|

市场调查报告书

商品编码

1626903

欧洲水处理自动化和仪器-市场占有率分析、行业趋势和统计、成长预测(2025-2030)Europe Water Automation and Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

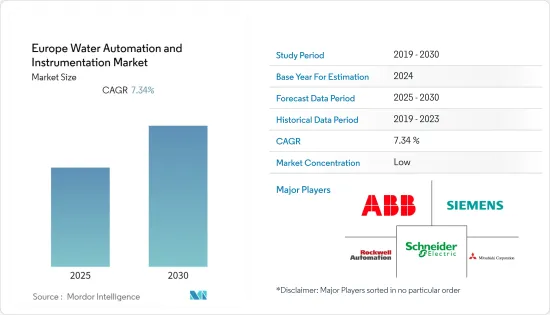

欧洲水处理自动化和仪器市场预计在预测期内复合年增长率为7.34%

主要亮点

- 随着饮用水资源的枯竭和政府的监管,管理营运成本已成为水产业相关人员面临的最大挑战之一。人事费用和能源相关成本占水务公司营运支出的最大份额。

- 目前市场上正在考虑的水自动化技术开发包括智慧监控技术,该技术使用压力和声波感测器透过无线监控系统来检测、报告和减少水损失,以及追踪资料和科学理解,这不断改进,包括最新的进展。

- 未计费水量水 (NRW) 是指在到达客户之前损失的水。由于供水管网洩漏和盗窃而造成损失。根据世界银行统计,全球自来水公司的未计费水量水总成本保守估计为每年 1,410 亿美元,其中三分之一发生在开发中国家。减少未计费水量水损失的需求日益增长,正在推动水务公司采用先进的水资源管理解决方案。

- 与水产业相关的测量设备和自动化解决方案需要定期维护。这给设备最终用户带来了压力,要求他们在产品的整个生命週期中承担维护成本。此外,它们的维护和操作需要高水准的技能。因此,由于缺乏合格且技术熟练的志愿者,製造商在操作自动化和控制系统时面临困难。

- COVID-19 疫情导致生产停顿并扰乱供应链,导致工业产出成长减弱,变送器、HMI SCADA 系统和分散式控制系统等多种设备的产量减少。

欧洲水处理自动化和仪器市场趋势

食品饮料业需求成长显着

- 食品和饮料的生产需要大量的水。水是食品和饮料加工行业的关键原材料之一,因此水质对于产品品质和运作可靠性至关重要。在食品和饮料行业实施水和污水自动化可以显着节省公司的收益,同时消除错误和浪费,提高效率和生产力,并扩大利润率。

- 此外,食品和饮料行业的不同公司正在实施不同的自动化和仪器方法。例如,秘鲁一家食品加工厂的天然地下水受到高浊度和砷的污染,无法用于食品加工。 AMI 的客製化解决方案结合了超过滤滤膜和凝聚剂预处理、深度过滤和滤液氯化,以生产符合客户食品加工用高品质标准的水。该系统是一个 AMI PLC 自动化系统,使用中央控制柜和触控萤幕 HMI 操作员介面。

- 此外,食品饮料行业已经引入了液体分析仪、压力测量系统、流量测量系统等仪器污水,在从生产线排放产品时使用上述仪器技术可以提高生产过程中的性能。此外,可以使用节省空间的模组化分析面板有效监测原水、製程水或污水。这简化了食品和饮料行业的日常流程整合和营运。

- DCS 和 SCADA 等自动化技术也用于各种食品和饮料行业,以控制各种设备,例如变速驱动器、品管系统、马达控制中心 (MCC)、窑炉、製造设备以及所使用的水和污水处理管理。

法国是该地区水处理自动化和仪器领域的领导者

- 法国的饮用水取水量略低于欧盟平均水平,但远低于美国、日本等其他已开发国家的平均水平。此外,根据 fp2e.org 发布的一份报告,法国首都饮用水的总取水量为 54 亿立方米,相当于每人每年 85 立方公尺多一点,即每天 234 公升。迫切需要限制这种用水量,以便监控、有效分配和控制该地区的水资源短缺。

- 政府正在鼓励该地区新建污水处理厂新计画,随着公共、交通、政府、基础设施、资源和製造业面临日益激烈的竞争并侵蚀净利率,自动化技术变得越来越重要。 2021年3月,苏伊士和施耐德电气集团宣布成立数位水务领域的领导企业,将共同开发和行销水循环管理的创新数位解决方案。该合资公司将透过提供用于规划、营运、维护和优化水处理基础设施的独特软体解决方案,帮助市政水务公司和产业加速数位转型。

- 这场流行病在世界各地造成了严重破坏,法国饮用水公司增加了其供水网路中的氯含量。这是因为许多公司已经停止营运。由于水在管道中长期停滞,增加氯的量可以防止微生物和病毒的生长。

- 这些案例正在推动所研究市场对自动化感测器和监控系统的需求,越来越多的公司致力于减少能源消耗并提高营运效率。

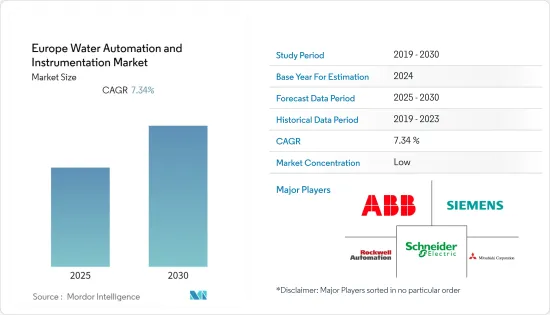

欧洲水处理自动化和仪器产业概况

主要企业包括ABB 集团、西门子股份公司、施耐德电气公司、GE 公司、罗克韦尔自动化公司、三菱汽车公司、艾默生电气公司、横河电机公司、Endress+ Hauser Pvt Ltd、EurotekIndia、Phoenix Contact、NALCO、MJK Automation。由于市场分散,各大公司之间的竞争也激烈。因此,预计市场集中度较低。

- 2021 年 4 月 - 苏伊士集团宣布成立法国第一家专门从事公共用水和污水管理的多服务半上市公司 (SEMOP)。我们为第戎大都会区 15 个市镇的 22 万名居民提供服务。

- 2020 年 11 月 - 环境物联网先驱、法国威立雅水务子公司 Birdz 宣布与水资源管理社群应用专家 FluksAqua 合併。此次合併旨在将 Birdz 的数位资料技术和 FluksAqua 的数位用户文化结合在一起。新公司为水务公司提供更全面、易于使用和高性能的数位服务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 政府规定节约水资源和能源

- 更多采用智能水技术

- 市场问题

- 缺乏操作仪器设备的熟练人员

第六章 市场细分

- 透过水自动化解决方案

- DCS

- SCADA

- PLC

- HMI

- 其他水处理自动化解决方案

- 按仪器解决方案

- 压力变送器

- 液位传送器

- 温度变送器

- 液体分析仪

- 气体分析仪

- 洩漏检测系统

- 流量感测器/变送器

- 其他水测量解决方案

- 按最终用户行业(定性分析)

- 化学

- 製造业

- 饮食

- 公共产业

- 纸/纸浆

- 其他的

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- ABB Group

- Siemens AG

- Schneider Electric SE

- GE Corporation

- Rockwell Automation Inc.

- Mitsubishi Motors Corporation

- Emerson Electric

- Yokogawa Electric Corporation

- Endress+Hauser Pvt. Ltd

- Eurotek India

- Phoenix Contact

- NALCO

- MJK Automation

- KROHNE LTD

第八章投资分析

第9章市场的未来

The Europe Water Automation and Instrumentation Market is expected to register a CAGR of 7.34% during the forecast period.

Key Highlights

- Managing operational costs emerged as one of the biggest challenges posed by stakeholders of the water industry, as the governments are imposing regulations, along with depletion of potable water resources. Expenses relating to labor and energy constitute the largest share in OPEX for water utilities.

- Several water automation-related technology developments currently being explored in the market include smart monitoring technologies using pressure and acoustic sensors to detect, report, and reduce water loss via wireless monitoring systems; and recent advances in water management through optimizing wastewater processing and recycling, as tracking data and scientific understanding continues to improve.

- Non-revenue water (NRW) is known as water lost before it reaches a customer. Losses can occur from leaks in the distribution network, during a theft, etc. According to the World Bank, the total cost to water utilities is from non-revenue water worldwide can be conservatively estimated at USD 141 billion per year, with a third of it occurring in the developing world. The rising demand to reduce non-revenue water losses led water utilities to adopt advanced water management solutions.

- The instrumentation and automation solutions involved in the water industry need periodic maintenance. Therefore, the pressure lies on the end-user of the equipment, who must bear the maintenance expenses throughout the product's lifetime. Also, their maintenance and handling require high skill. Consequently, manufacturers face difficulties while operating automation and control systems due to a lack of qualified and skilled applicants.

- The outbreak of COVID-19 halted the production and disrupted the supply chain, which led to weakened industrial output growth and the decline in the production of multiple types of equipment, such as transmitters, and affected the use of HMI SCADA systems and distributed control systems.

Europe Water Automation & Instrumentation Market Trends

Demand from Food and Beverage Industry to Witness a Significant Growth Rate

- The production of food and beverages requires a large amount of water. Water quality is crucial to product quality and operational reliability as water is one of the important raw materials in the food and beverage processing industry. The implementation of water and wastewater automation in the food and beverage industry can save significant revenues for the company along with eliminating errors and waste, enhancing efficiency and productivity, and expanding profit margins.

- Further, various companies in the Food and beverage industry are deploying various automation and instrumentation methods. For instance, a food processing plant in Peru was faced with natural groundwater contaminated with high turbidity and arsenic, making it unsuitable for use in food processing. AMI's custom-engineered solution incorporates ultrafiltration membranes with pretreatment by coagulant and depth filtration, as well as chlorination of the filtrate to produce water meeting the customer's high-quality standards for use in food product processing. The system is AMI PLC automated using a central control enclosure and touchscreen HMI operator interface.

- Moreover, instrumentation technology such as liquid analyzer, pressure measurement system, flow measurement system is being deployed in the food and beverage industry to reduce the volume of wastewater during the process by using the above-mentioned instrumentation technology when discharging products from the lines. Further, Raw water, process water, or wastewater can be efficiently monitored with modular, space-saving analysis panels. This simplifies daily process integration and operation in the food and beverage industries.

- Also, automation technologies such as DCS, SCADA, among others, are used in various food and beverage industries to control various instrumentality types, including variable speed drives, quality control systems, motor control centers (MCC), kilns, manufacturing equipment, and manage the water and wastewater treatment.

France to lead the Water Automation and Instrumentation in the region

- In France, the amount of water withdrawn for drinking water is marginally smaller than the EU average but far smaller than average levels in other developed countries like the USA or Japan. Moreover, according to a report published in fp2e.org, the total amount of water withdrawn for drinking water purposes in Metropolitan France was 5.4 billion m3, representing an annual amount of just over 85 m3 of water per person, 234 liters per person per day. There is an urgent need to bring this water usage in check to monitor, efficiently distribute, and control the water shortage in the region.

- The government is encouraging new projects of wastewater treatment plants in the region, and increased competition and eroding margins in utilities, transport, government, infrastructure, resources, and manufacturing make automation technologies very critical. In March 2021, The SUEZ and Schneider Electric groups announced the creation of a leader in digital water to develop and market a joint offering of innovative digital solutions for the management of the water cycle. This joint venture will support municipal water operators and industrial players in accelerating their digital transformations by providing them with a unique range of software solutions for planning, operation, maintenance, and optimization of water treatment infrastructure.

- The pandemic did cause havoc across the world due to which the French drinking water suppliers have increased the dose of chlorine in the water distribution networks. It was mainly done since many companies have ceased their activities. The water in the pipes remained stagnant for a longer period, so adding more chlorine prevented possible microbes or viruses from appearing.

- Such an instance would drive the demand for automated sensors and monitoring systems in the studied market, and more and more companies are aiming to reduce their energy consumption and increase their operational efficiency.

Europe Water Automation & Instrumentation Industry Overview

The major players include ABB Group, Siemens AG, Schneider Electric SE, GE Corporation, Rockwell Automation Inc., Mitsubishi Motors Corporation, Emerson Electric, Yokogawa Electric Corporation, Endress+ Hauser Pvt. Ltd, EurotekIndia, Phoenix Contact, NALCO, MJK Automation, and Blue Water Automation. As the market is fragmented, there is major competition between the major players. Therefore, the market concentration is expected to be low.

- April 2021 - SUEZ Group announced creating the first multiservice Semi-Public Company with a Single Operation (SEMOP) in France dedicated to both public water and wastewater management services. It will serve 220,000 inhabitants of 15 towns and cities of the Dijon metropole.

- November 2020 - Birdz, a pioneer in environmental IoT and a subsidiary of Veolia Water France, announces its merger with FluksAqua, a specialist in community applications for water management. This merger aims to collate Birdz's Digital Data skills with FluksAqua's Digital User culture. The new entity will offer the water operators even more comprehensive, easy-to-use, and high-performance digital services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulation to Save Water Resources and Energy

- 5.1.2 Increase in Adoption of Smart Water Technologies

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Personnel to Operate Instrumentation

6 MARKET SEGMENTATION

- 6.1 By Water Automation Solution

- 6.1.1 DCS

- 6.1.2 SCADA

- 6.1.3 PLC

- 6.1.4 HMI

- 6.1.5 Other Water Automation Solutions

- 6.2 By Water Instrumentation Solution

- 6.2.1 Pressure Transmitter

- 6.2.2 Level Transmitter

- 6.2.3 Temperature Transmitter

- 6.2.4 Liquid Analyzers

- 6.2.5 Gas Analyzers

- 6.2.6 Leakage Detection Systems

- 6.2.7 Flow Sensors/Transmitters

- 6.2.8 Other Water Instrumentation Solutions

- 6.3 By End-User Industry (Qualitative Analysis)

- 6.3.1 Chemical

- 6.3.2 Manufacturing

- 6.3.3 Food and Beverages

- 6.3.4 Utilities

- 6.3.5 Paper and Pulp

- 6.3.6 Other End-user Industries

- 6.4 By Country

- 6.4.1 Germany

- 6.4.2 United Kingdom

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric SE

- 7.1.4 GE Corporation

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Mitsubishi Motors Corporation

- 7.1.7 Emerson Electric

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 Endress + Hauser Pvt. Ltd

- 7.1.10 Eurotek India

- 7.1.11 Phoenix Contact

- 7.1.12 NALCO

- 7.1.13 MJK Automation

- 7.1.14 KROHNE LTD