFID), programmable alerts, electronic anti-tamper safeguards, and tracking systems. While costs are decreasing, developing its supply chain to facilitate larger-scale production is key to bringing active and intelligent packaging to market.

- The Centre for Process Innovation Limited (CPI) reports significant changes in the healthcare industry. Factors including longer life expectancies, an increase in chronic diseases, and a shift toward advanced and personalized therapies drive these changes. With more individuals taking multiple medicines, there is pressure on the National Health Service (NHS) to track drug distribution and patient adherence accurately. The industry is increasingly looking to technologies like active and intelligent packaging to address these challenges.

- Packaging can become intelligent and provide critical functionality by incorporating advanced features such as sensing and wireless communication. Beyond protecting the drug and providing information, this packaging can offer additional features as part of an IoT-enabled connected system.

- According to GOV.UK, the UK government's healthcare spending increased from USD 264.55 billion during 2022-2023 to USD 274.88 billion during 2023-2024. This increased expenditure could potentially contribute to the growth of the European active and intelligent packaging market by creating demand for innovative packaging solutions. These solutions aim to enhance medical product safety, traceability, and efficiency, reflecting a growing emphasis on healthcare and potentially driving advancements in packaging technologies to meet evolving industry needs.

The United Kingdom is Observing Notable Growth

- The UK active and intelligent packaging market is experiencing significant growth, driven primarily by the food, beverage, and pharmaceutical industries. The food and beverage sector, in particular, is adopting smart packaging solutions to extend the shelf life of frozen foods, which are gaining popularity nationwide.

- Consumer trends in the United Kingdom show an increasing willingness to spend more on high-quality food products, with a growing preference for healthier options. This shift has led to a rise in healthier food products on retail shelves, consequently boosting the demand for active and intelligent packaging in the food and beverage sector.

- A study by WRAP in the United Kingdom revealed that 60% of household food waste occurs due to consumers not using edible goods in time. The report also highlighted consumer interest in packaging that can maintain food freshness before and after opening and clearer on-pack messages about food storage.

- Brands are increasingly adopting active and intelligent packaging solutions to meet consumer demands for interactive, smart, user-friendly, connected, and eco-friendly packaging. For example, Cadbury, a British multinational company, has implemented smart packaging to enhance customer connections, utilizing MAXQ QR codes on its milk tray packaging.

- Amazon's sales in the United Kingdom have shown substantial growth over the past decade, with net sales rising from approximately USD 17.5 billion in 2019 to nearly USD 33.6 billion in 2023. This surge in e-commerce sales has increased demand for packaging solutions. Active and intelligent packaging technologies, including RFID tags, sensors, and smart labels, have become increasingly important in ensuring safe and efficient product delivery in the e-commerce industry.

Europe Active And Intelligent Packaging Industry Overview

The European active and intelligent packaging market is semi-consolidated and consists of a few significant companies like Amcor Group GmbH, Honeywell International Inc., Crown Holdings Inc., and Ball Corporation. The companies continuously invest in strategic partnerships and product developments to gain market share.

- May 2024: Amcor launched its European Innovation Center in Belgium. This facility will collaborate with regional brands and retailers to develop packaging solutions that enhance consumer experience and environmental sustainability. The center aims to pioneer new material technologies, creating more sustainable and high-performing packaging designs. These innovations will strive to improve product visibility in retail environments and increase consumer user-friendliness.

- April 2024: Avery Dennison, a global materials science and digital identification solutions company, formed a partnership with Controlant, a specialist in pharmaceutical supply chain digital transformation. This collaboration aims to improve real-time, end-to-end visibility and support sustainability efforts in the pharmaceutical industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Longer Shelf Life and Changing Consumer Lifestyle

- 5.1.2 Growing Demand for Fresh and Quality Food Products

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Issues in the Case of Intelligent Packaging

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Active Packaging

- 6.1.1.1 Gas Scavengers/Emitters

- 6.1.1.2 Moisture Scavenger

- 6.1.1.3 Microwave Susceptors

- 6.1.1.4 Other Active Packaging Technologies

- 6.1.2 Intelligent Packaging

- 6.1.2.1 Coding and Markings

- 6.1.2.2 Antenna (RFID and NFC)

- 6.1.2.3 Sensors and Output Devices

- 6.1.2.4 Other Intelligent Packaging Technologies

- 6.1.1 Active Packaging

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Honeywell International Inc.

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Ball Corporation

- 7.1.5 Sonoco Products Company

- 7.1.6 Avery Dennison Corporation

- 7.1.7 Timestrip UK Ltd

- 7.1.8 Coveris Holdings SA

- 7.1.9 Sealed Air Corporation

- 7.1.10 Dessicare Inc.

- 7.1.11 WestRock Company